Central Wealth Securities Investment Limited (CWSI) was founded in 2014. It is a member of Central Wealth Group Holdings Limited (00139.HK) which is a Hong Kong listed company. Central Wealth Group Holdings Limited was listed on the main board of Hong Kong Stock Exchange on March 15, 1994. It is a long history Hong Kong listed company with a steady operation and is deeply recognized by the Hong Kong securities regulatory agency. Central Wealth Group Holdings Limited has always been committed to providing a full range of financial services for its customers in China and Hong Kong. Currently, it holds Hong Kong securities No. 1 (dealing in securities), No. 4 (advising on securities), and NO.9 (asset management) licenses, with business covering securities brokerage, securities underwriting, margin financing, securities research, asset management (private funds set-up and management), structured products, and other integrated financial services.

CWSI Information

CWSI is a brokerage firm known for its user-friendly trading platforms, comprehensive educational resources, and strong regulatory compliance with the SFC. It offers competitive fees and advanced security measures to protect client funds. However, its fee structure can be complex, particularly for margin accounts.

Pros and Cons of CWSI

CWSI provides a secure and comprehensive trading experience with robust regulatory oversight, diverse account types, and advanced safety measures. However, the fee structure can be complex, and margin trading carries higher risks. Their extensive educational resources and customer support further enhance the user experience.

Is CWSI safe?

CWSI is considered a safe platform for trading based on three critical dimensions:

Regulation: CWSI is regulated by the Securities and Futures Commission (SFC), which ensures that the company adheres to strict financial regulations and standards.

Safety Measures: CWSI employs advanced encryption technologies to ensure the secure storage of funds and implements robust account security measures to prevent unauthorized access and protect user information from leaks.

What are securities to trade with CWSI?

CWSI offers a comprehensive suite of services designed to enhance your trading experience, including online stock trading, margin accounts, and access to IPOs. With online stock trading, investors can buy and sell a variety of securities through an intuitive, user-friendly platform. This convenience allows for real-time trading, access to market data, and the ability to manage portfolios from anywhere with an internet connection.

Margin accounts are another key feature provided by CWSI, enabling investors to borrow funds from the broker to purchase additional securities. This leverage can amplify potential gains, but it also increases the risk, as losses can exceed the initial investment. Margin accounts are essential for investors looking to maximize their buying power and execute more substantial trades with a smaller initial capital outlay.

Furthermore, CWSI provides access to IPOs (Initial Public Offerings), allowing investors to purchase shares in companies before they become publicly traded on the open market. Investing in IPOs can be highly lucrative, offering the potential for significant returns if the stock performs well after the offering. However, IPOs also come with higher risk due to their initial volatility and the uncertainty surrounding the companys future performance.

