Score

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China Taiwan

China TaiwanProducts

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 2 securities license(s)

SFCSuspicious Clone

China Hong Kong Securities Trading License

SFCSuspicious Clone

China Hong Kong Fund Management License

Brokerage Information

More

Company Name

Great Treasure International Inc.

Abbreviation

富盈金融

Platform registered country and region

Company address

Company website

https://gtreasuregroup.com/Check whenever you want

WikiStock APP

Previous Detection: 2024-12-24

- The China Hong Kong Securities and Futures Commission of Hongkong regulation (License No.: BIT632) claimed by the brokerage firm is suspected to be a clone firm, please be aware of the risks!

- The China Hong Kong Securities and Futures Commission of Hongkong regulation (License No.: BIT628) claimed by the brokerage firm is suspected to be a clone firm, please be aware of the risks!

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 1341

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

New Zealand

133599.55%Others

60.45%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Trading Fee

$1.95

Platform Service Fee

HK$15

Commission Rate

0.25%

Minimum Deposit

$0

Funding Rate

0%

Deposit Rate

0%

Regulated Countries

1

Products

5

| Galaxy Treasure Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | N/A |

| Trading Fees | Commission: Hong Kong Stock Market 0.05% of transaction amount (Min HK$5)Shanghai-HK / Shenzhen-HK Stock Connect (RMB): 0.25% of transaction amount (Min ¥100)Hong Kong Stock Market Trading Fee: 0.005% |

| Account Related Fees | Hong Kong Stock Market: HK$15 platform feeShanghai-HK / Shenzhen-HK Stock:Handling Fee: 0.00487% of transaction amountManagement Fee: 0.002% of transaction amountPortfolio Fee: Daily stock portfolio value x 0.008% / 365 days |

| Interests on Uninvested Cash | N/A |

| Margin Interest Rates | Cash accounts: Prime Rate (P) + 5% per annum, margin accounts: Prime Rate (P) + 3% per annum |

| Mutual Funds Offered | Yes |

| App/Platform | Mobile trading platform “Zhengjin Securities” |

| Promotion | N/A |

Galaxy Treasure Securities Information

Galaxy Treasure Securities, based in Hong Kong, offers a range of tradable securities including stocks, ETFs, and Mutual Funds. They provide low commission fees of 0.05% on Hong Kong stock transactions with a minimum charge of HK$5. Located at Room 1213, 12th Floor, Hong Kong Commercial Centre, 188 Connaught Road West, Hong Kong, they are regulated by the Securities and Futures Commission (SFC), ensuring compliance and investor protection.

Their services include a mobile trading platform for convenient access and research reports to support investment decisions.

Pros and Cons

Galaxy Treasure Securities offers several notable advantages, starting with its low commission fees of 0.05% per transaction with a minimum of HK$5 on Hong Kong stocks. This competitive pricing structure appeals to investors seeking cost-effective trading options. Moreover, the firm provides a wide range of tradable securities including stocks, ETFs, and Mutual Funds. The availability of a mobile trading platform enhances accessibility and convenience for clients, allowing them to manage their investments on the go. Galaxy Treasure Securities is also regulated by the Securities and Futures Commission (SFC), which provides a level of oversight and investor protection.

However, there are certain drawbacks to consider. While the firm offers a variety of securities, it lacks international tradable options compared to larger brokerage firms, potentially limiting portfolio diversification for global-minded investors. Additionally, the official website being available only in Chinese could pose a barrier for non-Chinese-speaking investors who prefer conducting transactions and accessing information in English or other languages.

| Pros | Cons |

| Low commission fees on HongKong stock : 0.05% on transactions, Min HK$5 | Lack international tradable securities |

| Various tradable securities: Stocks, ETFs, Mutual Funds | Official website in Chinese only |

| Mobile platform available for trading | |

| Provides research reports | |

| Regulated by SFC |

Is Galaxy Treasure Securities Safe?

Regulations:

Funds Safety:

Safety Measures:

Commissions and Fees

Margin Interest Rate

Is it safe to trade on Galaxy Treasure Securities?

Galaxy Treasure Securities is regulated by the Securities and Futures Commission (SFC), ensuring compliance with stringent financial standards to safeguard investor interests.

