Score

仁和资本

https://www.c-hcc.com.hk/SC/home

Website

Rating Index

Brokerage Appraisal

Products

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02194

Brokerage Information

More

Company Name

仁和资本有限公司

Abbreviation

仁和资本

Platform registered country and region

Company address

Company website

https://www.c-hcc.com.hk/SC/homeCheck whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.15%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Harmonia Capital |  |

| WikiStock Rating | ⭐⭐⭐ |

| Fees | 0.00565% of transaction amount of Transaction Fee (HKEX), 0.0027% of transaction amount of Levy Fee (SFC) and 0.1% of transaction amount, rounded up to at least HKD 1 of Stamp Duty (HK SAR Govt) and so on |

| Promotions | No |

| Customer Support | (9:00 a.m. to 6:00 p.m. except Saturdays, Sundays and public holidays) phone, fax and email |

What is Harmonia Capital?

Harmonia Capital, under SFC, is renowned for its tailored asset management and investment advisory services designed to cater to the distinct needs of high-net-worth clients. Harmonia Capital offers a diverse range of investment opportunities in securities such as stocks, bonds.

Pros & Cons of Harmonia Capital

| Pros | Cons |

| Regulated by SFC | Complexity in Services |

| Tailored Services | Lack of Security Measures |

| Comprehensive Investment Options |

Regulated by SFC: Harmonia Capital operates under the supervision of the Securities and Futures Commission (SFC), ensuring compliance with stringent regulatory standards. This regulatory oversight enhances transparency and investor confidence.

Tailored Services: The firm specializes in providing personalized asset management and investment advisory services tailored for high-net-worth individuals. This focus likely results in customized investment strategies that meet specific client needs.

Comprehensive Investment Options: Harmonia Capital offers a diverse range of investment opportunities including stocks, bonds, warrants, CBBCs, funds, IPO subscriptions, and underwriting services. This breadth allows clients flexibility in constructing diversified portfolios.

Cons:Complexity in Services: The firms extensive service offerings, which include underwriting and complex financial instruments like CBBCs, may be challenging for less experienced investors to understand fully. This complexity could pose risks if not managed properly.

Lack of Security Measures: While the firm emphasizes regulatory compliance, specific details about their security measures to protect client investments and data are not mentioned. This lack of transparency regarding security practices could be a concern for some investors.

Is Harmonia Capital Safe?

Harmonia Capital operates under the oversight and regulation of the Securities and Futures Commission (SFC), holding License No. BOP761. As a pivotal financial regulator within an esteemed international financial hub, the SFC is dedicated to fortifying and safeguarding the integrity and robustness of Hong Kong's securities and futures markets. Its primary mission is to uphold the interests of investors and ensure the industry's stability through stringent oversight and regulatory frameworks. This commitment extends to fostering transparency, maintaining fair practices, and enhancing market efficiency, thereby promoting investor confidence and contributing to the sustainable growth of Hong Kong's financial ecosystem.

What are Securities to Trade with Harmonia Capital?

Harmonia Capital offers a wide range of securities and services to its customers in the Hong Kong market.

Stocks: Harmonia Capital provides access to Hong Kong stocks, allowing customers to trade equities listed on the Hong Kong Stock Exchange.

Bonds: Customers can also invest in bonds through Harmonia Capital, offering fixed-income securities that provide regular interest payments and return of principal upon maturity.

Warrants: Harmonia Capital allows customers to trade warrants, which are derivative securities that give the holder the right to buy or sell an underlying asset at a specified price within a specific time frame.

CBBCs (Callable Bull/Bear Contracts): Customers can trade CBBCs through Harmonia Capital, which are structured products that allow investors to take leveraged positions on an underlying asset.

Trading Funds: Harmonia Capital offers trading funds, providing customers with access to a diversified portfolio of assets that are actively managed by professionals.

IPO Subscription: Customers can participate in initial public offerings (IPOs) through Harmonia Capital, enabling them to invest in newly listed companies at the IPO price.

Placing and Underwriting Services: Harmonia Capital also provides placing, IPO, and bond underwriting services for listed companies, assisting in the issuance and distribution of securities in the market.

Harmonia Capital Services Review

Harmonia Capital offers a suite of asset management and investment advisory services tailored to meet the needs of high-net-worth clients.

