We created FXGT.com because we wanted to revolutionize the trader experience. We set out three rules to guide our mission: to empower traders with competence, and a peace of mind.

FXGT Information

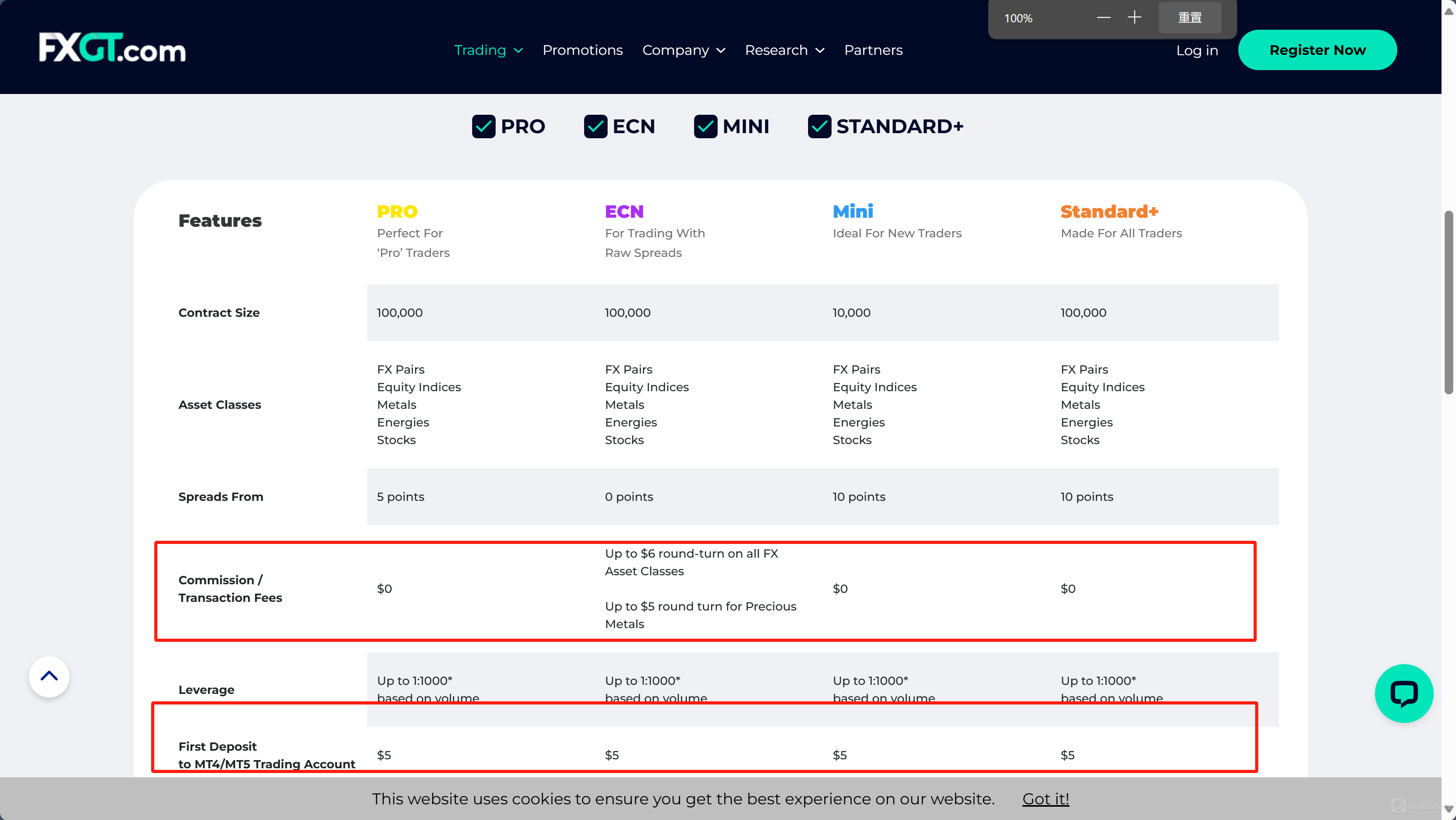

FXGT offers low transaction fees, with ECN accounts charged $6 for FX and $5 for precious metals, while other accounts incur no fees.

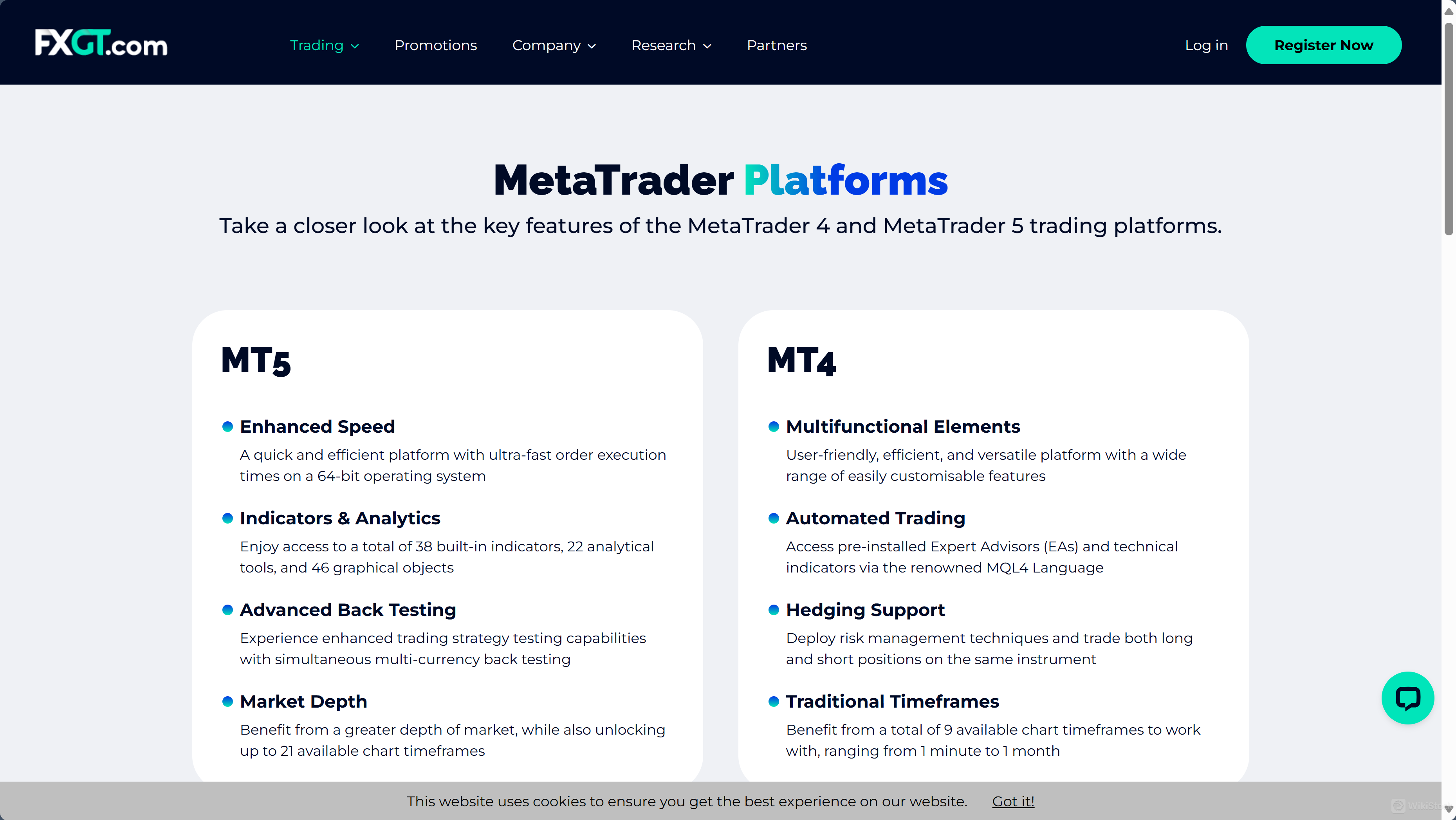

The minimum deposit required to open an account is $5, making it accessible for a wide range of investors. Clients also benefit from an interest rate of 1.82% on uninvested cash. FXGT supports mutual funds trading and provides access to popular trading platforms like MT4 and MT5.

