Trade Finance is in our DNA. For more than 10 years, OffersFX has helped clients make trade payments, access liquidity, and manage risk. We connect counterparties with market-leading Traditional Trade for CFDs on shares, commodities, forex, and indices. Our institutional strength, practical expertise, comprehensive technology, and unparalleled network enable us to deliver a powerful global trading platform, when and where our clients need it.

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

OffersFX Information

OffersFX is a regulated online brokerage firm recognized for its comprehensive range of financial services and robust trading platforms. Traders can access a diverse array of trading products including Contracts for Difference (CFDs) across indices, commodities, shares, and forex, allowing them to speculate on price movements without owning the underlying assets.

With transparent fee structures that include competitive spreads and zero deposit and withdrawal fees, OffersFX prioritizes affordability and transparency. The brokerage also emphasizes trader education through introductory and advanced courses, eBooks, and analytical tools like signals and technical analysis reports. Moreover, it provides both web-based and mobile trading platforms.

Pros & Cons

Pros

Regulated by CySEC: Being regulated by the Cyprus Securities and Exchange Commission (CySEC) (license number 180/10) ensures OffersFX adheres to stringent regulatory standards.

Wide Range of Trading Products: Offers CFDs across indices, commodities, shares, and forex, providing traders with diverse opportunities to speculate on global markets.

Zero Deposit and Withdrawal Fees: No fees charged for deposits or withdrawals, enhancing affordability and transparency for clients.

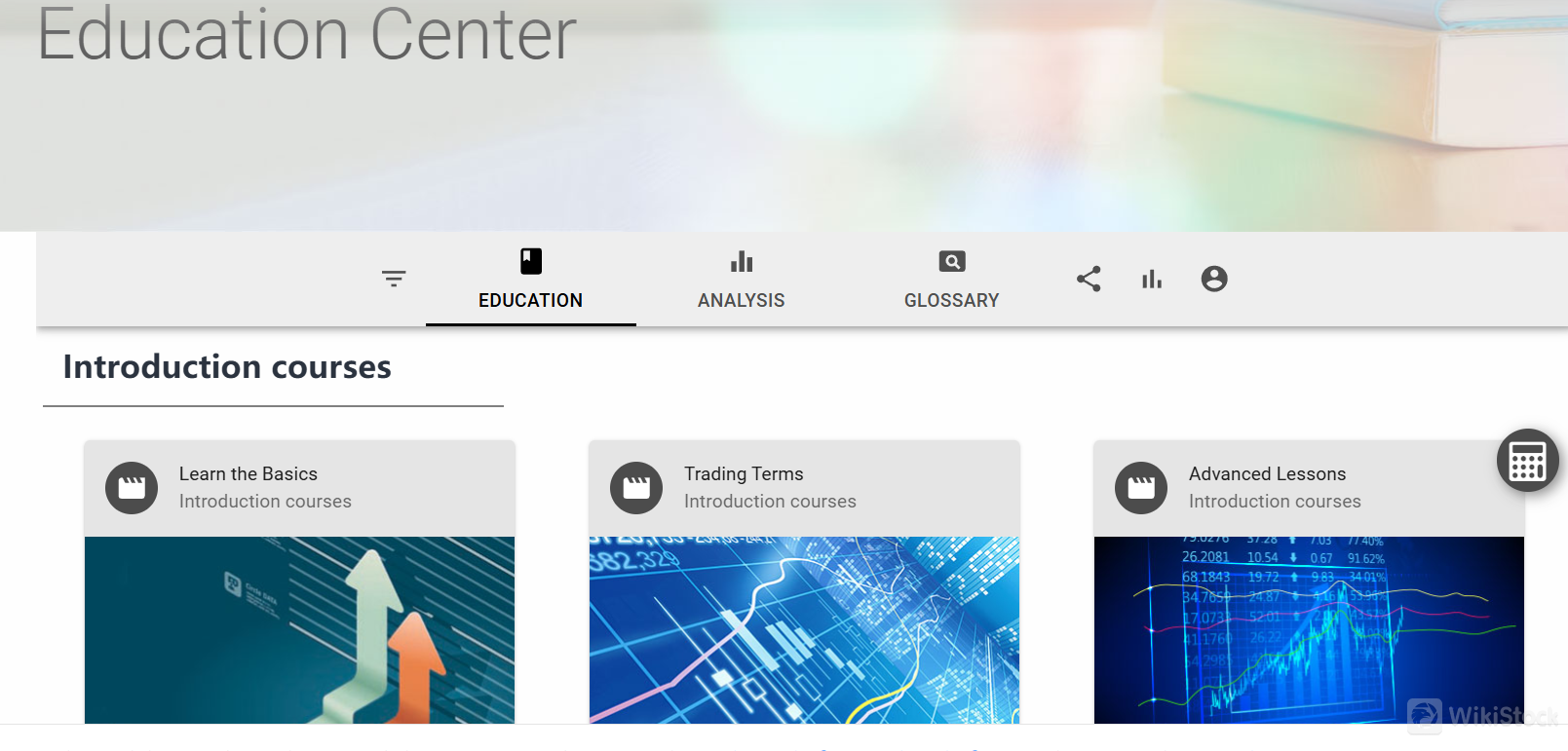

Comprehensive Educational Resources: Provides a range of educational materials including courses, eBooks, and analysis tools to support trader development and decision-making.

