We keep our spreads low and don’t charge any commission. That way you get the best available price every time you trade.

Trading.com Information

Trading.com is a digital trading platform that offers a user-friendly trading experience through its MT5 platform accessible on various devices including PC, websites, and mobile applications.

The platform highlights its competitive edge with low fees, featuring zero commissions and spreads from 0.6 pips, and a straightforward registration process, allowing users to open an account in under 4.5 minutes.

However, potential users should be cautious as it also bears significant risks; notably, 70.14% of retail investor accounts lose money when trading CFDs due to high leverage, underscoring the platforms high-risk nature.

Pros & Cons

Pros:

Trading.com is a digital trading platform that offers a user-friendly experience through its MT5 platform, which is accessible on various devices including PCs, websites, and mobile applications. The platform stands out for its competitive edge with low fees, featuring zero commissions and spreads starting from 0.6 pips. Additionally, it boasts a straightforward registration process, allowing users to open an account in under 4.5 minutes.

Cons:

Despite its appealing features, Trading.com has notable drawbacks. The standard account has relatively high spreads, starting at 0.6 pips, which affects trading costs. The platform is limited in its investment services and offers only one type of trading account, which will not meet the diverse needs of all users. Most importantly, the platform bears significant risks; 70.14% of retail investor accounts lose money when trading CFDs due to high leverage, highlighting the high-risk nature of trading on this platform.

Is Trading.com Safe?

Regulations:

Trading.com is regulated by the United Kingdom Financial Conduct Authority (FCA), a prominent financial regulatory body known for its rigorous standards and oversight. With the regulatory status of Trading.com listed as regulated under License No. 705428, users can be assured that the platform adheres to stringent regulations designed to maintain the integrity of financial markets and protect consumers.

Funds Safety:

Trading.com ensures the safety of clients' funds through several measures. Being regulated by the FCA typically means that client funds are segregated from the companys own funds and are protected under the Financial Services Compensation Scheme (FSCS). This scheme provides coverage of up to £85,000 per client in the event of the company's insolvency, offering an additional layer of security for traders' investments.

Safety Measures:

Trading.com employs robust encryption technologies to ensure the security of funds storage and the protection of personal data. The platform is committed to safeguarding the confidentiality of client information and utilizes advanced security measures to prevent unauthorized access and data breaches.

Additionally, Trading.com has privacy policy that outlines the measures taken to protect user information, demonstrating its commitment to maintaining a secure trading environment. These safety measures include regular reviews to stay abreast of regulatory changes and technological advancements, ensuring ongoing protection for users.

What are securities to trade with Trading.com?

Trading.com offers a variety of securities for traders to engage with, including:

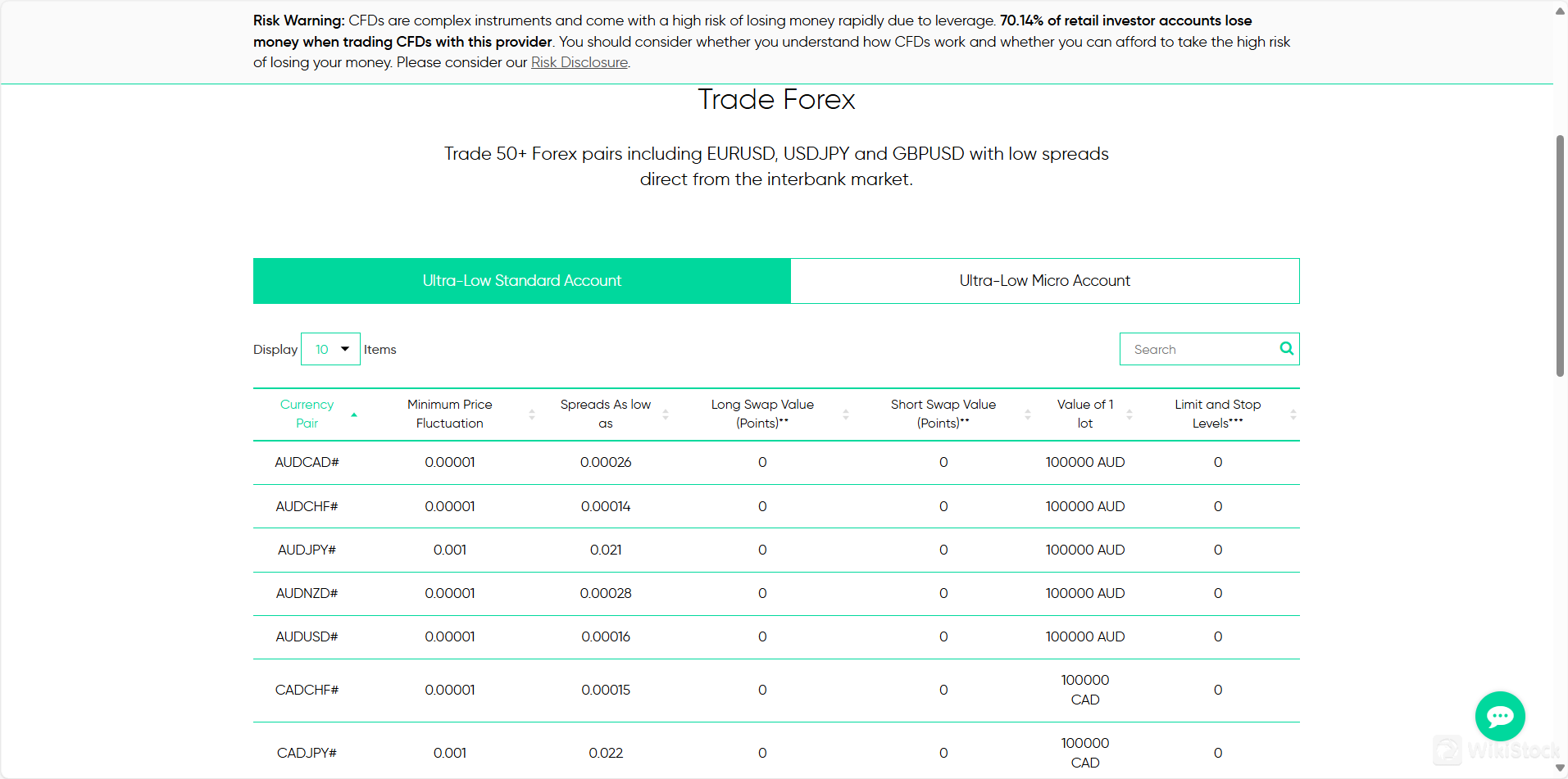

Forex:

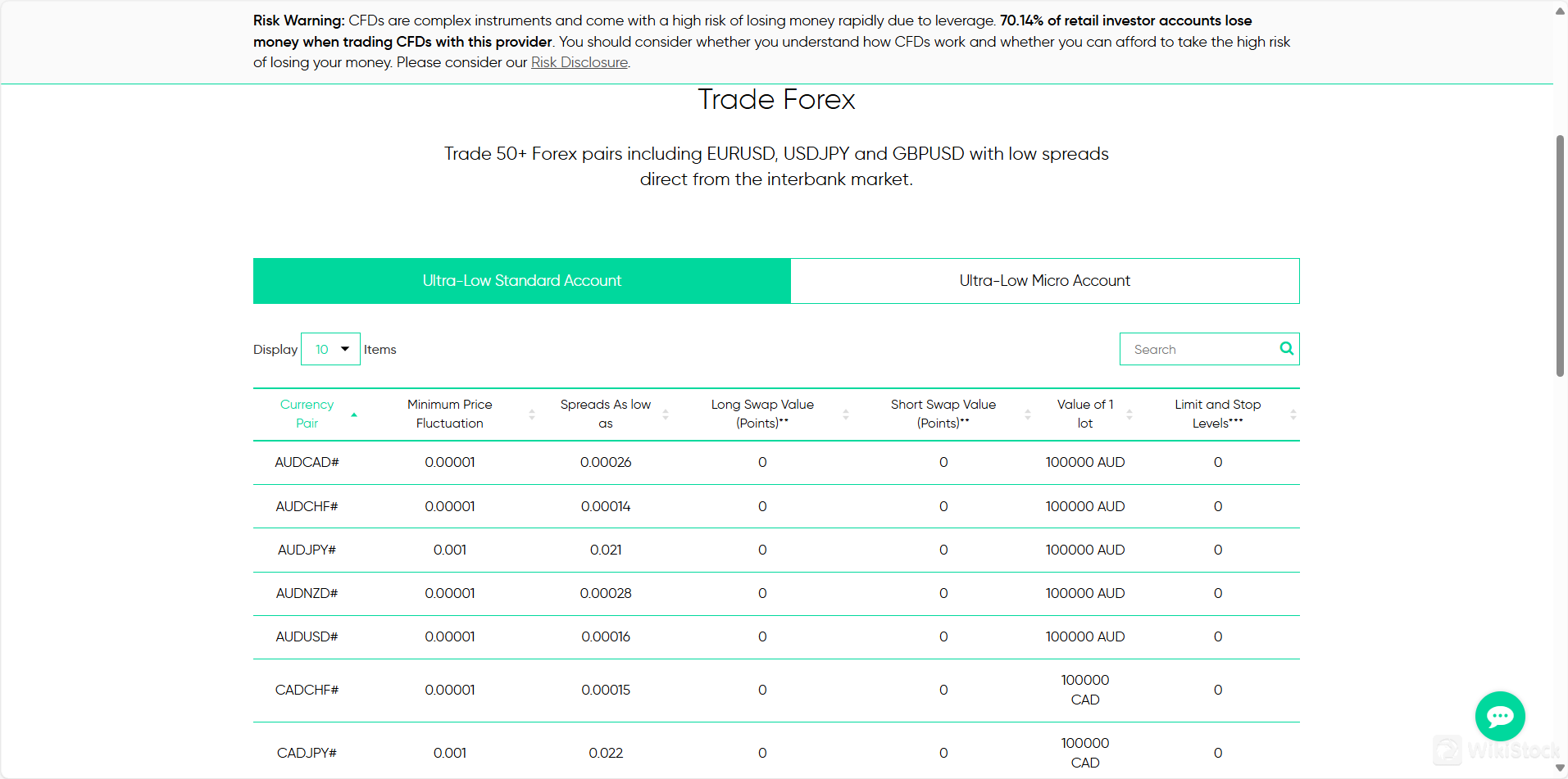

Trading.com offers an extensive range of forex trading options, allowing traders to engage in the dynamic and highly liquid global foreign exchange market. With numerous currency pairs available, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs, traders can take advantage of various market opportunities and volatility.