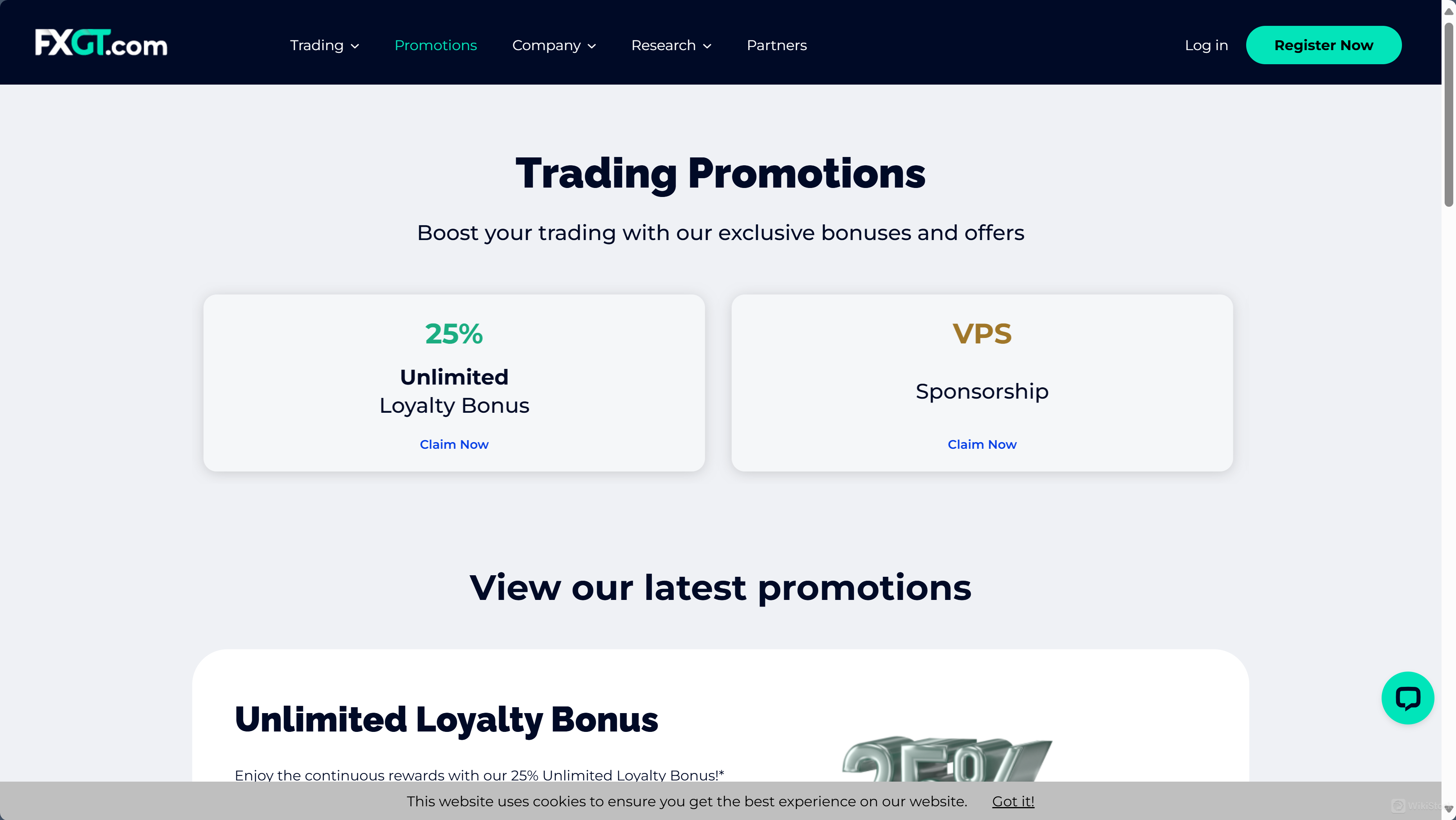

Promotions include a 25% Unlimited Loyalty Bonus and VPS Sponsorship, enhancing the trading experience for active users.

Pros & Cons

Pros:

FXGT is well-regulated by multiple authoritative bodies including CYSEC, FSA, FSCA, and VFSC, ensuring a high level of trust and compliance. It offers a wide array of tradable securities like stocks, forex, and precious metals on renowned platforms MT4 and MT5. The platform features low to zero commission rates on trades and employs attractive promotional strategies to enhance user engagement and trading value.

Cons:

Despite its advantages, FXGT requires a minimum deposit of $5, which could be a barrier for some potential users looking for no-entry cost platforms. It lacks a unique trading platform, relying instead on widely-used systems like MT4 and MT5, and does not offer a dedicated mobile app, limiting trading flexibility and on-the-go access for users.

Is FXGT Safe?

Regulations:

FXGT is regulated by multiple authorities across different jurisdictions, enhancing its credibility and security as a trading platform. It holds licenses from the Cyprus Securities and Exchange Commission (CySEC) under License No. 382/20, the Seychelles Financial Services Authority (FSA) under License No. SD019, the Financial Sector Conduct Authority (FSCA) in South Africa under License No. 48896, and the Vanuatu Financial Services Commission (VFSC) under License No. 700601.