Variety of Trading Platforms: OffersFX WebTrader, Mobile Trading App, and Tablet Trading App cater to different trader preferences and enhance accessibility.

Cons

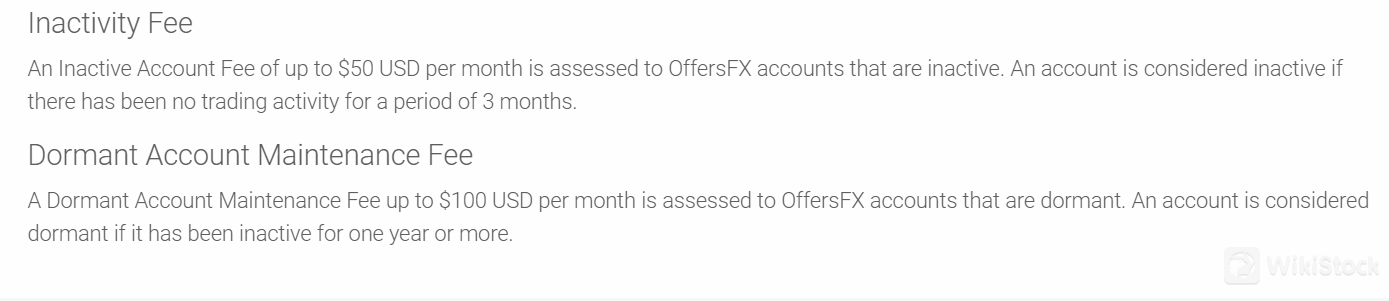

Inactive and Dormant Account Fees: Charges an Inactive Account Fee of up to $50 per month after three months of no trading activity, and a Dormant Account Maintenance Fee of up to $100 per month for inactive accounts for one year or more.

Limited Information on Margin Rates: Margin interest rates are not specified, which can affect traders' ability to assess the full cost of maintaining leveraged positions.

Mutual Funds Not Offered: OffersFX does not provide access to mutual funds, limiting diversification options for investors seeking this asset class.

Is OffersFX Safe?

OffersFX is regulated by the oversight of the oversight of the Cyprus Securities and Exchange Commission (CySEC), holding license No. 180/10. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market. By adhering to the regulations, OffersFX ensures that its operations are conducted with the utmost professionalism and accountability, instilling confidence in its clients and stakeholders.

