Freetrade offers a wide range of financial services, enabling clients to access global markets. However, the platform is hindered by high fees, potentially limiting returns for investors. While it boasts a global presence, there may be concerns regarding conflicts of interest, particularly in terms of product promotion. Despite these challenges, Freetrade prides itself on its skilled expertise, providing clients with valuable insights and advice to navigate market risks effectively.

Hong Kong Securities: This generally refers to financial instruments such as stocks, bonds, and other tradable assets that are bought and sold on the Hong Kong Stock Exchange (HKEX), a major financial market in Asia.

US Stock Trading: This involves the buying and selling of shares (stocks) of companies listed on stock exchanges in the United States, such as the New York Stock Exchange (NYSE) or NASDAQ.

Pilot Programme: A Pilot Programme is a trial or experimental initiative designed to test new regulations, policies, or programs in a controlled environment before potential broader implementation.

Bond Trading: Bond trading involves the buying and selling of debt securities issued by governments, municipalities, or corporations. Bonds typically pay interest and have a specified maturity date when the principal amount is repaid to the bondholder. Bond trading occurs in various markets globally, including in Hong Kong and the United States.

WK Securities Fees Review

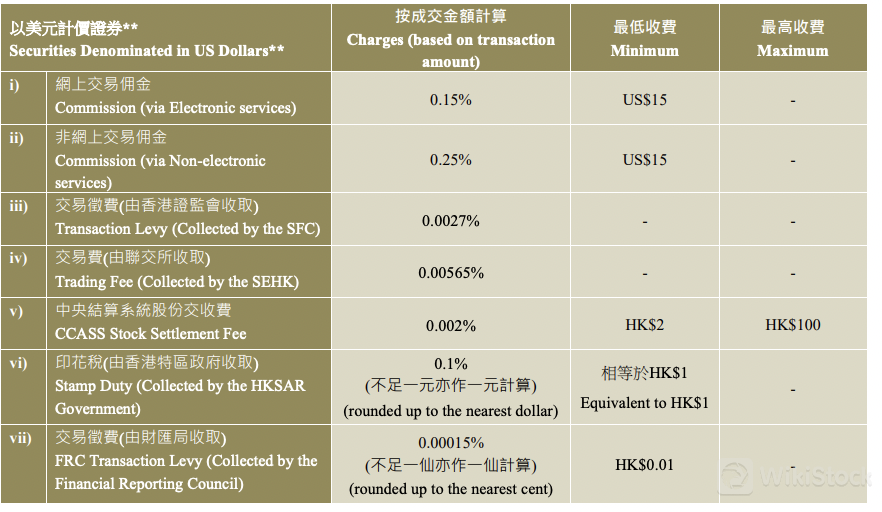

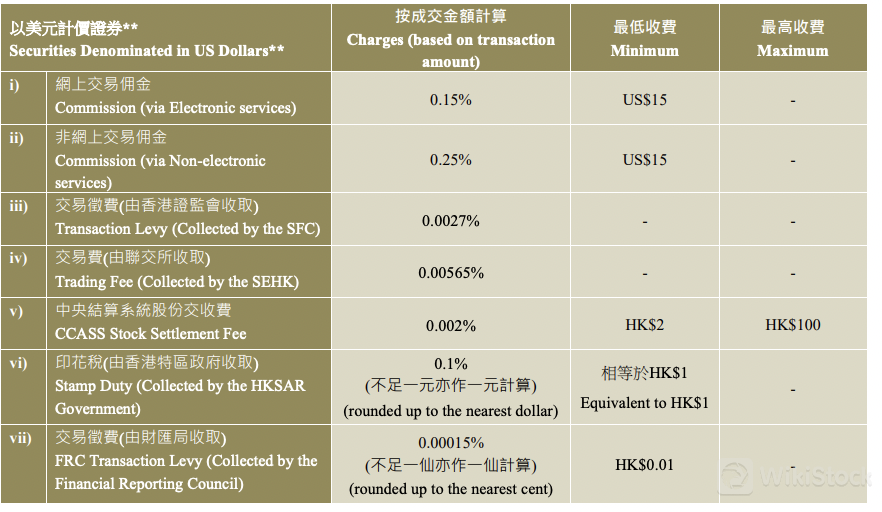

WK Securities charges competitive fees for stock trading services. For transactions conducted via electronic services, commissions are 0.15% of the transaction amount, with a minimum fee of HK$100. Non-electronic service commissions are slightly higher at 0.25% with the same minimum charge. Additionally, a transaction levy of 0.0027% based on the transaction amount is collected by the SFC, while the SEHK collects a trading fee of 0.00565%. CCASS stock settlement fees range from 0.002% to a maximum of HK$100, with a minimum charge of HK$2. Stamp duty charges are 0.1% of the transaction amount, with a minimum fee of HK$1. Finally, the FRC transaction levy is 0.00015%, with a minimum charge of HK$0.01.