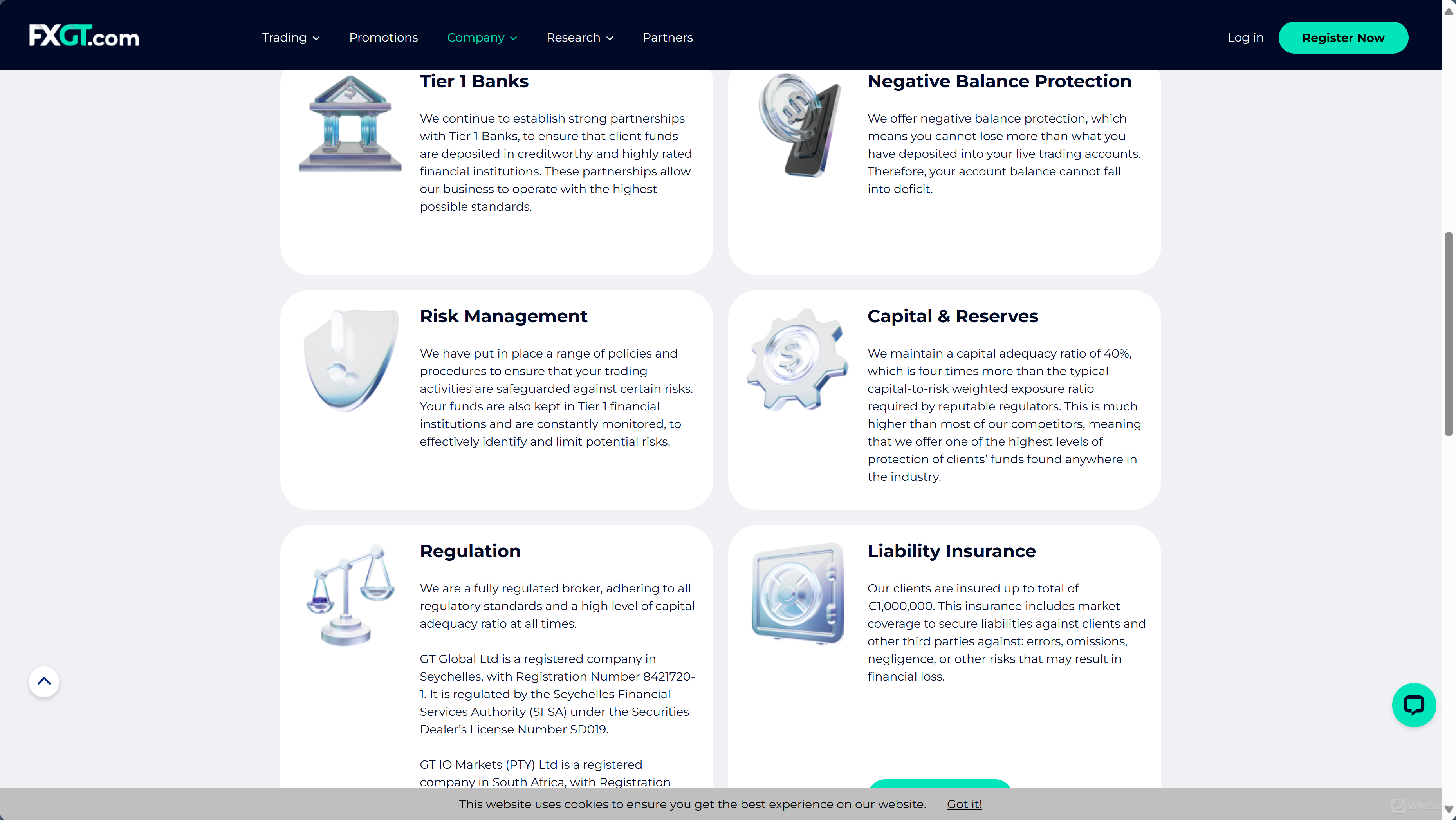

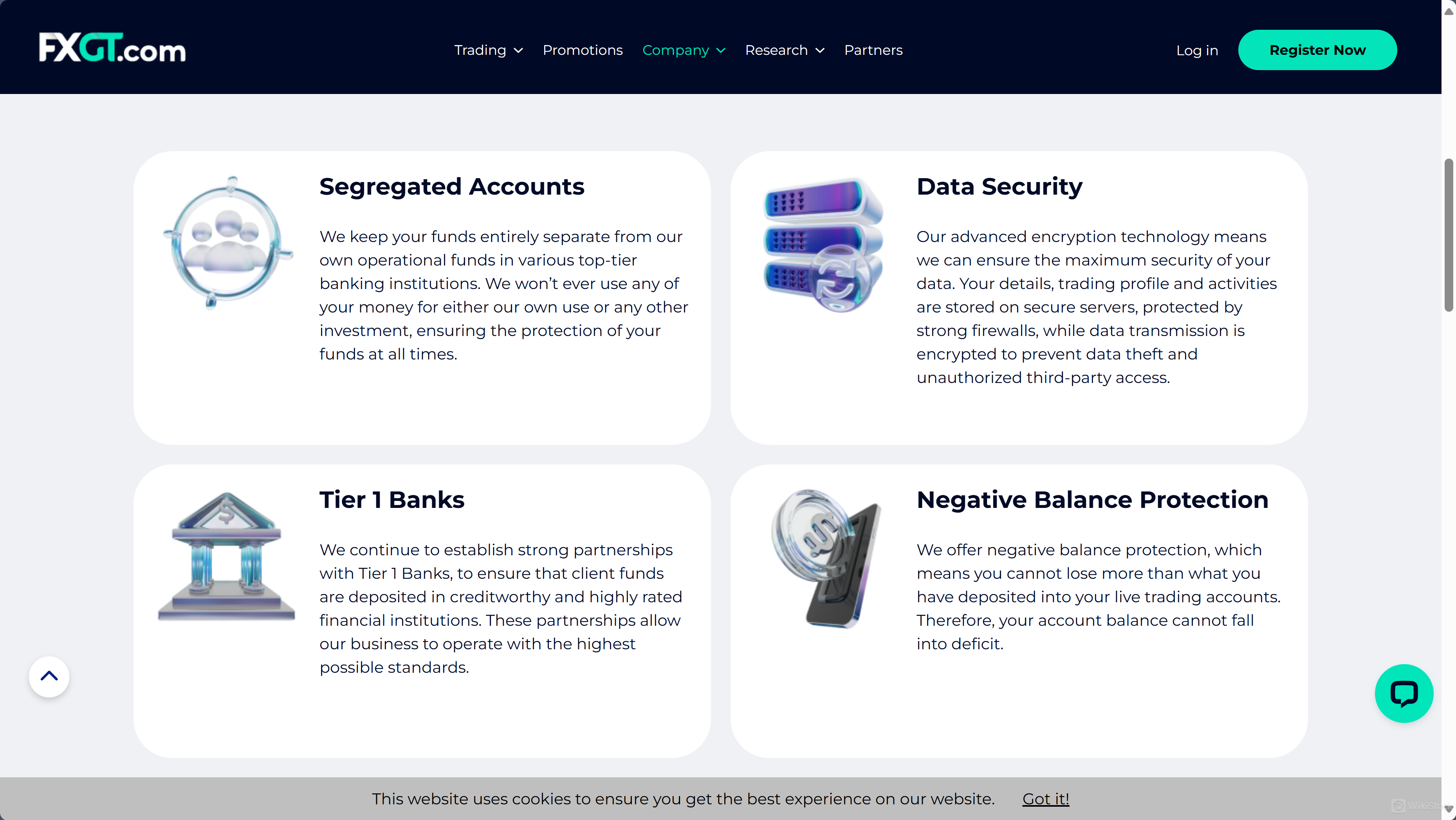

Funds Safety:

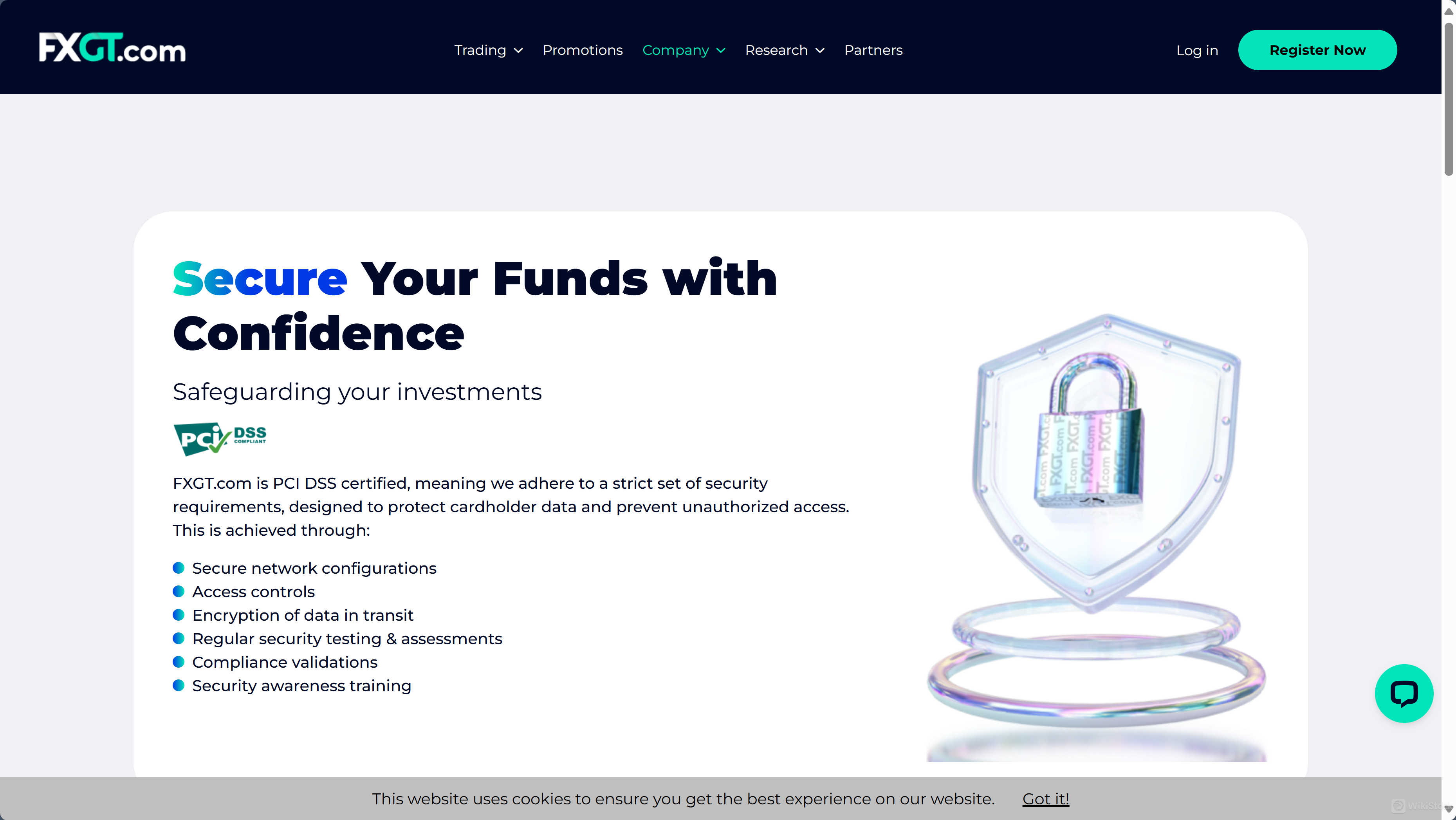

FXGT prioritizes the security of client funds through segregated accounts, ensuring that client assets are kept distinct from the company's operational funds. This segregation safeguards clients' investments by preventing their use for any other company activities. Additionally, FXGT is PCI DSS certified, affirming its adherence to stringent data security standards which protect sensitive information and financial transactions.

Furthermore, FXGT provides an added layer of security with insurance coverage for client funds. Clients are insured up to a total of €1,000,000, which covers market-related liabilities including errors, omissions, negligence, and other risks that could result in financial losses. This insurance policy enhances the safety of investments and provides clients with greater peace of mind while trading on the platform.

Safety Measures:

To secure client data and funds, FXGT employs advanced encryption technologies across its trading platforms and network communications. The firm conducts regular security assessments and compliance validations to maintain high-security standards. Additionally, FXGT offers negative balance protection, ensuring that clients cannot lose more than their deposited funds, which further contributes to the overall safety and reliability of trading with FXGT.