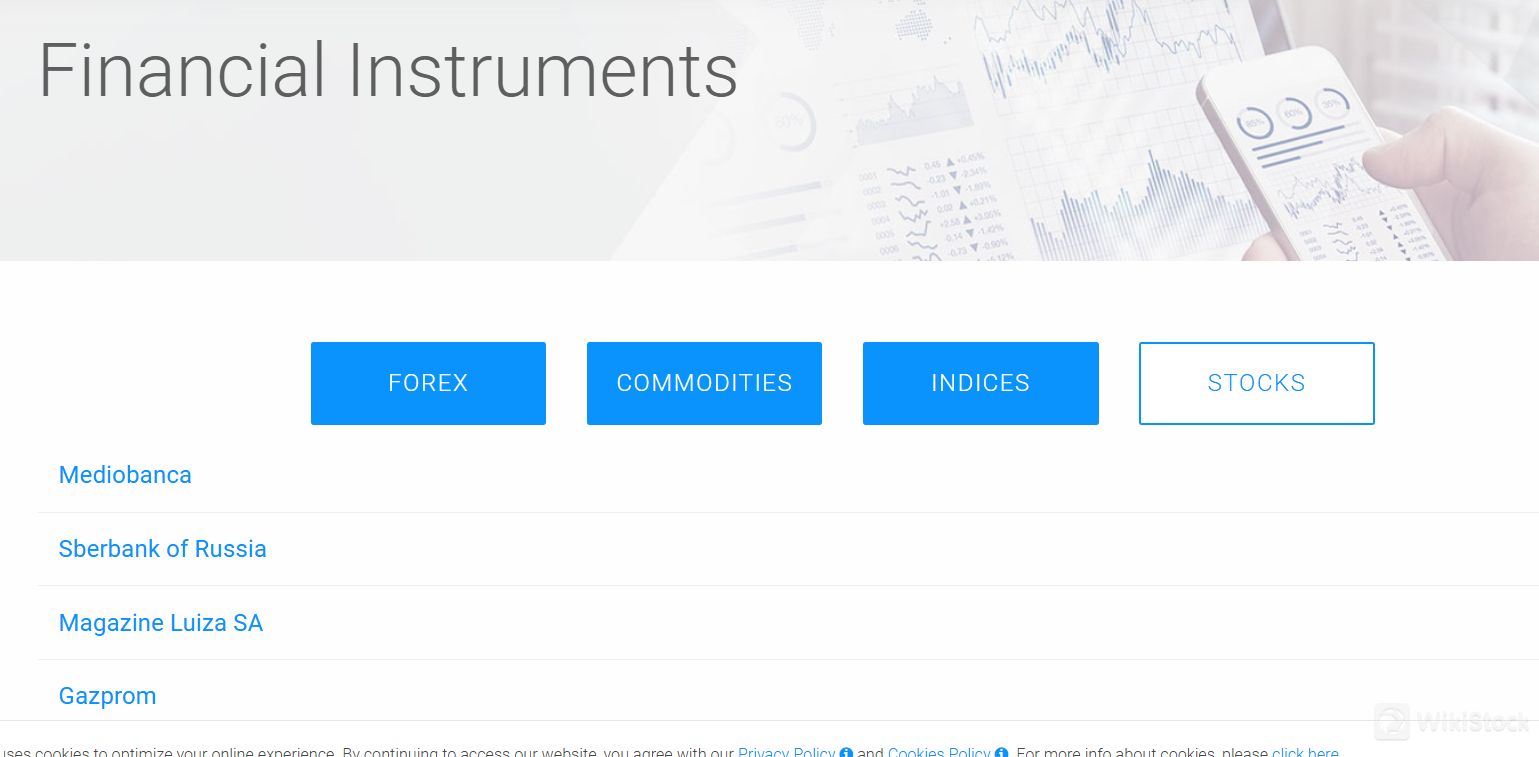

What are Securities to Trade with OffersFX?

Traders can engage in Contracts for Difference (CFDs) across a variety of asset classes including indices, commodities, shares, and forex.

CFDs allow traders to speculate on price movements without owning the underlying assets, offering flexibility and profit opportunities in both rising and falling markets.

Indices CFDs enable traders to trade on the performance of global stock indices, while commodities CFDs provide access to trade precious metals, energies, and agricultural commodities. Shares CFDs allow traders to speculate on the price movements of individual company stocks from global markets.

Additionally, forex CFDs offer the opportunity to trade major, minor, and exotic currency pairs with competitive spreads and leverage options, allowing traders to capitalize on currency fluctuations.