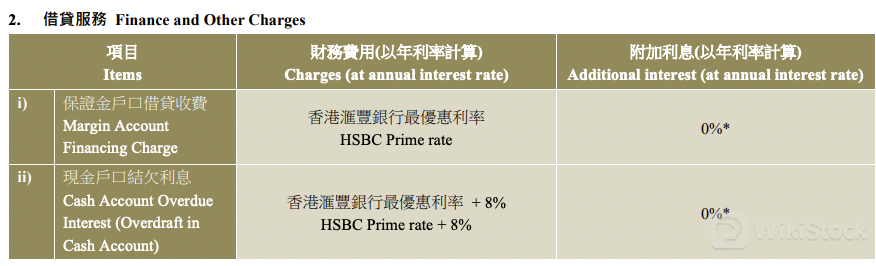

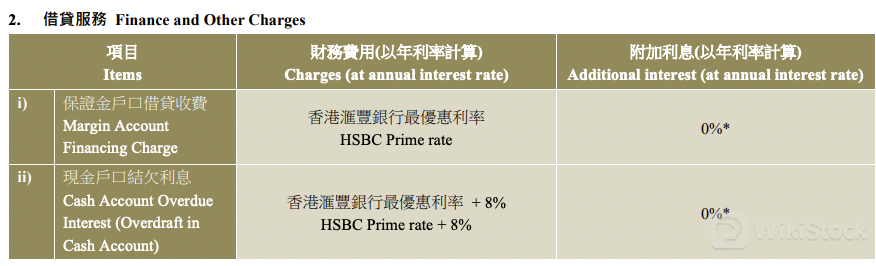

WK Securities offers competitive and transparent fee structures to its clients. Finance and other charges include a margin account financing charge calculated at the HSBC Prime rate, with an additional interest rate of 0% annually. For cash accounts, overdue interest applies in the event of an overdraft. These terms ensure clarity and support clients in managing their financial positions effectively while accessing the services of WK Securities.