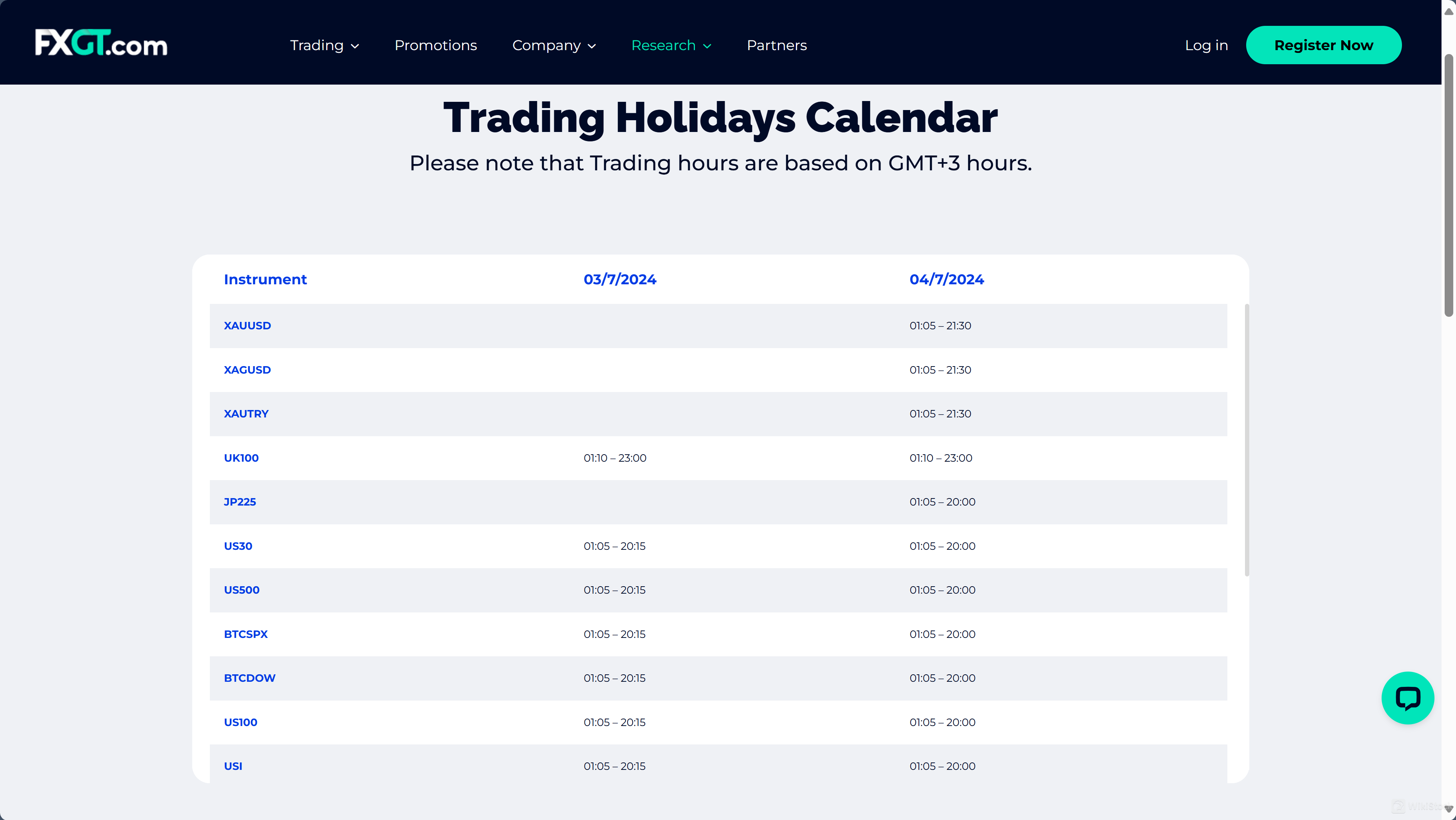

What are securities to trade with FXGT?

FXGT offers a selection of securities for trading, designed to satisfy various investment styles and market interests. Here's a detailed look at the asset classes available:

- Forex (Foreign Exchange):

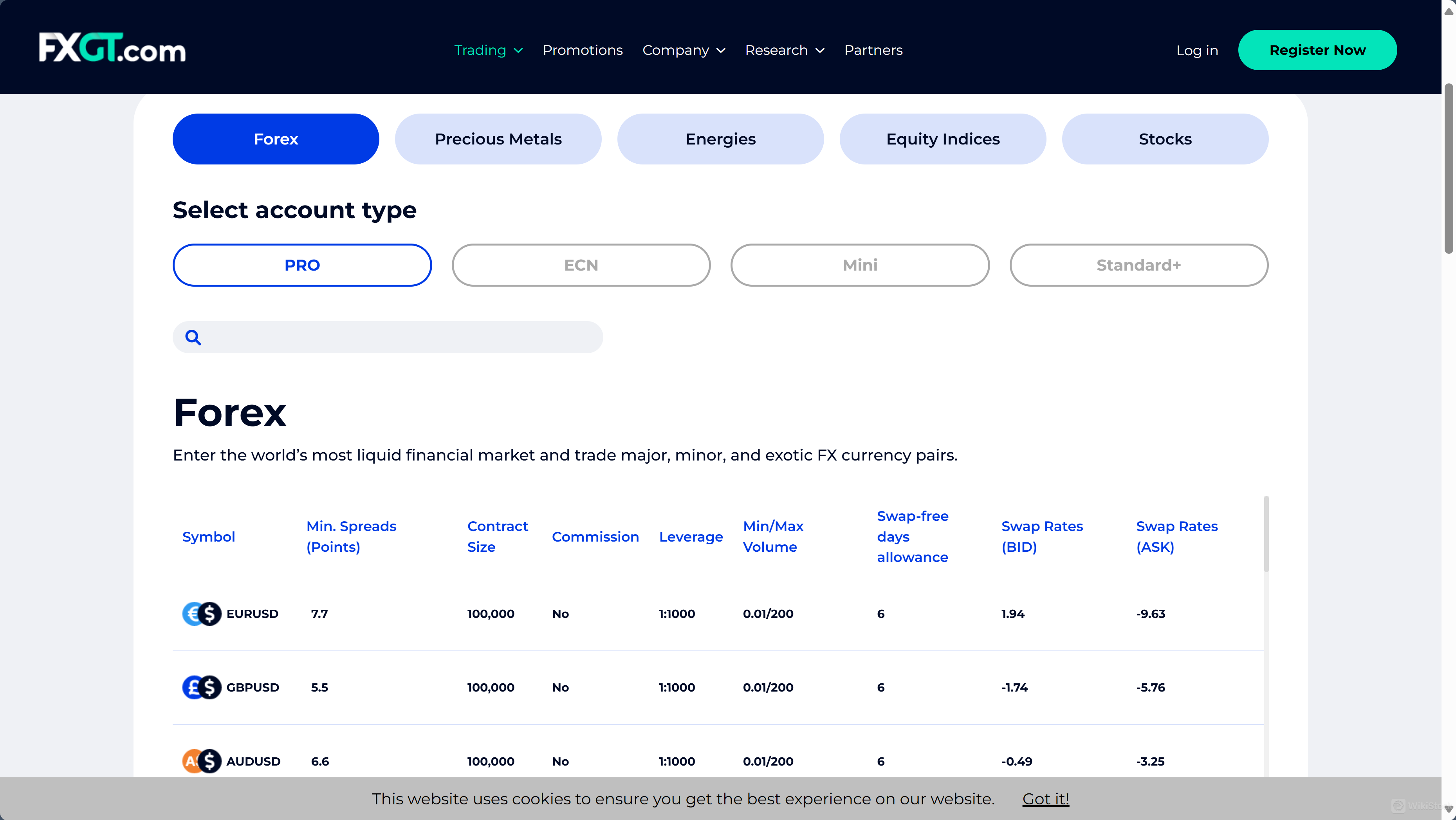

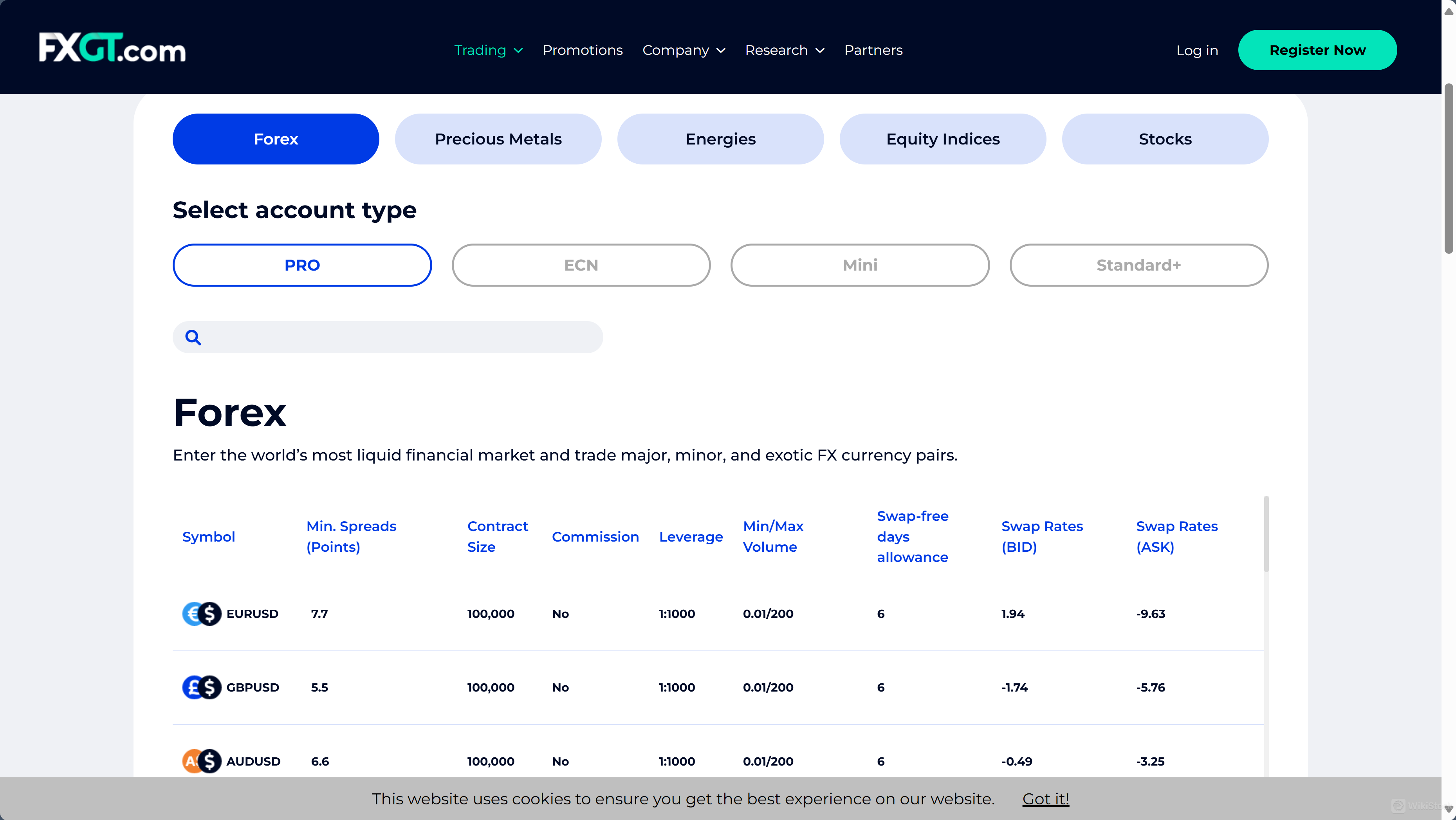

- FXGT provides traders with access to the forex market, which is the world's largest financial market with high liquidity. Traders can speculate on currency price movements involving major pairs like EUR/USD, minor pairs, and exotic currencies. Forex trading offers the flexibility of high leverage and nearly 24/5 market access, making it a dynamic environment for short-term and long-term strategies.