Is Galaxy Treasure Securities a good platform for beginners?

Yes, Galaxy Treasure Securities offers educational resources and a user-friendly interface, making it suitable for beginners to start trading with guidance.

Is Galaxy Treasure Securities legit?

Yes, Galaxy Treasure Securities is a legitimate brokerage firm licensed by the Securities and Futures Commission (SFC) in Hong Kong.

Is Galaxy Treasure Securities good for investing or retirement?

Galaxy Treasure Securities provides a range of investment options including stocks, ETFs, and Mutual Funds, making it suitable for both short-term investing and long-term retirement planning.

Galaxy Treasure Securities holds two securities licenses regulated by the Securities and Futures Commission (SFC). These licenses include a Securities Trading License with License No. BIT628 and a Fund Management License with License No. BIT632. These licenses signify that Galaxy Treasure Securities is authorized by the SFC to engage in securities trading and fund management activities within the regulatory framework stipulated by the Commission.

Galaxy Treasure Securities does not explicitly provide information regarding account balance insurance coverage on their platform.

Galaxy Treasure Securities emphasizes security through several measures. They are regulated by the Securities and Futures Commission (SFC), ensuring compliance with financial regulations and investor protection standards. Their platform likely employs encryption protocols to safeguard user data and transactions. Additionally, robust authentication methods are in place to secure account access.

What are Securities to Trade with Galaxy Treasure Securities?

Galaxy Treasure Securities offers a wide selection of tradable securities.

Stocks represent ownership in publicly traded companies, allowing investors to participate in corporate growth and dividends. They are traded on major stock exchanges and provide opportunities for capital appreciation based on company performance and market dynamics.

ETFs (Exchange-Traded Funds) are investment funds that trade on exchanges similar to individual stocks. They typically track an index, commodity, or sector and offer investors diversification benefits with lower costs compared to traditional mutual funds. ETFs are favored for their transparency, liquidity, and ability to provide exposure to specific market segments or investment themes.

Additionally, Galaxy Treasure Securities facilitates trading in Mutual Funds, which pool investments from multiple individuals to purchase a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds offer investors access to diversified portfolios without requiring direct management.