CWSI Accounts

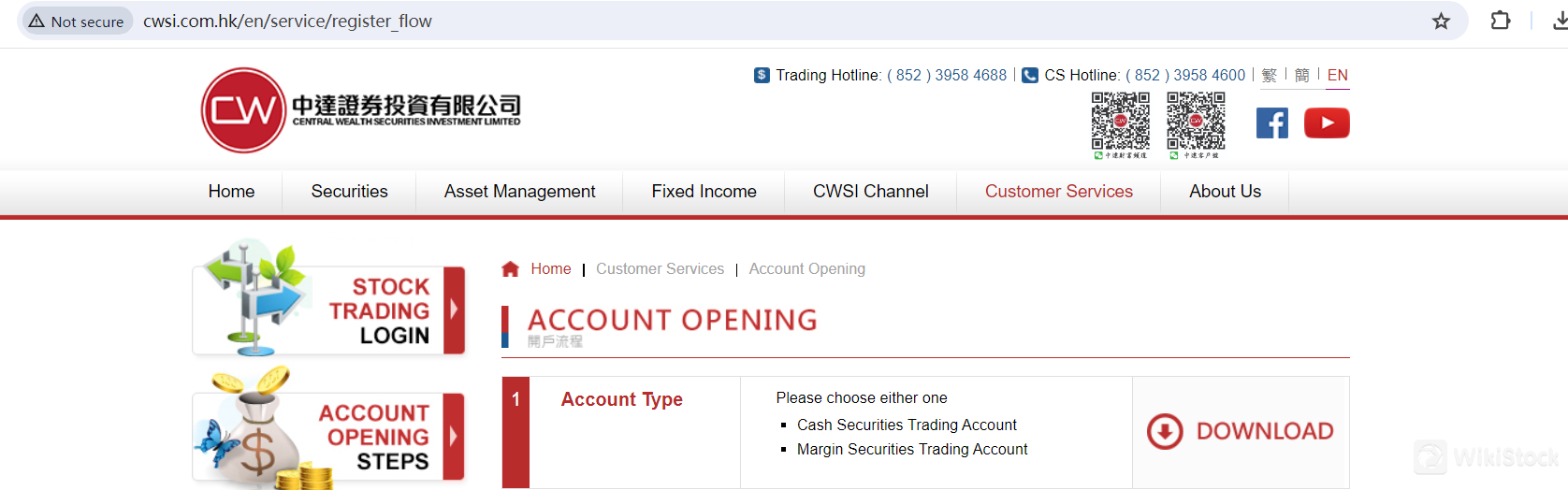

CWSI offers two primary types of trading accounts to cater to different investment strategies and needs: the Cash Securities Trading Account and the Margin Securities Trading Account.

The Cash Securities Trading Account is a straightforward and traditional form of trading account. In this type of account, investors use their own funds to purchase securities. Transactions are settled in cash, meaning the investor must have the total amount of money required to complete a trade in their account at the time of the transaction. This account type is ideal for investors who prefer to trade without borrowing funds, thereby minimizing risk. It offers a simple and transparent way to manage investments, making it suitable for both beginners and experienced traders who want to avoid the complexities of leveraged trading.

On the other hand, the Margin Securities Trading Account provides investors with the ability to borrow funds from the broker to purchase securities, thereby increasing their buying power. This type of account is designed for more experienced investors who seek to maximize their potential returns through leverage. By borrowing money, investors can make larger trades than they could with their own capital alone. However, this comes with higher risk, as losses can exceed the initial investment due to the use of borrowed funds. Margin accounts also require investors to maintain a minimum account balance and may involve margin calls if the value of the securities drops below a certain level. This account type is suitable for investors who are comfortable with risk and have a thorough understanding of margin trading and its implications.