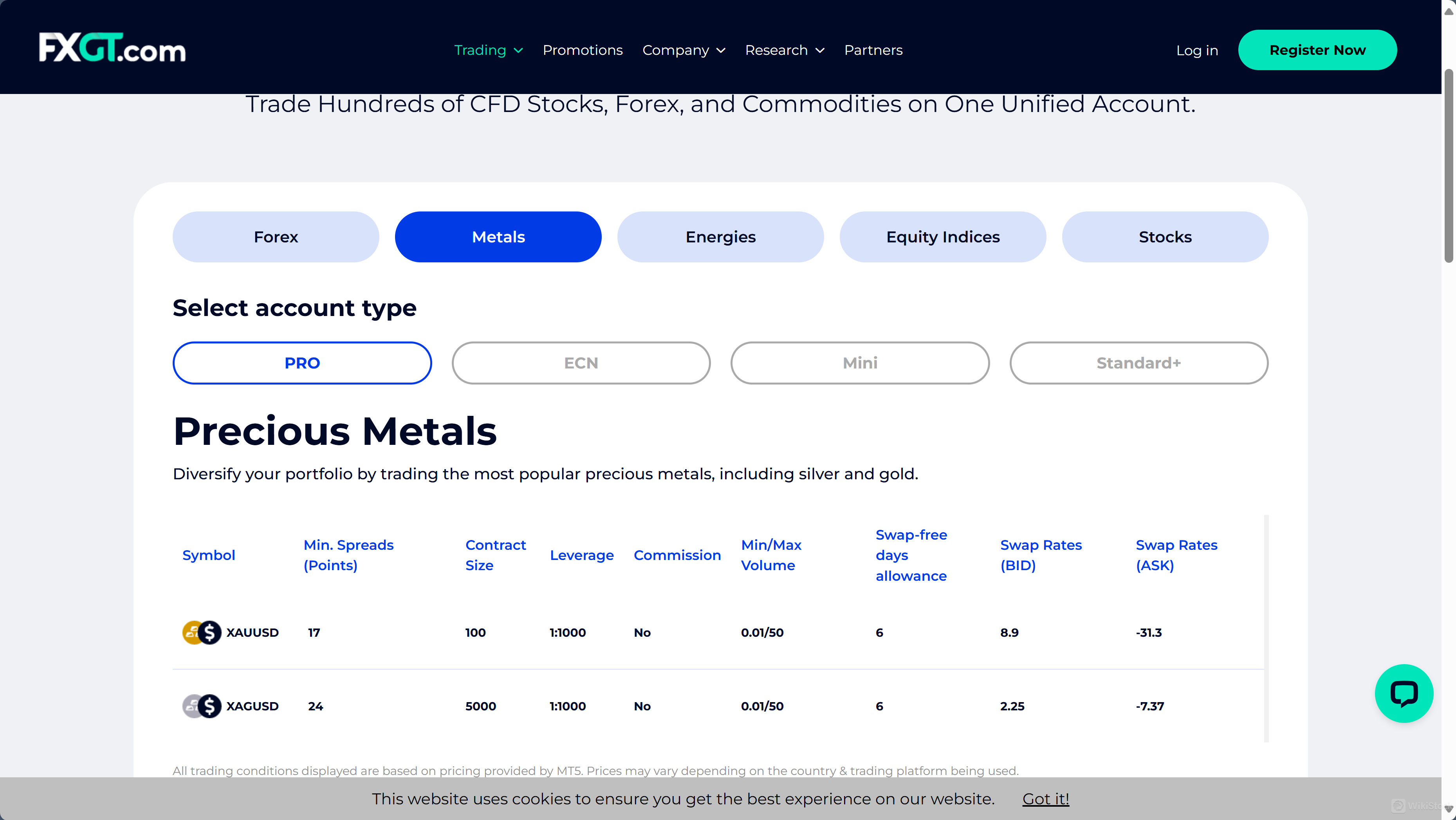

- Precious Metals:

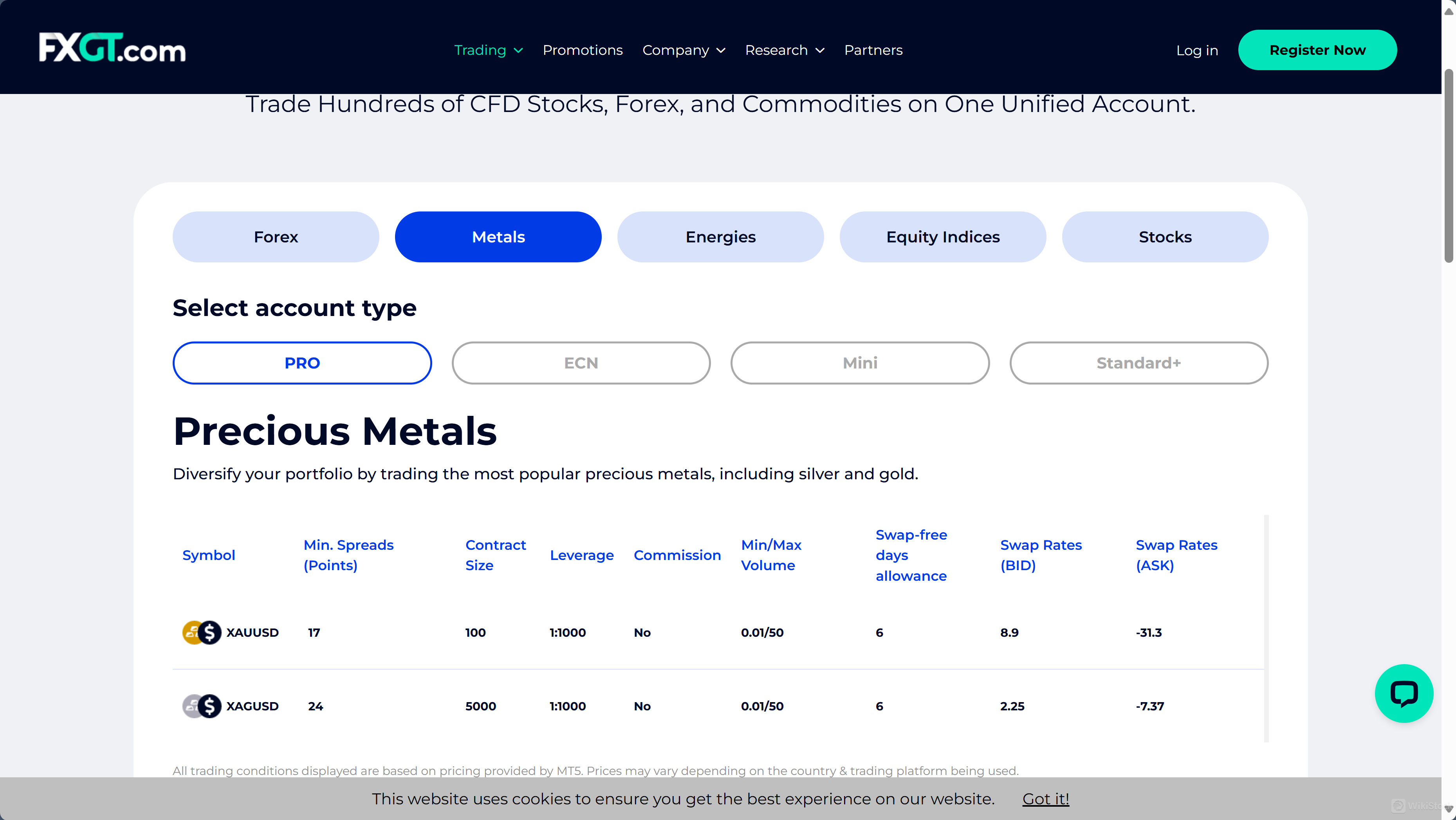

- Trading precious metals, such as gold and silver, is popular on FXGT due to their status as traditional safe havens during economic uncertainty and inflationary periods. Metals can be traded against various currencies and are favored for their ability to hedge against currency devaluation and stock market volatility.