Galaxy Treasure Securities Fees Review

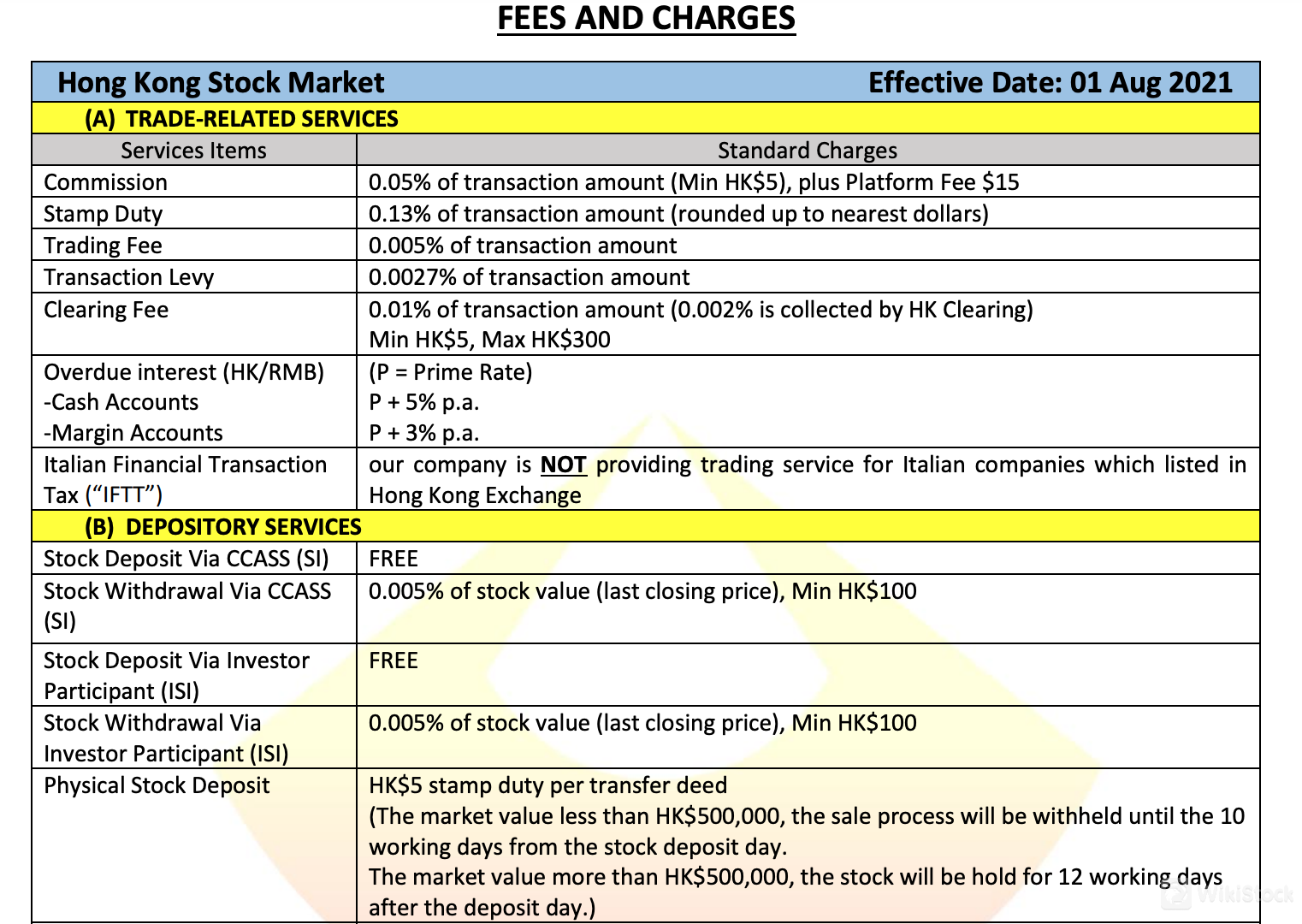

A. Trade-Related Services - Hong Kong Stock Market

Commission:

Galaxy Treasure Securities charges a commission of 0.05% on the transaction amount, with a minimum of HK$5, plus a platform fee of HK$15. These fees are applicable to trades executed on the Hong Kong Stock Market, providing clarity on costs associated with buying and selling securities.

Stamp Duty:

A stamp duty of 0.13% is applied to the transaction amount, rounded up to the nearest dollar. This statutory fee is mandatory for both buyers and sellers in Hong Kong equity transactions.

Trading Fee:

For trading activities, Galaxy Treasure Securities imposes a fee of 0.005% on the transaction amount. This fee contributes to the operational expenses incurred during the execution of trades.

Transaction Levy:

A transaction levy of 0.0027% is levied on the transaction amount. This levy supports the regulatory functions of the Securities and Futures Commission (SFC) in Hong Kong.

Clearing Fee:

The clearing fee amounts to 0.01% of the transaction amount, with 0.002% collected by HK Clearing. The fee structure includes a minimum charge of HK$5 and a maximum of HK$300, ensuring efficient settlement of trades.

Overdue Interest:

For cash accounts, overdue interest is calculated at Prime Rate (P) + 5% per annum. Margin accounts incur interest at Prime Rate (P) + 3% per annum, reflecting the cost of holding outstanding balances.

Italian Financial Transaction Tax (IFTT):

Galaxy Treasure Securities does not provide trading services for Italian companies listed on the Hong Kong Exchange, exempting clients from potential IFTT liabilities.

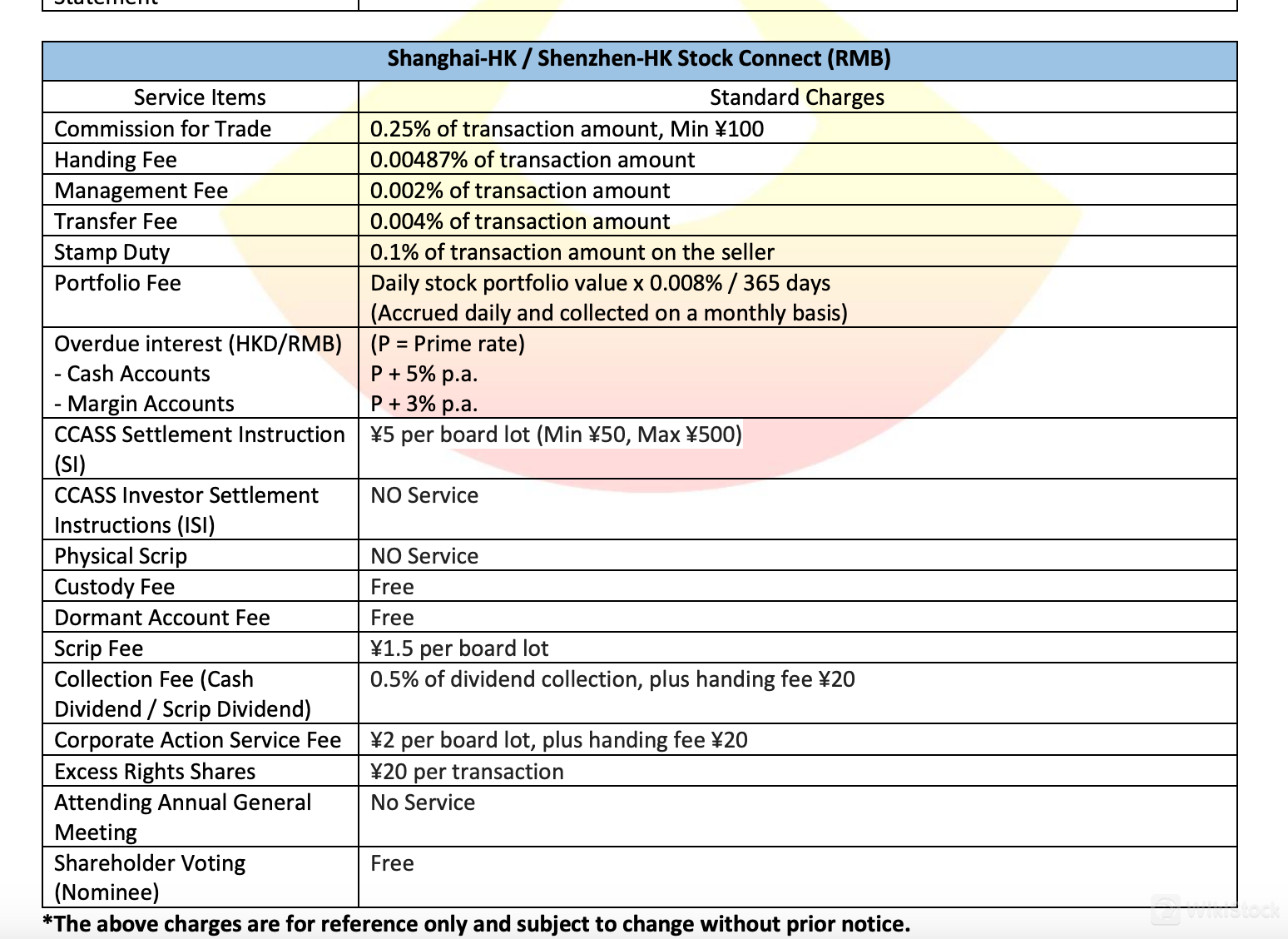

B. Shanghai-HK / Shenzhen-HK Stock Connect (RMB)

Commission for Trade:

In the Shanghai-HK / Shenzhen-HK Stock Connect, Galaxy Treasure Securities charges a commission of 0.25% on the transaction amount, with a minimum of ¥100. This fee structure applies to trades involving Mainland Chinese stocks through the Connect, ensuring transparency in trading costs.

Handling Fee:

A handling fee of 0.00487% is applied to the transaction amount, covering operational costs related to executing trades.

Management Fee:

Galaxy Treasure Securities imposes a management fee of 0.002% on the transaction amount for trades executed through the Shanghai-HK / Shenzhen-HK Stock Connect, contributing to the administrative expenses incurred.

Transfer Fee:

A transfer fee of 0.004% is levied on the transaction amount. This fee ensures proper handling of securities transfers between Hong Kong and Mainland China.

Stamp Duty:

On the seller's side, a stamp duty of 0.1% is applied to the transaction amount for securities traded via the Stock Connect.