Their multi-category asset management business spans various investment avenues, including the secondary stock market, overseas bond market, participation in IPOs, real estate, and more. They focus on value investment strategies and aim for absolute returns, ensuring long-term steady appreciation for their clients.

One of their notable offerings is the establishment of Cayman Funds, which invest in high-yield bonds through leverage, providing customers with liquidity while yielding higher coupon rates. Additionally, institutions can directly participate in newly issued bonds, benefitting from favorable interest rates and higher financing limits.

Harmonia Capital also provides discretionary portfolio management services, offering customized investment solutions, asset allocation advice, and personalized wealth management services based on clients' risk appetites.

Harmonia Capital Fees Review

Harmonia Capitals fee structure encompasses a range of charges across trading, custody, corporate actions, bond trading, banking services, and real-time quotes.

| Trading Fees | |

| Electronic System Trading Commission | Minimum 0.15% per transaction amount; Minimum fees: HKD 100, CNY 100, USD 15 |

| Non-Electronic System Trading Commission (via phone) | Minimum 0.25% per transaction amount; Minimum fees: HKD 100, CNY 100, USD 15 |

| Additional Trading Fees | |

| Transaction Fee (HKEX) | 0.00565% of transaction amount |

| Levy Fee (SFC) | 0.0027% of transaction amount |

| Stamp Duty (HK SAR Govt) | 0.1% of transaction amount, rounded up to at least HKD 1 |

| Custody and Handling Fees | |

| Deposit Fee (Physical Stocks) | HKD 5 per transfer deed |

| Withdrawal Fee (Physical Stocks) | HKD 2 per board lot, plus additional fees from HKSCC |

| Corporate Actions and Proxy Services | |

| Registration Transfer Fee | HKD 1.5 per board lot |

| Dividend/Interest Collection Fee | 0.5% of total dividend amount, minimum fees based on currency |

| Rights Issue/Redemption Fee | Variable fees based on shares and transactions |

| Bond Trading and Custody | |

| Bond Trading Commission | 0.75% of face value of the bond |

| Bond Settlement Fee | Fixed fees for transactions in HKD, CNY, or USD |

| Custody Fee for Bond Portfolios | Annual 0.05% of bond portfolios face value, charged monthly, with minimum fee |

| Banking Services | |

| General Withdrawal Fee | Charges vary based on withdrawal amount |

| Remittance and Local Cash Transfer Fees | Set fees for each transaction |

| Real-time Quote Service | |

| Mainland Users | HKD 238/month |

| International | HKD 388/month |

Harmonia Capital Deposit & Withdrawal Review

- Deposits

Methods Available:

FPS Transfer: Customers are advised to keep a screenshot of the transfer.

Local Bank Transfer: Customers should retain the bank transfer slip and bear any applicable interbank transfer fees.

Telegraphic Transfer: Customers should keep the telegraphic transfer receipt and bear the telegraphic transfer fees.

Cheque: Customers should retain a copy of the cheque and the deposit receipt.

Conditions:

Deposits must be from a bank account registered with Harmonia Capital at the time of account opening.

Third-party deposits are not accepted. If the source of funds cannot be verified, the deposit may be returned, and the depositor will bear any refund costs. Cash deposits into the companys bank account are not accepted.

Cutoff Times:

Deposits notified or made after 4:00 PM from Monday to Friday will be processed the next business day. If it's a Hong Kong public holiday or a half-day, processing will be postponed to the next working day.