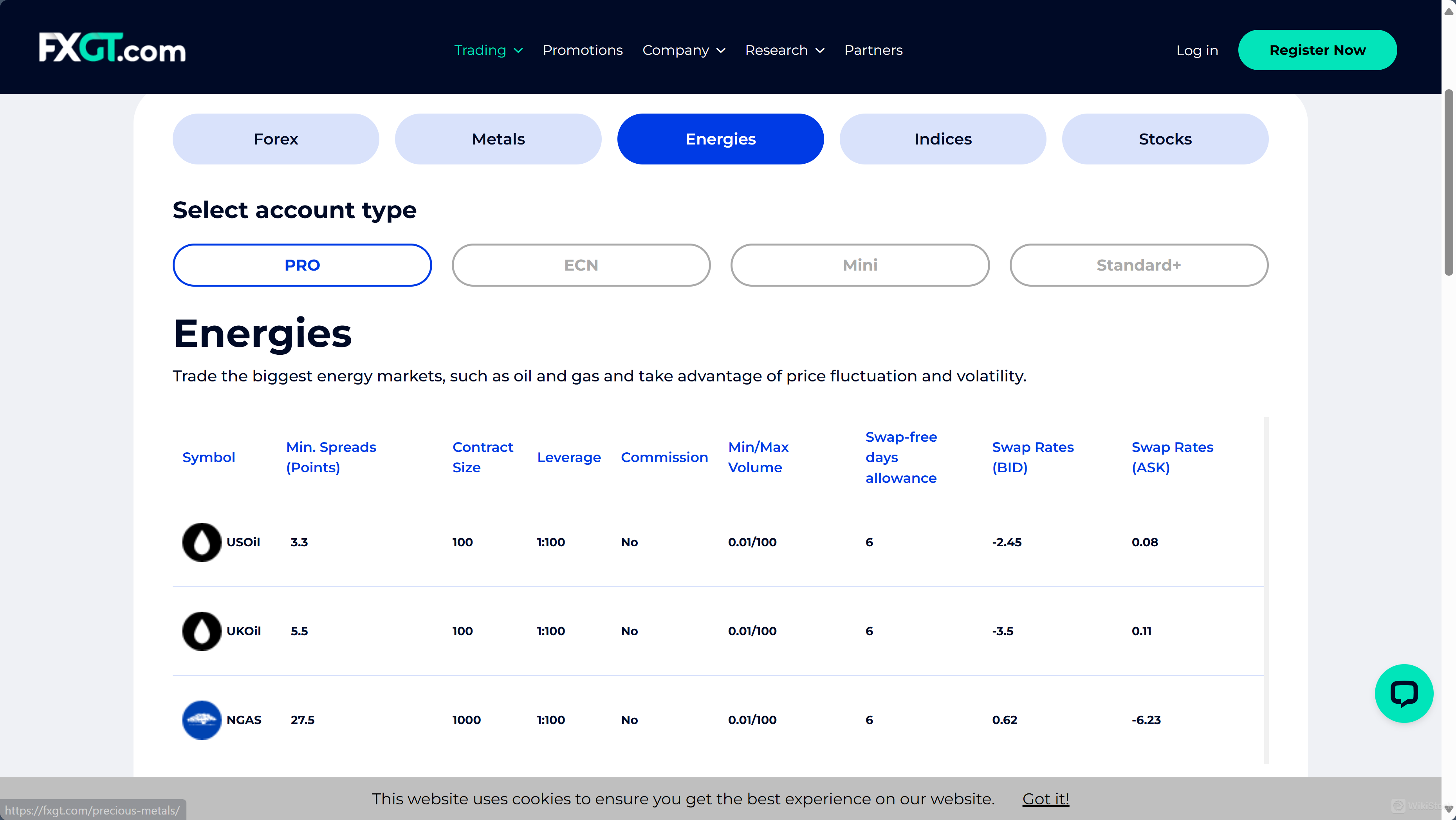

- Energies:

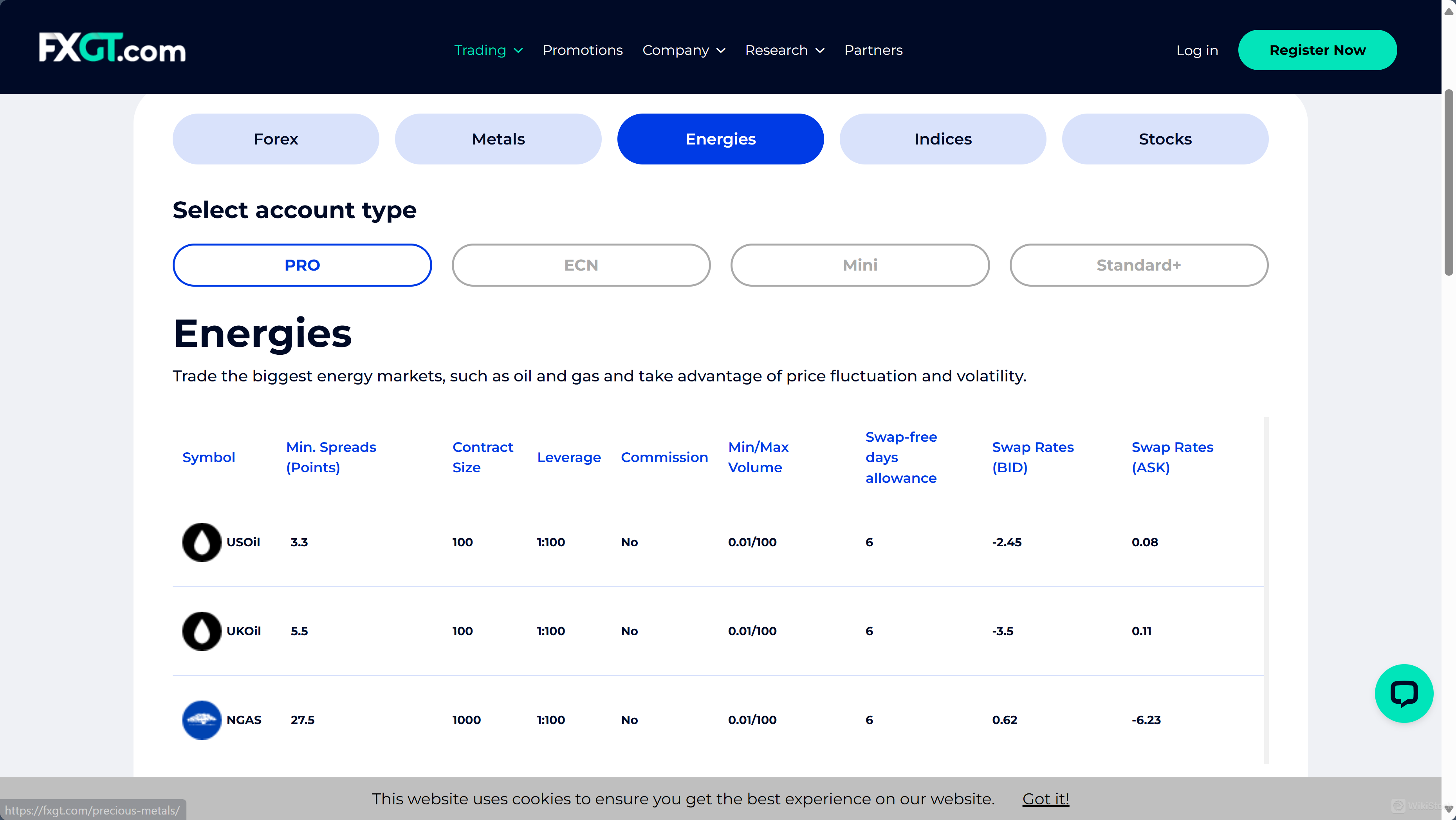

- The energy sector on FXGT includes commodities like crude oil and natural gas, which are essential to global economic activity. Energy commodities are sensitive to geopolitical, environmental, and supply-demand changes, offering unique opportunities for traders to capitalize on price fluctuations driven by global events.