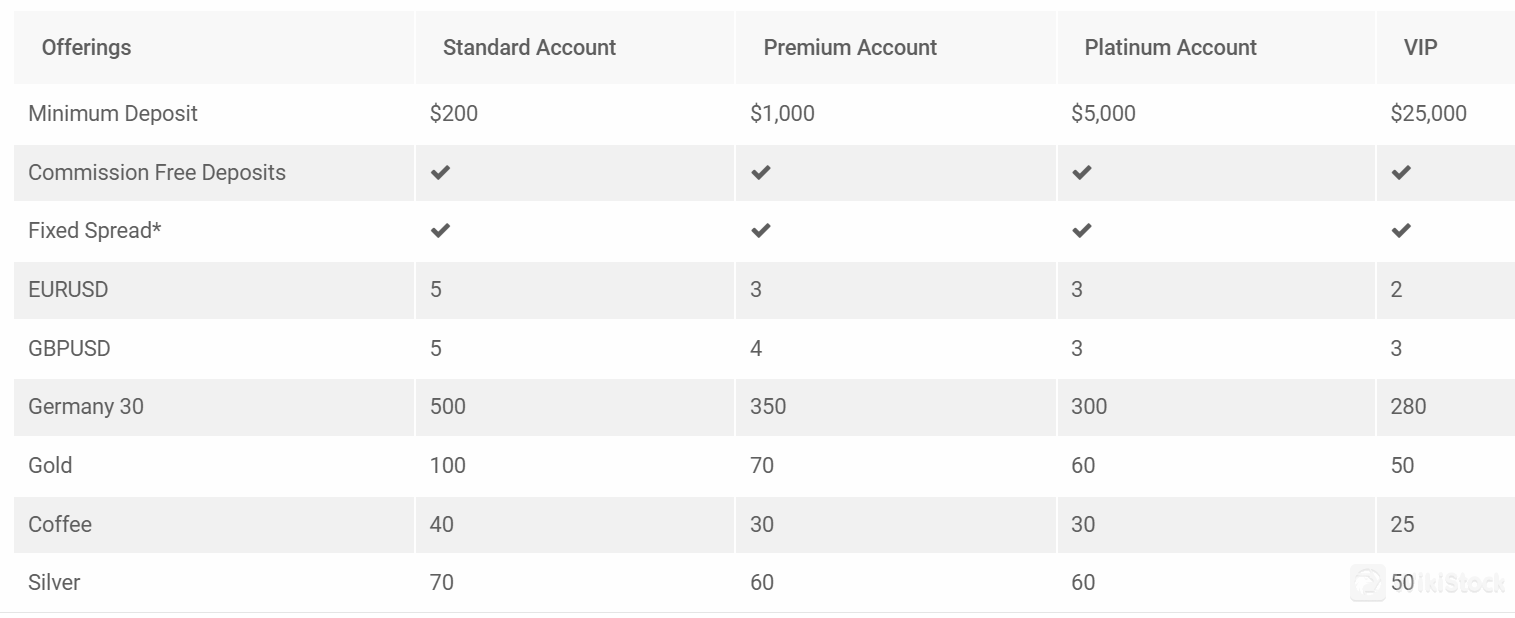

OffersFX Accounts

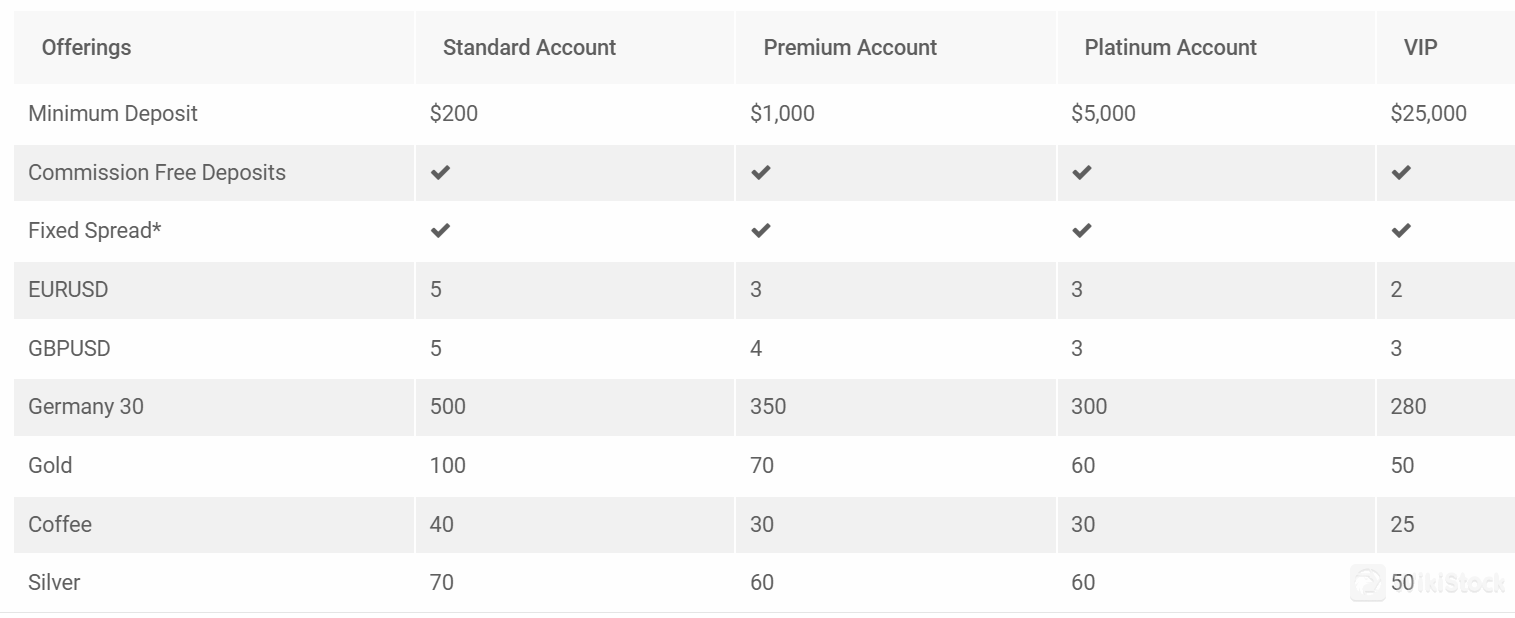

The Standard Account requires a minimum deposit of $200, offering accessibility to new and casual traders. For those seeking enhanced trading conditions, the Premium Account requires a minimum deposit of $1,000, providing benefits such as commission-free deposits and lower fixed spreads.

The Platinum Account, with a minimum deposit of $5,000, further enhances trading conditions. For elite traders looking for exclusive privileges, the VIP Account requires a substantial minimum deposit of $25,000, offering premium services and personalized support.

Each account type provides commission-free deposits and fixed spreads.

