MFG is duly authorized and licensed by the Hong Kong Securities and Futures Commission to conduct business in Types 1, 2, 4, 5 & 9 regulated activities, namely dealing in and advising on securities and future contracts, as well as asset management. MFG is also an Exchange Participant of both the Stock Exchange of Hong Kong Securities Clearing Company Limited and the HKFE Clearing Corporation Limited.

What is MFG Online?

MFG Online is a trading platform known for its competitive fee structure, with commission rates starting from 0.25% and a minimum of HK$100, which may appeal to both casual and frequent traders.

It offers a variety of user-friendly trading applications such as EX Trader, SPTrader, and OATS.NET, meeting different trading preferences and devices.

However, one potential drawback is the interest on uninvested cash, which is relatively high at 3.21%, possibly deterring investors who maintain large cash balances.

Pros & Cons

Pros:

MFG Online offers a wide range of securities, low commissions of 0.25%, and is regulated by the SFC. It features multiple trading platforms and provides brokerage and wealth management services.

Cons:

The platform lacks 24/7 customer support and educational resources. Deposits are limited to bank transfers only, which might not be convenient for all users.

Is MFG Online Safe?

Regulations:

MFG Online is regulated by the Securities and Futures Commission of Hong Kong (SFC), under license number AMV148. The SFC is an independent statutory body responsible for regulating Hong Kong's securities and futures markets, ensuring the integrity and soundness of financial practices.

Funds Safety:

Yuanta Financial Holding Co., Ltd. ensures the safety of client funds through stringent management and regulatory compliance. The firm holds and manages clients' personal and transactional data with high security within an information preservation company's system, ensuring that all personal data is kept confidential and accessed only under strict controls and procedures.

The firms adherence to various legal and regulatory frameworks further supports the safeguarding of client funds, maintaining integrity in financial management and client transactions.

Safety Measures:

Yuanta has implemented robust data security protocols to protect the integrity and confidentiality of its clients' personal information. The firm utilizes a strict internal IP management model and employs a VPN system among its subsidiaries to manage clients' data securely.

Additionally, advanced firewall systems are in place to thwart unauthorized access and cyber threats. These measures are part of Yuanta‘s commitment to ensuring that personal data is not accessed either directly or indirectly by unauthorized third parties, thereby upholding the safety and privacy of its clients’ investments and personal information.

What are securities to trade with MFG Online?

With MFG Online, you can trade a diverse array of securities that satisfy different investment strategies and goals:

Hong Kong Stock: As one of the world's leading financial centers, Hong Kong's market hosts over 2,200 listed companies on The Stock Exchange of Hong Kong Limited (HKEX). The market's valuation exceeds 30,000 billion Hong Kong Dollars, making it the 7th largest globally and the 3rd largest in Asia.

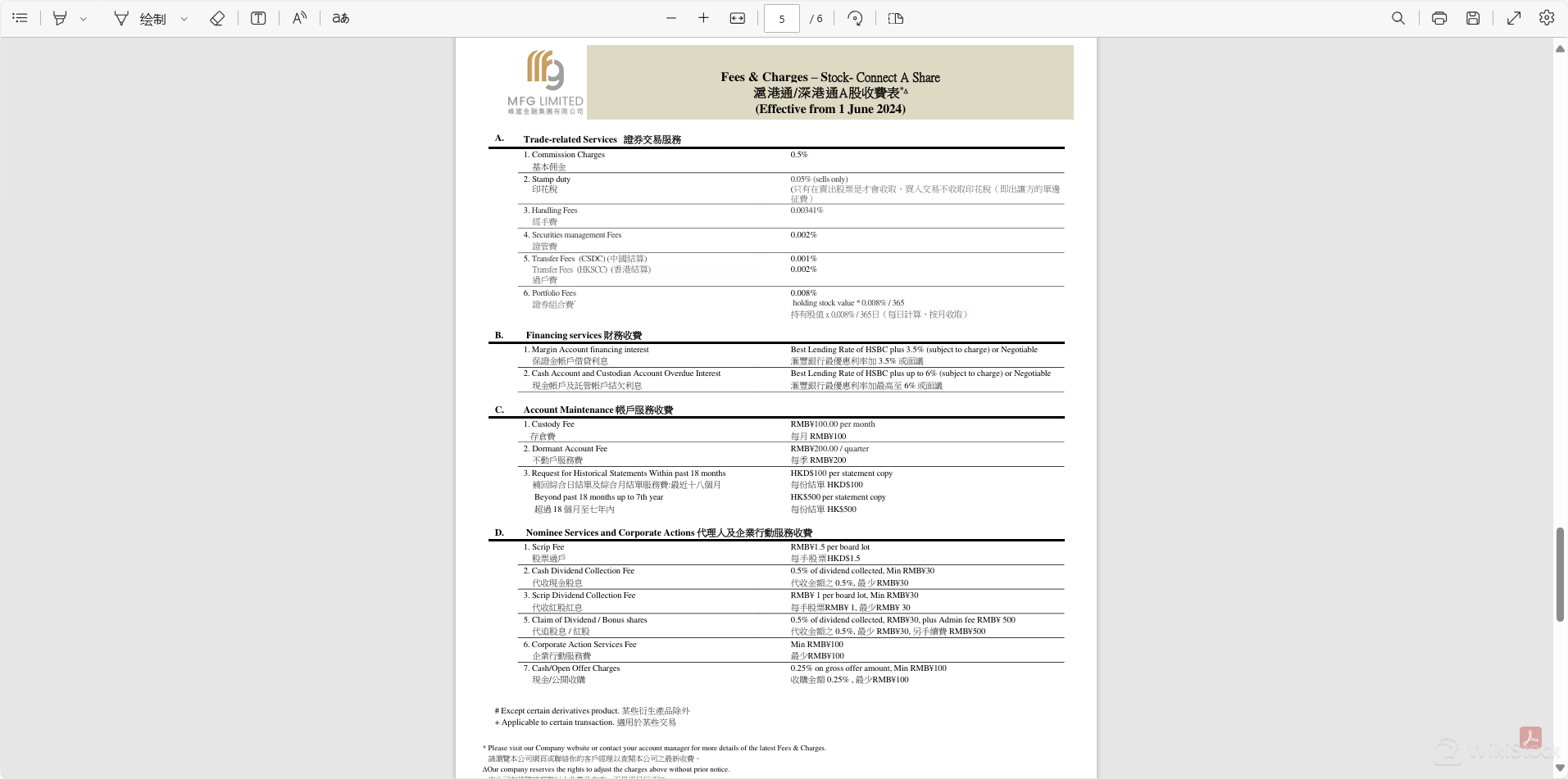

Stock Connect: This program enables direct trading access between Hong Kong and mainland China's stock exchanges in Shanghai and Shenzhen. Since its launch in November 2014, investors can trade in more than 2,000 eligible stocks, bridging international and local investment opportunities.