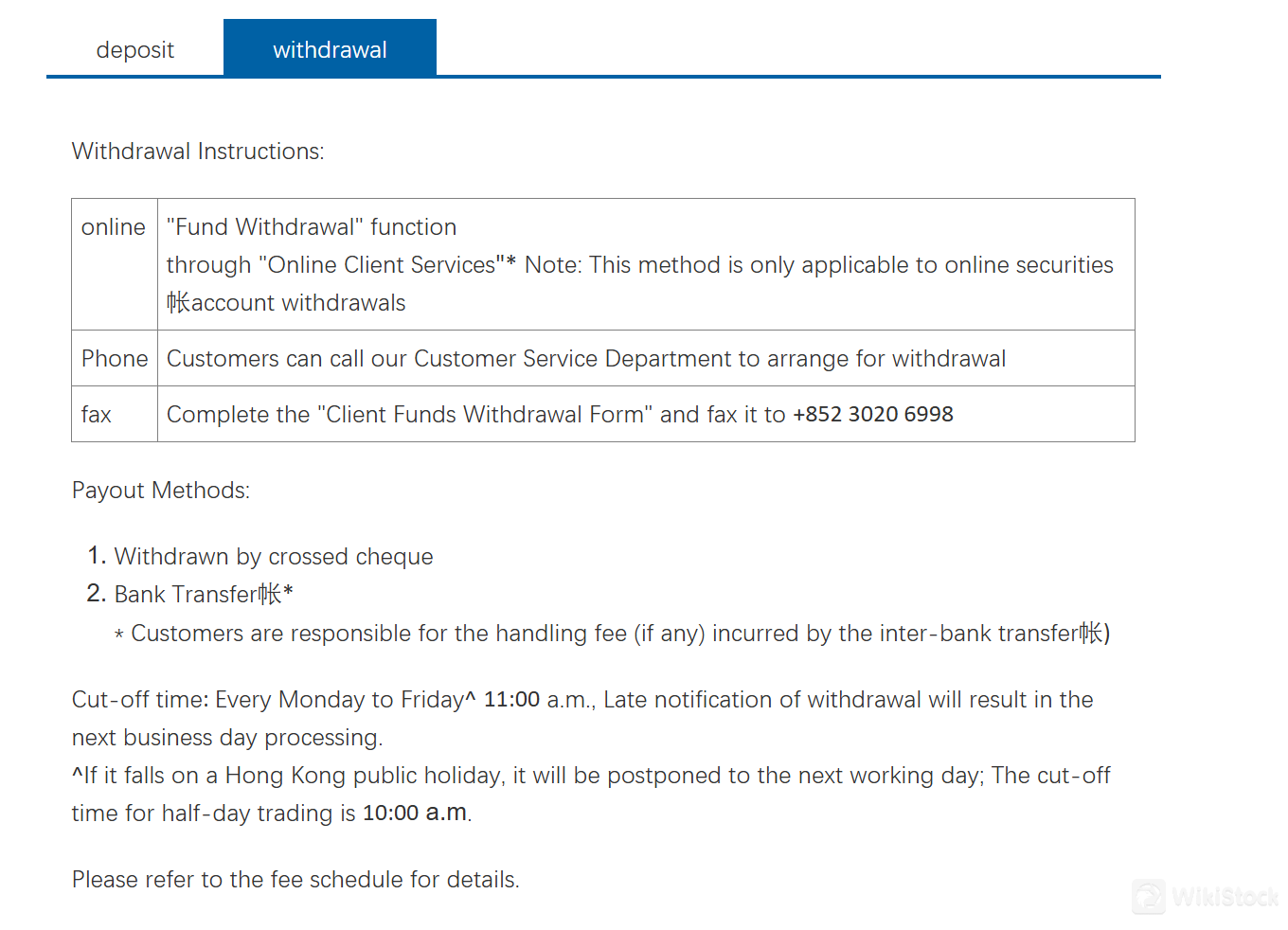

- Withdrawals

Methods Available:

Online Customer Service: Through the 'Withdraw Funds' feature for online securities accounts.

Phone: Customers can call customer service to arrange withdrawals.

Fax: Customers can complete a 'Customer Fund Withdrawal Form' and fax it to +852 3020 6998.

Receiving Methods:

Funds can be withdrawn via crossed cheque or bank transfer. Customers must bear any interbank transfer fees if applicable.

Cutoff Times:

Requests for withdrawal received after 11:00 AM from Monday to Friday will be processed the next business day. If its a Hong Kong public holiday or a half-day, processing will be postponed to the next working day.