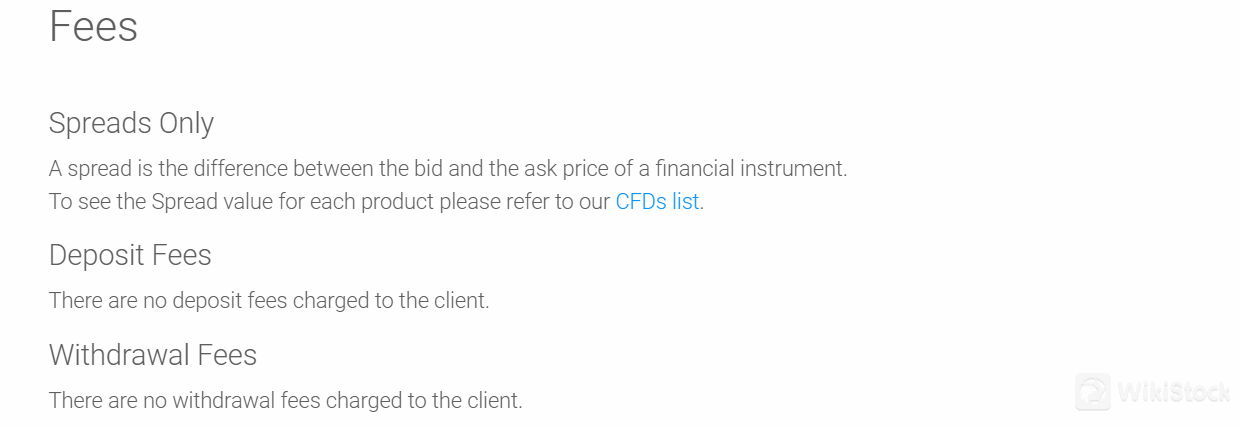

OffersFX Fees Review

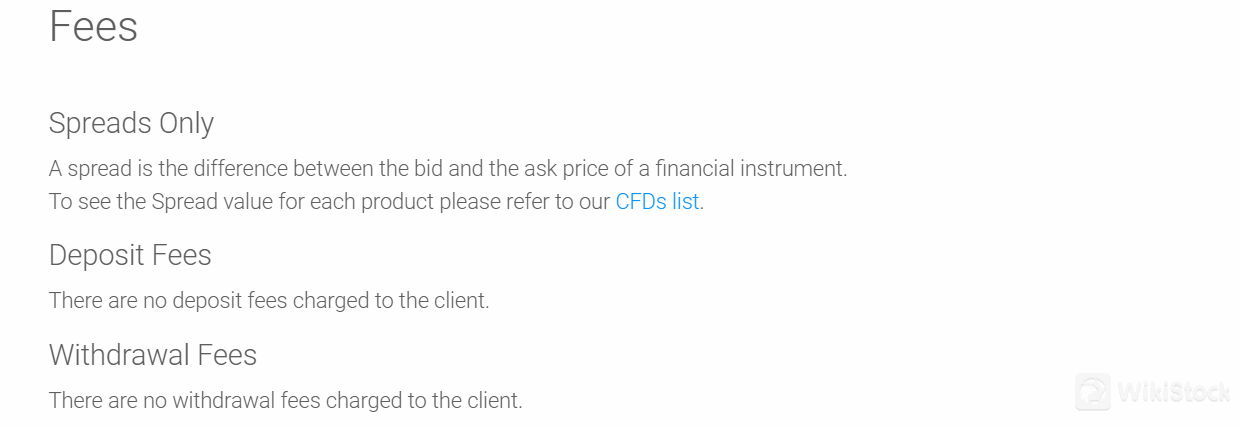

Traders can benefit from competitive spreads across all financial instruments, which represent the difference between the bid and ask prices. This ensures clarity in trading costs and allows traders to make informed decisions. Importantly, OffersFX does not charge any deposit or withdrawal fees.

However, clients are supposed to note that an Inactive Account Fee of up to $50 per month is apply if there has been no trading activity for three consecutive months. Additionally, a Dormant Account Maintenance Fee of up to $100 per month is charged to accounts that remain inactive for one year or more.

OffersFX App Review

OffersFX provides a versatile array of trading platforms. Their offerings include OffersFX WebTrader, a robust web-based platform that allows seamless access to the markets from any browser without requiring downloads. For traders on the move, OffersFX offers a Mobile Trading App and Tablet Trading App, ensuring flexibility and convenience in executing trades and managing portfolios on iOS and Android devices.