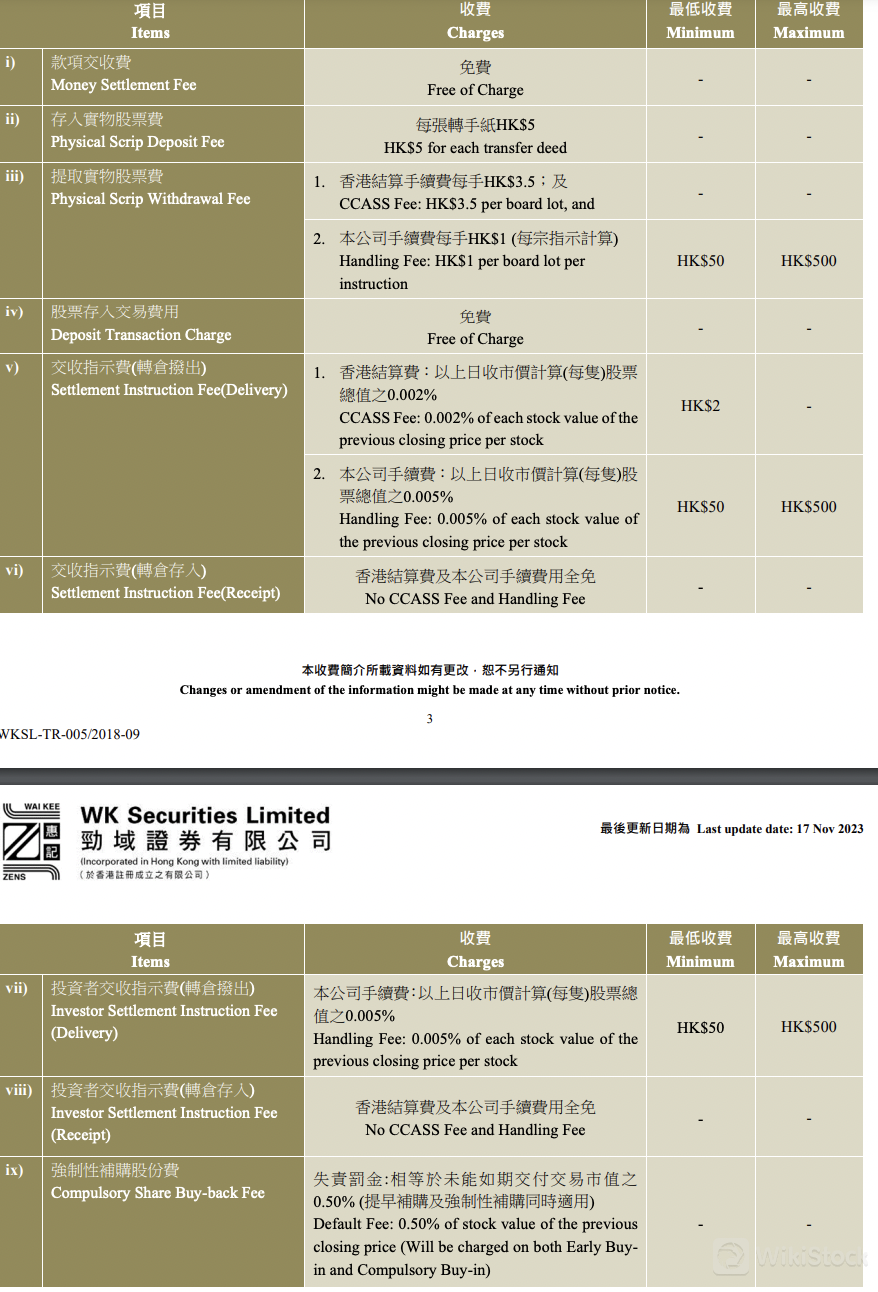

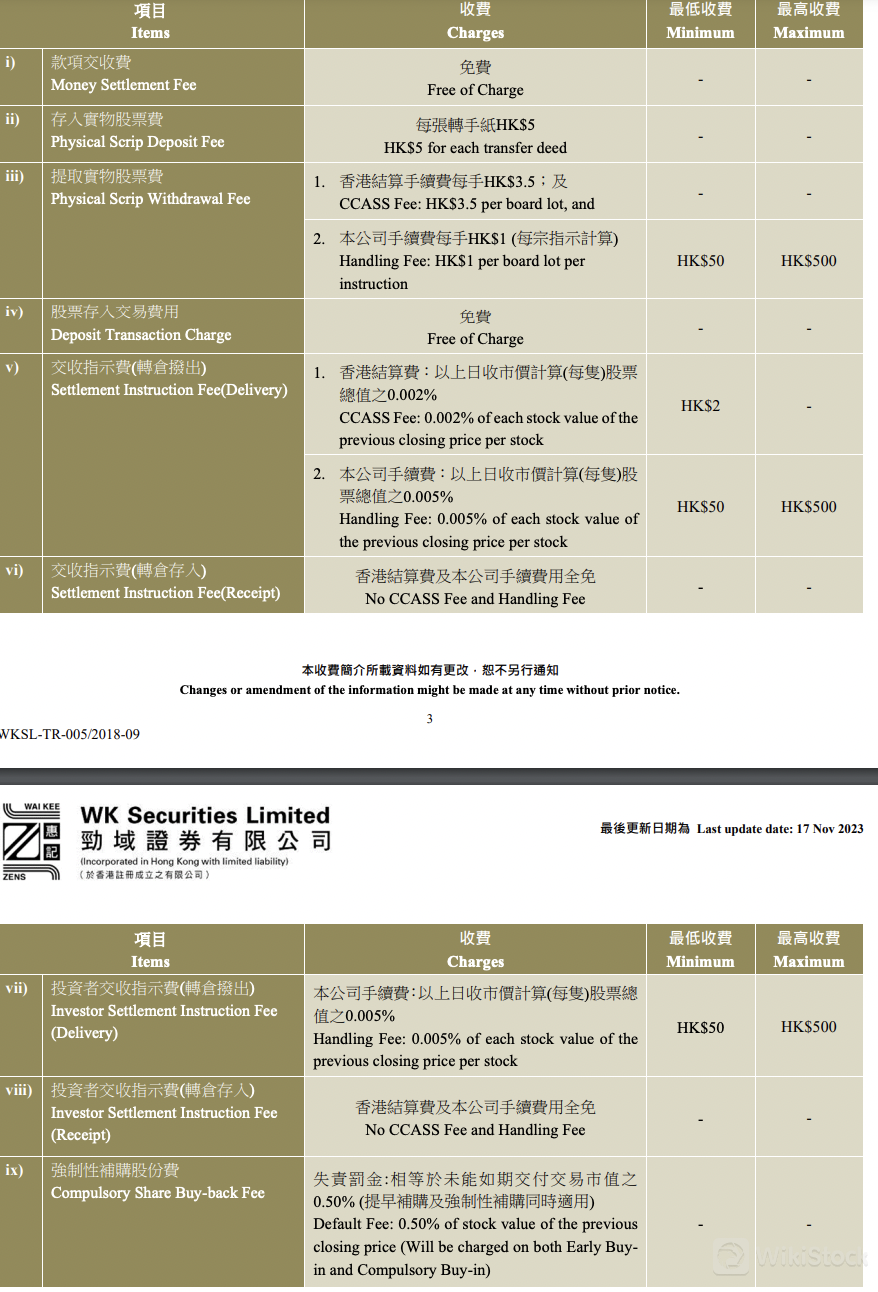

WK Securities offers a structured fee schedule for various services related to securities transactions. Money settlement is provided free of charge, while physical scrip deposits incur a fee of HK$5 per transfer deed. Withdrawals involve a CCASS fee of HK$3.5 per board lot and a handling fee starting at HK$1 per board lot with a maximum of HK$500 per instruction. Deposit transactions do not carry a charge, and settlement instructions for delivery are subject to a fee of HK$2, alongside CCASS and handling fees calculated as percentages of the stock value with minimum and maximum caps of HK$50 and HK$500, respectively. Receipt settlement instructions omit CCASS and handling fees but include an investor settlement instruction fee ranging from HK$50 to HK$500. Compulsory share buy-backs attract a default fee of 0.50% of the stock's previous closing price, applicable to both early and compulsory buy-ins.