CWSI Fees Review

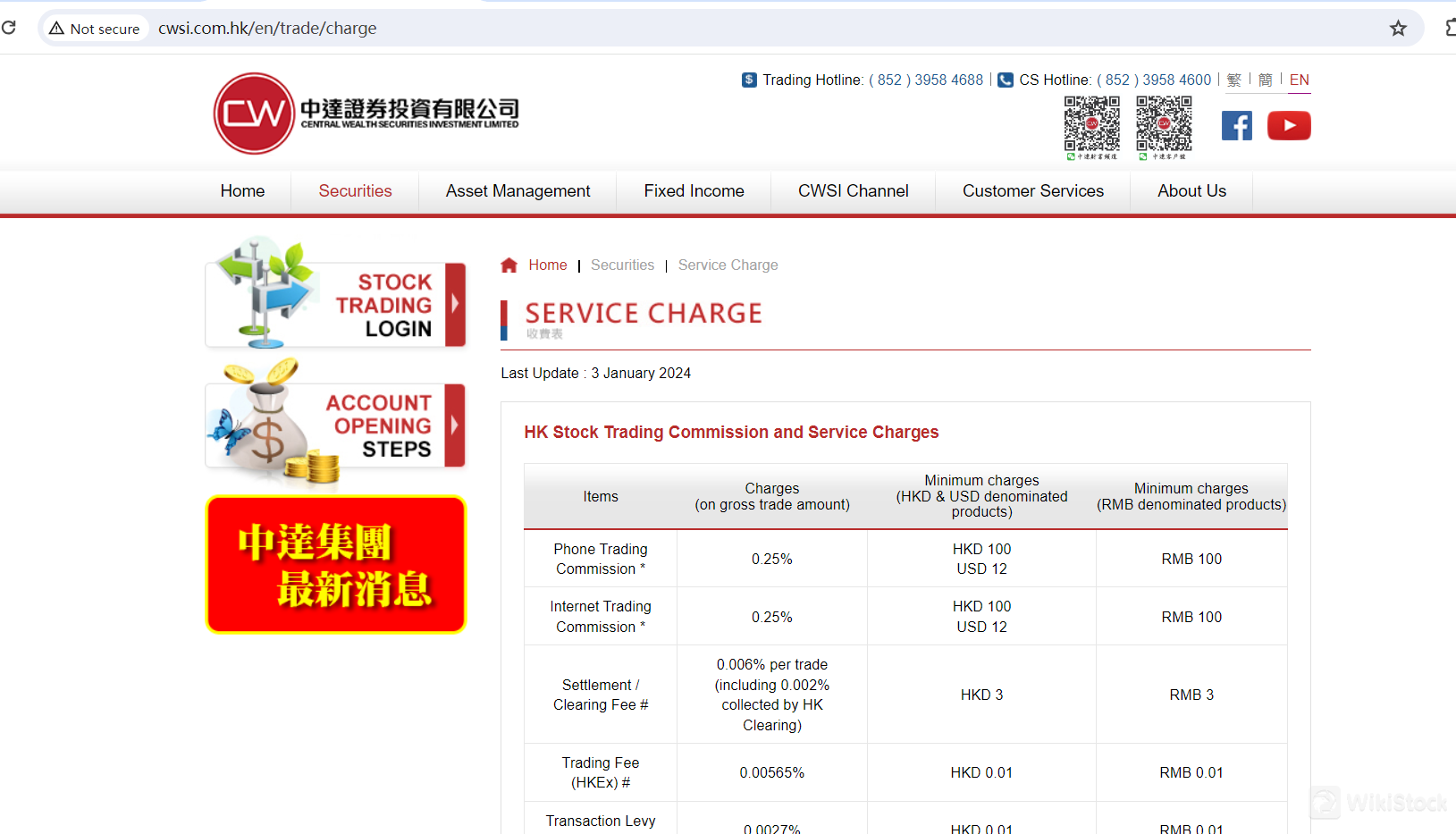

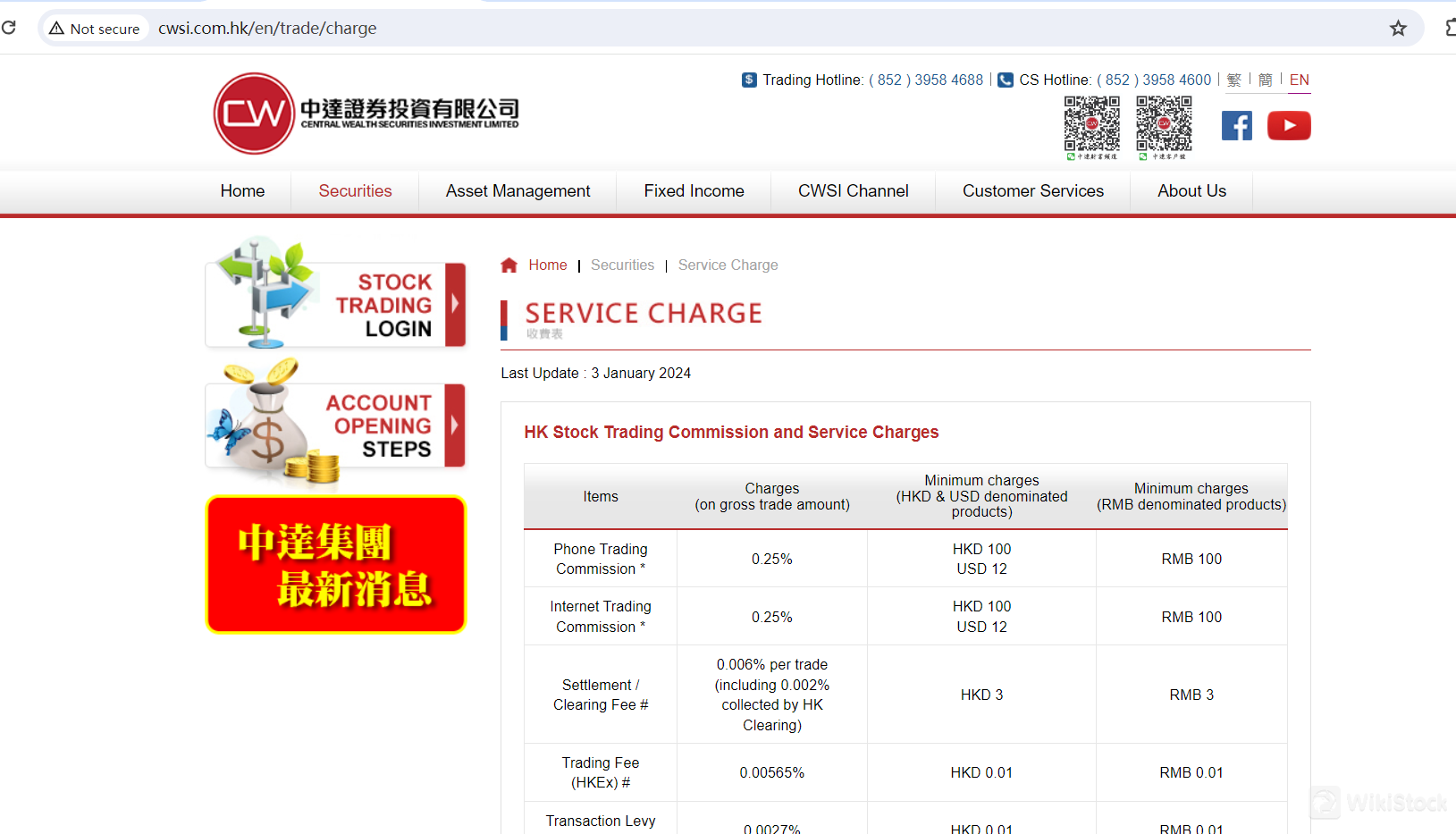

CWSI offers a range of HK stock trading services with specific commission and service charges for different trading methods. For phone trading, the commission is 0.25% of the gross trade amount with minimum charges of HKD 100, USD 12, or RMB 100 depending on the currency denomination. Similarly, internet trading also incurs a commission of 0.25% with the same minimum charges as phone trading.

Additional fees include a settlement/clearing fee of 0.006% per trade, which includes 0.002% collected by HK Clearing and has a minimum charge of HKD 3 or RMB 3. The trading fee (HKEx) is 0.00565% with minimum charges of HKD 0.01 or RMB 0.01. There is also a transaction levy (SFC) of 0.0027% and a stamp duty of 0.1%, rounded up to the nearest dollar. Additionally, the FRC transaction levy is 0.00015%, rounded to the nearest cent.

For scrip handling, settlement-related, and account maintenance services, fees vary. A stock custody fee for dormant accounts is HKD 0.012 per board lot per month with a minimum of HKD 10. Physical scrip deposit costs HKD 5 per transfer deed, while physical scrip withdrawal is charged at HKD 10 per board lot with a minimum of HKD 200. CCASS settlement instruction (SI) involves a client commission based on stock value with a minimum charge of HKD 200 for withdrawal instructions.

Corporate actions and other services also have specific fees. For attending or authorizing a third party to attend a general meeting of stockholders, the administration fee is HKD 100 per application. The handling charge for IPO applications is HKD 120 for financing and HKD 50 for non-financing HKD-denominated products, with corresponding RMB charges.

For Shanghai and Shenzhen Connect trading, the trading commission is 0.25% with a minimum charge of RMB 120. Other fees include a handling fee of 0.00341%, a securities management fee of 0.002%, and transfer fees of 0.001% (China) and 0.002% (Hong Kong). The stamp duty for these trades is 0.05% of the transaction amount on the seller.

For U.S. shares trading, the trading commission is 0.25% with a minimum of USD 30 per transaction. The SEC fee is 0.00278% for sell orders, rounded to the nearest cent, with a minimum of USD 0.01. The clearing fee is USD 0.003 per share with a minimum of USD 0.50.

Overall, CWSI provides a detailed fee structure for various trading and account maintenance services, ensuring transparency and clarity for investors.