Research & Education

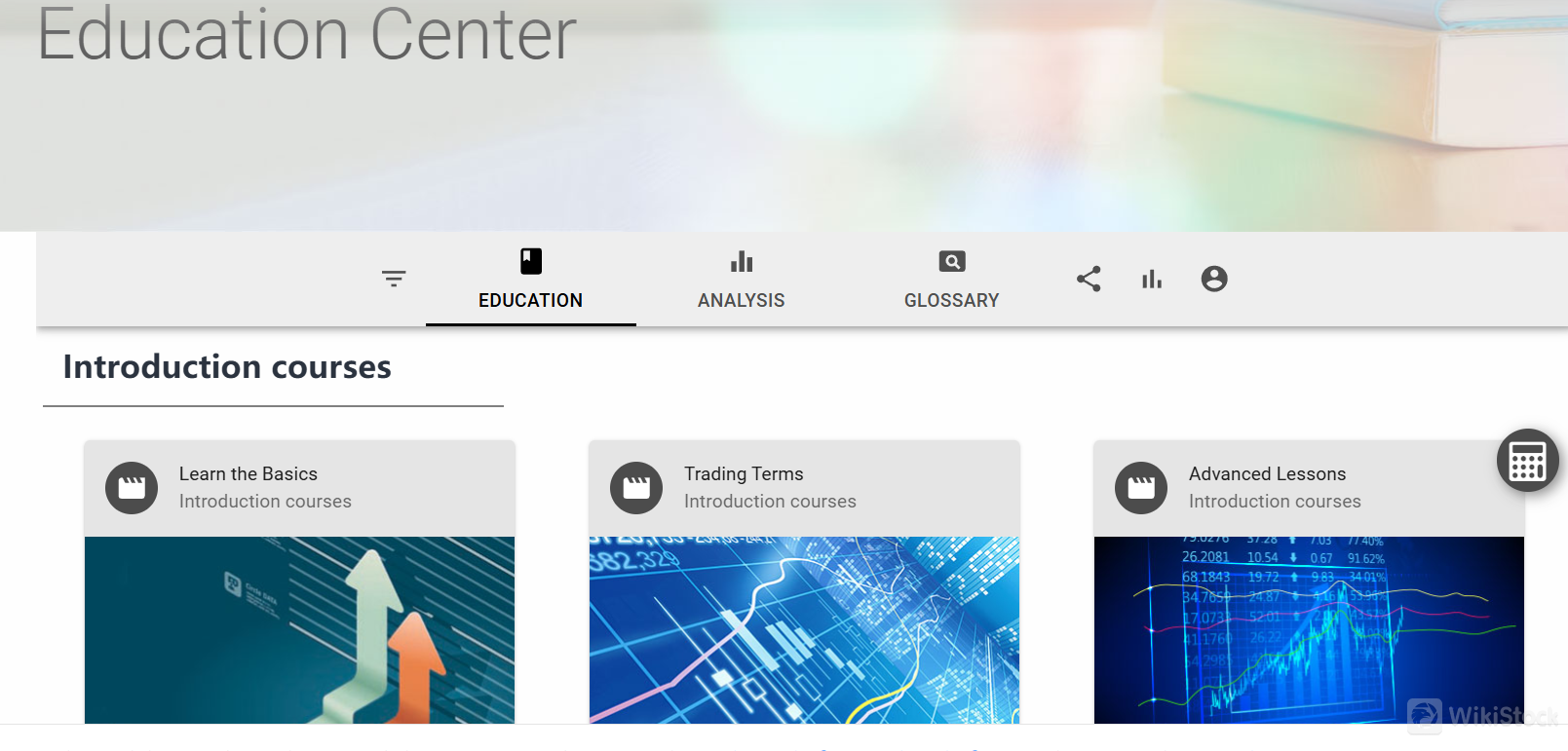

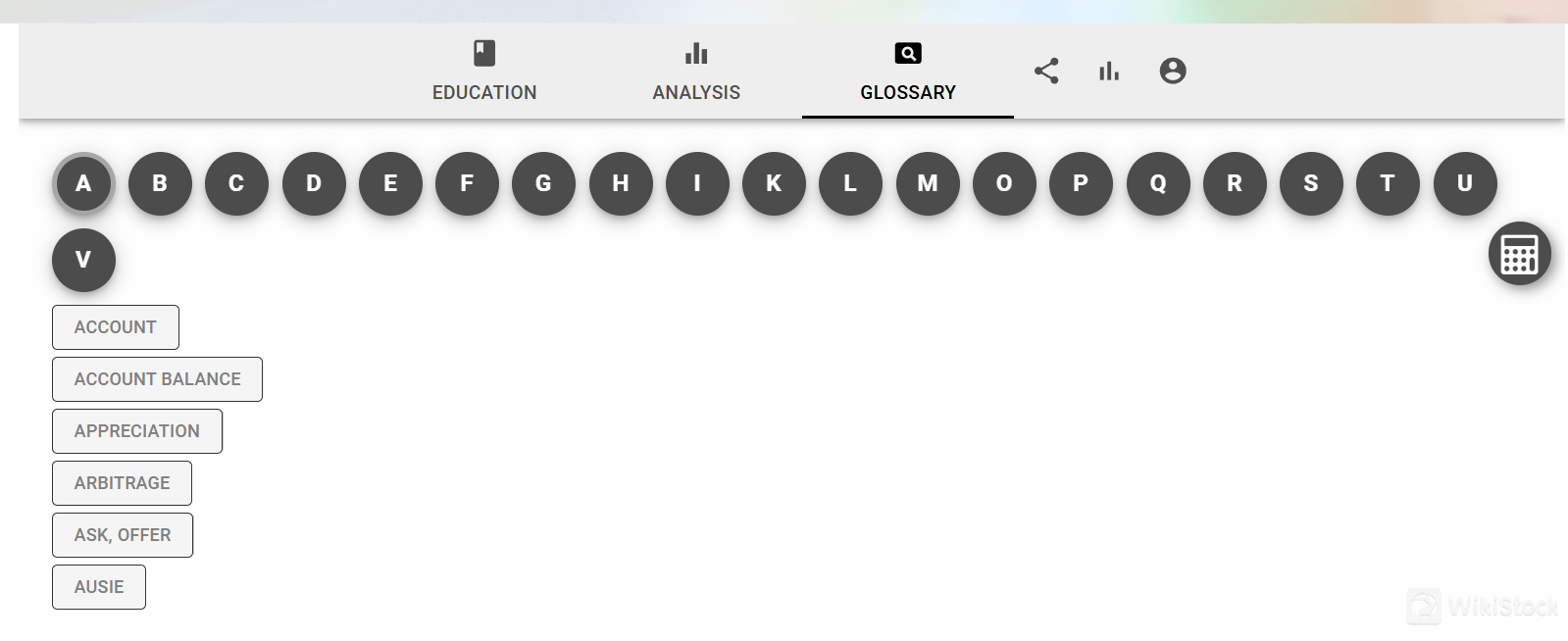

OffersFX provides a range of educational materials, including introductory courses that lay the foundation for understanding financial markets, as well as in-depth courses that delve deeper into advanced trading strategies and techniques. Traders can also benefit from a collection of informative eBooks that cover various aspects of trading and investing.

In addition to educational content, OffersFX offers valuable analysis tools such as signals, technical analysis reports, and fundamental analysis insights, equipping traders with the information needed to make informed trading decisions. A dedicated glossary further aids in understanding key trading terminologies and concepts, ensuring traders have all the resources necessary to succeed in the dynamic world of financial markets.