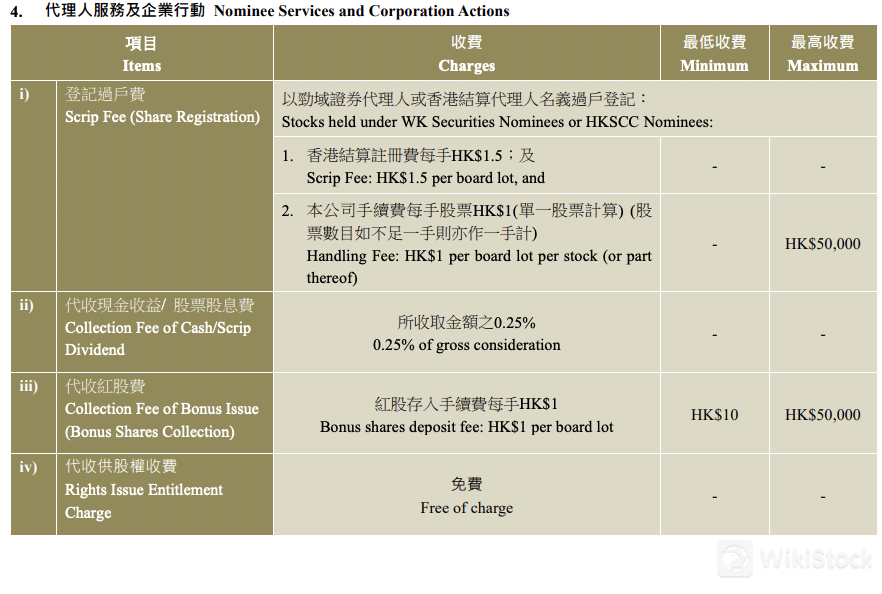

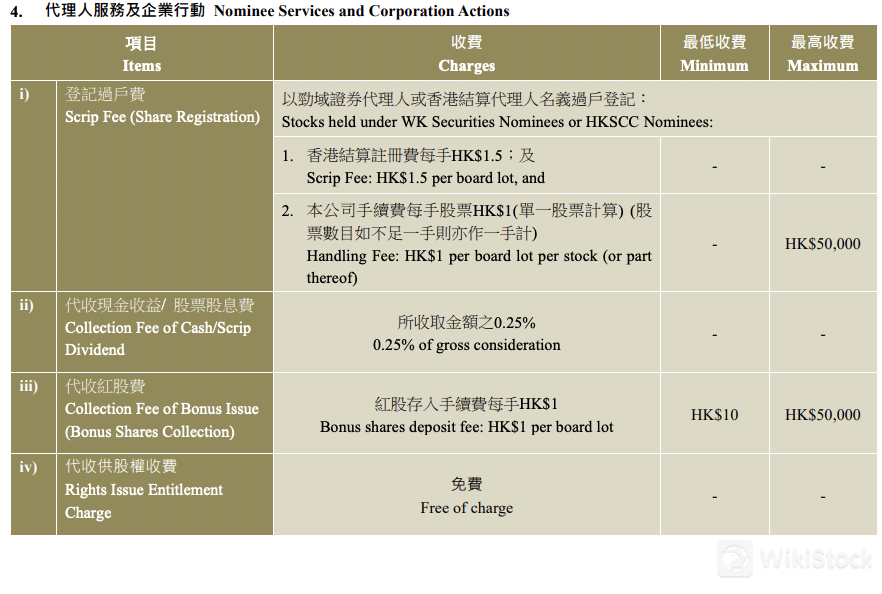

WK Securities outlines a structured fee framework for various services related to securities transactions. Scrip fees for stocks held under WK Securities Nominees or HKSCC Nominees are set at HK$1.5 per board lot, with a handling fee of HK$1 per board lot per stock or part thereof, capped at HK$50,000. The collection fee for cash or scrip is 0.25% of the gross consideration. Dividend collection incurs a fee ranging from HK$10 to HK$50,000, while bonus issues involve a deposit fee of HK$1 per board lot. Rights issue entitlements are provided free of charge, ensuring straightforward management of investor transactions within established fee parameters.

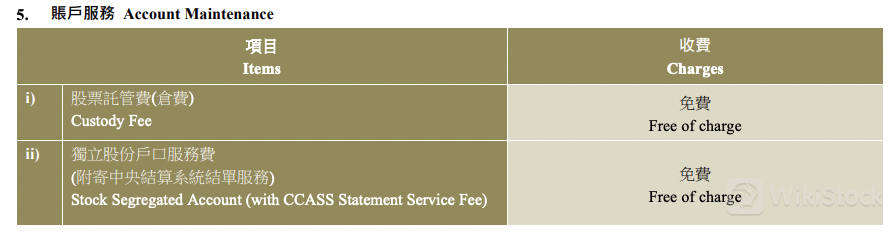

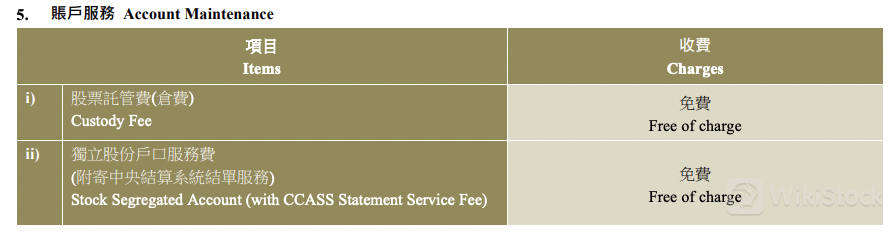

WK Securities offers a transparent fee structure for its custody services, where custody fees are entirely free of charge. For clients opting for a Stock Segregated Account with CCASS Statement Service, there are no additional fees.