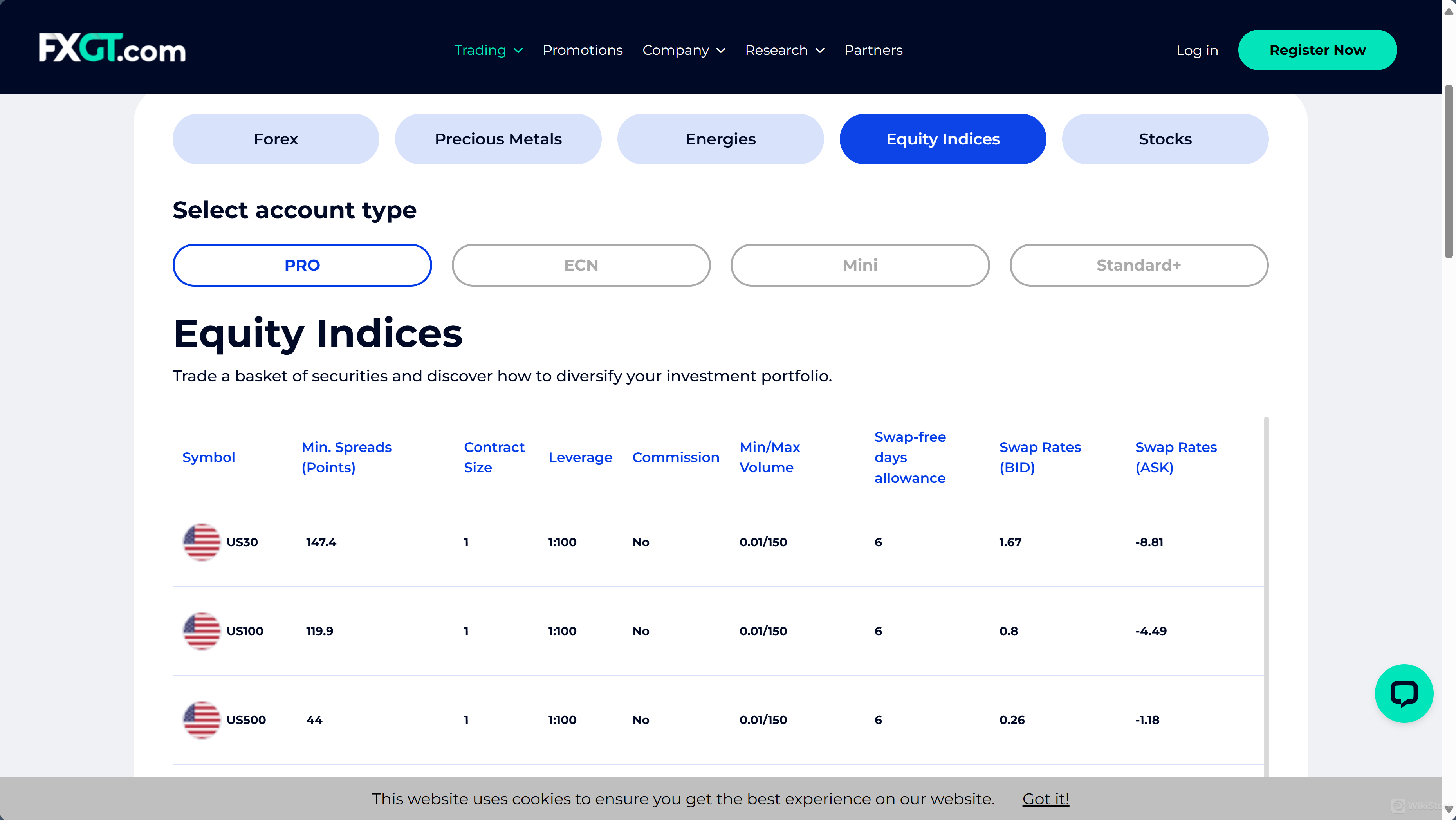

- Equity Indices:

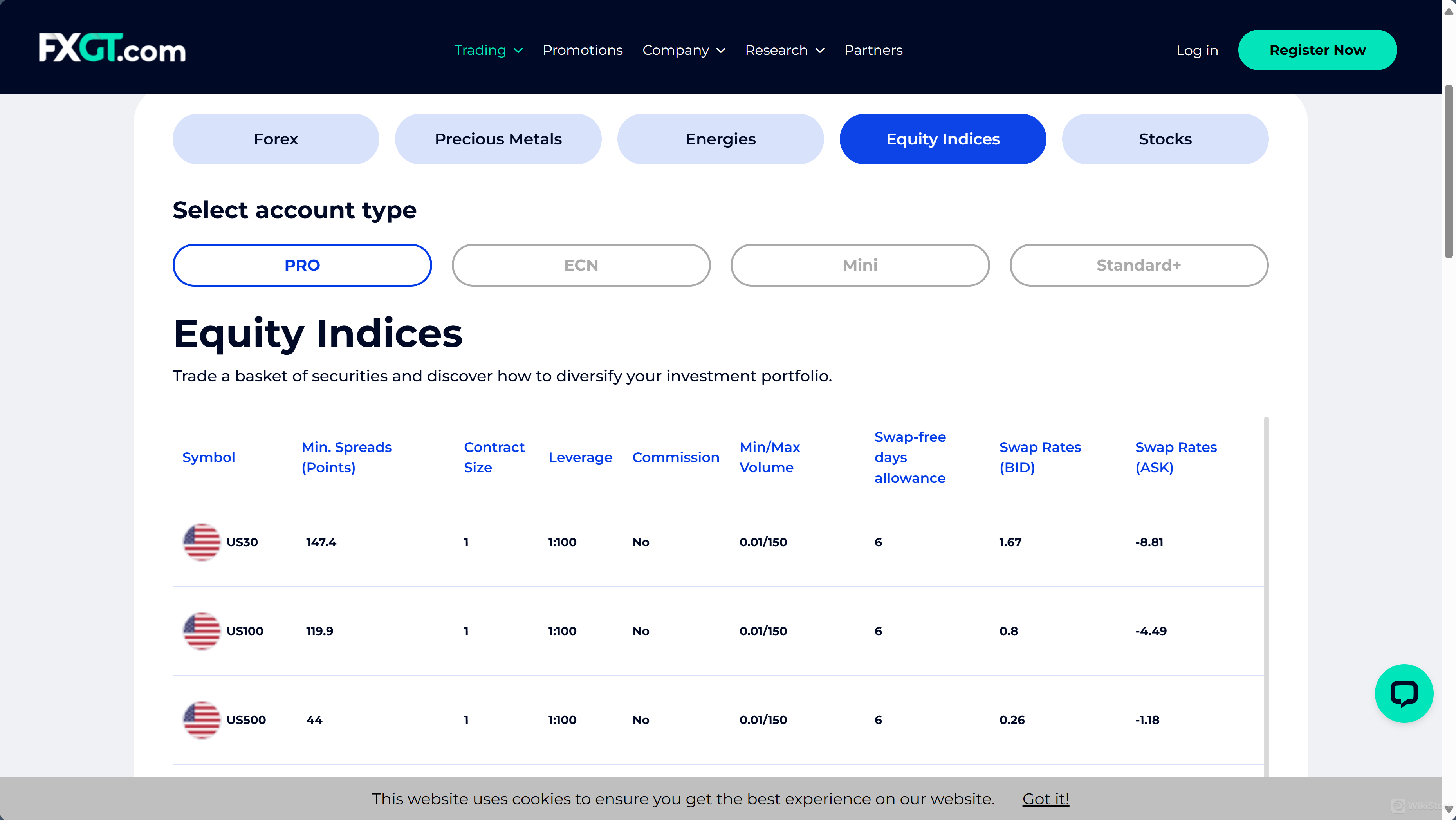

- FXGT offers trading on several major global equity indices, which include baskets of stocks representing specific market sectors or the broader economy. Indices trading allows investors to gain exposure to entire sectors of the financial markets without having to trade individual stock components. This is particularly useful for traders looking to leverage broader market trends.