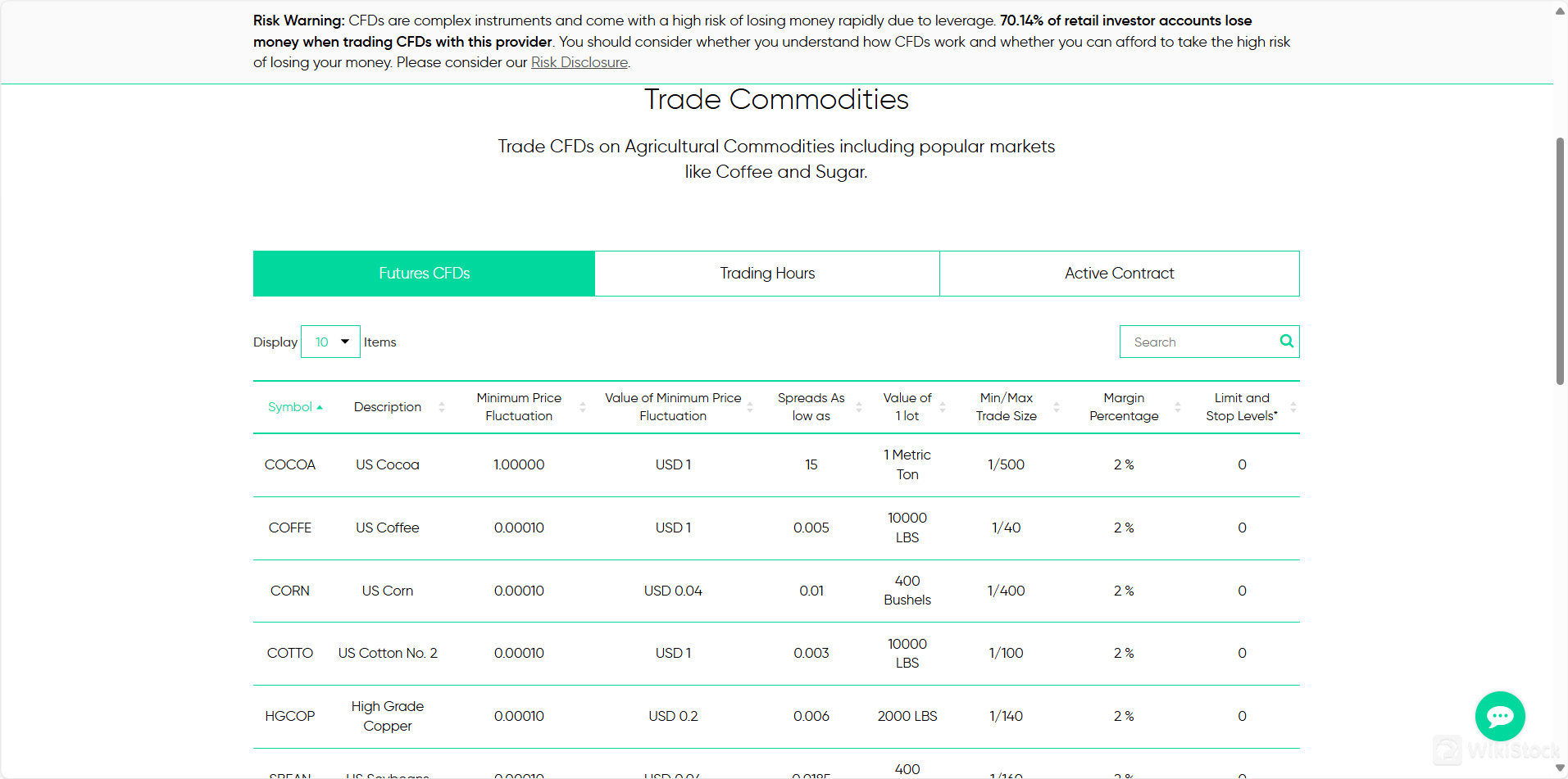

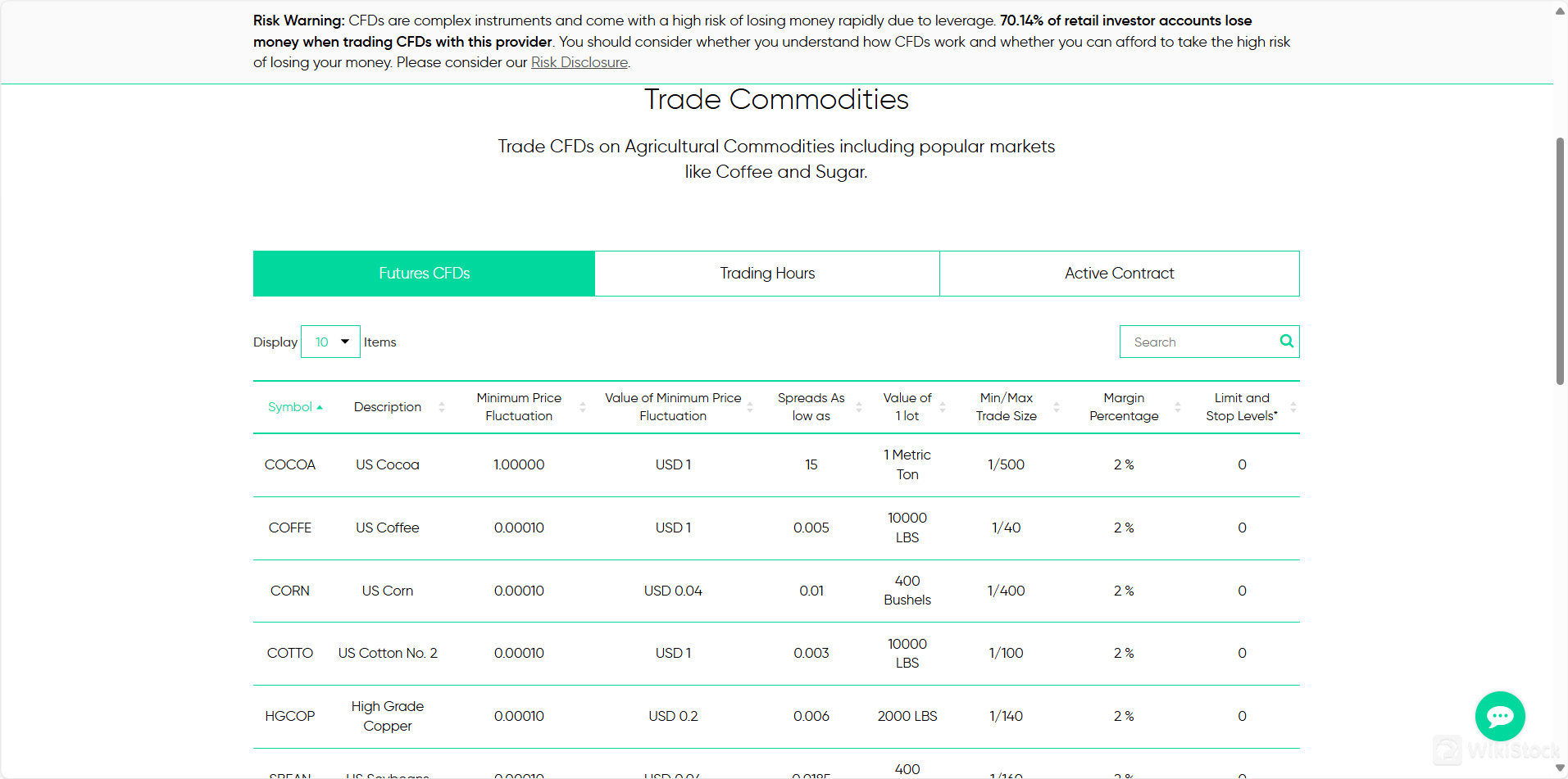

Commodities:

Traders can diversify their portfolios by investing in a variety of commodities through Trading.com. The platform offers access to agricultural products, precious metals, and other raw materials. This includes popular commodities such as coffee, wheat, and sugar, which are essential components of global trade.

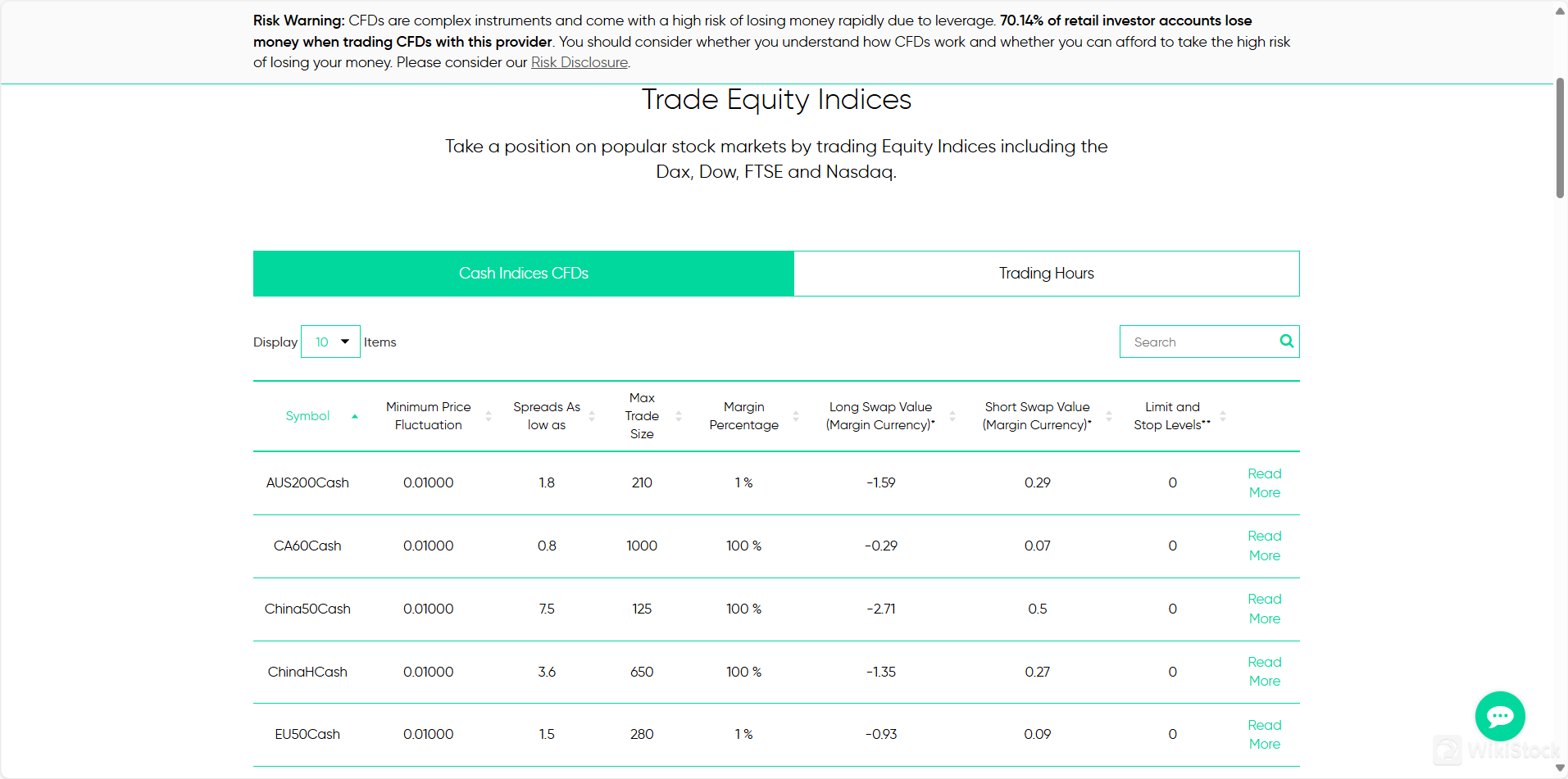

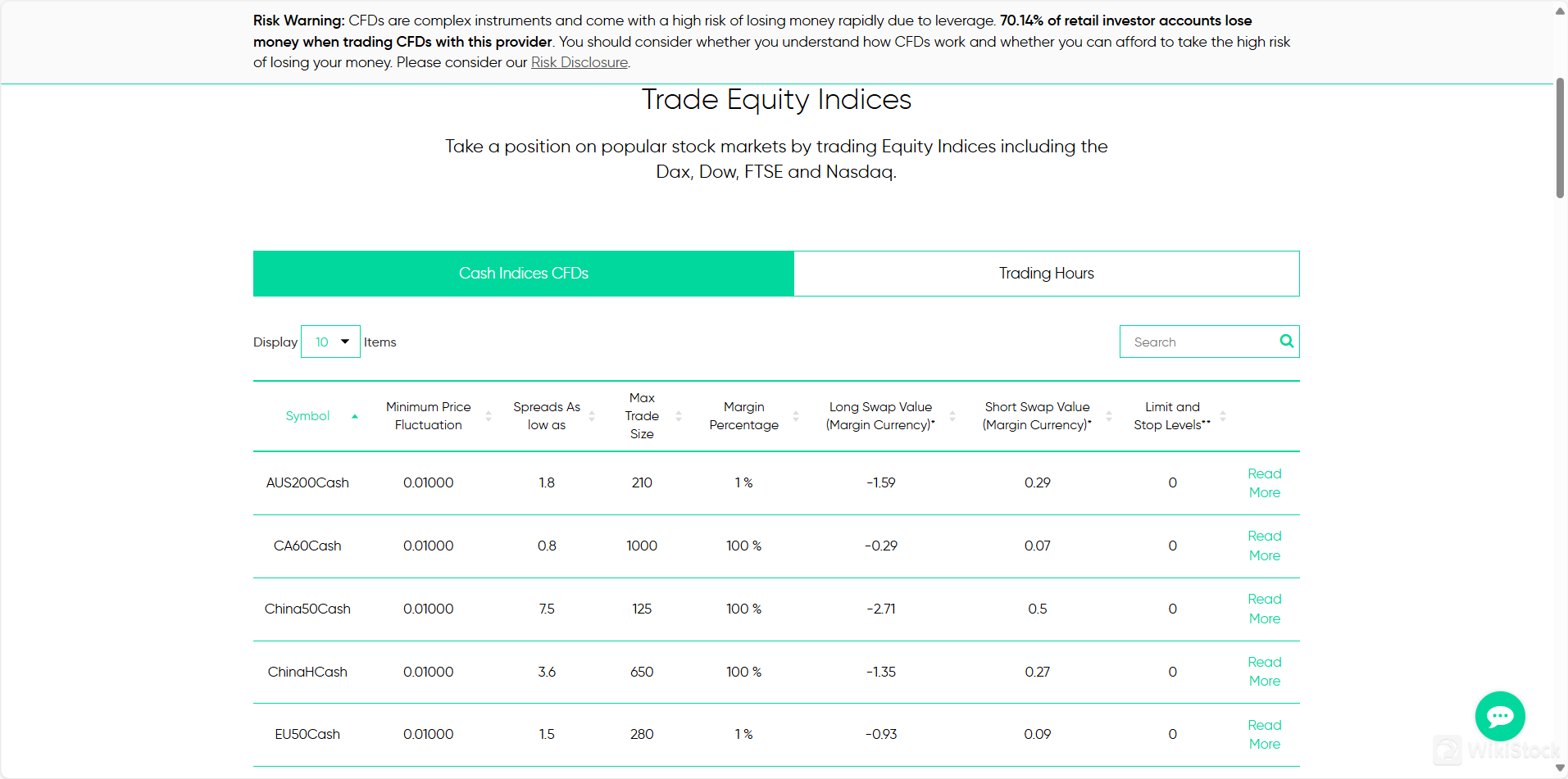

Indices:

Trading.com provides opportunities to trade major stock indices from around the world, offering a way to gain exposure to broader market performance without having to trade individual stocks. Indices such as the S&P 500, NASDAQ, FTSE 100, and DAX represent the performance of leading companies in various regions.