Portfolio Fee:

A portfolio fee of daily stock portfolio value x 0.008% / 365 days is accrued daily and collected on a monthly basis, contributing to the management of clients' portfolios.

Overdue Interest:

For cash accounts, overdue interest is calculated at Prime Rate (P) + 5% per annum. Margin accounts incur interest at Prime Rate (P) + 3% per annum, reflecting the cost of holding outstanding balances.

CCASS Settlement Instruction (SI):

For settlement instructions via CCASS, Galaxy Treasure Securities charges ¥5 per board lot, with a minimum of ¥50 and a maximum of ¥500, ensuring efficient settlement of transactions.

CCASS Investor Settlement Instructions (ISI):

There is no service charge for investor settlement instructions via CCASS for trades executed through the Shanghai-HK / Shenzhen-HK Stock Connect.

| Fee Type | Hong Kong Stock Market | Shanghai-HK / Shenzhen-HK Stock Connect (RMB) |

| Commission | 0.05% of transaction amount (Min HK$5) + HK$15 platform fee | 0.25% of transaction amount (Min ¥100) |

| Stamp Duty | 0.13% of transaction amount | 0.1% of transaction amount (on seller) |

| Trading Fee | 0.005% of transaction amount | - |

| Transaction Levy | 0.0027% of transaction amount | - |

| Clearing Fee | 0.01% of transaction amount (Min HK$5, Max HK$300) | - |

| Handling Fee | - | 0.00487% of transaction amount |

| Management Fee | - | 0.002% of transaction amount |

| Portfolio Fee | - | Daily stock portfolio value x 0.008% / 365 days |

| Overdue Interest | Cash Accounts: Prime Rate (P) + 5% p.a. <br> Margin Accounts: Prime Rate (P) + 3% p.a. | Cash Accounts: Prime Rate (P) + 5% p.a. Margin Accounts: Prime Rate (P) + 3% p.a. |

| CCASS Settlement Instruction (SI) | - | ¥5 per board lot (Min ¥50, Max ¥500) |

| CCASS Investor Settlement Instructions (ISI) | - | No service |

Galaxy Treasure Securities charges margin interest rates based on the Prime Rate (P). For cash accounts, the rate is Prime Rate (P) + 5% per annum, while margin accounts incur Prime Rate (P) + 3% per annum. These rates reflect the cost of borrowing funds to leverage investments and vary with prevailing market conditions.

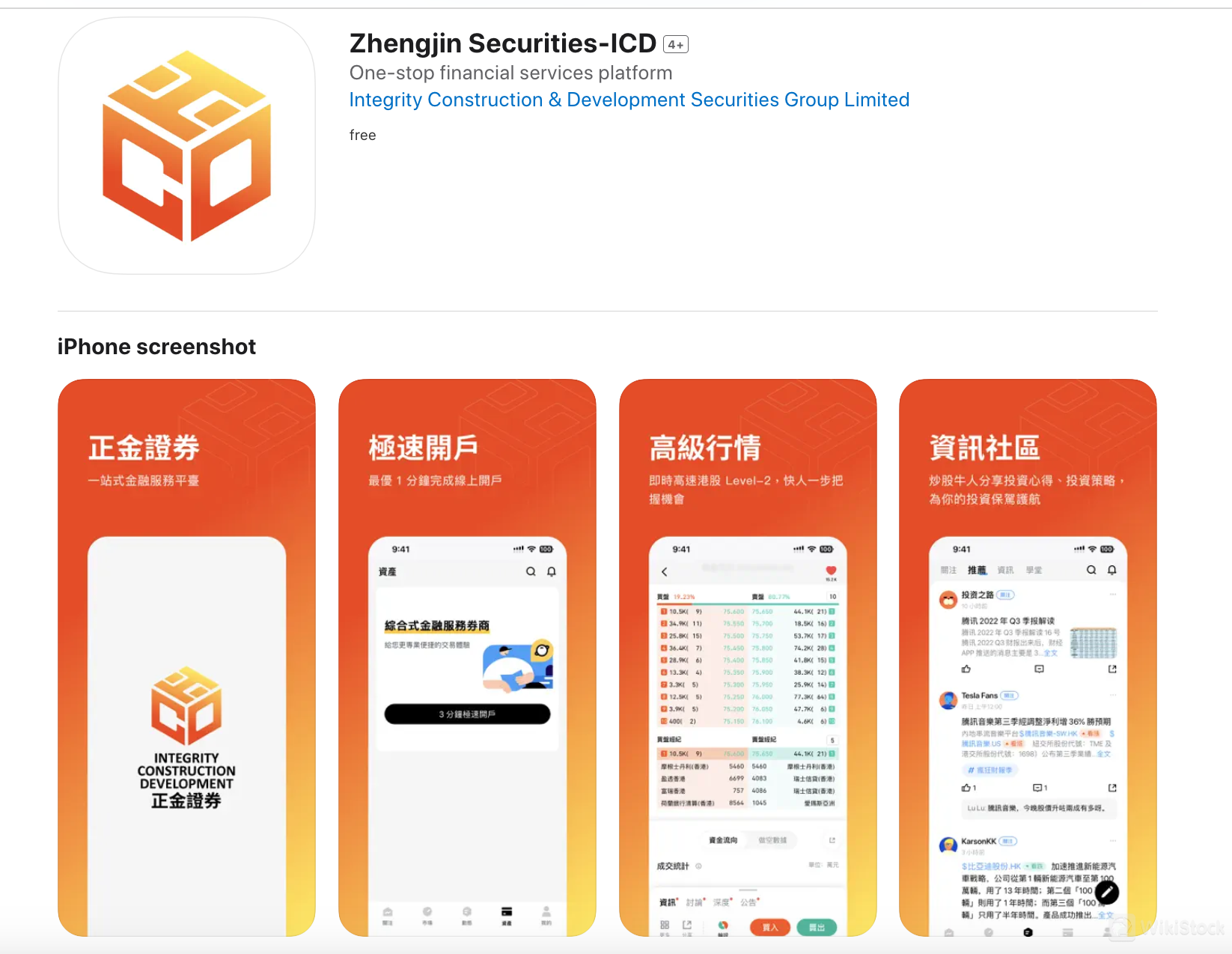

Galaxy Treasure Securities App Review

The app offered by Galaxy Treasure Securities, called Zhengjin Securities, functions as a competitive financial services platform.

Key features include extremely fast account opening, advanced real-time Level-2 quotes for Hong Kong stocks, and an information community where stock trading experts share investment strategies. The app also boasts dedicated trading channels for quick order execution and competitive transaction prices. To download the app, users can search for “Zhengjin Securities” on their respective app stores (e.g., Apple App Store or Google Play Store) and follow the installation instructions provided.

This platform provides efficient and informative tools for investors interested in Hong Kong stock markets and enhancing trading experiences.

Research & Education

Galaxy Treasure Securities offers a robust array of educational resources and research reports covering various topics such as market insights, investment strategies, and regulatory updates.

Their platform includes reports from reputable sources like the Asia Cancer Research Foundation, China Consumer Report, and in-depth studies on emerging trends like NFTs and Special Purpose Acquisition Companies (SPACs). These resources inform investors about critical developments affecting their investments.

In comparison to popular brokers, Galaxy Treasure Securities appears competitive by providing specialized research across various sectors and asset classes, enhancing their clients' ability to make informed investment decisions.