CWSI App Review

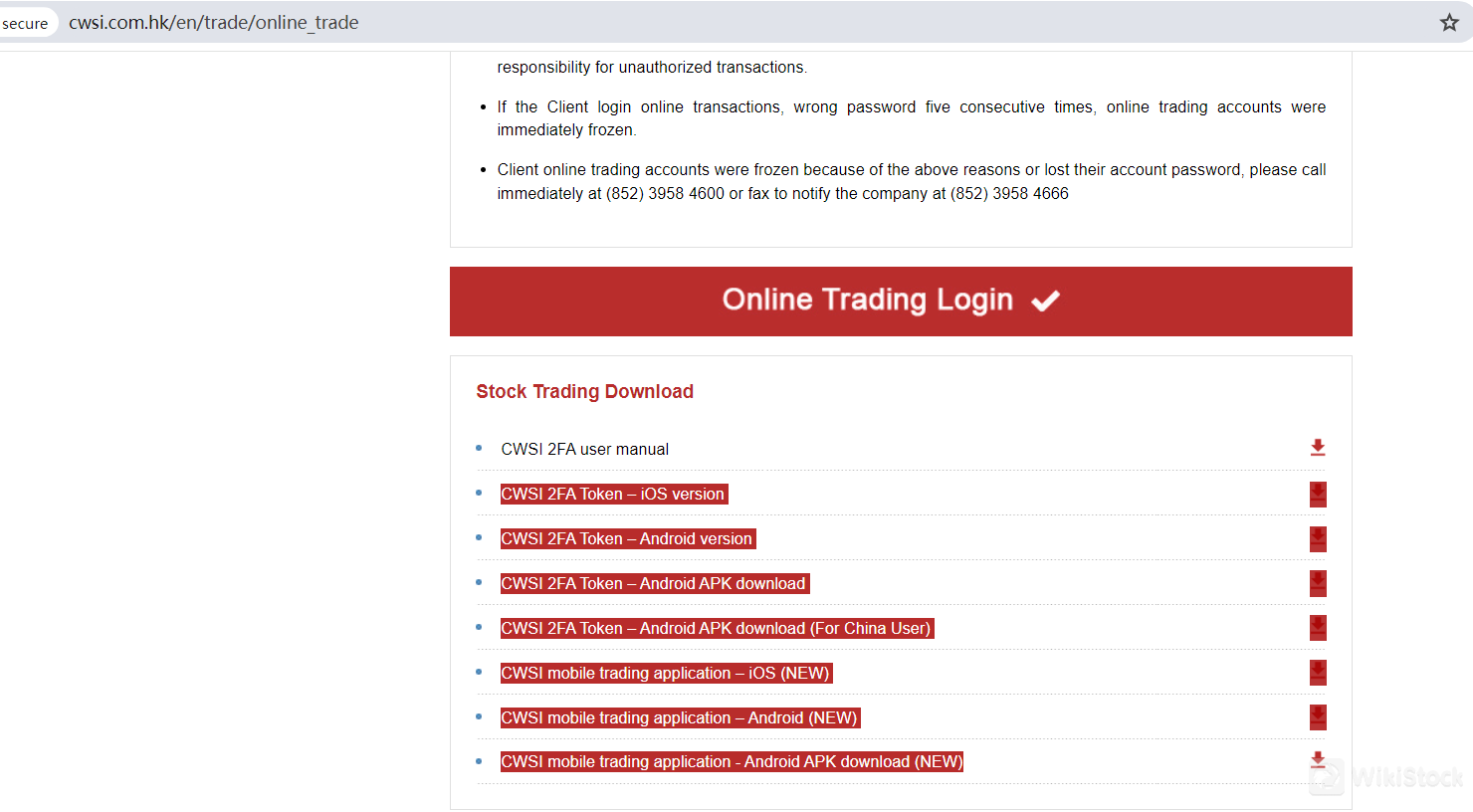

CWSI provides a range of secure and efficient trading platforms to meet the diverse needs of its clients, ensuring they can trade conveniently from various devices. These platforms are designed to enhance the trading experience by offering robust security features, user-friendly interfaces, and accessibility.