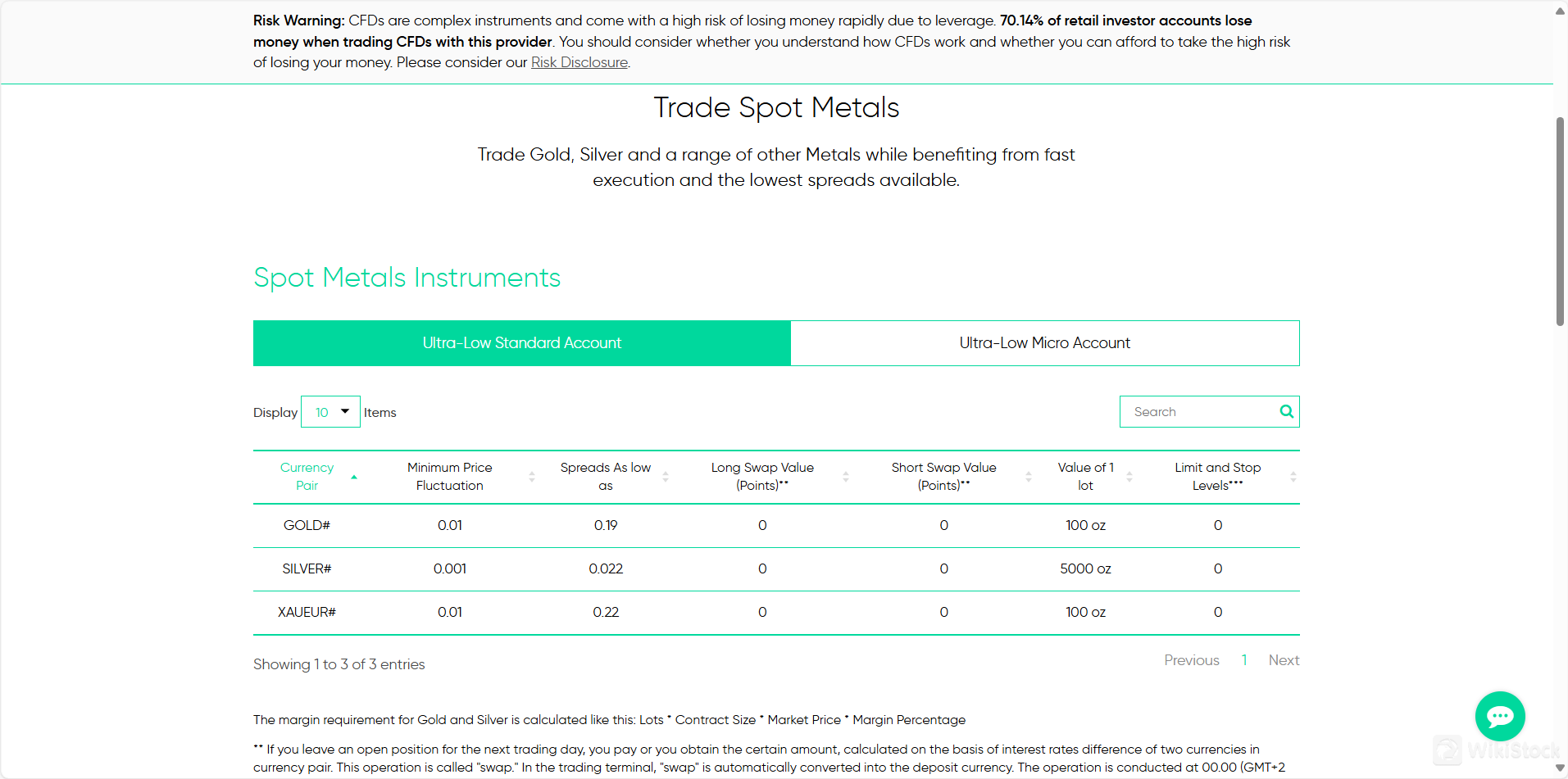

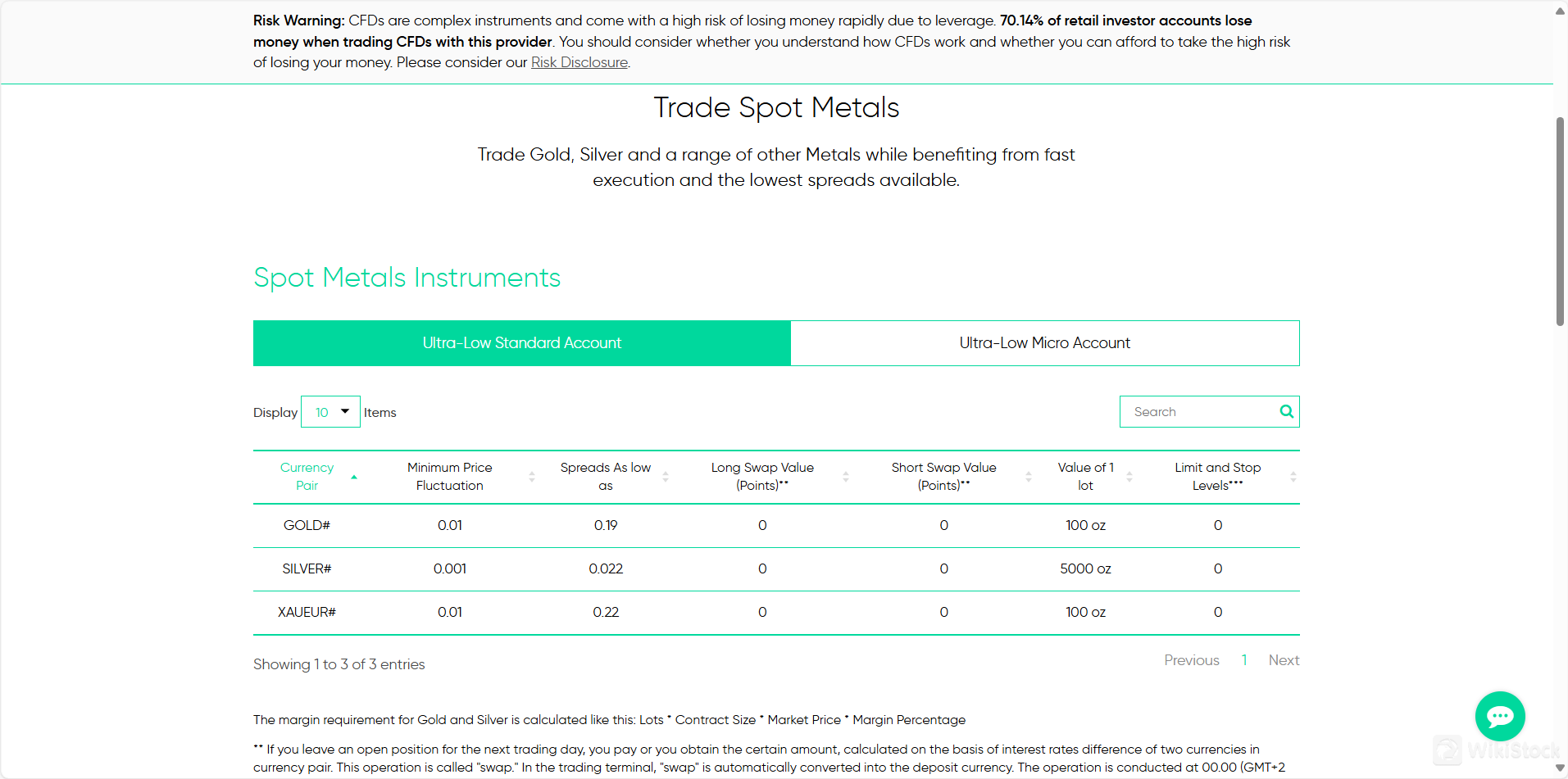

Metals:

Investing in precious metals like gold, silver, platinum, and palladium is made easy with Trading.com. These metals are often viewed as safe-haven assets, especially during times of economic uncertainty. Gold, in particular, is a popular choice for hedging against inflation and currency fluctuations.

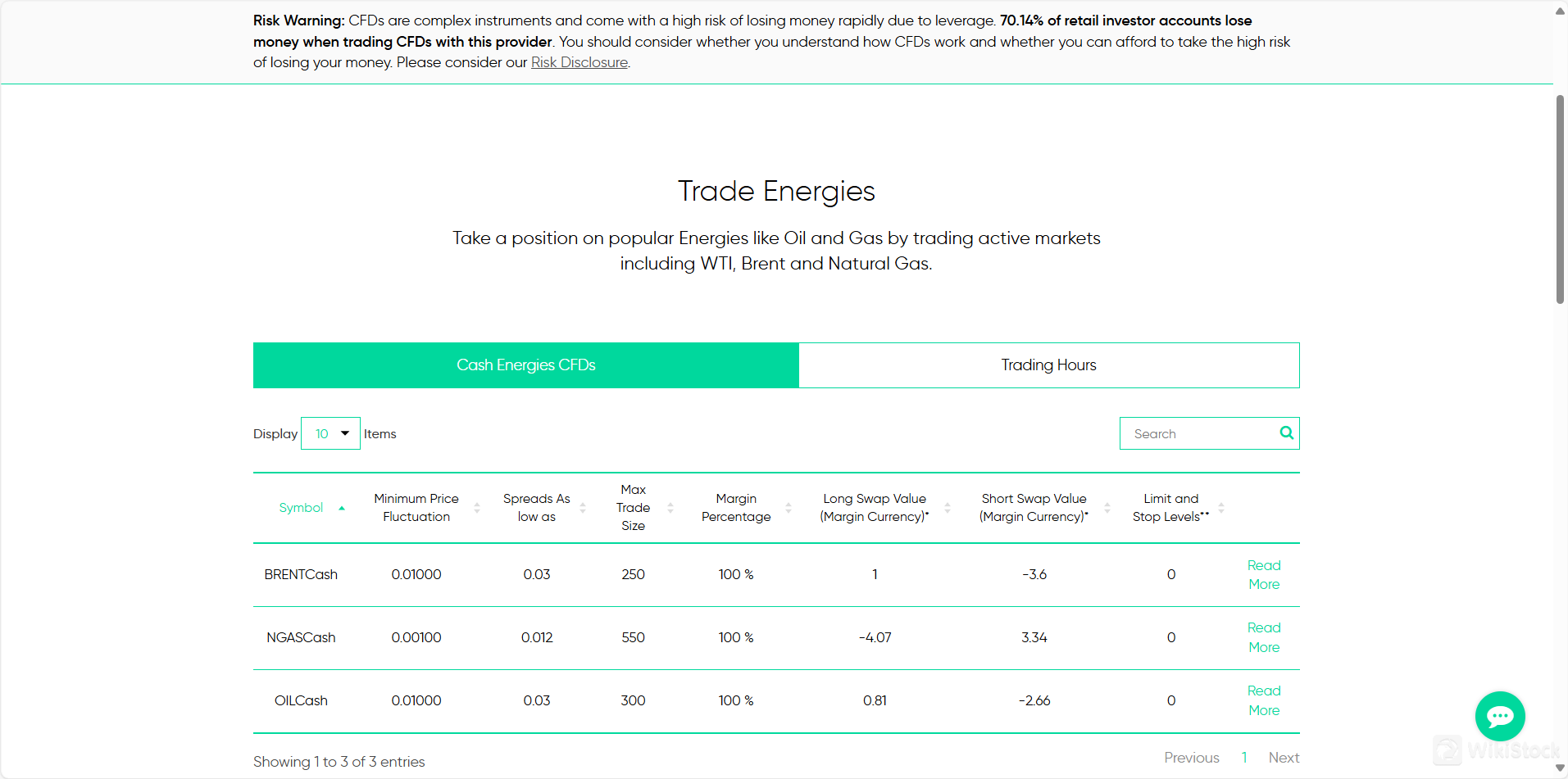

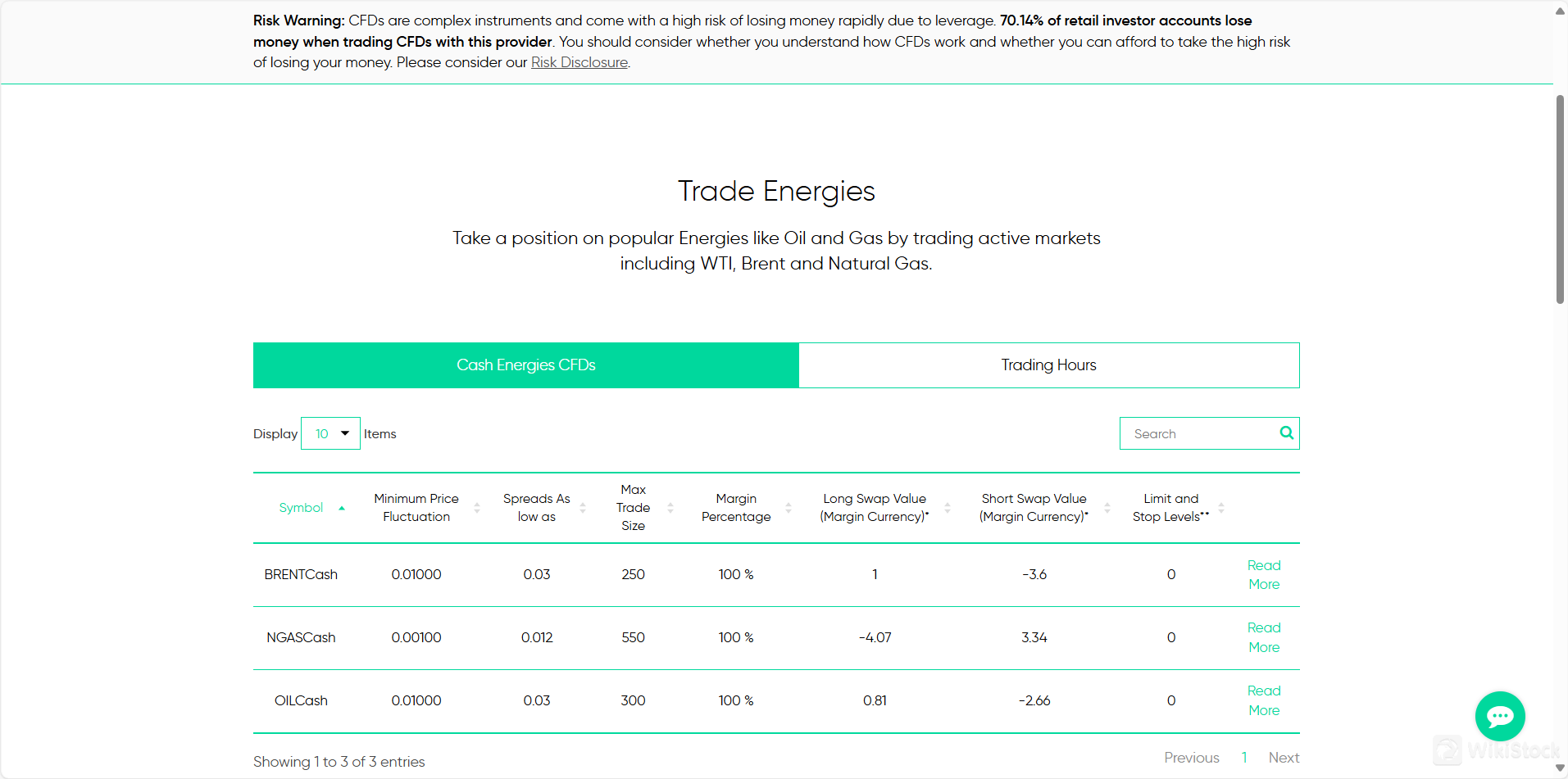

Energies:

Energy commodities, including oil and natural gas, are vital components of the global economy, and Trading.com offers a way to trade these crucial resources. Investors can participate in the energy markets by trading instruments related to crude oil (both Brent and WTI) and natural gas. The energy market is influenced by a variety of factors, including geopolitical tensions, production levels, and seasonal demand.

Trading.com Fee Review

Trading.com offers a straightforward and competitive fee structure designed to appeal to a wide range of traders. Below are the key elements of their fee structure:

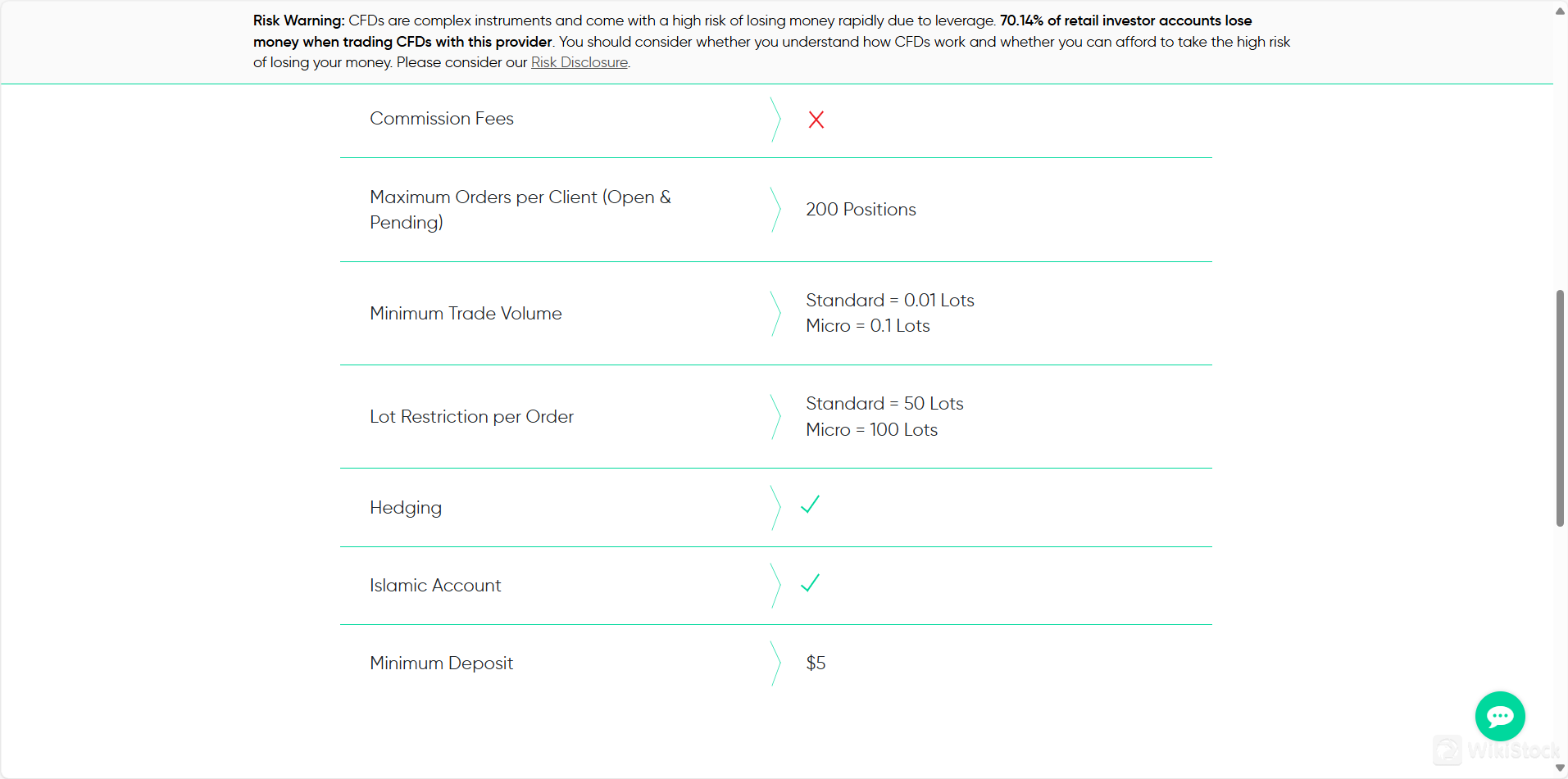

Commission Fees:

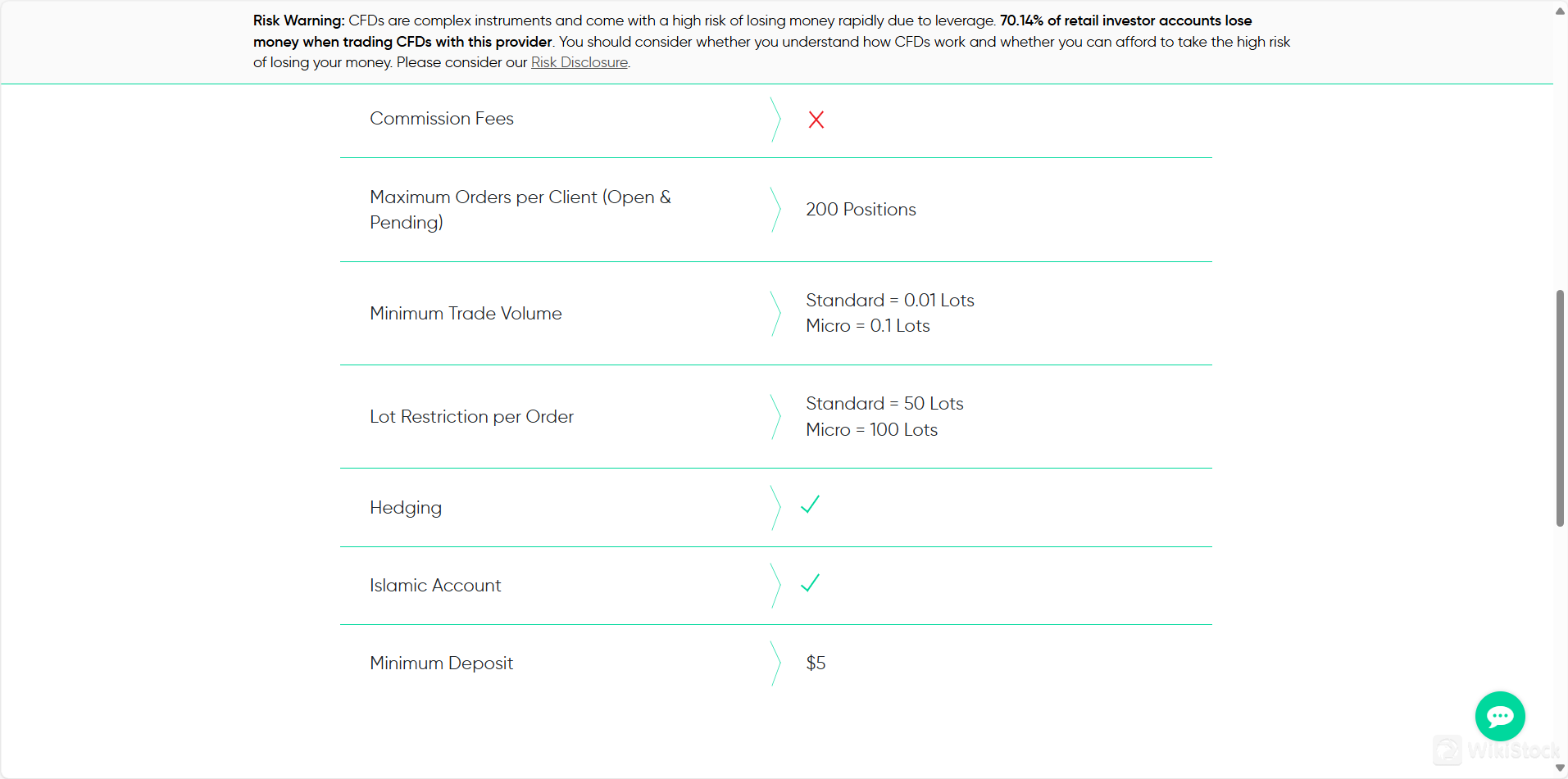

Trading.com features 0 commission fees on trades, allowing traders to execute transactions without incurring additional costs beyond the spread.

Spreads:

The average spread on major currency pairs is 0.6 pips, which is competitive in the industry. This spread will vary depending on market conditions and the specific currency pair being traded.

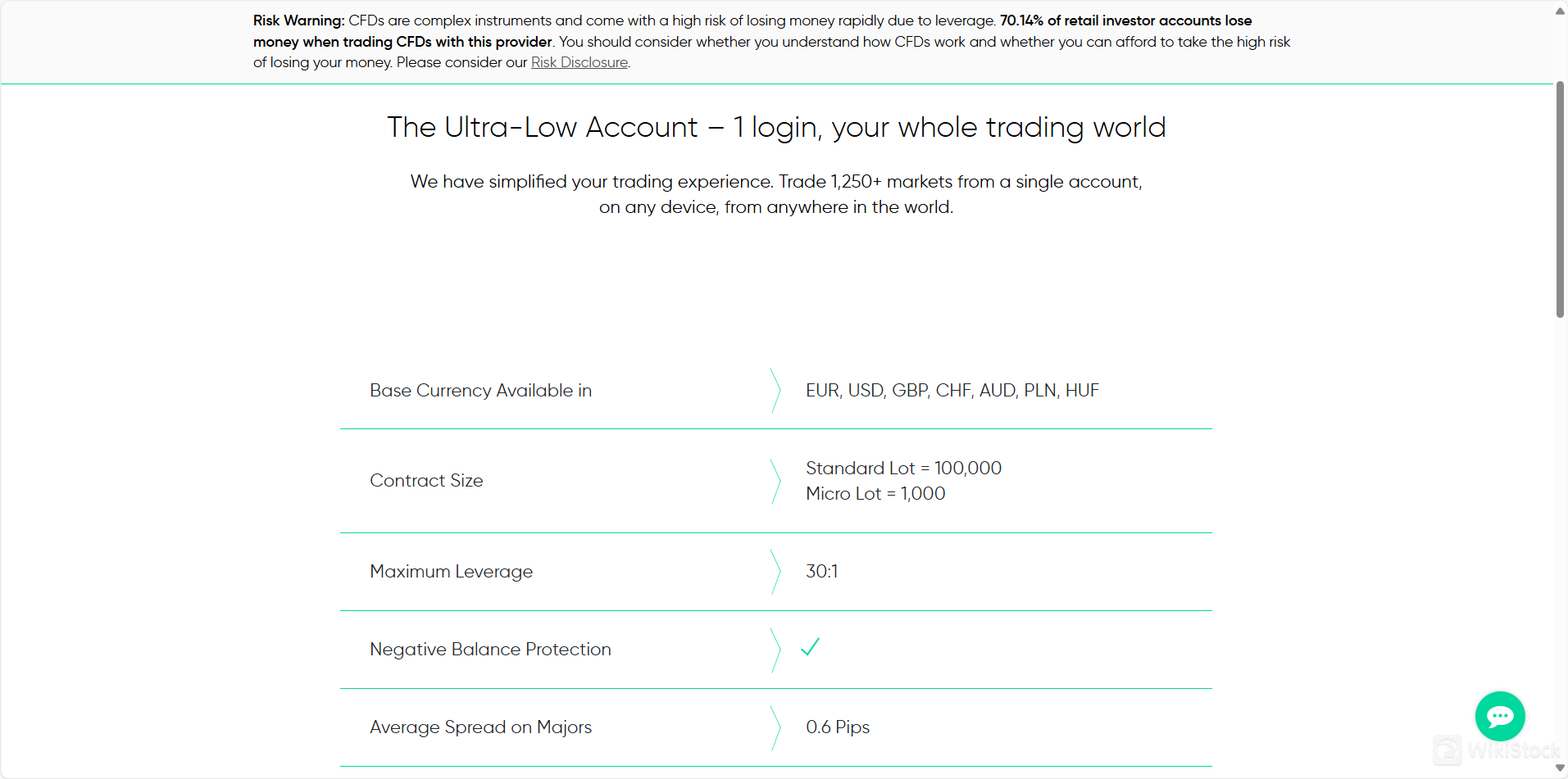

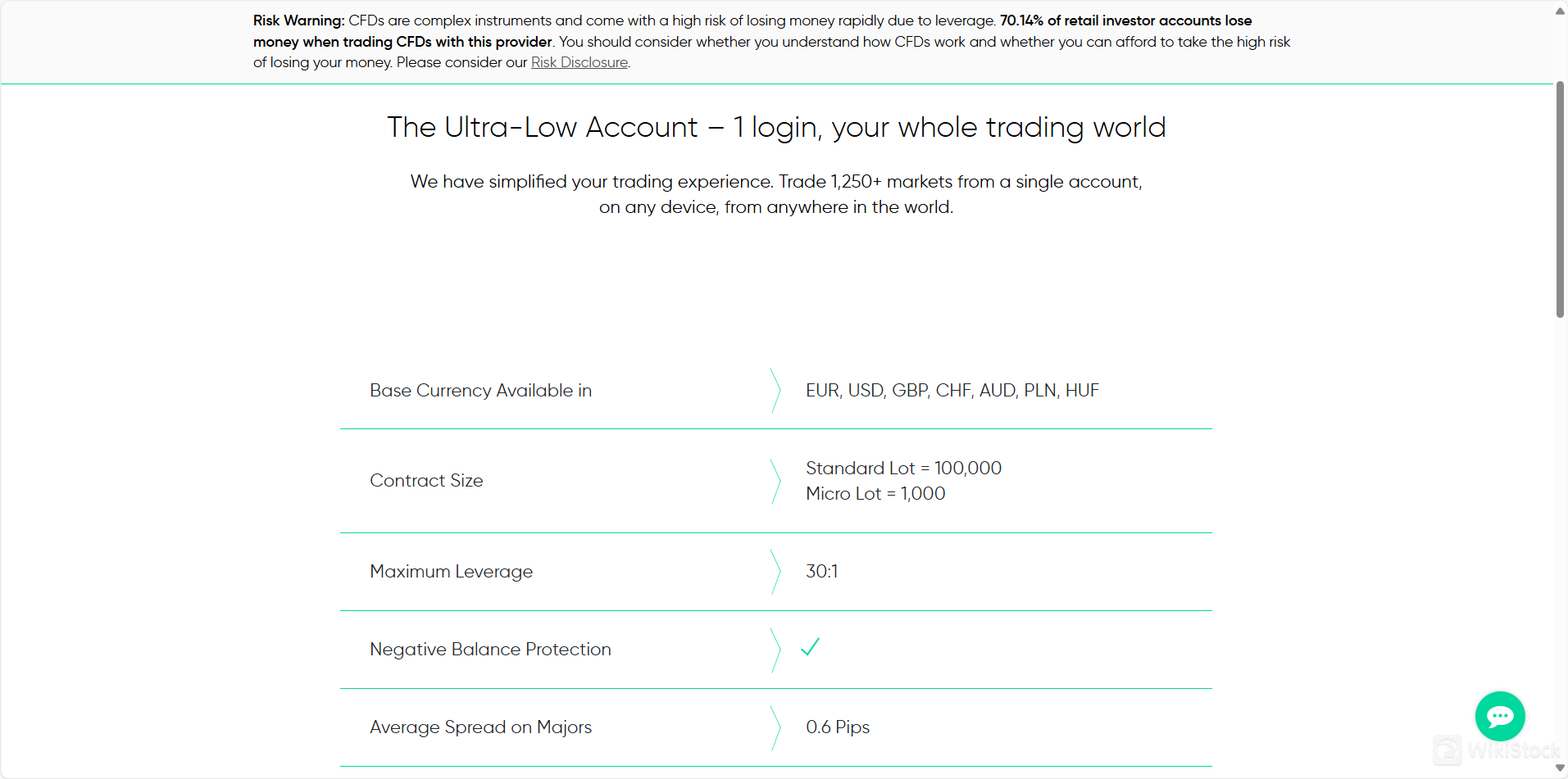

Account Details:

- Base Currency Available: EUR, USD, GBP, CHF, AUD, PLN, HUF

- Contract Size: Standard Lot = 100,000 units, Micro Lot = 1,000 units

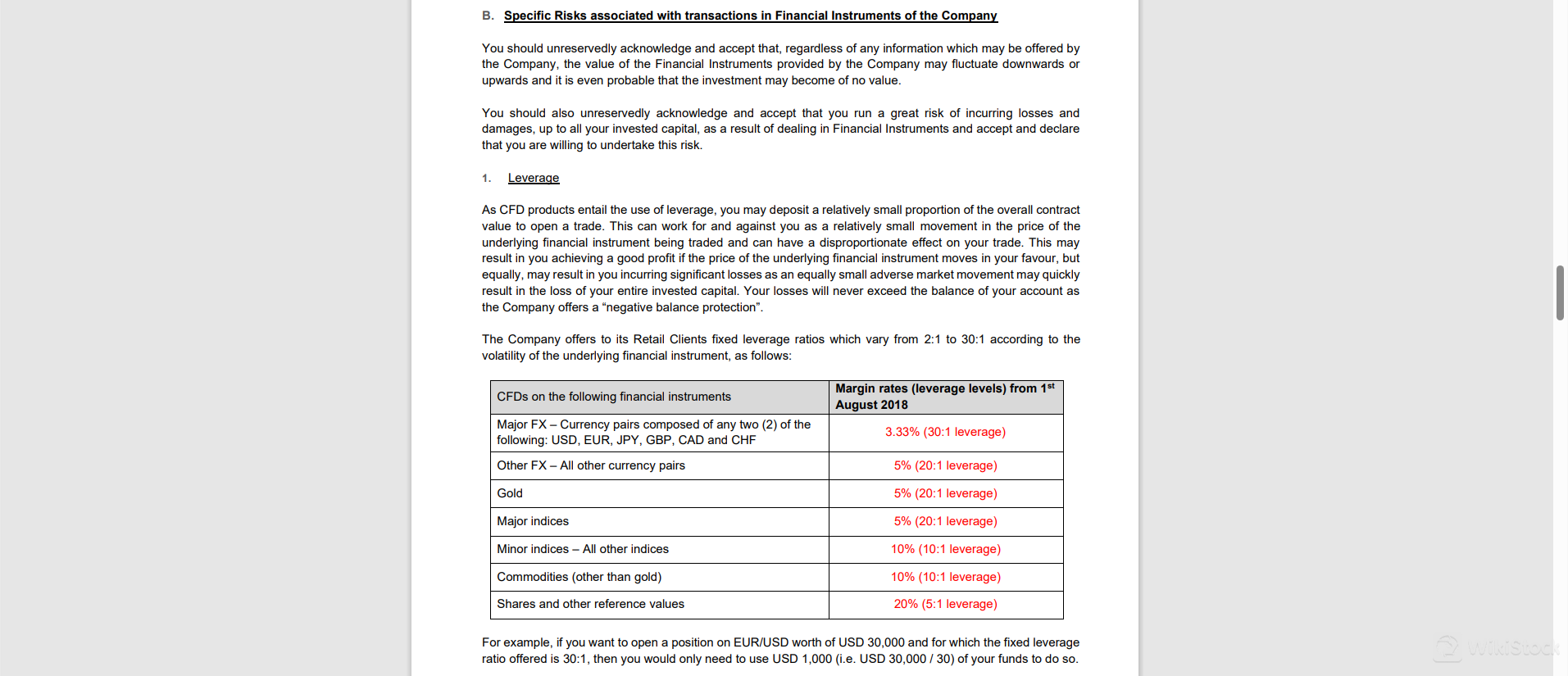

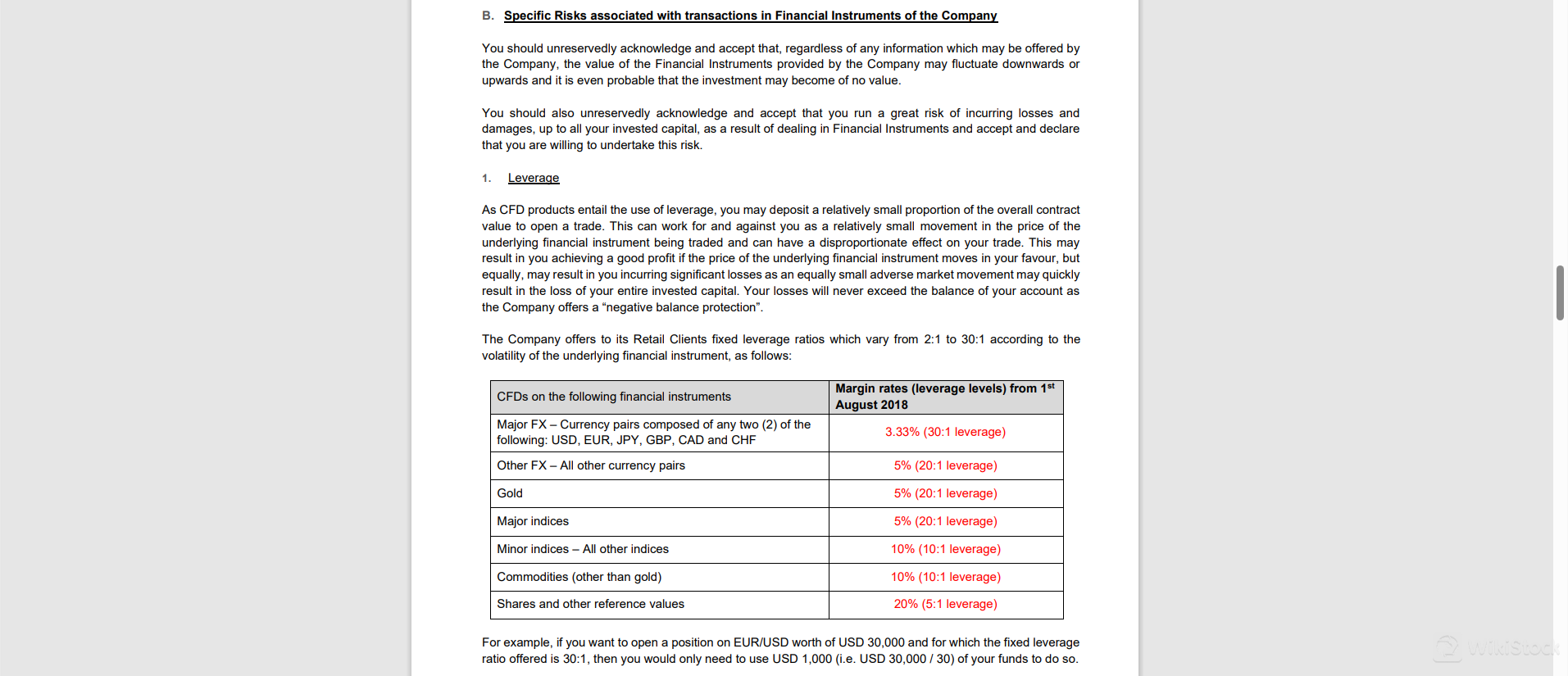

- Maximum Leverage: 30:1

- Negative Balance Protection: Available to protect traders from incurring negative balances.

Order Limits:

- Maximum Orders per Client (Open & Pending): 200 positions

- Minimum Trade Volume: Standard = 0.01 lots, Micro = 0.1 lots

- Lot Restriction per Order: Standard = 50 lots, Micro = 100 lots

Additional Features:

- Hedging: Allowed

- Islamic Account: Available for traders who require Sharia-compliant trading options

- Minimum Deposit: $5, making it accessible for traders with varying capital levels.

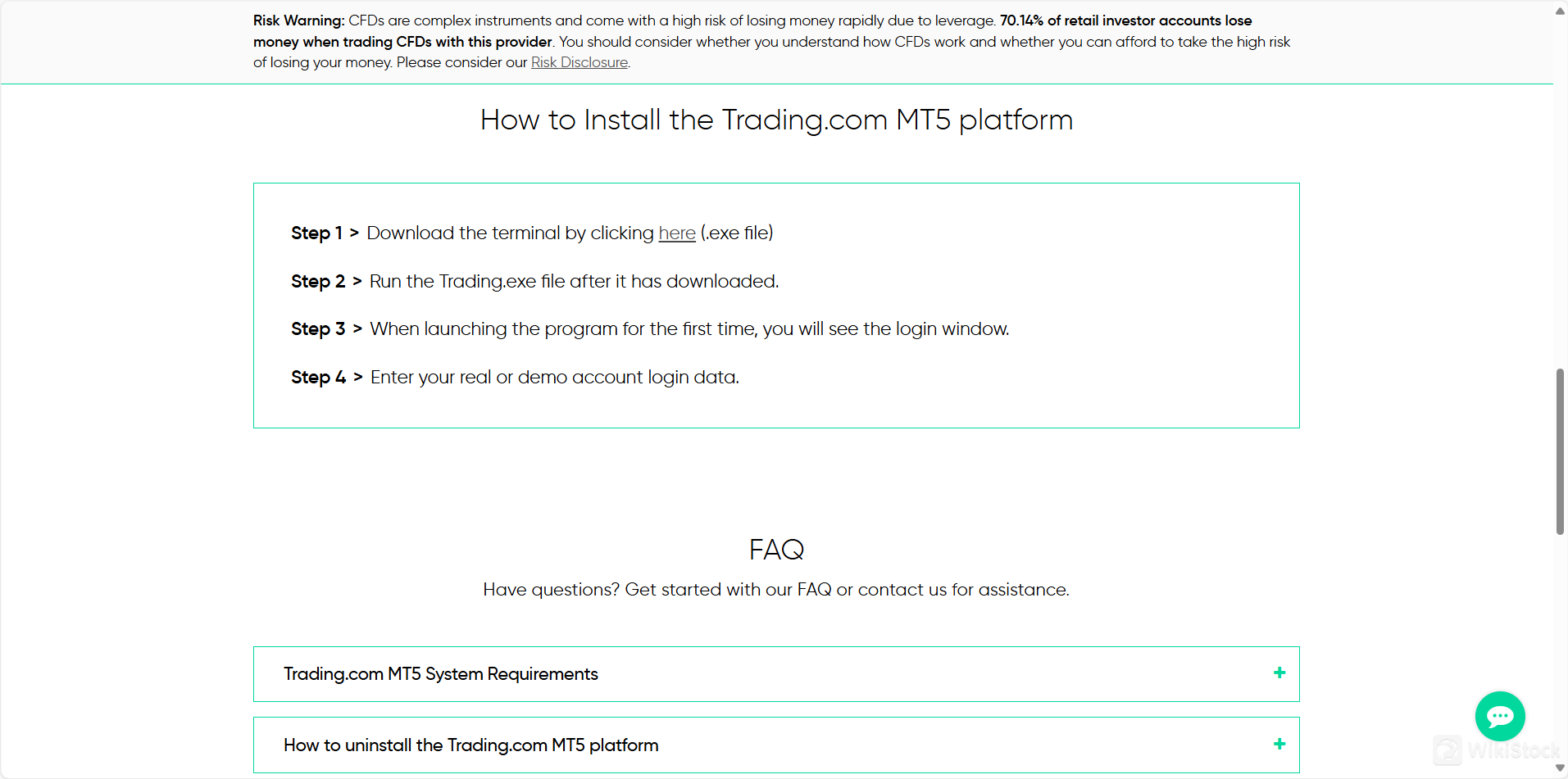

Trading.com Trading Platform Review

Trading.com offers the advanced MT5 trading platform, providing users with access to over 1,250 markets including Forex, CFDs, Stocks, Indices, and Metals.

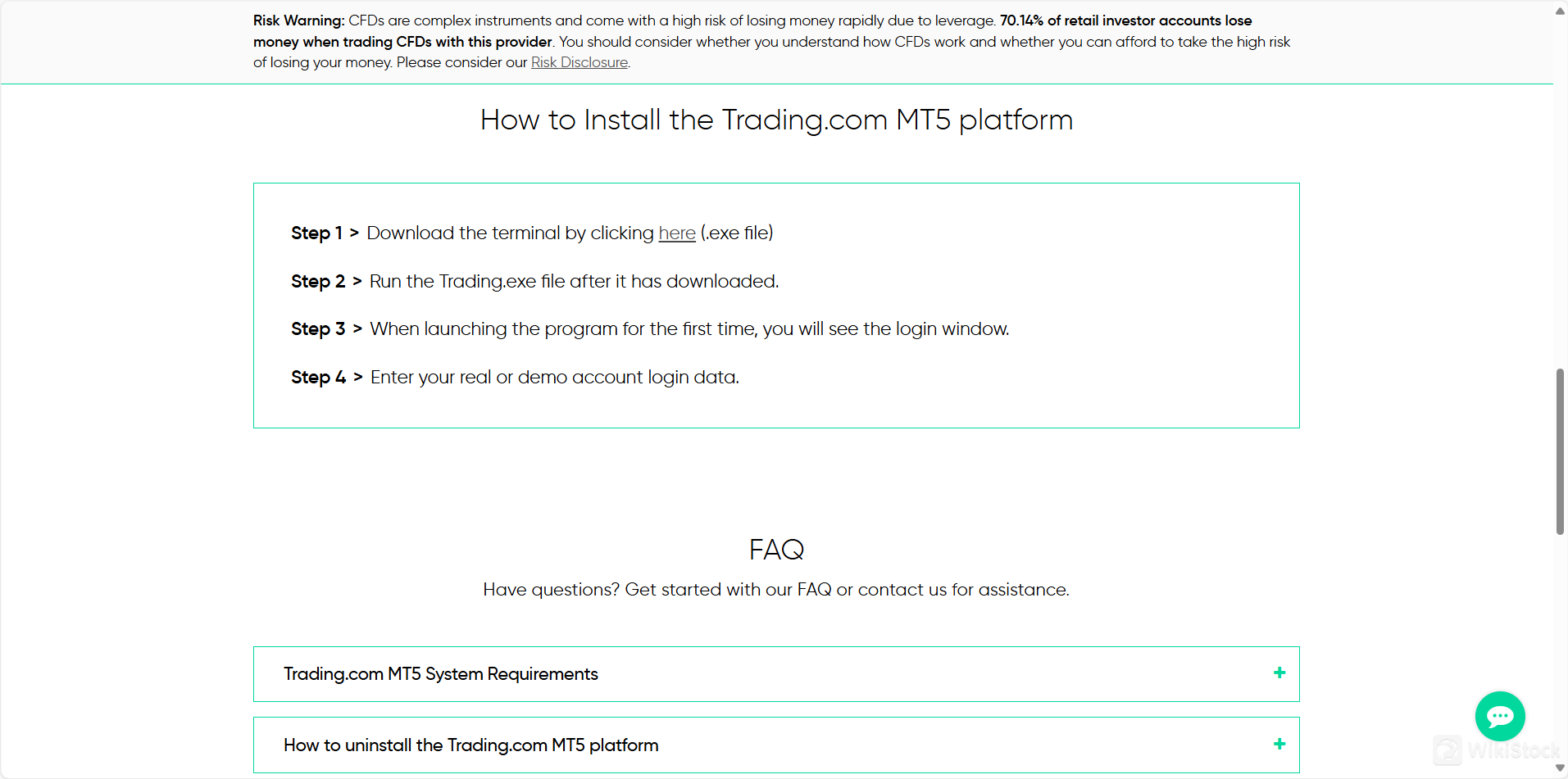

PC

The Trading.com MT5 platform for PC offers advanced charting, integrated EA functionality, and over 80 analysis tools. It supports 1-click trading with no re-quotes or rejections, providing a robust trading experience.

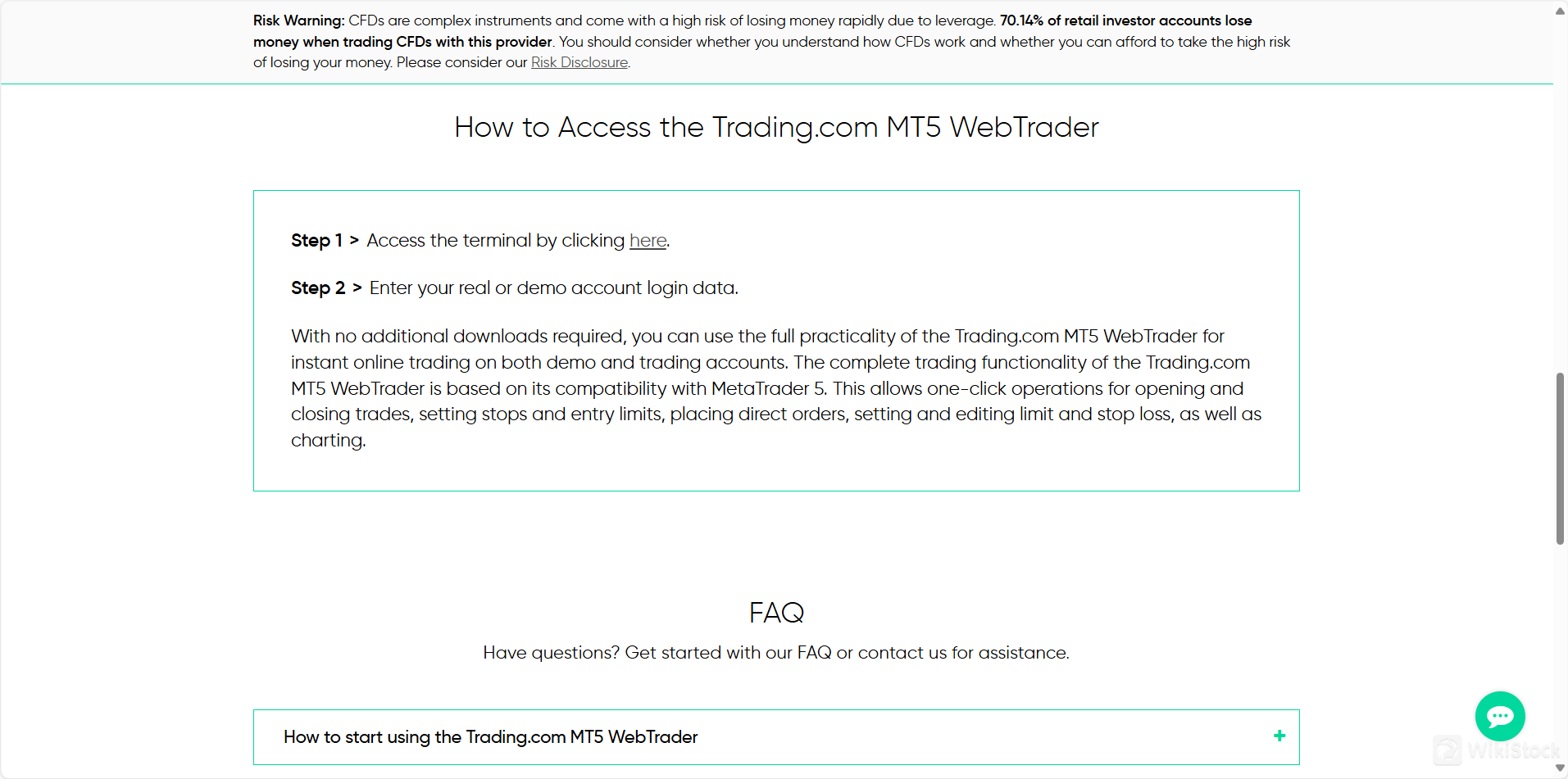

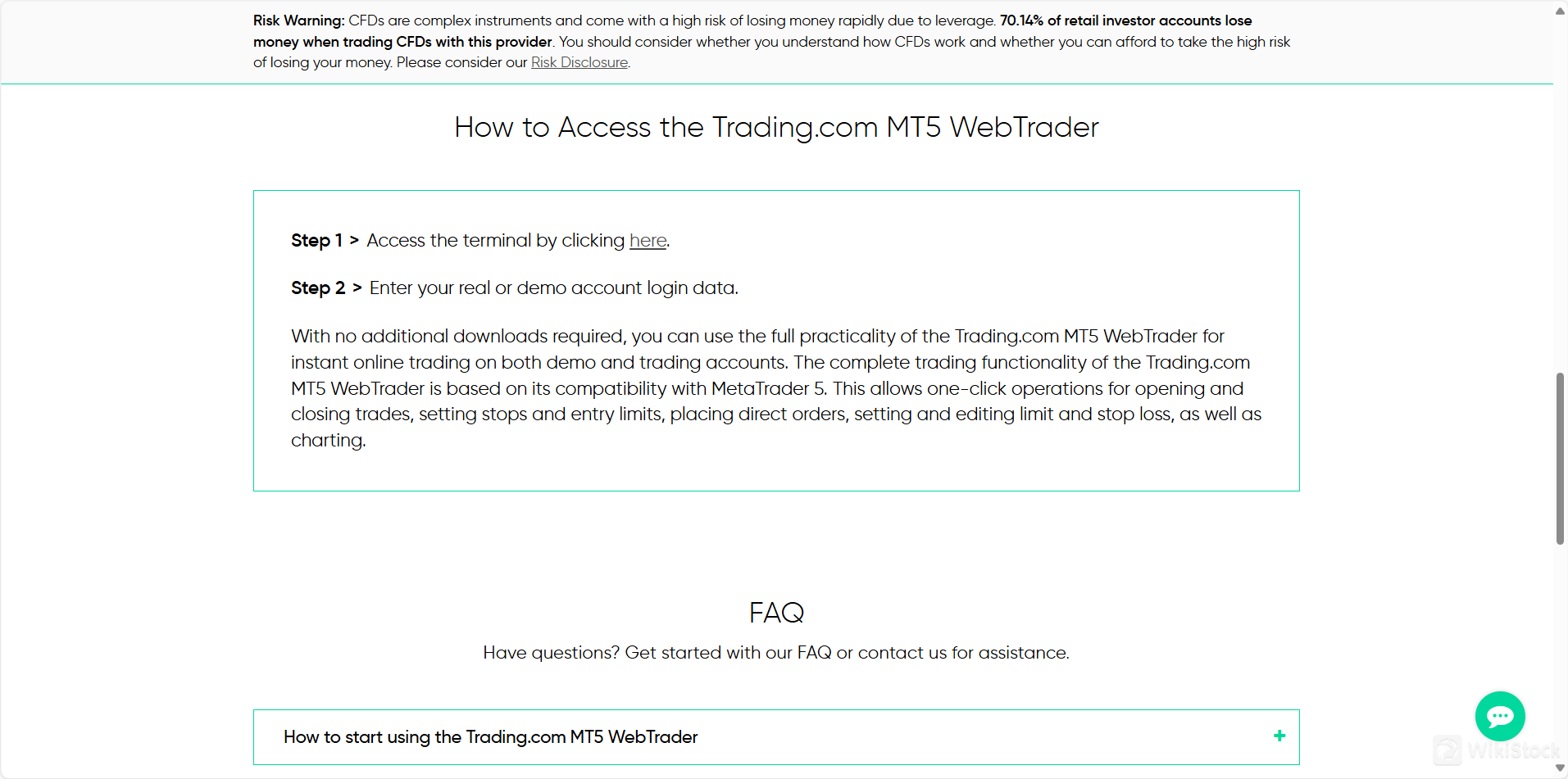

WebTrader

The Trading.com MT5 WebTrader allows trading directly from your browser without software installation. It offers real-time quotes, advanced charting, and full trading functionality, ideal for trading on the go.

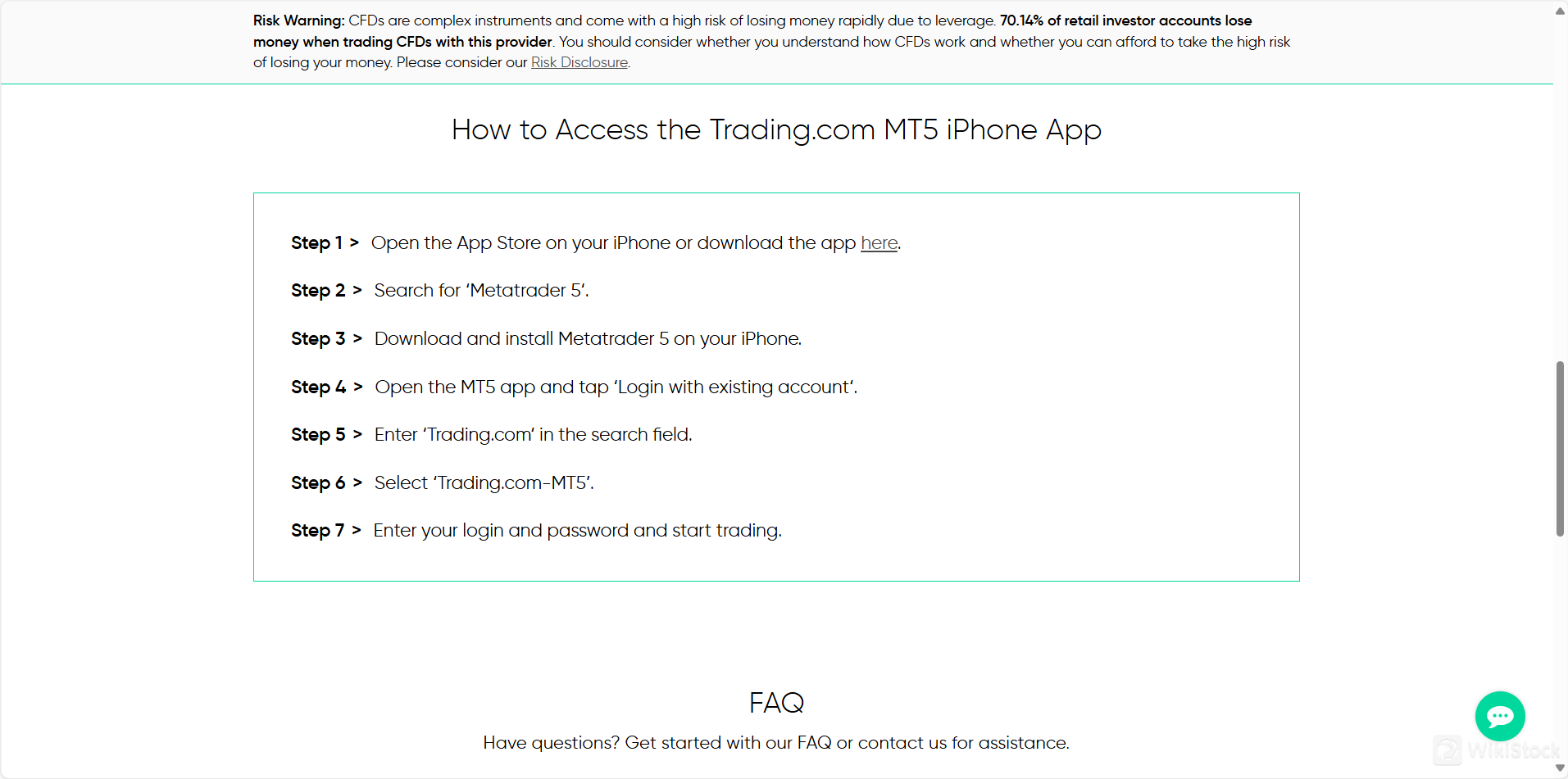

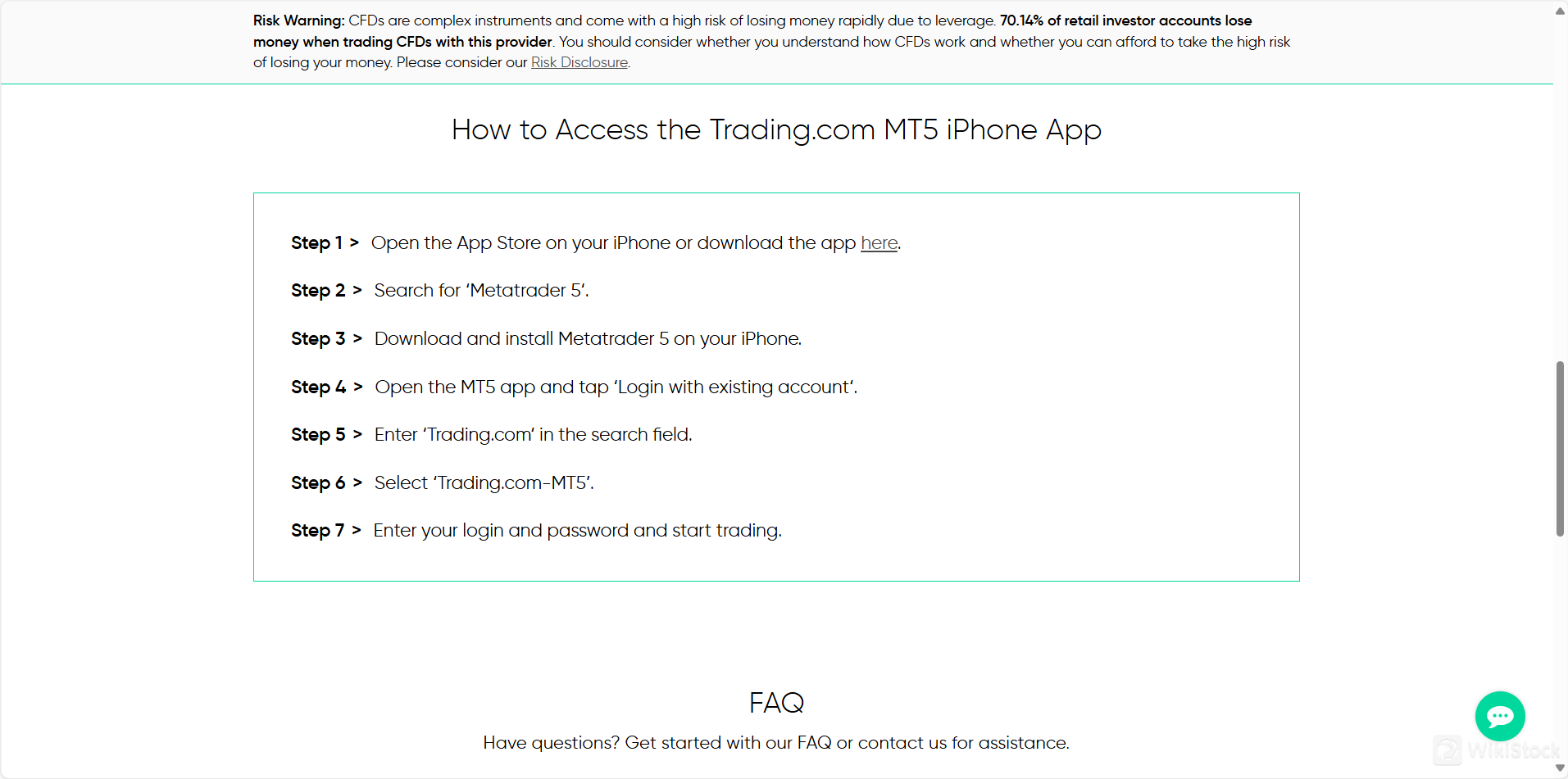

iPhone

The Trading.com MT5 app for iPhone provides real-time quotes, interactive charts, and 1-click trading. It ensures efficient trading with full account management and integrated EA functionality on mobile.

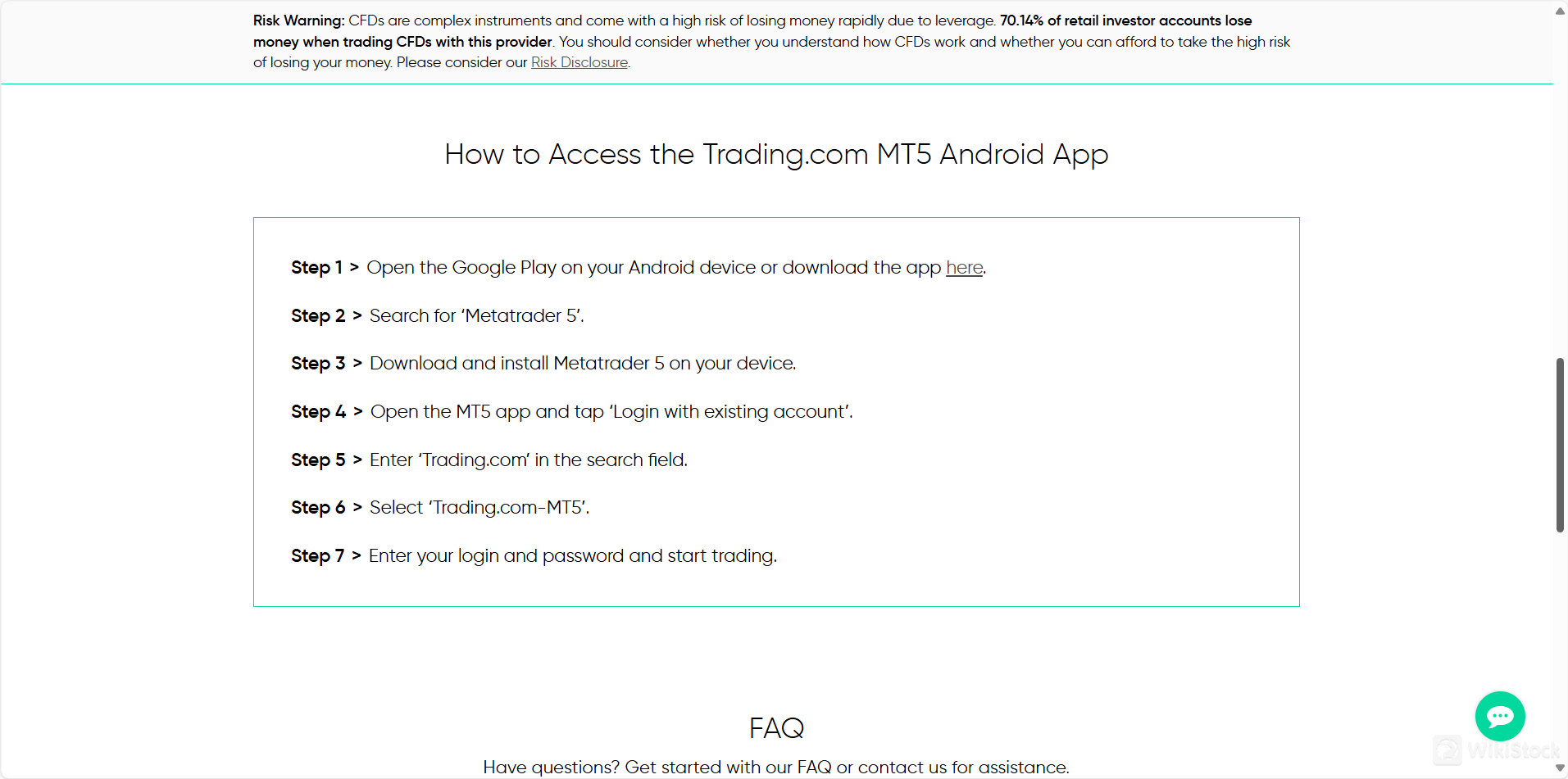

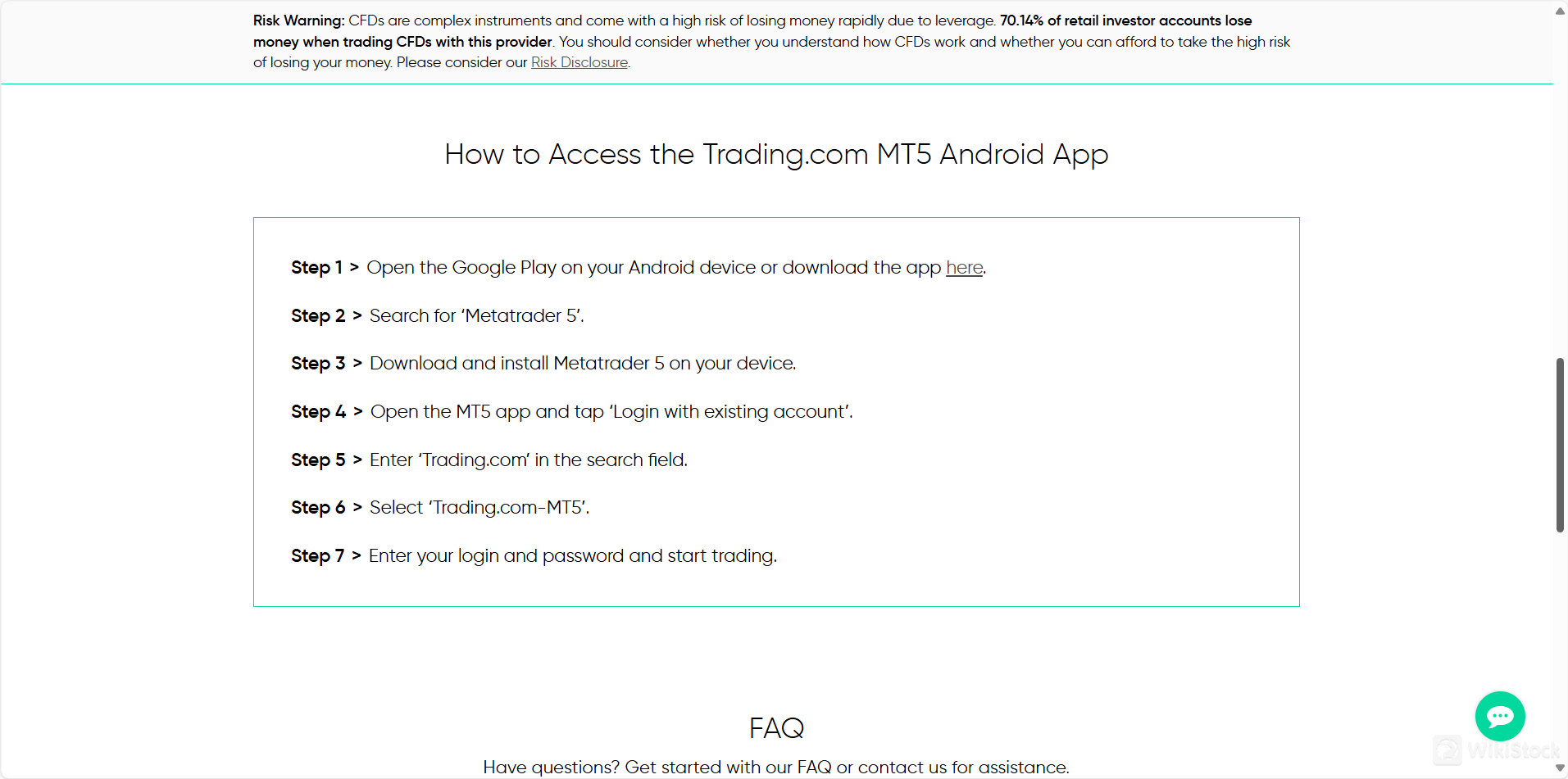

Android

The Trading.com MT5 app for Android offers real-time quotes, advanced charting, and 1-click trading. It allows full account management and trading on the go with integrated EA functionality.

Research & Education

Trading.com provides trading tools for its users.

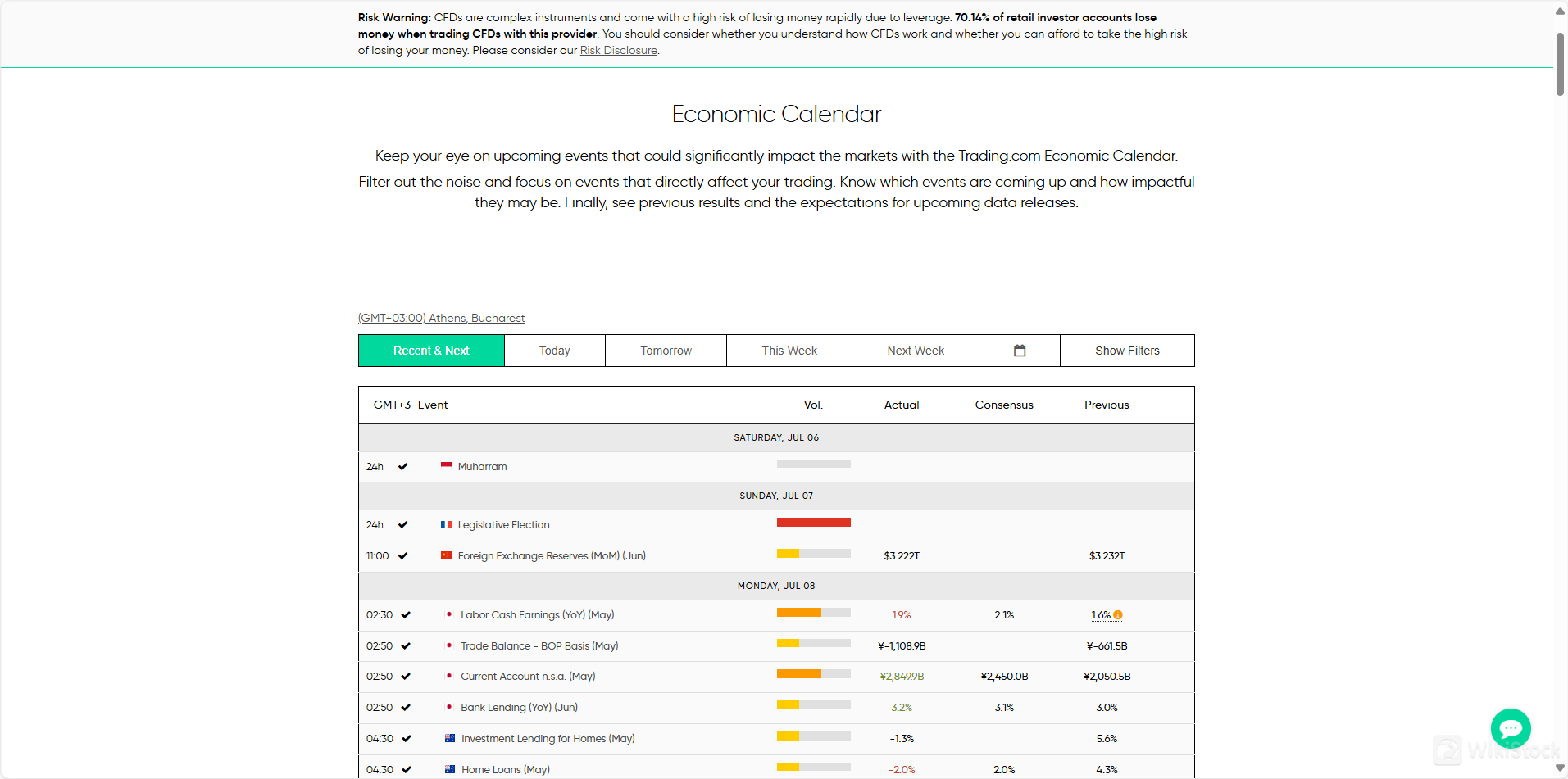

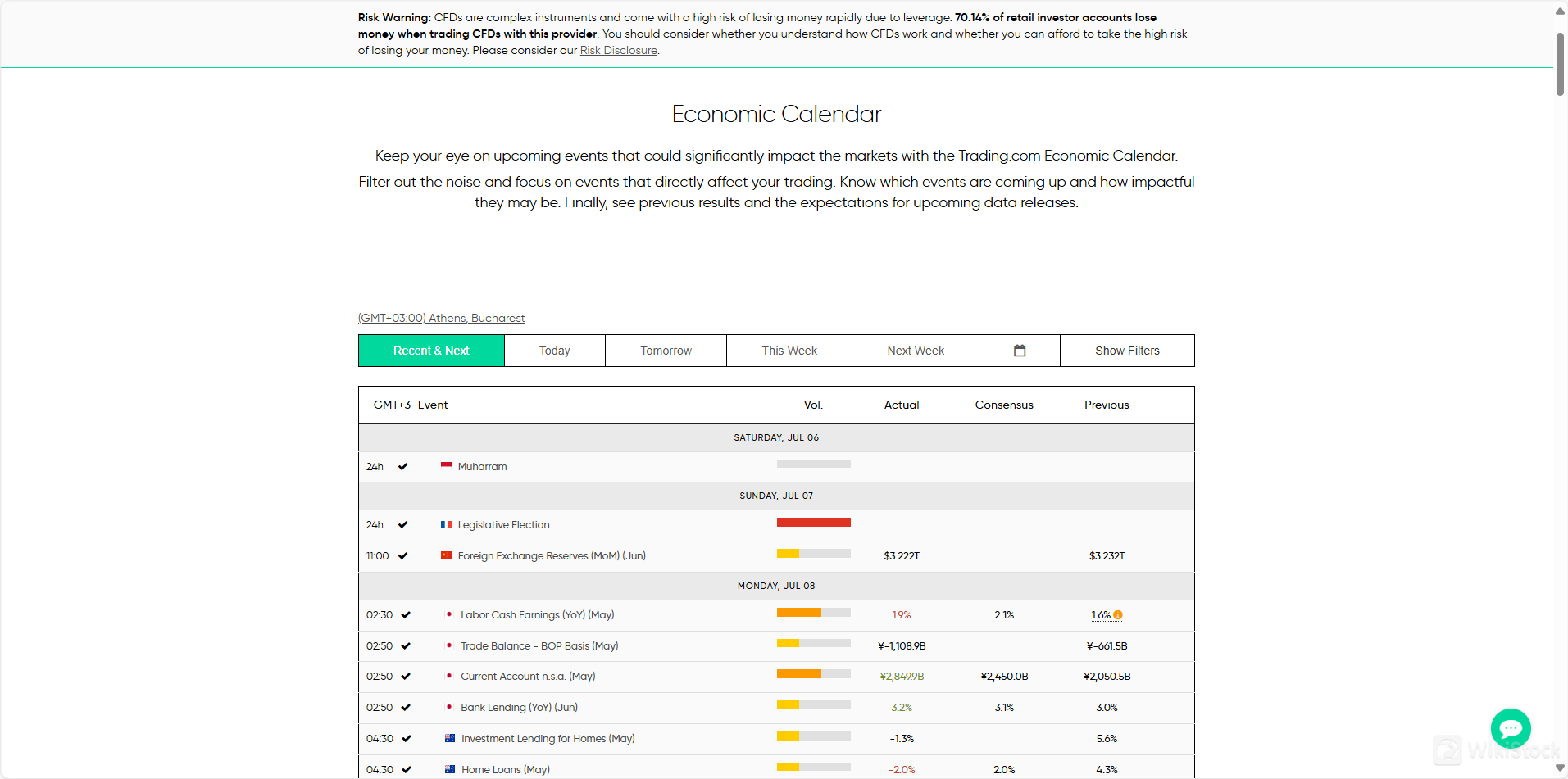

Economic Calendar:

Trading.com provides an Economic Calendar that helps traders keep track of upcoming events that could impact the markets significantly. This tool allows traders to filter out unnecessary noise and focus on events relevant to their trading strategies. The calendar displays previous results and expectations for upcoming data releases, covering key macroeconomic indicators such as the Consumer Confidence Index (CCI), Consumer Price Index (CPI), Gross Domestic Product (GDP), and Non-farm Payroll Employment (NFP), among others.

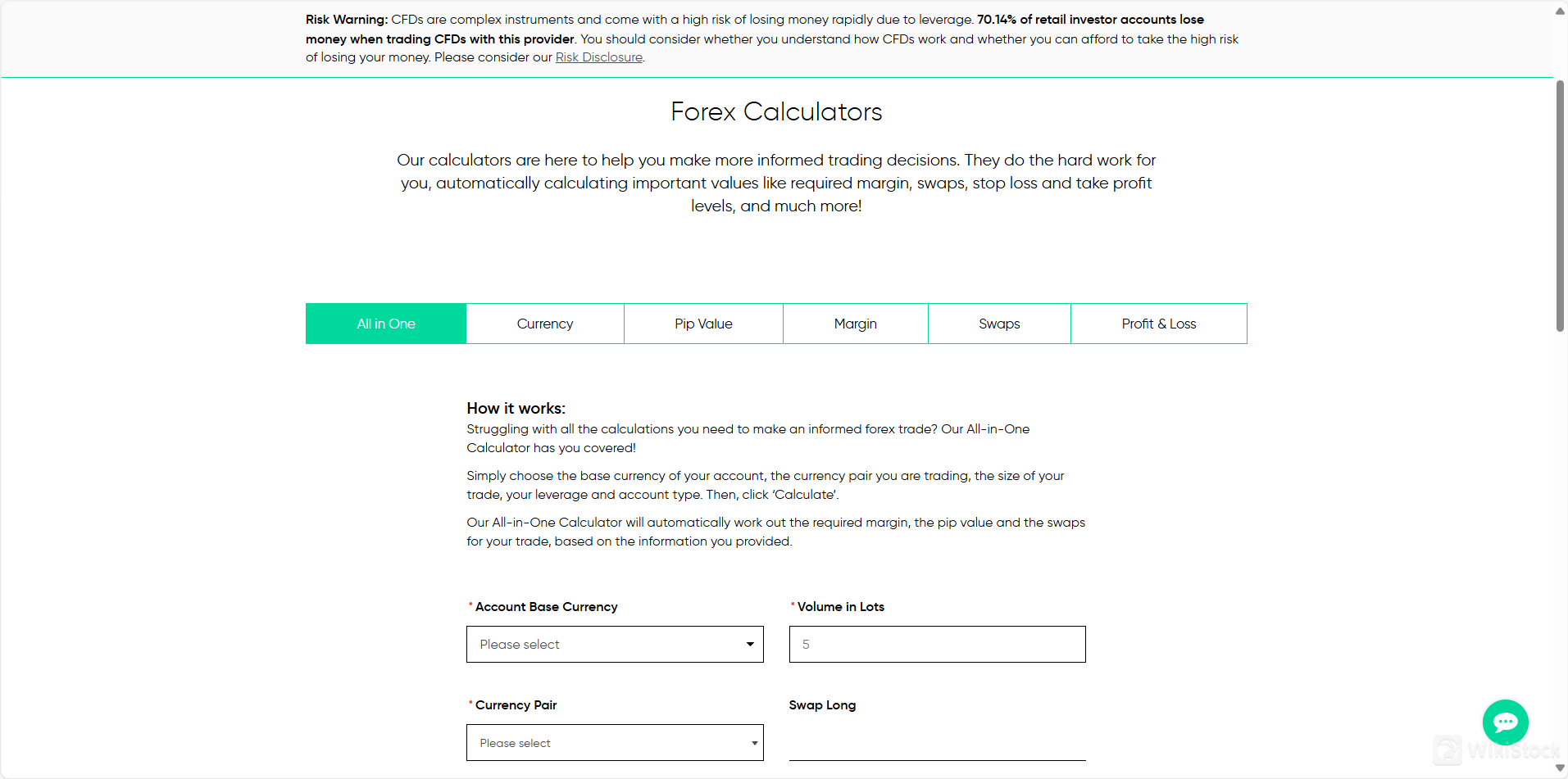

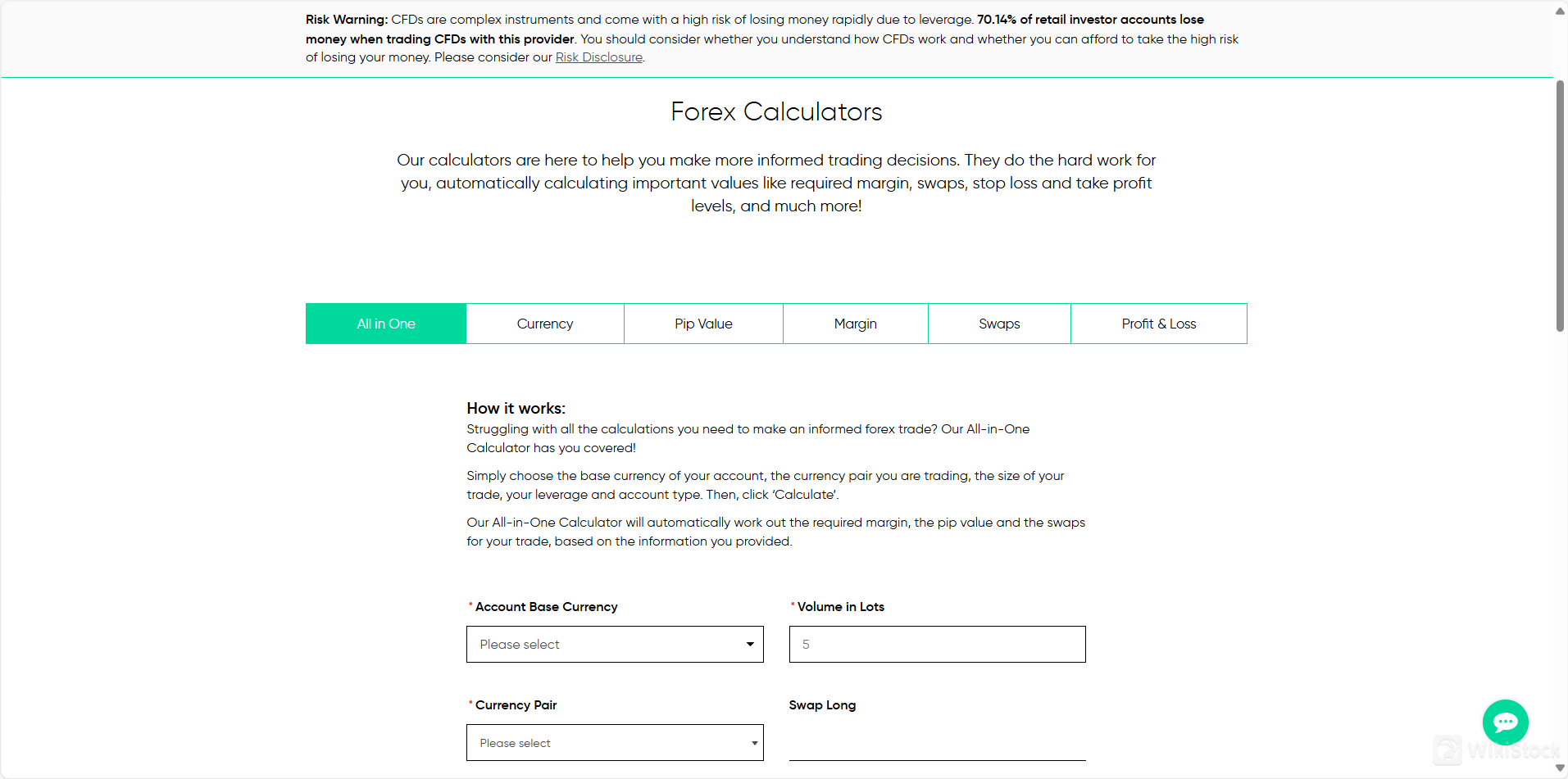

Forex Calculators:

To aid in making informed trading decisions, Trading.com offers a suite of forex calculators. These tools simplify complex calculations related to required margin, swaps, stop loss and take profit levels, pip value, and profit and loss. The All-in-One Calculator is particularly useful, allowing traders to input their base currency, currency pair, trade size, leverage, and account type to automatically compute essential trading values. This ensures traders can manage their positions effectively without manual calculation errors.

Customer Service

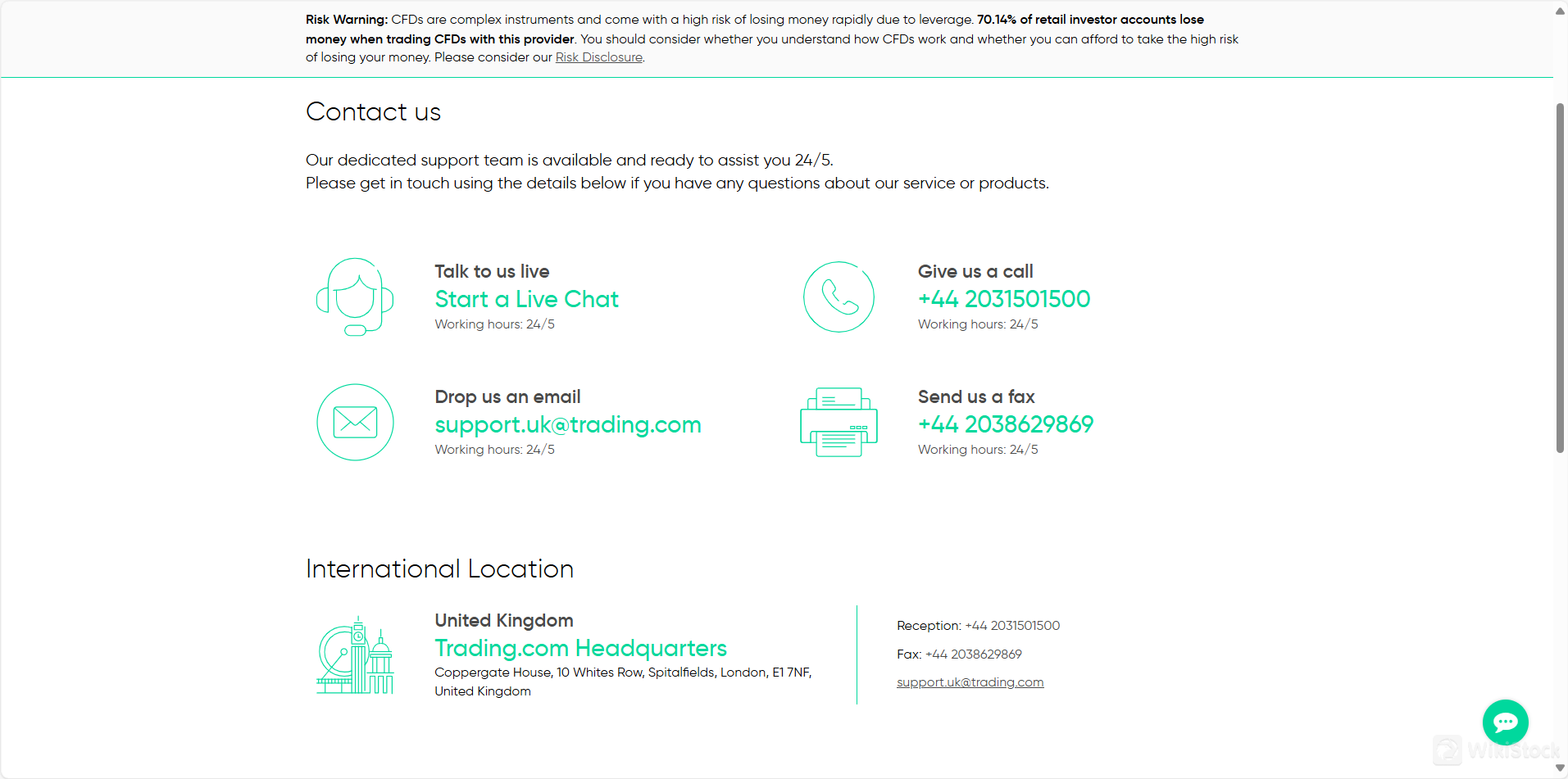

Trading.com offers customer support available 24/5 to assist with any questions about their services or products.

Traders can start a live chat, call at +44 2031501500, email support.uk@trading.com, or send a fax to +44 2038629869.

The support team is dedicated to providing timely and effective assistance, ensuring that traders have the help they need throughout their trading journey.

The headquarters is located at Coppergate House, 10 Whites Row, Spitalfields, London, E1 7NF, United Kingdom.

Conclusion

Trading.com provides a robust and user-friendly trading platform, regulated by the FCA, offering a wide range of markets including Forex, CFDs, Stocks, Indices, and Metals.

With features like zero commission fees, competitive spreads, advanced MT5 platform access across various devices, and customer support, it attracts both novice and experienced traders.

However, potential users should be aware of the high risks associated with CFD trading, as indicated by the significant percentage of retail investor accounts that lose money due to leverage.

FAQs

- What markets can I trade on Trading.com?

You can trade a variety of markets including Forex, CFDs, Stocks, Indices, and Metals on Trading.com.

- Is Trading.com regulated?

Yes, Trading.com is regulated by the United Kingdom Financial Conduct Authority (FCA) under License No. 705428.

- What is the minimum deposit required to start trading on Trading.com?

The minimum deposit required to start trading on Trading.com is $5.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)