Customer Service

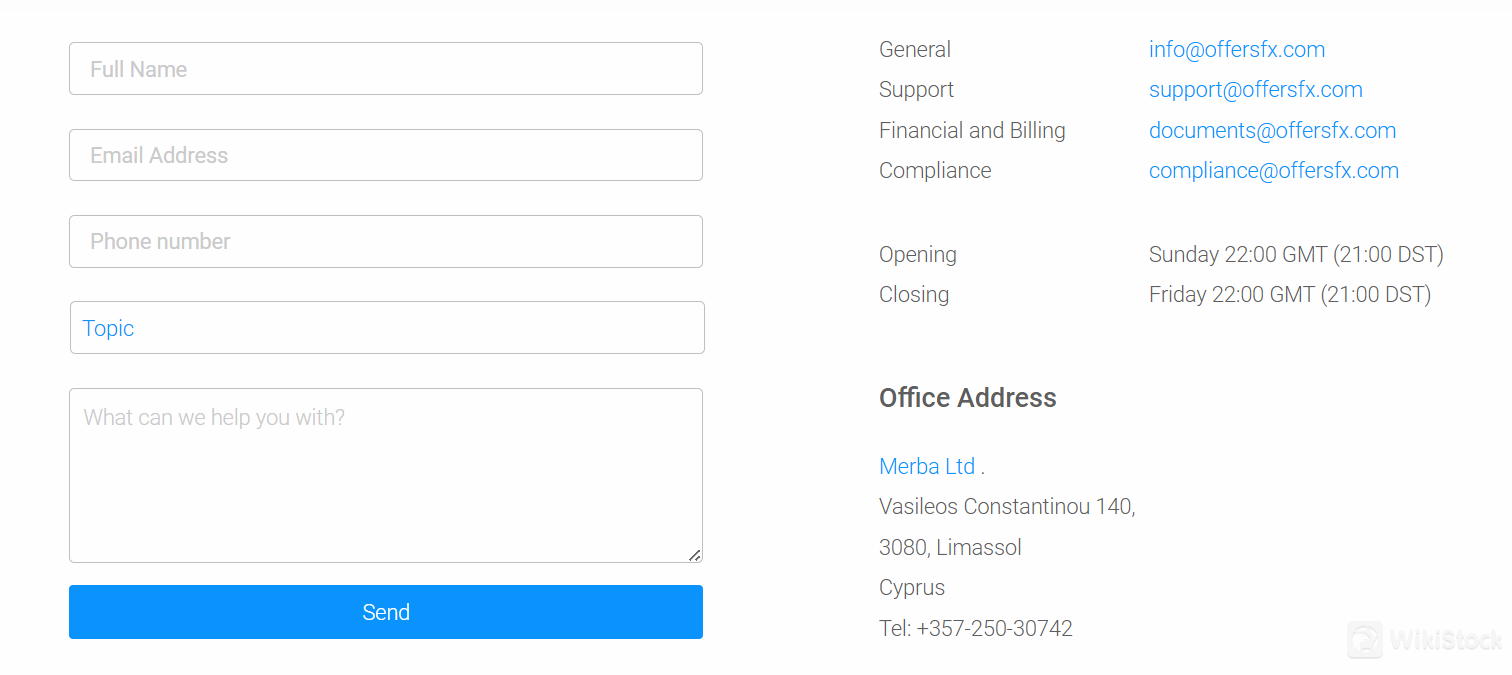

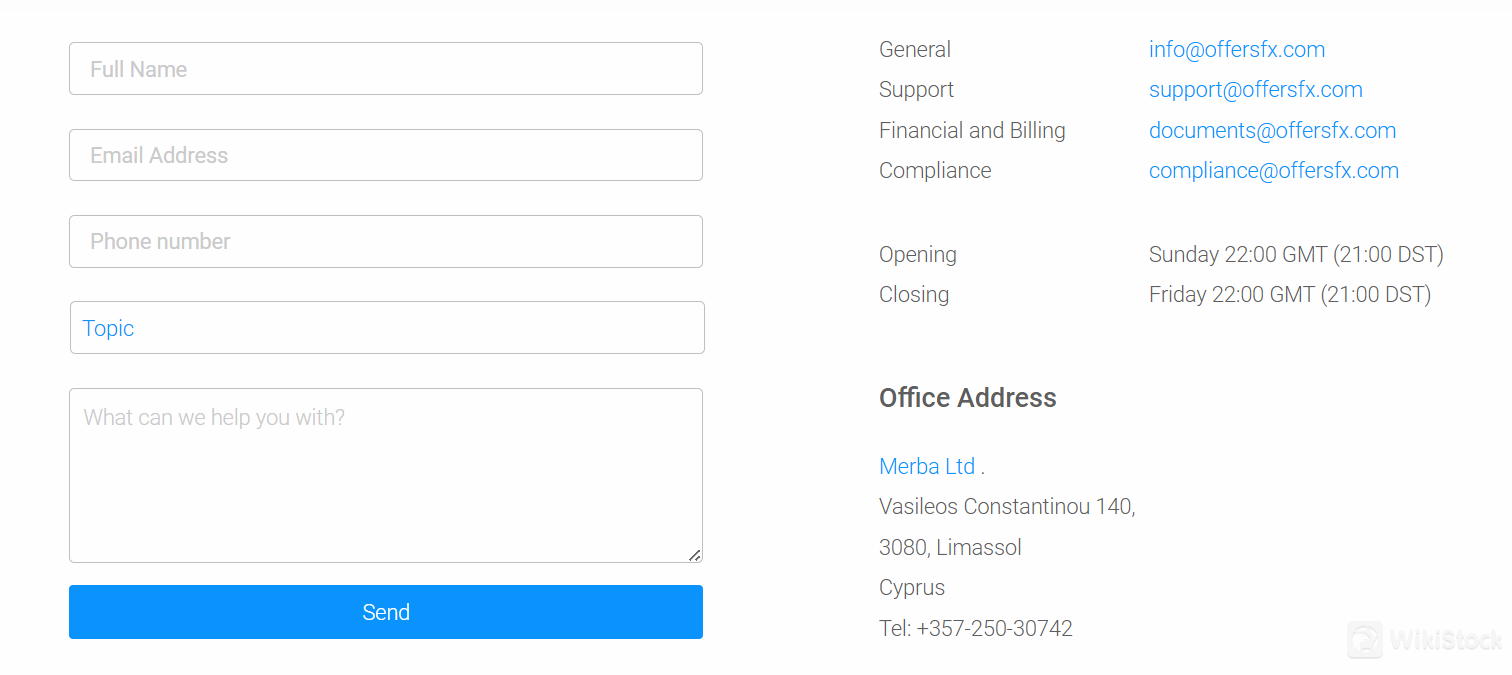

OffersFX's support team can be reached through:

- Email:

- Genera Support: linfo@offersfx.com, support@offersfx.com

- Financial and Billing: documents@offersfx.com

- Compliance: compliance@offersfx.com

- Opening: Sunday 22:00 GMT (21:00 DST), Closing: Friday 22:00 GMT (21:00 DST)

- Office Address: Merba Ltd . Vasileos Constantinou 140, 3080, Limassol, Cyprus

Tel: +357-250-30742

- Contact form

Conclusion

In conclusion, OffersFX presents itself as a regulated trading platform with transparent fee structure and educational resources, offering offering a wide array of trading products, including CFDs across indices, commodities, shares, and forex.

However, clients should be mindful of inactive and dormant account fees, as well as the absence of information regarding margin rates and the offering of mutual funds.

Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

Frequently Asked Questions (FAQs)

Is OffersFX suitable for beginners?

Yes, OffersFX is suitable for beginners due to its user-friendly platform, educational resources, and comprehensive customer support.

Is OffersFX regulated?

Yes, OffersFX is regulated by the Cyprus Securities and Exchange Commission (CySEC).

What trading products does OffersFX offer?

OffersFX provides Contracts for Difference (CFDs) across a range of asset classes including indices, commodities, shares, and forex.

Are there any fees for deposits and withdrawals?

No, OffersFX does not charge any deposit or withdrawal fees.

What are the account minimums at OffersFX?

The Standard Account requires a minimum deposit of $200, while higher-tier accounts such as Premium, Platinum, and VIP require deposits of $1,000, $5,000, and $25,000 respectively.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)