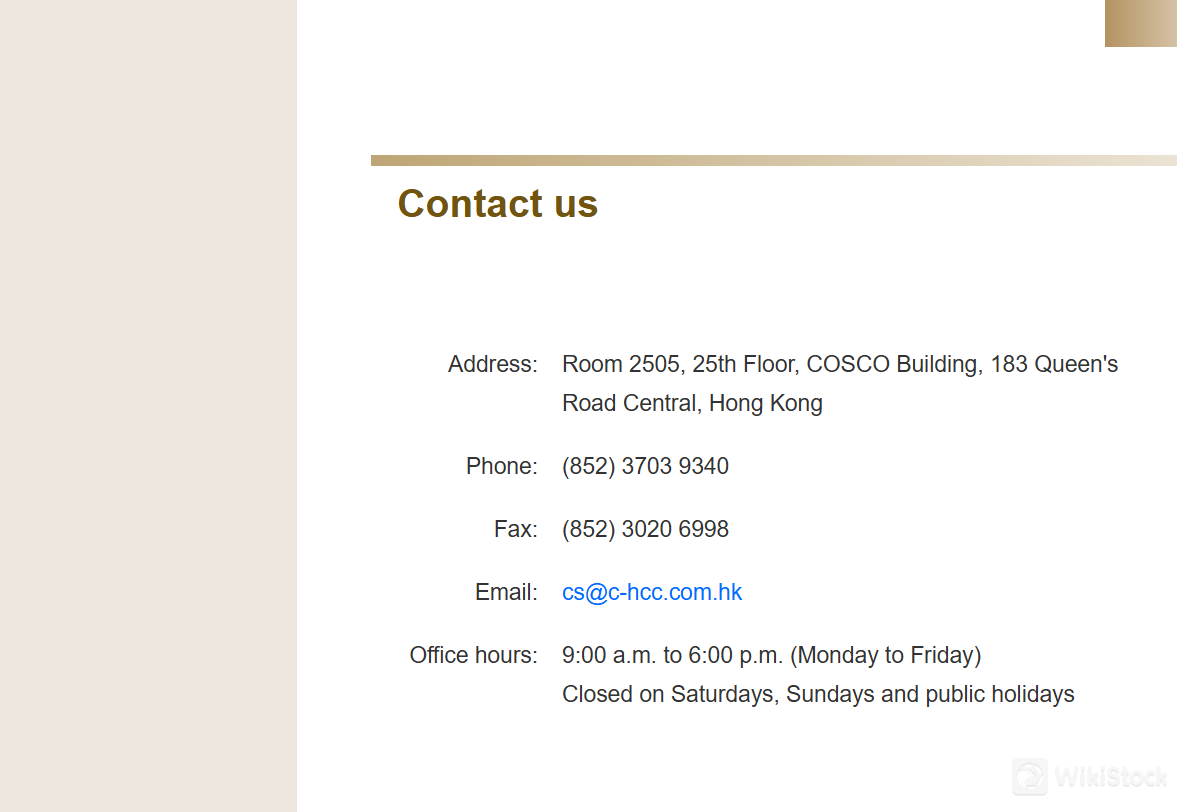

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Office hours: 9:00 a.m. to 6:00 p.m. (Monday to Friday), Closed on Saturdays, Sundays and public holidays

Phone:(852) 3703 9340

Fax:(852) 3020 6998

Email:cs@c-hcc.com.hk

Address: Room 2505, 25th Floor, COSCO Building, 183 Queen's Road Central, Hong Kong

Conclusion

In conclusion, Harmonia Capital presents a range of investment opportunities and tailored services, backed by strong regulatory oversight frommSFC. Their focus on personalized asset management for high-net-worth individuals and diverse investment options can offer clients the flexibility to create diversified portfolios that align with their financial goals.

However, the complexity of some of the financial instruments and potential lack of transparency regarding security measures may require careful consideration, particularly for less experienced investors. Overall, Harmonia Capital can be a valuable partner for those seeking comprehensive investment guidance and a broad range of investment opportunities, provided they fully understand and are comfortable with the offered services.

Frequently Asked Questions (FAQs)

Is Harmonia Capital regulated?

Yes. It is regulated by SFC.

What types of securities can I invest in with Harmonia Capital?

You can trades stocks, bonds, warrants, CBBCs, funds, IPO subscription, and placing and underwriting services.

How can I contact Harmonia Capital?

You can contact via telephone:(852) 3703 9340, fax: (852) 3020 6998 and email:cs@c-hcc.com.hk.

How long after selling can I withdraw from Harmonia Capital?

Requests for withdrawal received after 11:00 AM from Monday to Friday will be processed the next business day.

Is there any additional fees I should be aware of?

Yes, in addition to brokerage fees, clients incur other charges such as stamp duty, transaction levies and so on.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

Matrix Securities

Score

NG

Score

常匯證券

Score

興旺證券

Score

ZSL

Score

Cornerstone Securities

Score

GSL

Score

Huayu Securities

Score

Chelsea Securities

Score

West Bull

Score