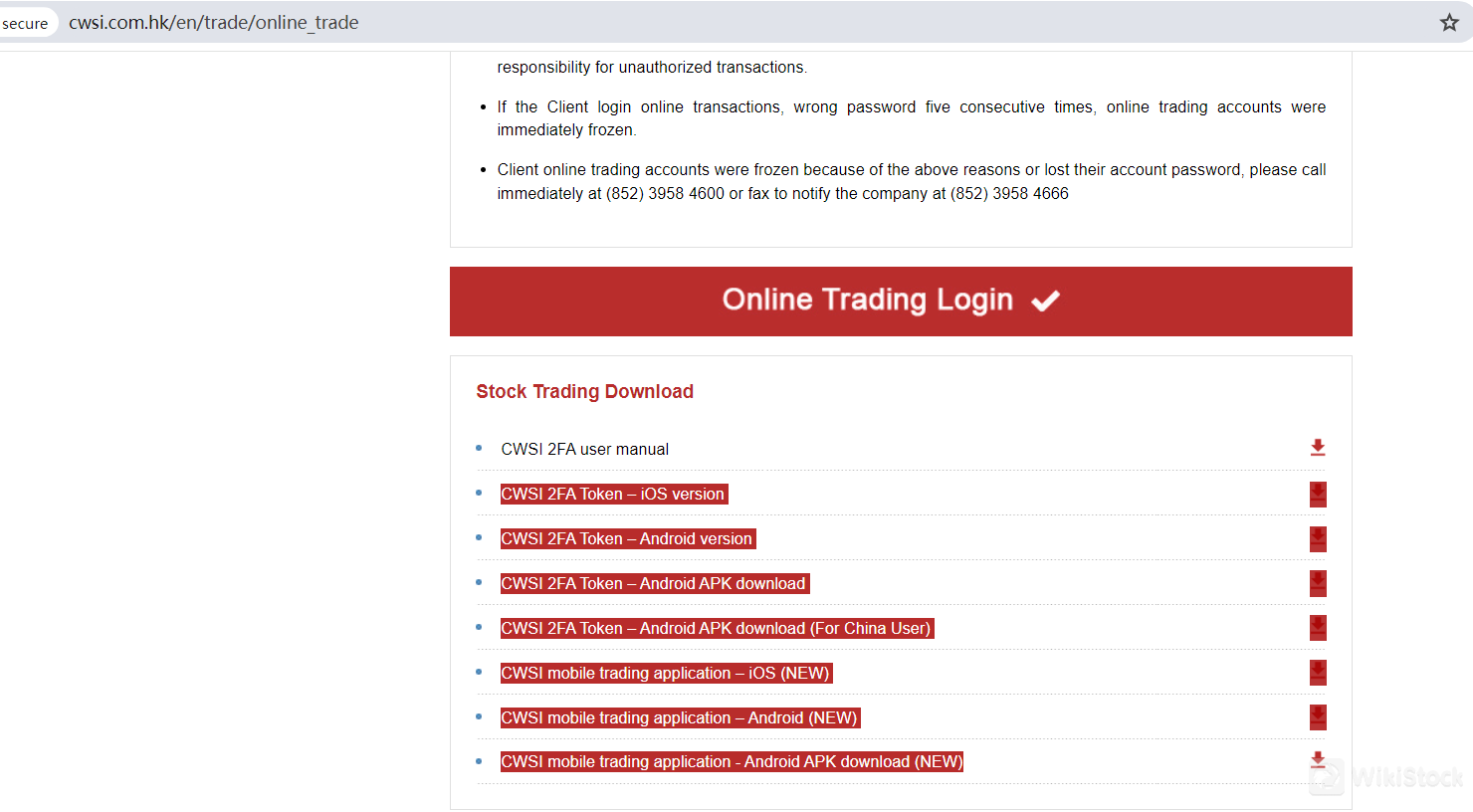

The CWSI 2FA Token – iOS version and CWSI 2FA Token – Android version are essential security tools for users who want to ensure their trading accounts are protected with two-factor authentication (2FA). These tokens provide an additional layer of security by requiring a second form of verification, typically a unique code generated by the token, in addition to the usual password. This significantly reduces the risk of unauthorized access and enhances the overall security of trading activities.

For Android users in China, the CWSI 2FA Token – Android APK download (For China User) provides a localized version of the security token application, ensuring seamless functionality and compliance with regional requirements. This APK version can be downloaded directly, providing Chinese users with the same level of security and convenience as other users.

In addition to security tokens, CWSI offers comprehensive mobile trading applications that cater to modern traders' needs. The CWSI mobile trading application – iOS (NEW) is designed for Apple device users, providing a sleek, intuitive interface that allows for efficient trading on the go. This application offers real-time market data, advanced charting tools, and the ability to execute trades quickly and efficiently.

Similarly, the CWSI mobile trading application – Android (NEW) offers a robust trading experience for Android users. It includes features such as real-time quotes, detailed market analysis, and seamless trade execution. For users who prefer to download applications directly, the CWSI mobile trading application - Android APK download (NEW) provides an alternative method to install the app, ensuring flexibility and accessibility.

Overall, CWSI's trading platforms are designed to provide secure, efficient, and user-friendly experiences for traders. Whether through advanced 2FA tokens or comprehensive mobile trading applications, CWSI ensures that its clients can trade confidently and conveniently, regardless of their preferred devices or operating systems.

Research and Eduation

CWSI provides comprehensive educational and research resources to support investors in making informed decisions. Their offerings likely include:

Research Reports: Detailed analyses and insights on various markets, industries, and specific securities. These reports help investors understand market trends and make data-driven decisions. Access these reports here.

News and Notices: Updates on market conditions, company announcements, and other relevant financial news. This helps investors stay current with important developments that might impact their investments. For the latest news, visit CWSI News.

Customer Service

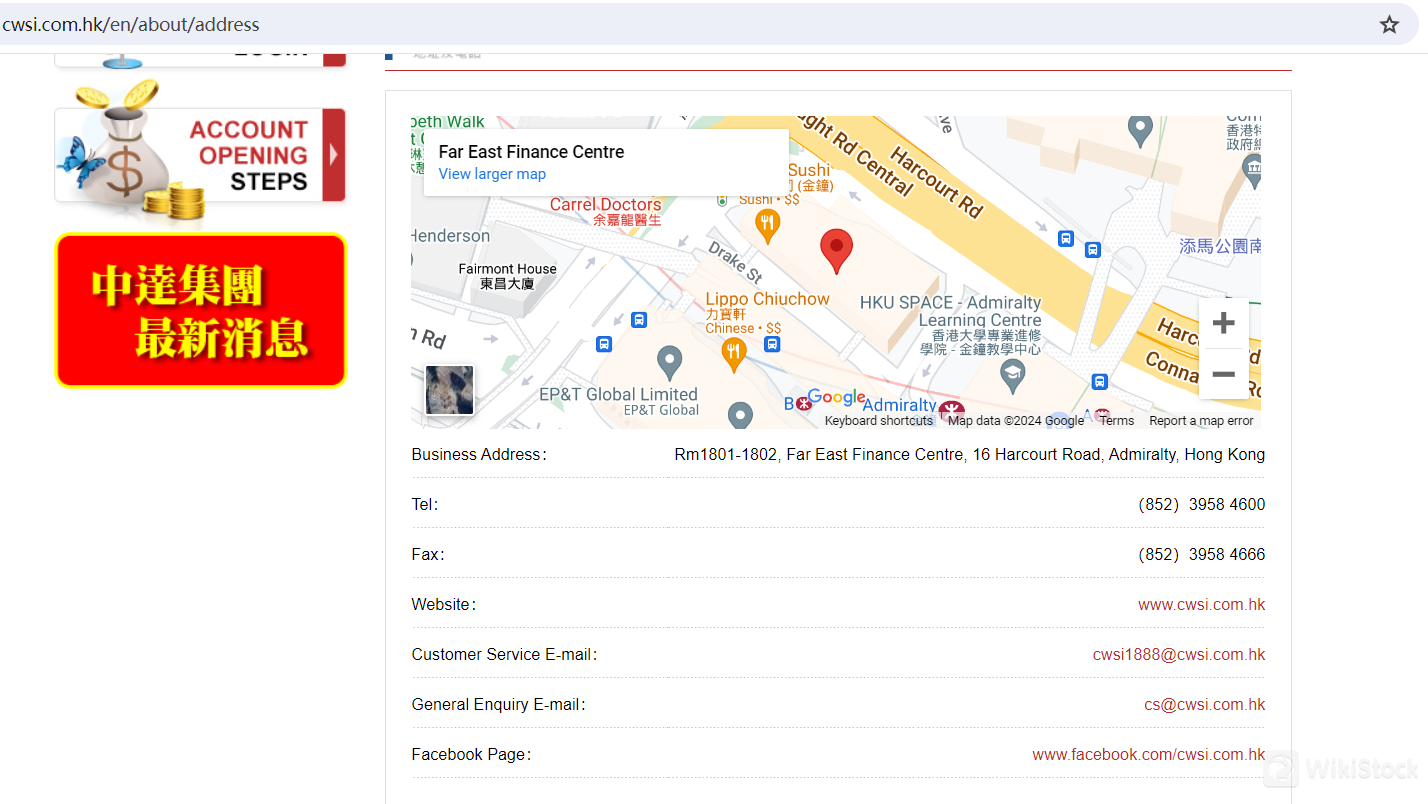

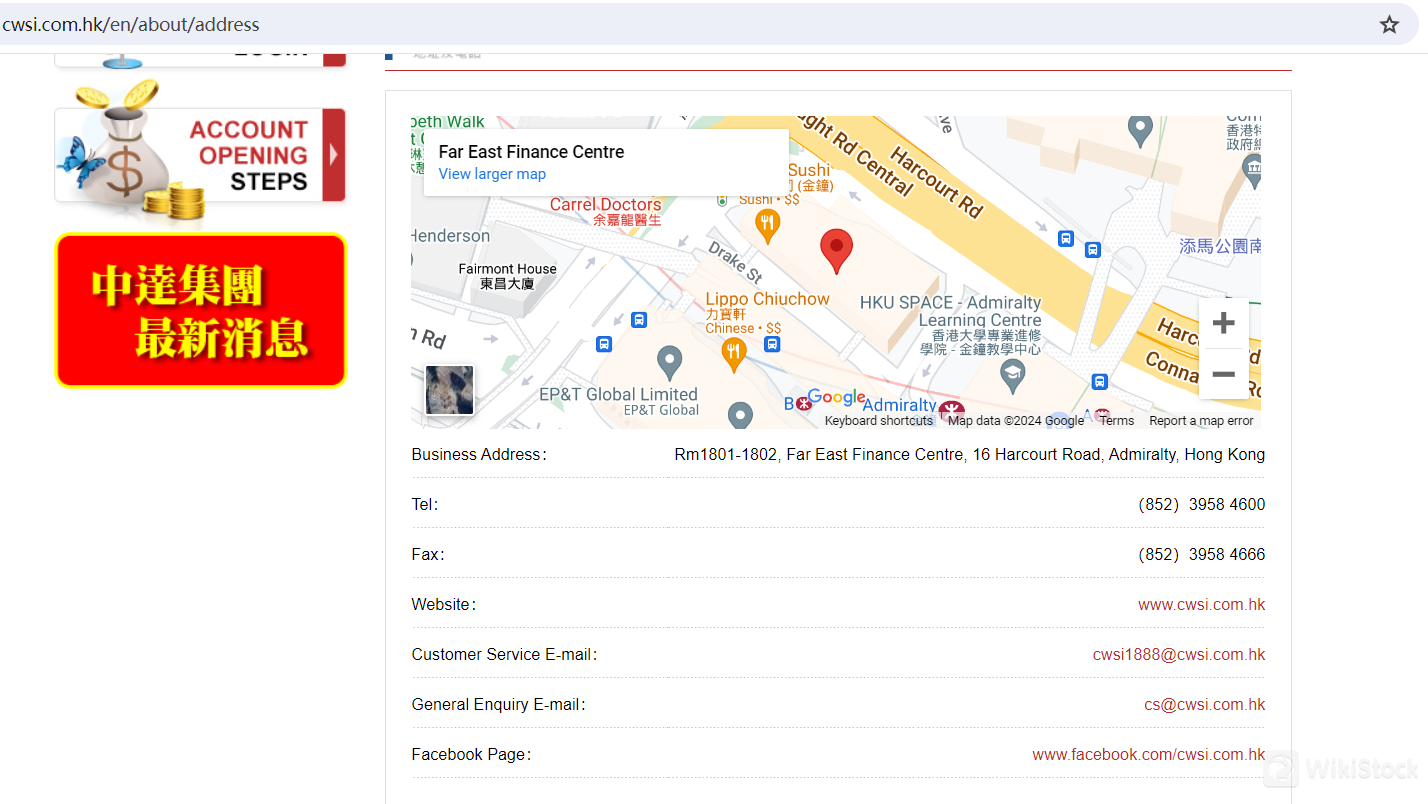

CWSI offers robust customer support to ensure client satisfaction and address inquiries efficiently. Their main office is located at Rm1801-1802, Far East Finance Centre, 16 Harcourt Road, Admiralty, Hong Kong. Customers can reach them via phone at (852) 3958 4600 or fax at (852) 3958 4666. For support, they provide specific email addresses: cwsi1888@cwsi.com.hk for customer service and cs@cwsi.com.hk for general inquiries. Additionally, they maintain an active presence on Facebook at www.facebook.com/cwsi.com.hk, offering another platform for interaction and updates.

Conclusion

CWSI is a comprehensive brokerage firm offering a range of trading services with competitive fees, robust security measures, and user-friendly platforms. It provides diverse account types and extensive educational resources, making it suitable for both novice and experienced investors. However, its fee structure can be complex, especially for margin accounts, which may pose a higher risk due to the potential for significant losses. Overall, CWSI stands out for its regulatory compliance and commitment to client security.

FAQs

Is CWSI safe to trade?

Yes, CWSI is safe to trade. It is regulated by the Securities and Futures Commission (SFC), ensuring compliance with strict financial regulations. Additionally, CWSI employs advanced encryption technologies and robust account security measures to protect client funds and information.

Is CWSI a good platform for beginners?

Yes, CWSI is a good platform for beginners. It offers user-friendly trading apps, comprehensive educational resources, and access to a variety of securities. The platform is designed to support both novice and experienced investors.

Is CWSI legit?

Yes, CWSI is a legitimate brokerage firm. It is regulated by the SFC and adheres to strict industry standards and regulations, ensuring a trustworthy and secure trading environment.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--