Customer Service

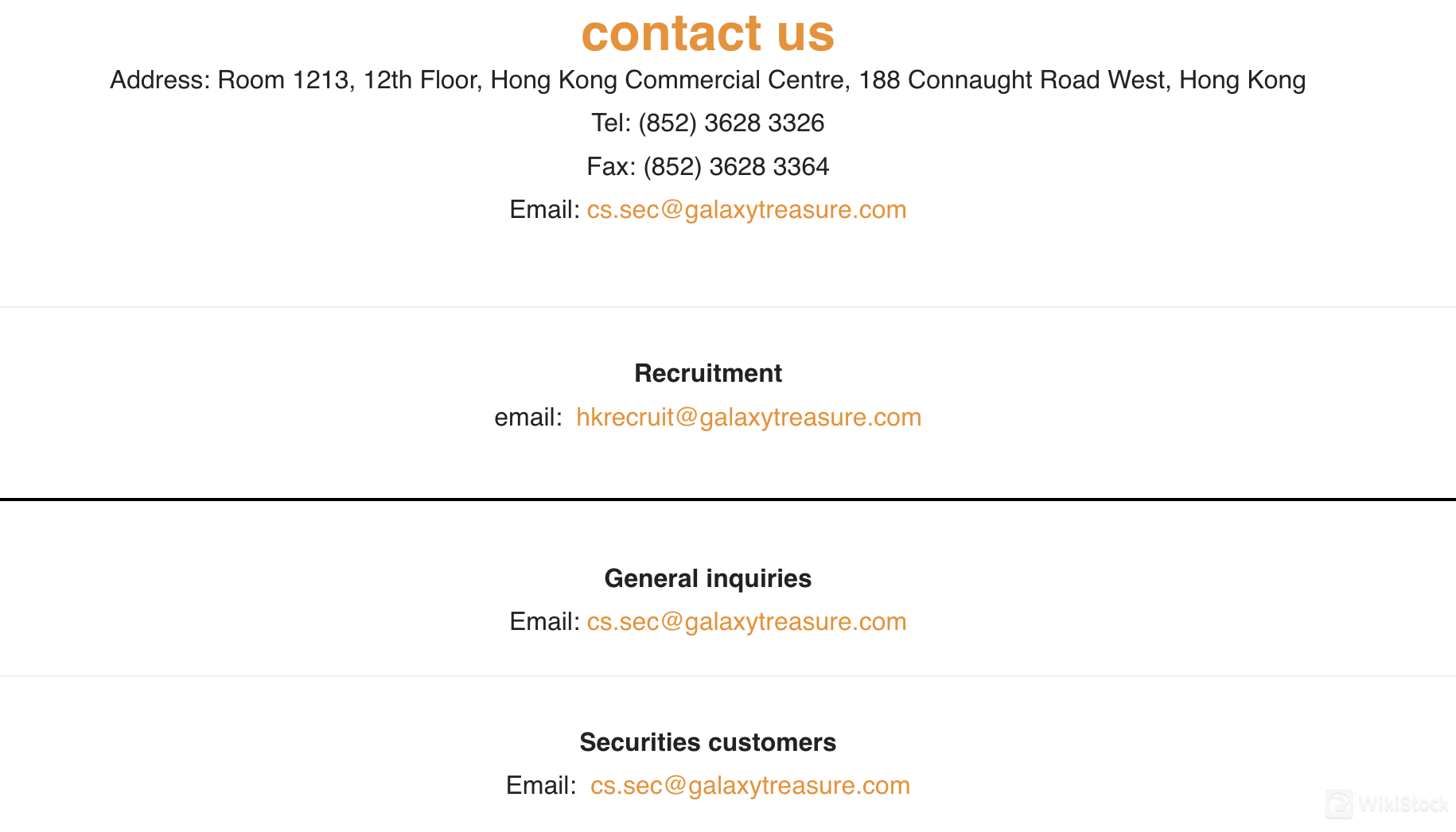

Galaxy Treasure Securities provides customer support through various channels.

For general inquiries and securities-related issues, customers can reach them via email at cs.sec@galaxytreasure.com. Their office is located at Room 1213, 12th Floor, Hong Kong Commercial Centre, 188 Connaught Road West, Hong Kong. They can also be contacted by phone at (852) 3628 3326 during their service hours.

For recruitment inquiries, individuals can email hkrecruit@galaxytreasure.com.

Conclusion

Galaxy Treasure Securities presents a compelling option for Hong Kong-based investors seeking a straightforward and competitively priced platform for trading stocks, ETFs, and Mutual Funds. With a low commission fee structure and a mobile trading platform for convenience, it serves well to active traders and investors looking to manage their portfolios efficiently.

However, potential users should note the platform's limitations in international securities and the predominance of Chinese-language resources on their website, which impact accessibility for non-Chinese-speaking investors.

FAQs

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

1-2 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

OPSL

Score

偉祿亞太證券

Score

鴻昇金融集團

Score

东兴证券

Score

IISL

Score

Elstone

Score

Hooray Securities

Score

SBI China Capital

Score

Sorrento

Score

Sanston

Score