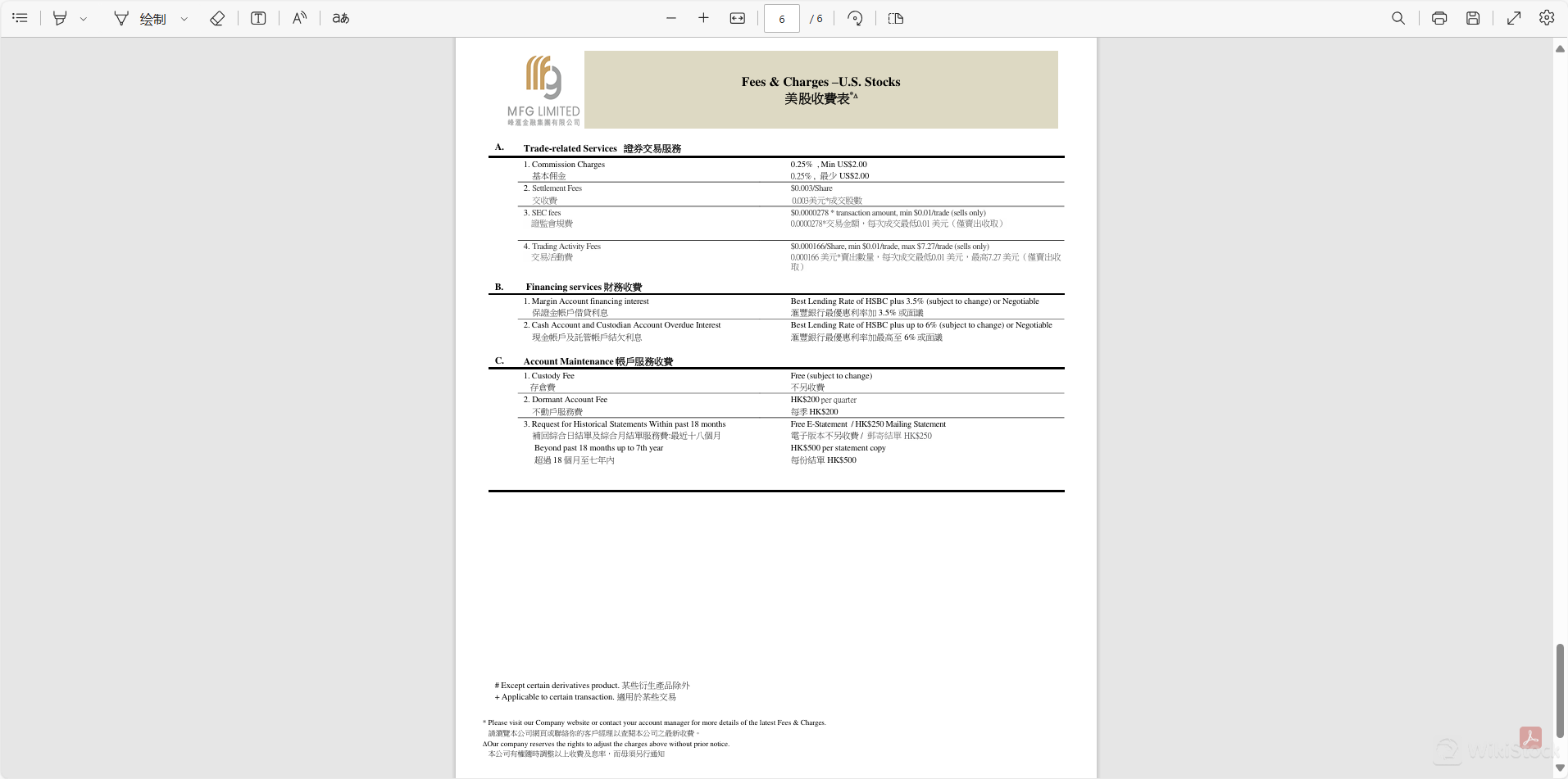

Global Securities: MFG connects clients to several of the world's major stock markets including those in the United States, United Kingdom, Australia, Japan, Singapore, and Taiwan. This allows for international diversification and risk management. For real-time transactions, clients can place orders via telephone during the trading hours of the Hong Kong and U.S. markets.

Other Investment Products: MFG offers a wide range of additional investment products, each meeting different aspects of market engagement:

Callable Bull/Bear Contracts (CBBCs): These allow investors to make leveraged returns based on the movements of underlying securities.

Real Estate Investment Trusts (REITs): These provide exposure to real estate markets through tradable security.

Debt Securities: Bonds and other fixed-income securities are available for those seeking stable returns.

Derivative Warrants: These are options that give the right, but not the obligation, to buy or sell a security at a certain price before a certain date.

Initial Public Offerings (IPOs): MFG offers access to newly listed companies' stocks, often a way to enter a stock at its early market stages.

Private Placements: Investments in securities not offered publicly, typically to a small number of chosen investors.

Exchange Traded Funds (ETFs): These funds track indices, commodities, or baskets of assets like index funds but trade like stocks on an exchange.

Equities

Hong Kong Stock: Trade over 2,200 listed companies on the Hong Kong Stock Exchange.

Stock Connect: Access more than 2,000 qualified stocks through connections with Shanghai and Shenzhen stock exchanges.

Global Securities: Invest in major stock markets around the world including the United States, United Kingdom, Australia, Japan, Singapore, and Taiwan.

Bonds

MFG offers a wide variety of bonds, suitable for those seeking stable and regular interest income as part of a long-term investment strategy, particularly for retirement planning:

Corporate Bonds: Issued by well-known corporations globally.

Government Bonds: Issued by local or overseas governments.

Perpetual Bonds: Bonds with no maturity date.

Callable Bonds: Bonds that can be redeemed by the issuer before maturity.

Puttable Bonds: Bonds that can be sold back to the issuer at certain times before maturity.

Convertible Bonds: Bonds that can be converted into a predetermined amount of the issuing company's equity.

Exchangeable Bonds: Bonds that can be converted into the equity of a company different from the issuer.

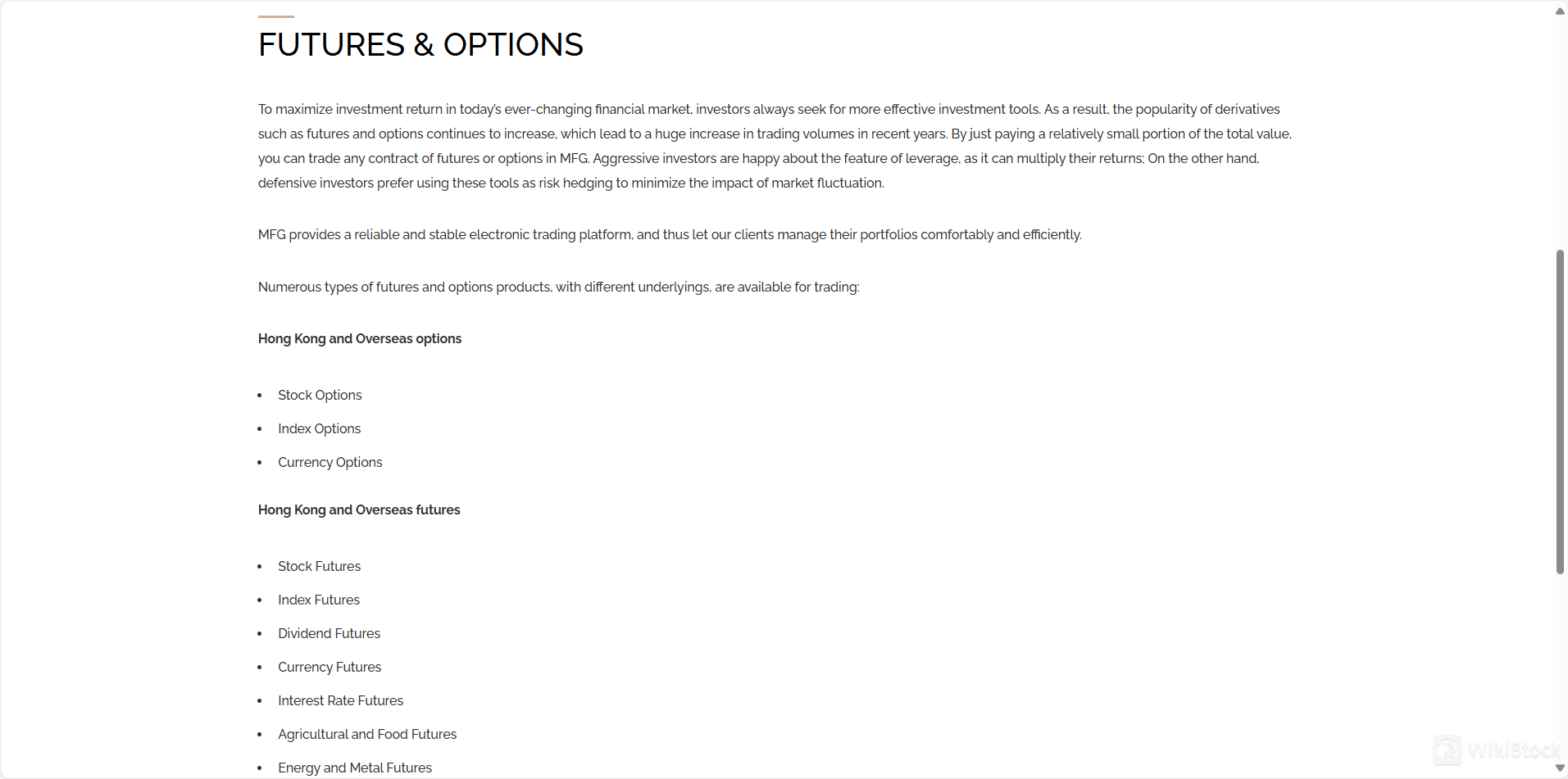

Derivatives

MFG provides a variety of derivatives for those seeking either leverage or risk management solutions:

Options: Including stock options, index options, and currency options.

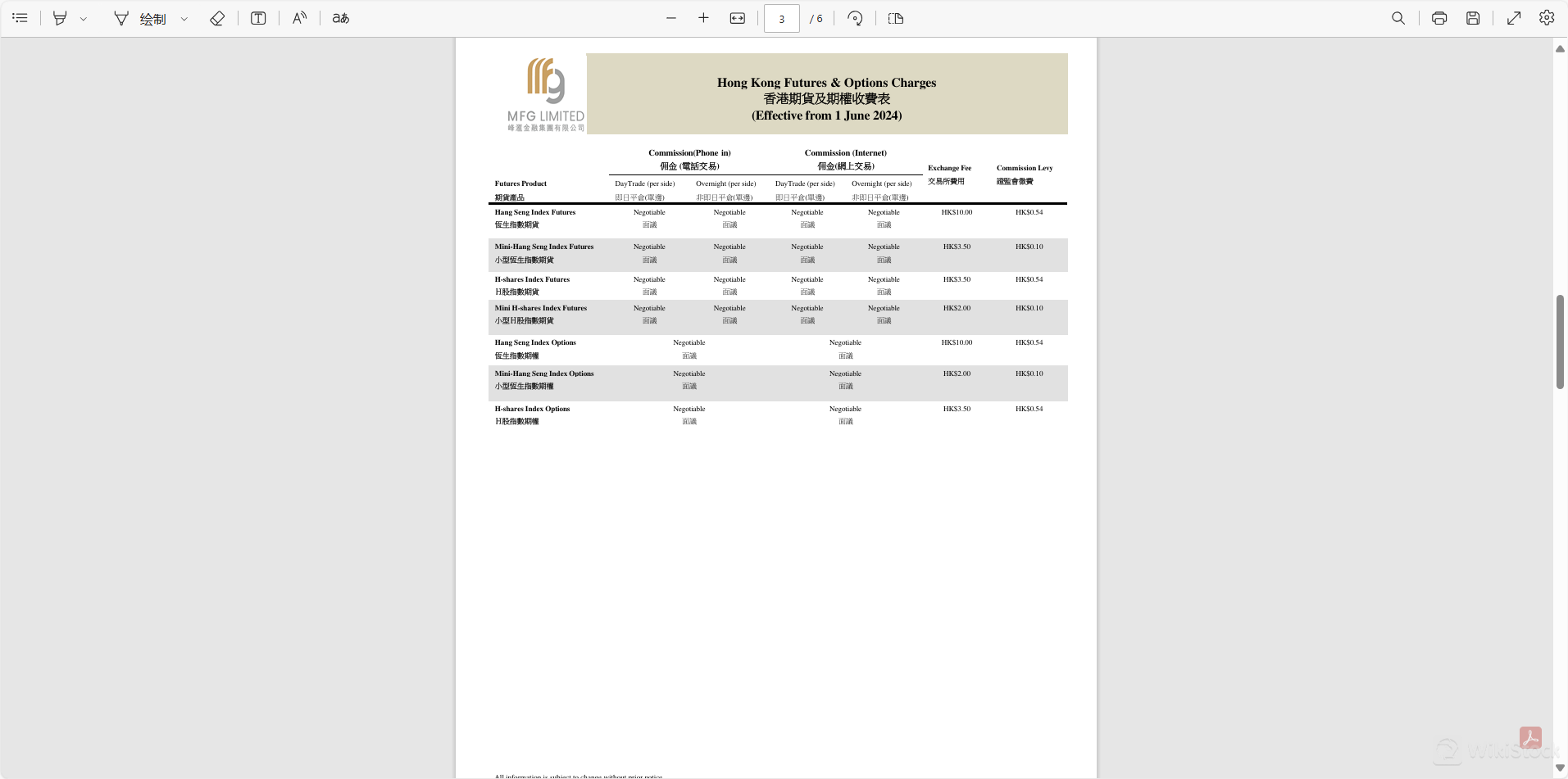

Futures: Including stock futures, index futures, dividend futures, currency futures, interest rate futures, agricultural and food futures, energy, and metal futures.

Investment Schemes

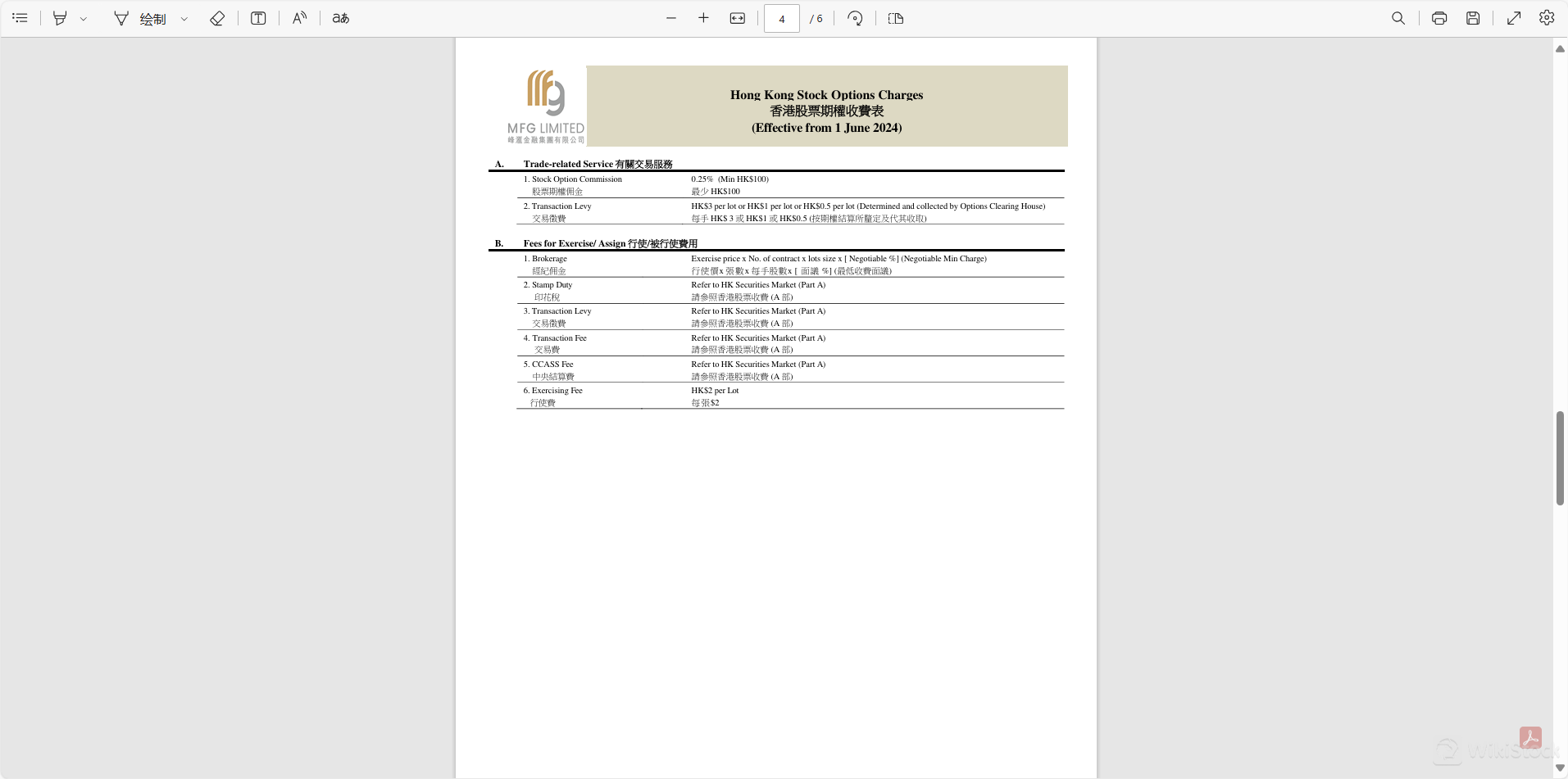

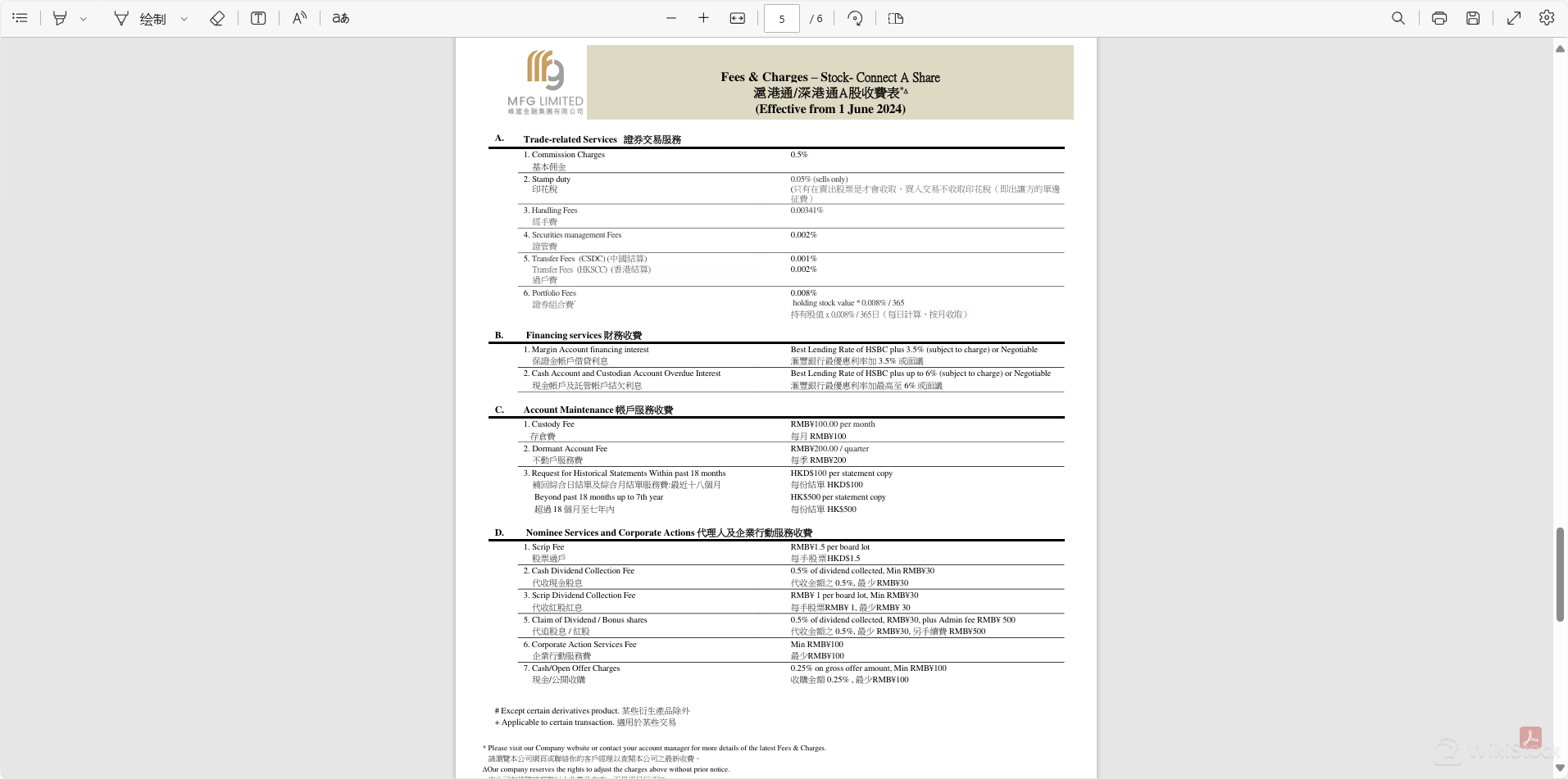

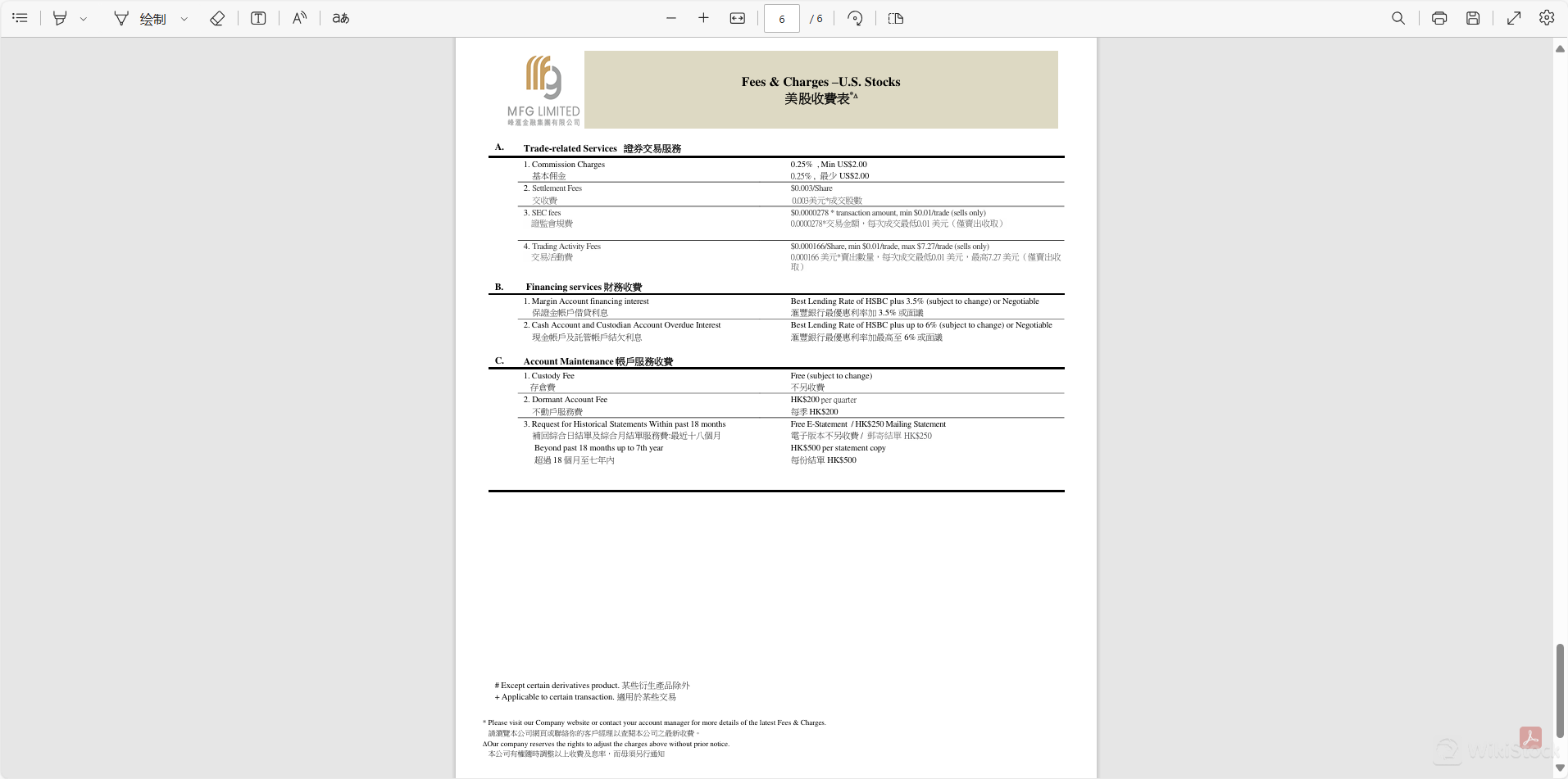

MFG Online Fee Review

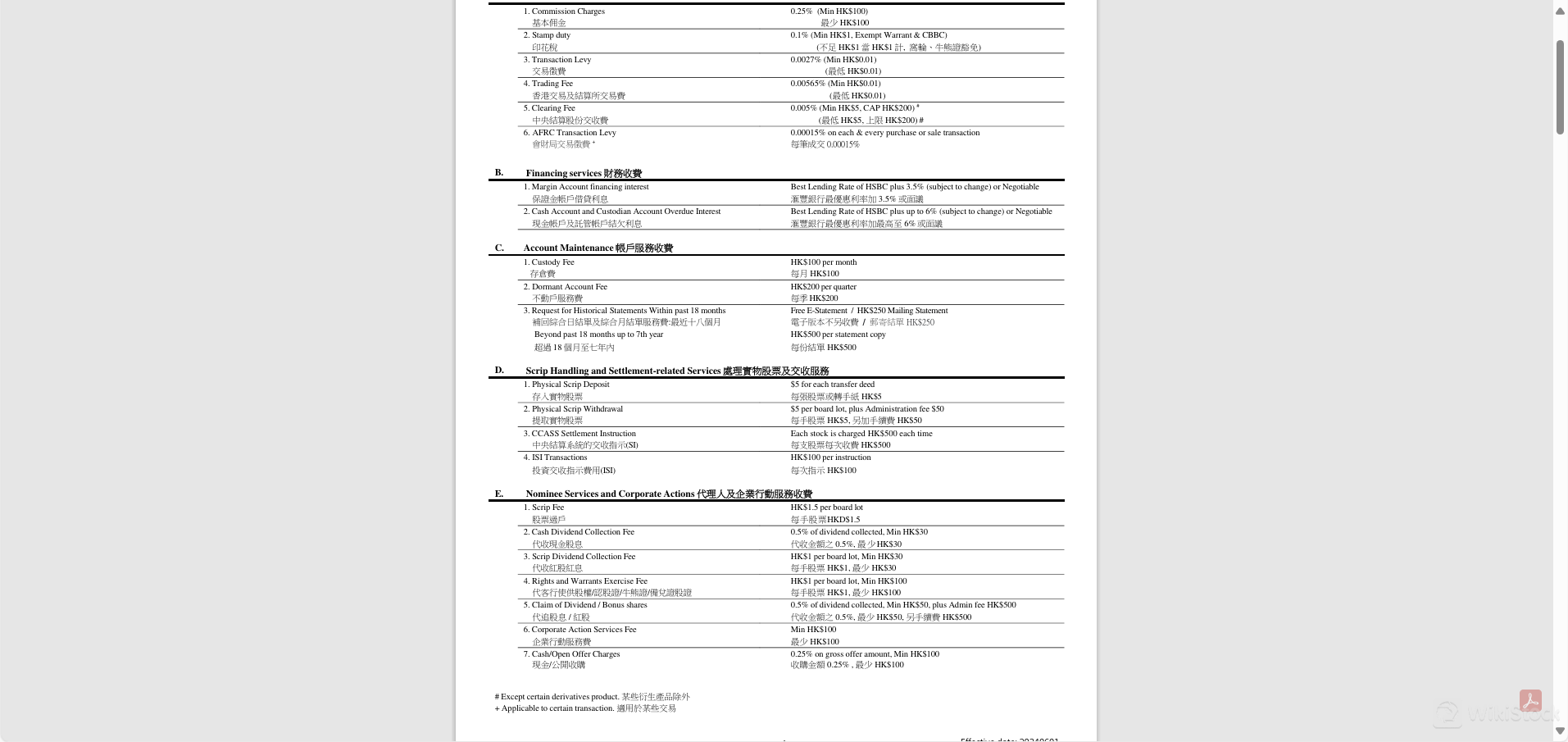

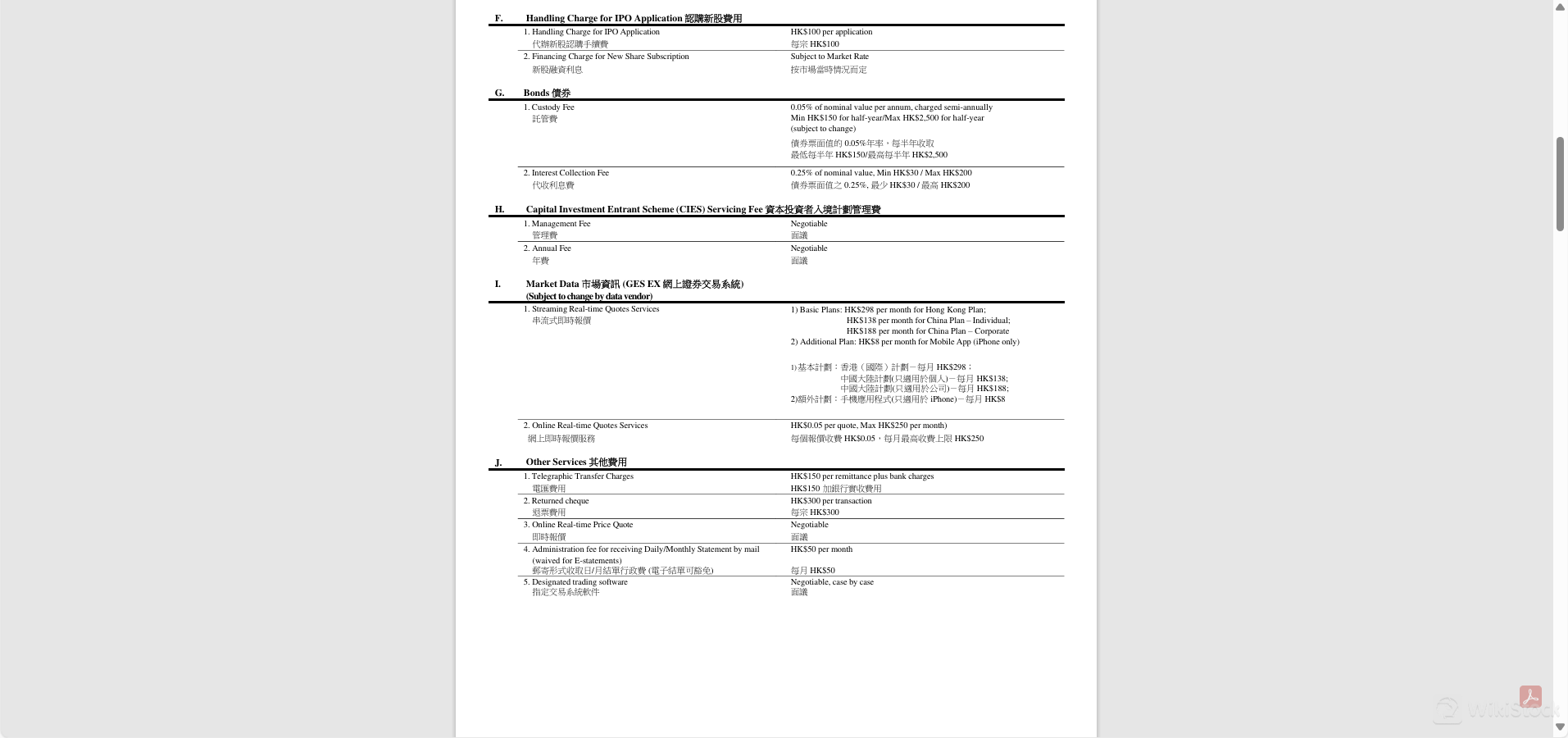

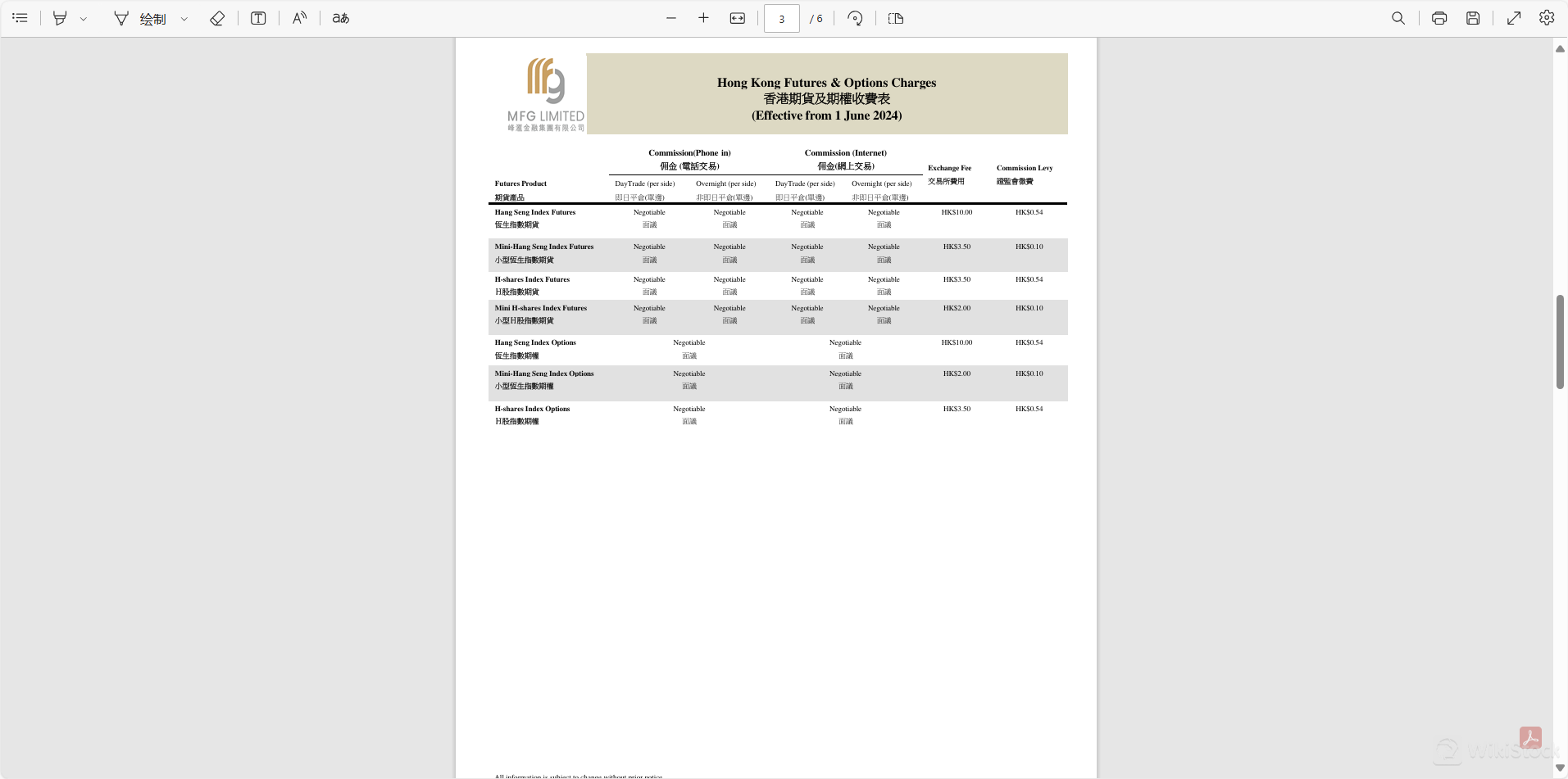

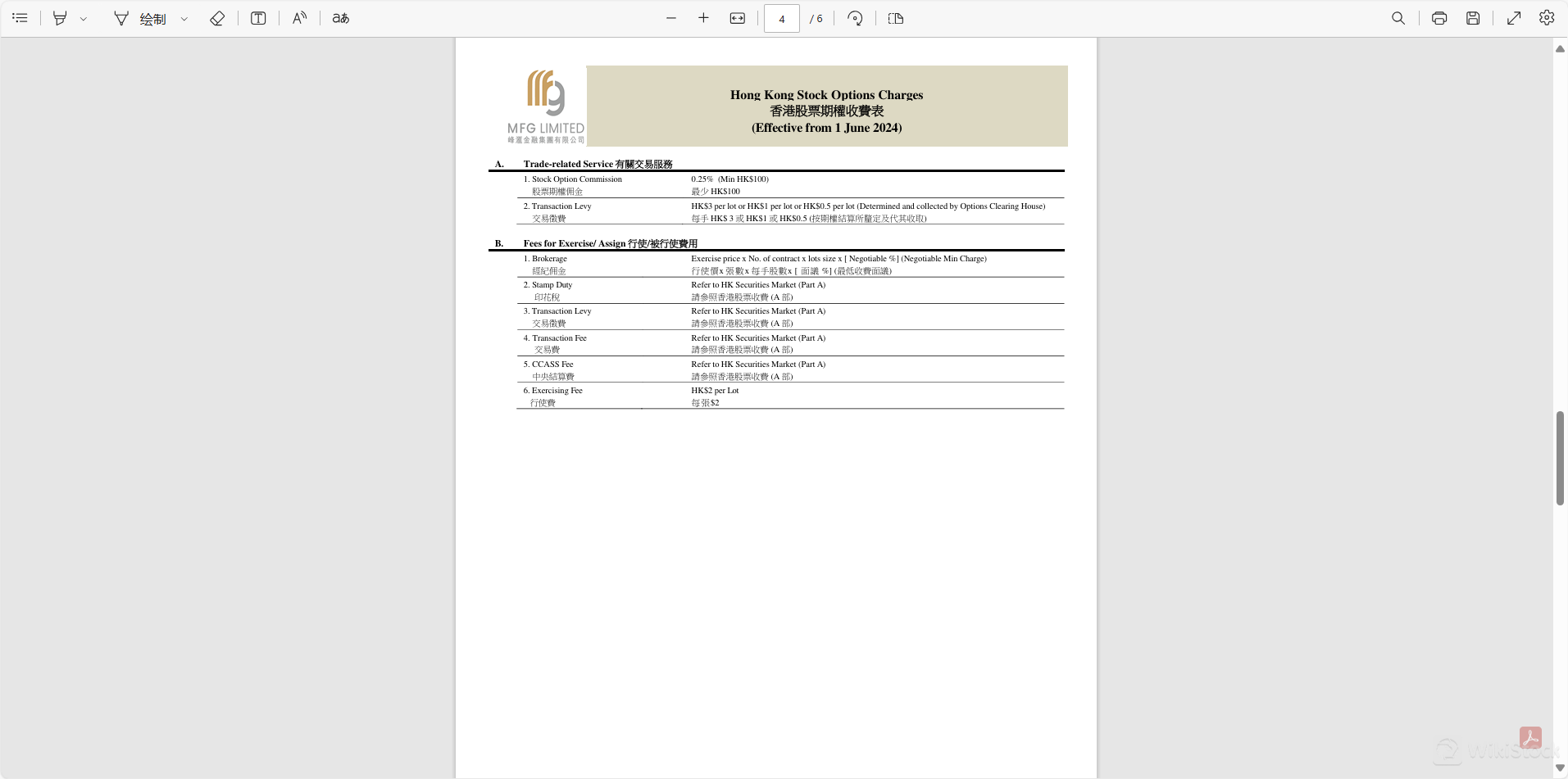

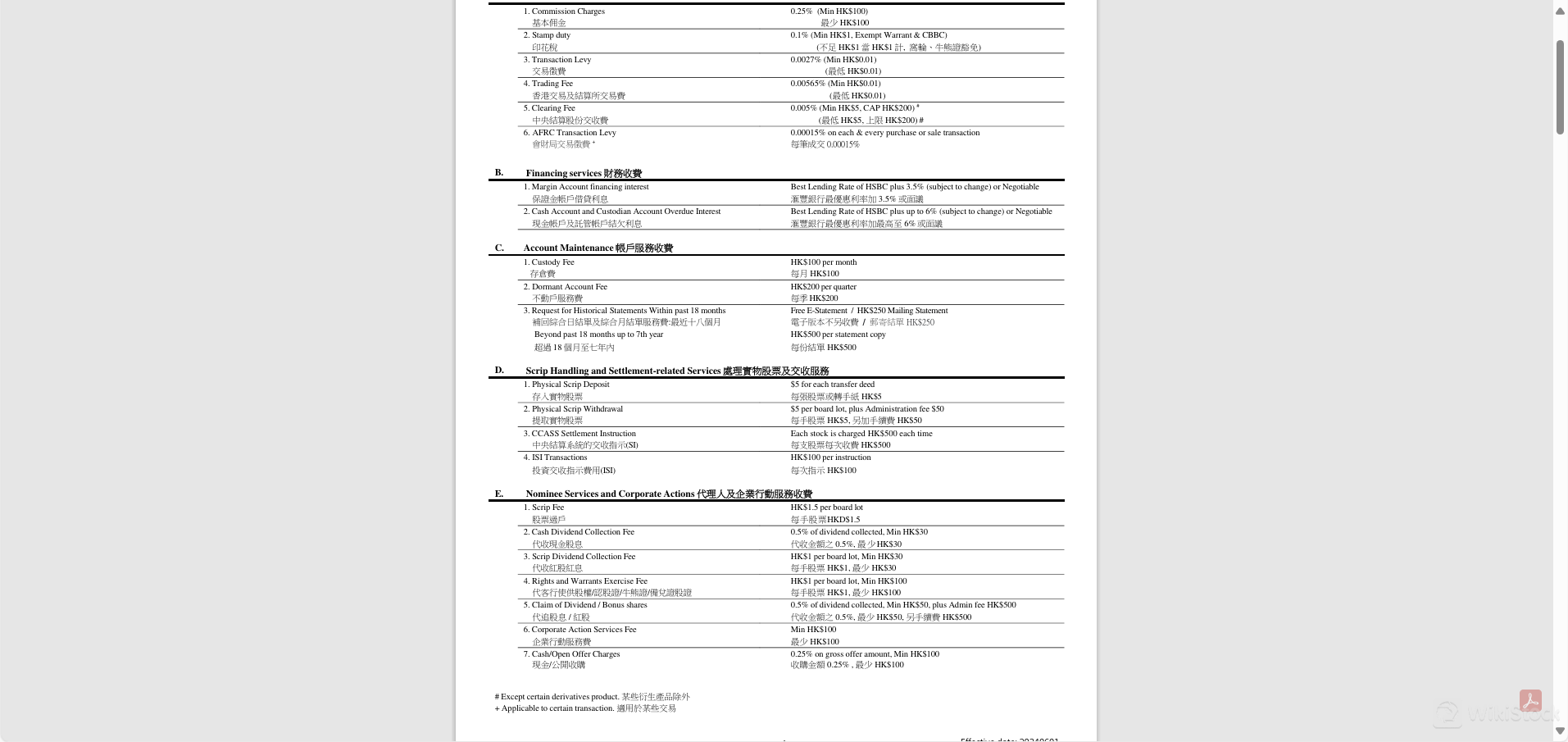

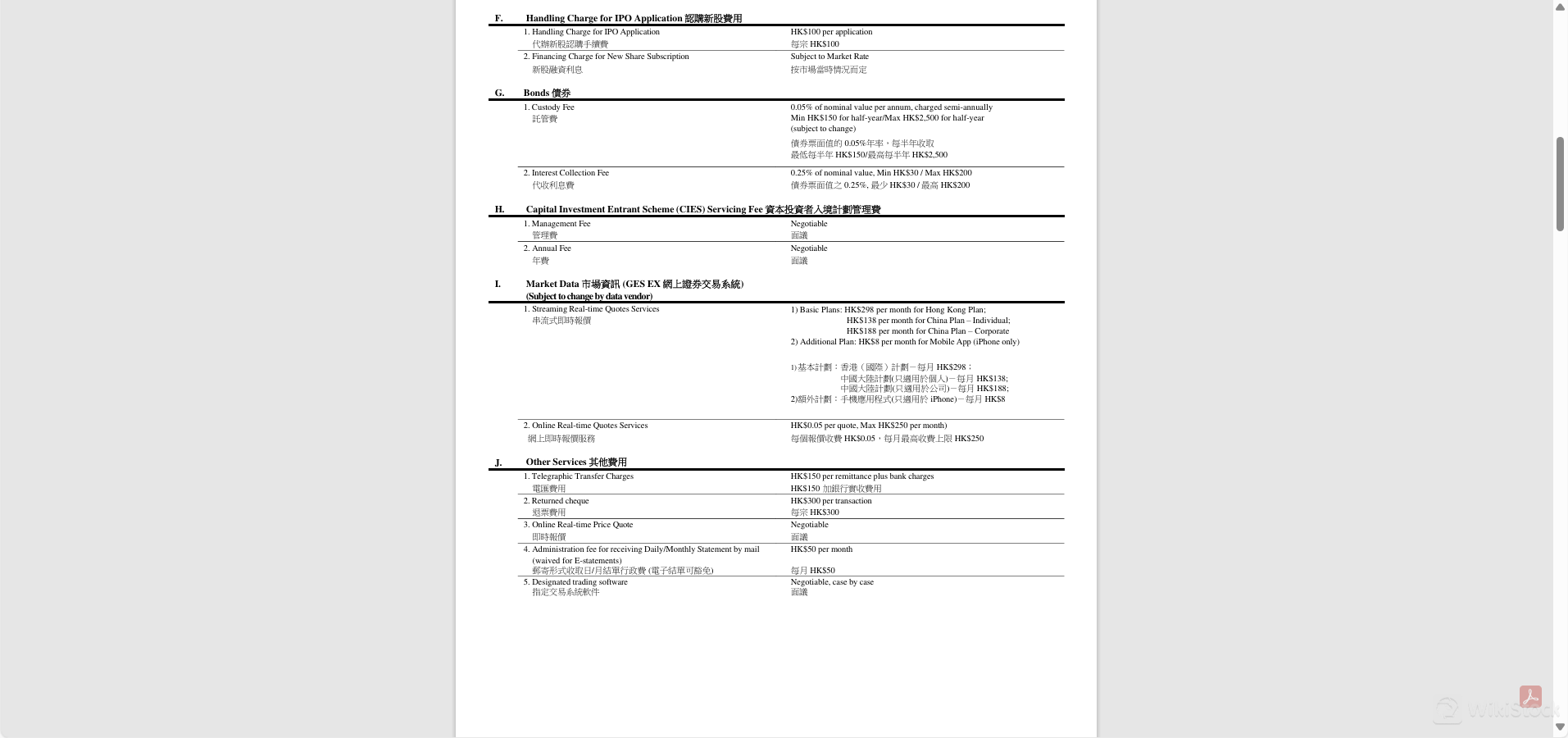

MFG Online's fee structure covers a wide range of services tailored for various trading and investment needs.

The fees span across trade-related services, account maintenance, financing services, and additional charges for special services like IPO handling and nominee services.

This structure ensures that all aspects of trading, from commission to custody fees and from financing interest rates to corporate action fees, are transparent and tailored to the needs of different investors.

MFG Online Trading Platform Review

MFG Limited offers a range of trading platforms suitable for different types of trading activities:

EX Trader - PC: This platform is designed for securities trading. It is available in both 32-bit and 64-bit versions for PCs.

SPTrader - PC and Mobile: SPTrader is available for both PC and mobile devices, aiming specifically for futures trading.

Auton - Mobile: This mobile platform is tailored for securities trading, providing flexibility for traders on the go.

OATS.NET - PC: This platform is specifically designed for stock option trading on PCs.

Research & Education

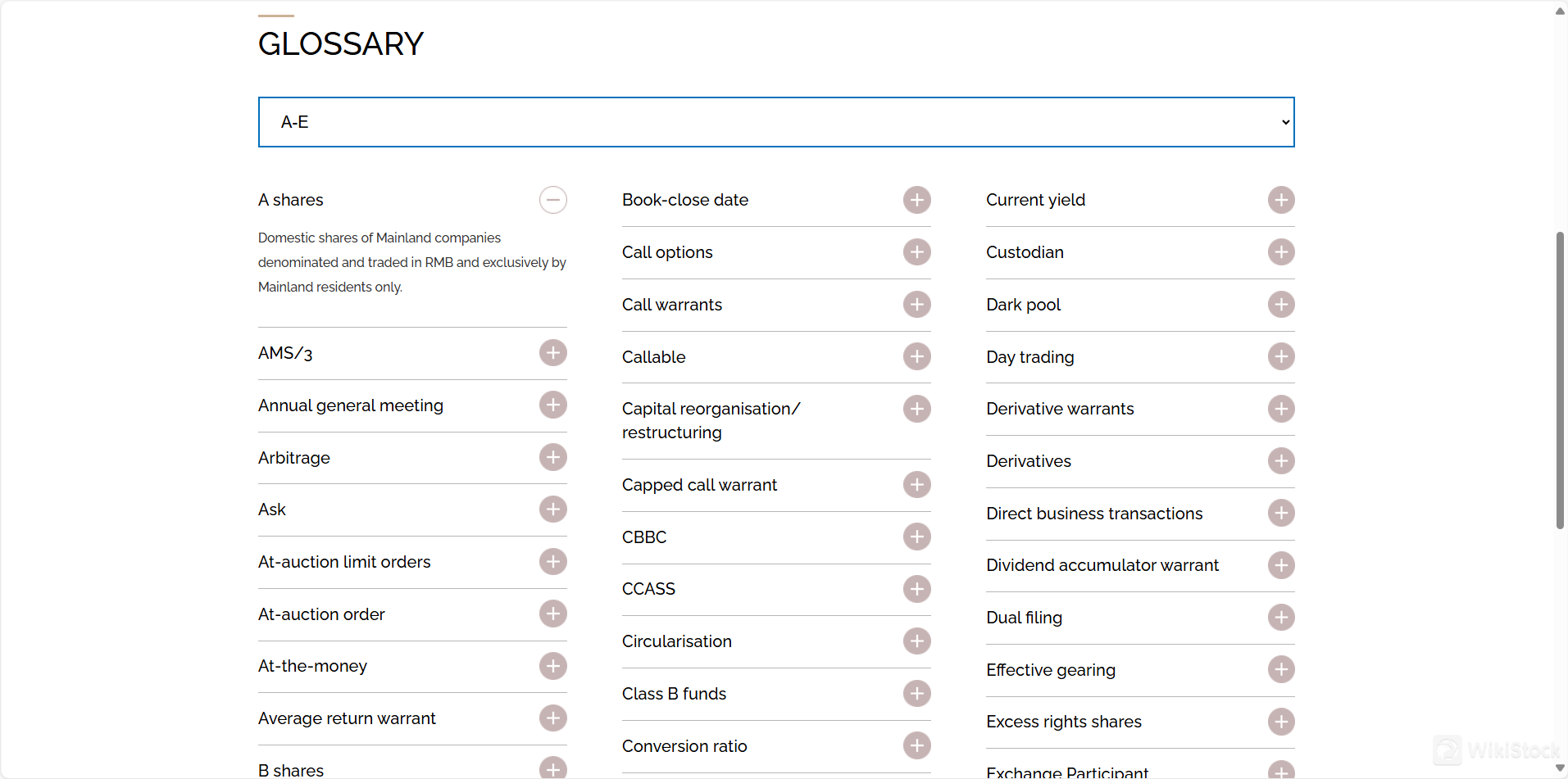

MFG Limited appears to provide a glossary as part of its research and educational resources.

This glossary includes a wide range of financial and trading terms, which would be helpful for both novice and experienced traders to understand complex financial concepts and the mechanisms of various trading activities.

The glossary covers terms from “A shares” to “Extraordinary general meeting,” encompassing aspects like market operations, types of orders, financial instruments, corporate actions, and more.

This educational approach indicates that MFG Limited values informing and educating its clients, helping them make more informed decisions in their trading and investment activities.

Customer Service

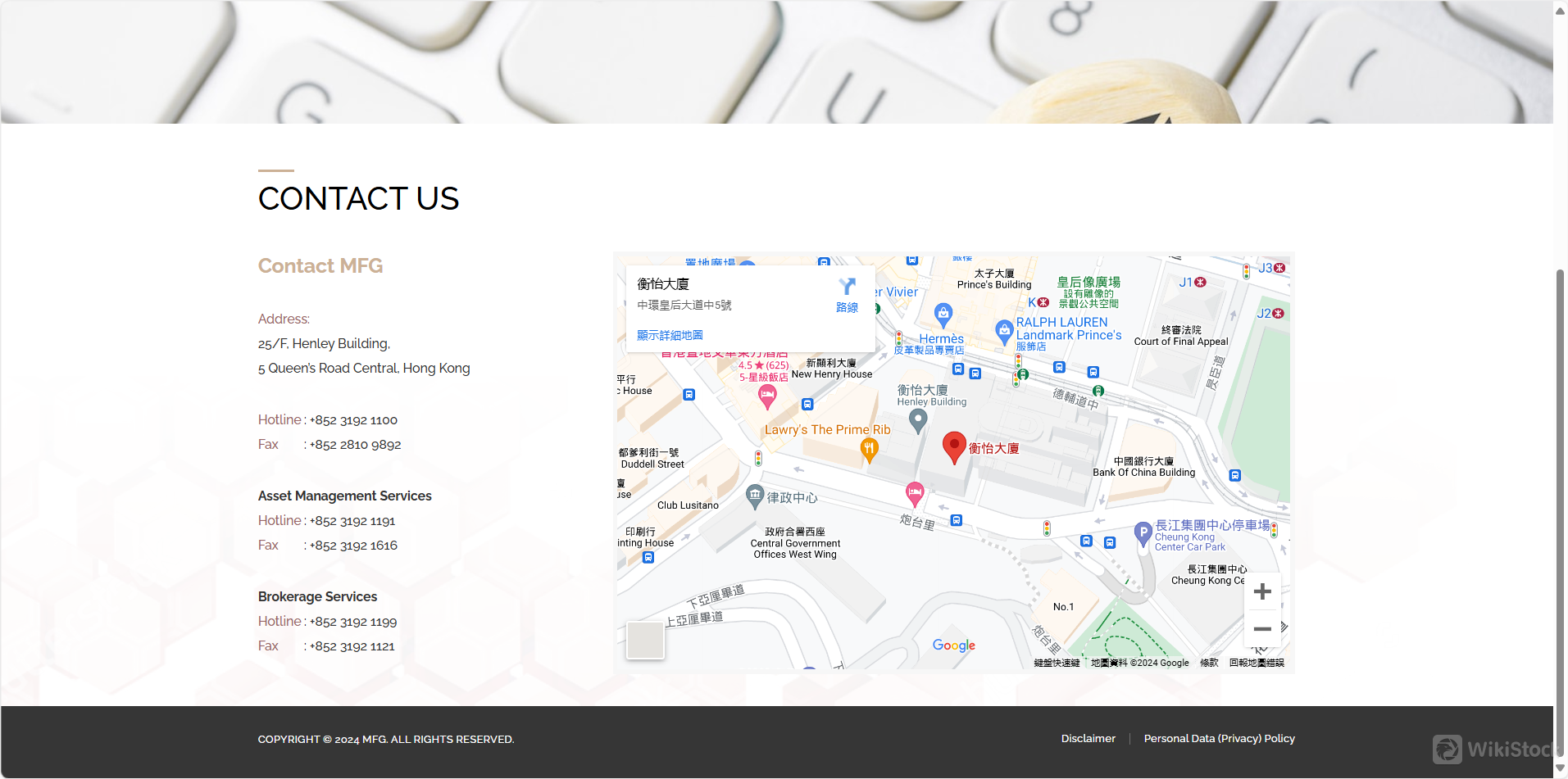

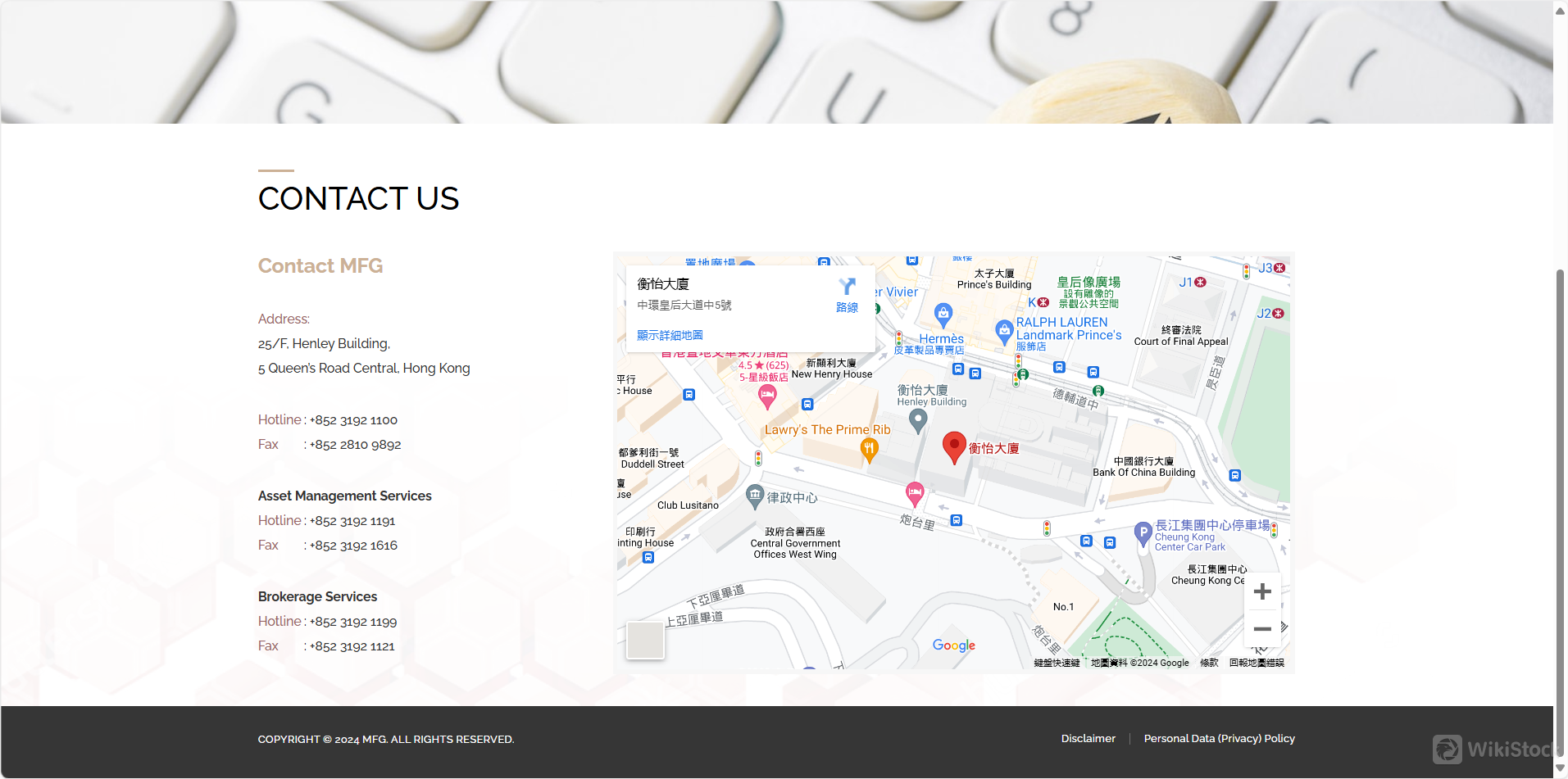

MFG Limited provides several customer support options, differentiated by the type of service:

General Contact

Address: 25/F, Henley Building, 5 Queens Road Central, Hong Kong

General Hotline: +852 3192 1100

Fax: +852 2810 9892

Asset Management Services

Hotline: +852 3192 1191

Fax: +852 3192 1616

Brokerage Services

Hotline: +852 3192 1199

Fax: +852 3192 1121

Conclusion

MFG Limited is a financial services provider based in Hong Kong, offering a wide range of tradable securities including stocks, bonds, derivatives, and investment schemes like the Capital Investment Entrant Scheme (CIES).

Attracting a diverse clientele, MFG is designed to accommodate various investment strategies with its offerings of global securities, a robust selection of bonds for long-term investors, and aggressive trading options through derivatives.

MFG's platforms support trading in multiple formats, ensuring flexibility and efficiency for all types of investors.

FAQs

1. What types of bonds does MFG Limited offer?

MFG offers corporate, government, perpetual, callable, puttable, convertible, and exchangeable bonds.

2. Can I trade international stocks with MFG?

Yes, MFG provides access to major global stock markets including the US, UK, Australia, Japan, Singapore, and Taiwan.

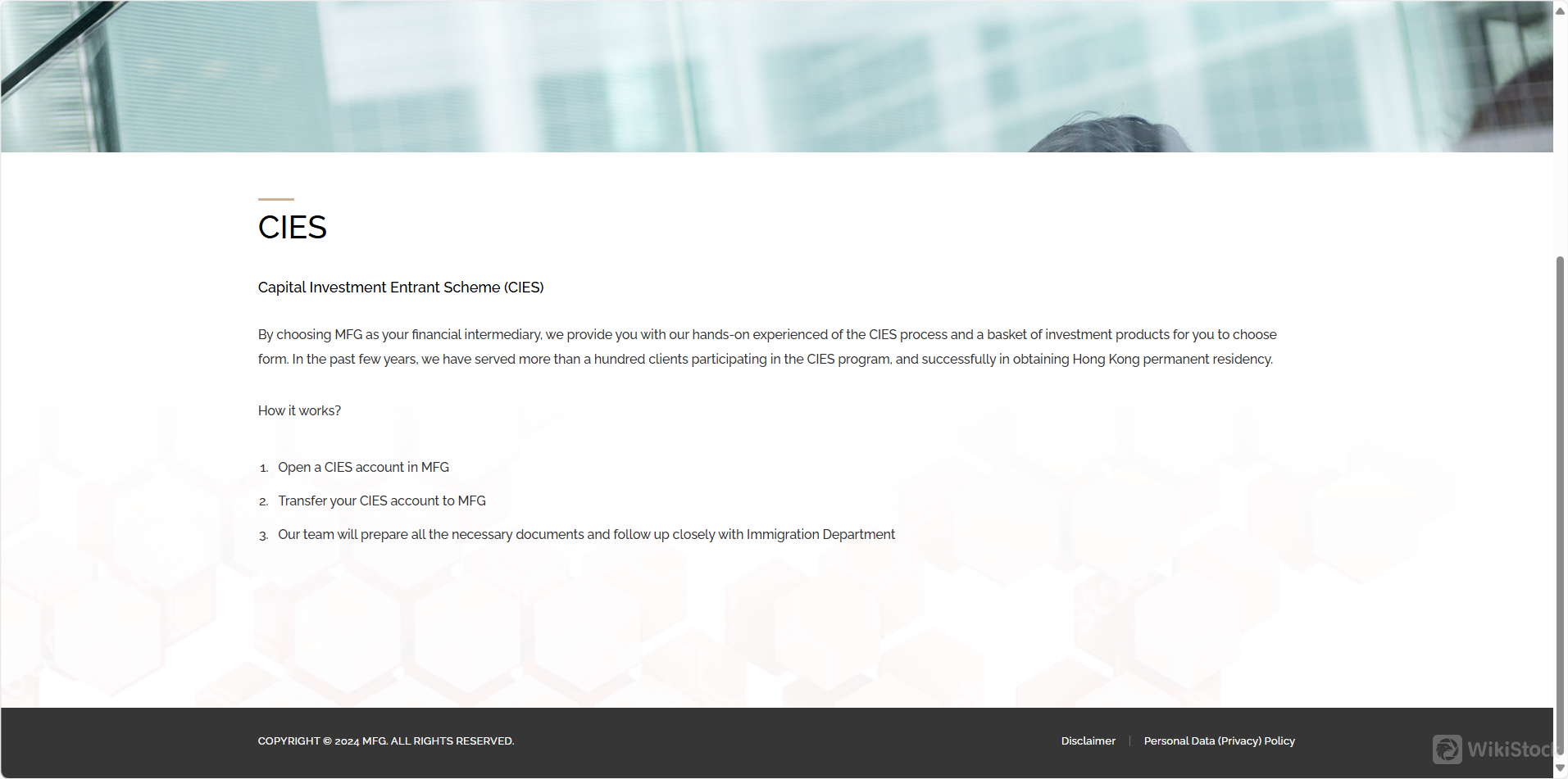

3. Does MFG assist with the Capital Investment Entrant Scheme (CIES)?

Yes, MFG offers assistance with the CIES, helping clients obtain Hong Kong permanent residency.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

United States

United StatesObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)