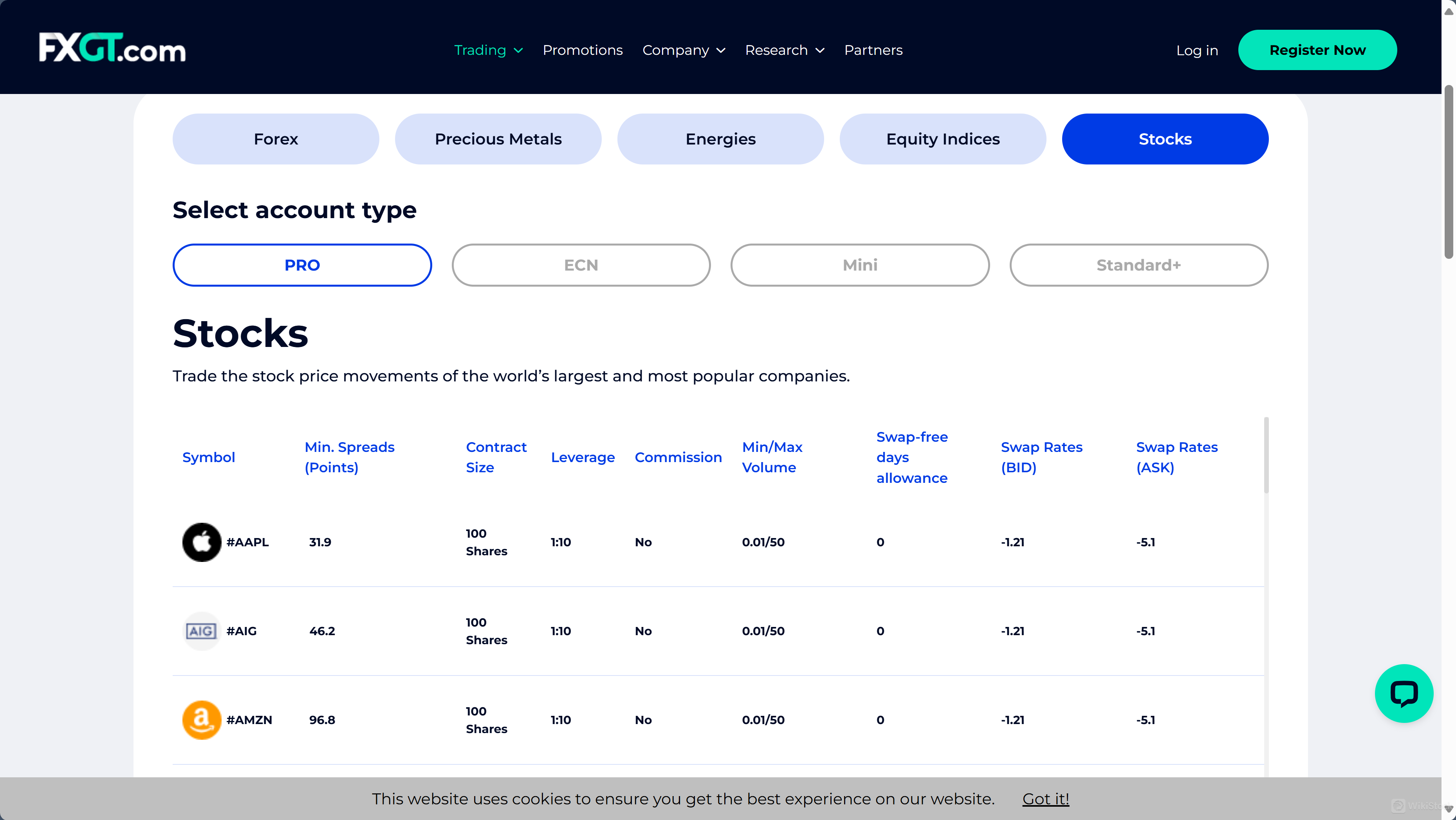

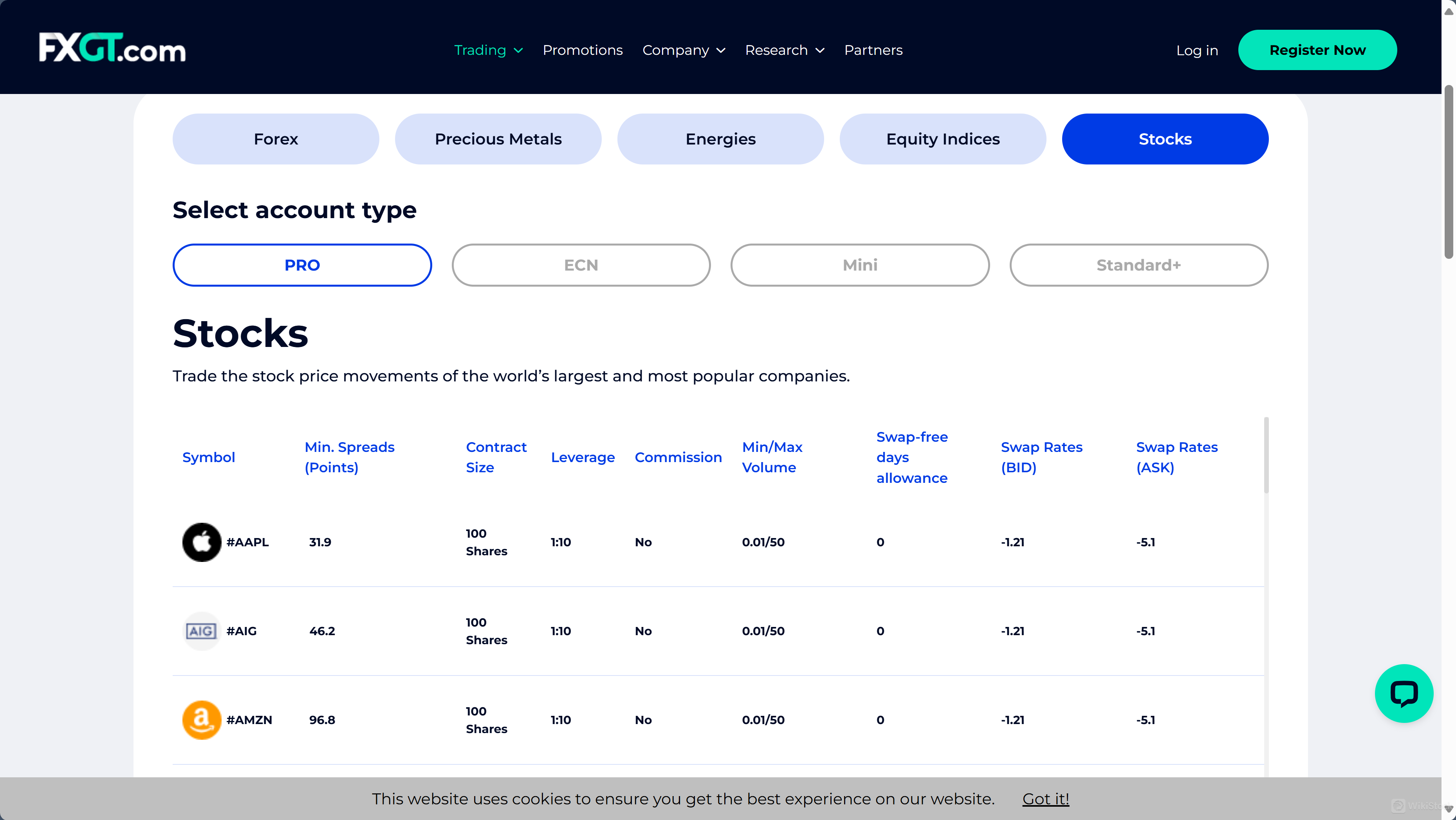

- Stocks:

- Traders on FXGT can buy and sell shares of individual companies listed on major stock exchanges. This allows traders to take positions based on their assessments of company performance, industry health, and economic indicators. Stock trading on FXGT is suitable for those who prefer direct investment in companies rather than through derivatives or pooled formats.

FXGT Account Review

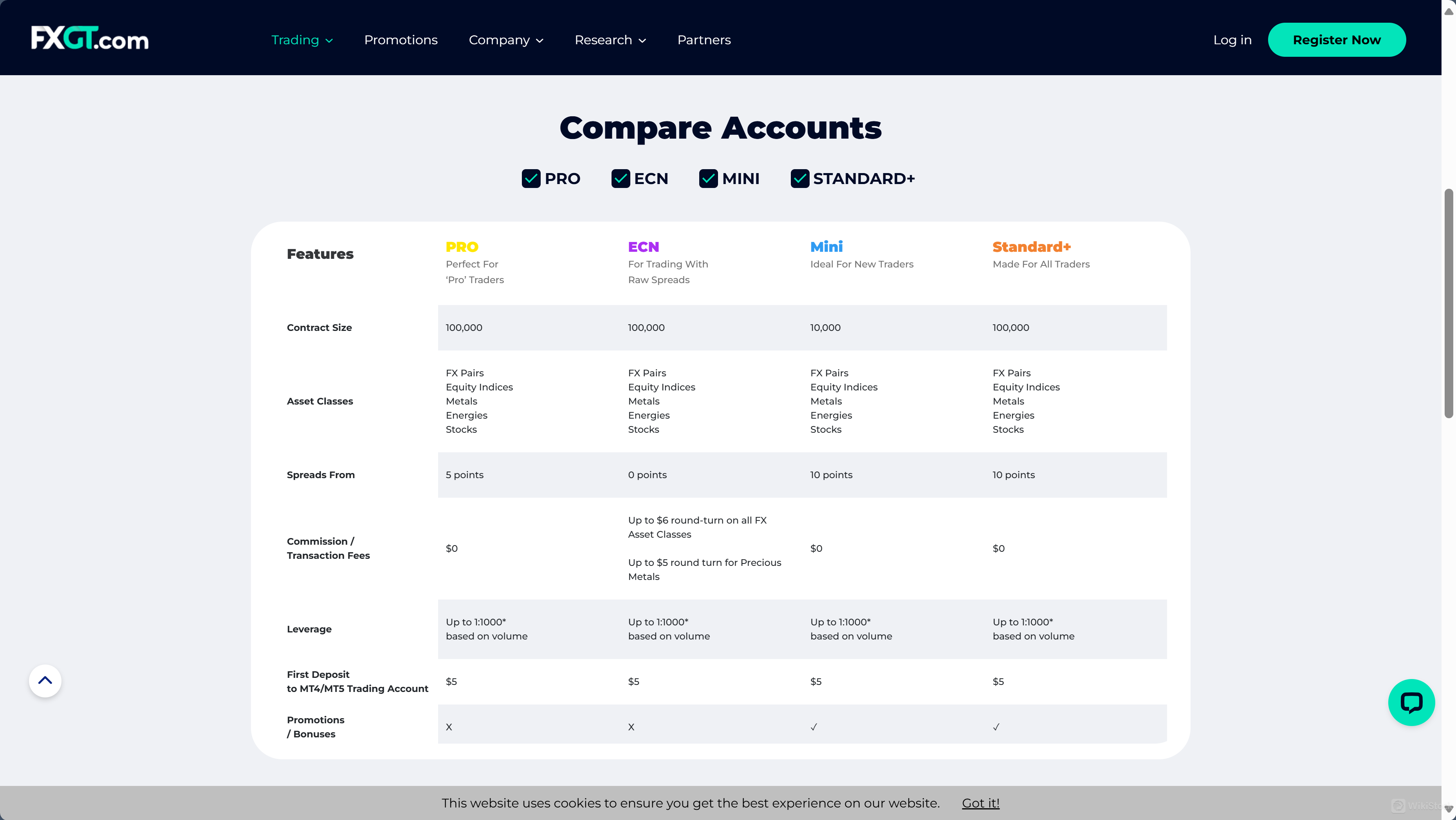

FXGT offers a variety of trading account types tailored to different levels of traders, from beginners to professionals, providing flexibility and customization according to individual trading styles and strategies. Here's an overview of the account types available:

- PRO Account:

- This account is designed for professional traders who require advanced trading capabilities. It offers access to all asset classes including FX pairs, equity indices, metals, energies, and stocks. The PRO account emphasizes minimal trading costs, featuring very low spreads and no commissions, making it ideal for high-volume traders who seek to maximize their trading efficiency and profitability.

- ECN Account:

- The ECN (Electronic Communication Network) account is suited for traders looking for raw spreads and direct market access. This account type is particularly attractive for those trading Forex and precious metals, as it offers very tight spreads starting from 0 points, with a commission structure that is clear and competitive. It's designed to provide a transparent trading environment where traders can benefit from immediate trade execution and reduced trading costs.

- Mini Account:

Obtain 4 securities license(s)

--

--

--

--