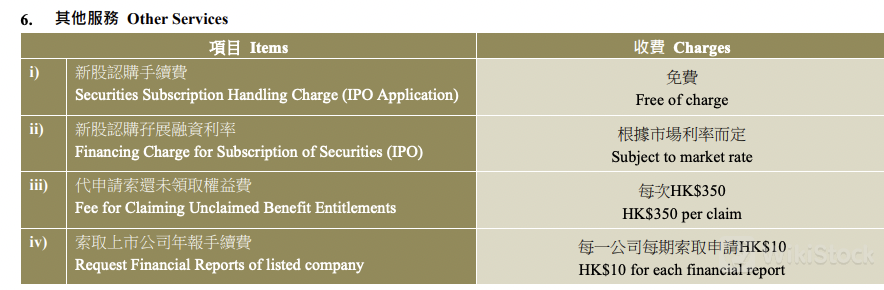

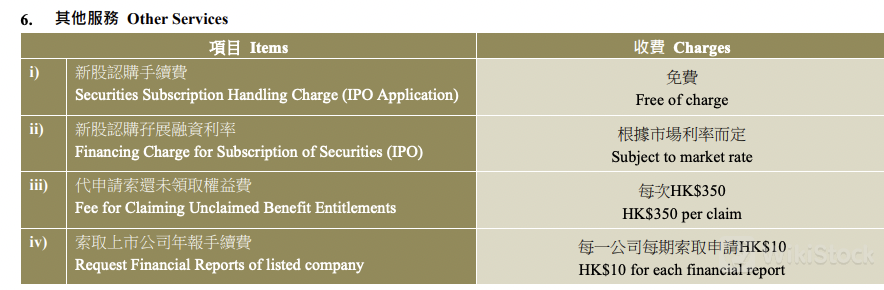

WK Securities outlines a straightforward fee structure for various services related to securities transactions. For Securities Subscription Handling, including IPO applications, no charges apply. The fee for claiming unclaimed benefit entitlements is fixed at HK$350 per claim, providing clarity and ease in accessing owed benefits. Additionally, requesting financial reports of listed companies incurs a nominal fee of HK$10 per report.

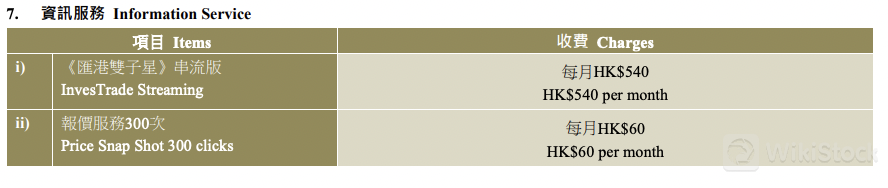

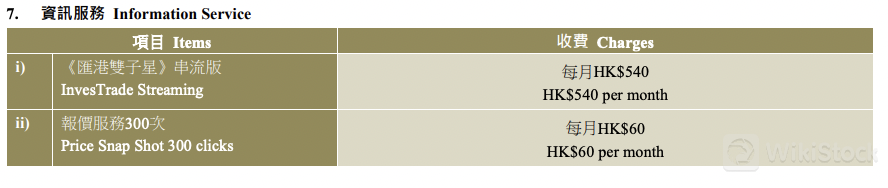

WK Securities offers a structured fee schedule for additional services to enhance trading capabilities. The InvesTrade Streaming service is available at HK$540 per month. For access to Price Snap Shot with 300 clicks per month, a fee of HK$60 applies, allowing users to monitor price movements and market trends.

WK Securities Platform Review

WK Securities's web-based platform offers a user-friendly platform for clients to manage their investments conveniently. With intuitive navigation and robust features, users can access real-time market data, execute trades seamlessly, and monitor their portfolios with ease. The app's interface is designed for efficiency, allowing clients to stay informed and make informed investment decisions from any device with internet access. Despite its strengths, some users may find the app lacking in advanced tools or customization options compared to desktop or mobile counterparts.

Customer Service

WK Securities prides itself on providing comprehensive customer service support to its clients.

Tel: 2272 3880Email:enquiry@wksecuritiesltd.comFax: 3188 2356Address: Unit 1501, 15/F., Tai Tung Building, 8 Fleming Road, Wanchai, Hong Kong.

Conclusion

In conclusion, WK Securities presents a reputable option in the financial services landscape, offering a broad range of investment opportunities and expert advice. With its global presence and skilled expertise, clients can access various markets and receive valuable insights to navigate market risks effectively. However, high fees and potential conflicts of interest may pose challenges for some investors. Despite these drawbacks, WK Securities provides a user-friendly web platform for managing investments, satisfying the needs of both novice and experienced investors.

FAQs

Is WK Securities safe to trade?

WK Securities is generally considered safe to trade with, given its reputation and regulatory oversight. However, like any investment firm, there are inherent risks associated with trading, and it's essential for investors to conduct their own research and assess their risk tolerance before engaging in trading activities.

Is WK Securities a good platform for beginners?

WK Securities can be a suitable platform for beginners due to its user-friendly interface and access to educational resources. However, novice investors should exercise caution and start with small investments while familiarizing themselves with the platform and the basics of investing.

Is WK Securities legit?

Yes, WK Securities is a legitimate financial institution that operates under regulatory oversight. Verifying the legitimacy of any investment firm before engaging in transactions is essential. And WK Securities typically complies with industry regulations and standards.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 2 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong