スコア

China Taiping

https://www.tpfh.cntaiping.com/en

会社公式HP

レーティング

会社鑑定

影響力

C

影響力指数 NO.1

China

China取引品種

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

8.10%FX会社を上回る

取引商ライセンス

2件ライセンスを保有

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Fund Management License

グローバルシーツ

![]() 1のFX会社席がある

1のFX会社席がある

China Hong Kong HKEX

シート番号 01217

会社情報

More

会社名

Taiping Financial Holdings Company Limited

社名略語

China Taiping

会社登録国・地域

法人電話番号

会社所在地

会社のウェブサイト

https://www.tpfh.cntaiping.com/enいつでも確認することが可能です

WikiStock APP

経営分析

China Taiping決算カレンダー

Currency: HKD

サイクル

FY2023 Annual Report

2019/08/28

Revenue(YoY)

148.70B

+14.25%

EPS(YoY)

1.50

+92.16%

China Taiping決算予測

Currency: HKD

- 日付サイクル営業利益・予想値

- 2019/08/282019/H1147.624B/137.673B

インターネット遺伝子

遺伝子インデックス

アプリのスコア

アプリのダウンロード数

- サイクル

- ダウンロード数

- 2024-05

- 2174

集計ルール:データは現時点におけるアプリの過去1年間のダウンロード数を示します。

アプリの地区の人気度

- 国/地域ダウンロード数比率

Oman

134399.56%Macao

68382.79%China

718.52%

集計ルール:データはアプリの現時点における過去1年間のアプリのダウンロード数と地域でのシェアを示します。

会社特徴

Commission Rate

0.15%

Funding Rate

2.5%

New Stock Trading

Yes

Margin Trading

YES

FX会社紹介

会社案内

| China Taiping Financial Holdings |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees | Varies by service (e.g., 0.25% for non-internet trading, 0.15% for internet trading) |

| Account Fees | Various fees depending on the services (e.g., account maintenance, trading fees, etc.) |

| Margin Interest Rates | Prime rate + 2.5% for margin accounts |

| Mutual Funds Offered | Yes |

| App/Platform | Megahub Mobile APP, Trading Program for Mobile (Chinese Only), Desktop Trading Program (Chinese Only) |

| Promotions | Not available yet |

What is China Taiping?

China Taiping Financial Holdings (TPFH) is a well-established and regulated financial group providing various financial services, including services in corporate finance, securities brokerage, asset management, trust services, and loans. Additionally, TPFH provides many trading products, covering equities, bonds, ETFs, mutual funds, and structured products. Clients benefit from comprehensive research and educational resources, as well as strong customer support and robust safety measures to protect their investments and personal information.

Pros and Cons of China Taiping

China Taiping Financial Holdings offers a range of financial services regulated by the HKEX, ensuring a robust and secure trading environment. The company provides diverse investment products, comprehensive research, and educational resources, supported by advanced security measures. However, some services and platforms are available only in Chinese, which may limit accessibility for non-Chinese speaking clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Is China Taiping safe?

Regulation

China Taiping Financial Holdings is regulated by the Hong Kong Stock Exchange (HKEX). This regulation ensures that the company adheres to stringent financial and operational standards set by HKEX, promoting transparency, fair trading practices, and the protection of investors' interests. Being regulated by a reputable body like HKEX provides a level of assurance that China Taiping operates within a robust regulatory framework designed to maintain market integrity and investor confidence.

Funds Safety

China Taiping employs stringent measures to safeguard client assets, including segregation of client funds from company funds to prevent misuse. Additionally, China Taiping provides insurance coverage for client accounts to protect against unforeseen circumstances. The specific insurance amount and coverage details are designed to offer substantial protection to clients, ensuring that their investments are secure even in adverse conditions. This insurance coverage underscores the companys commitment to safeguarding client assets comprehensively.

Safety Measures

China Taiping implements advanced encryption technologies to ensure the security of clients' funds and personal information. These encryption methods protect data transmission and storage, making it difficult for unauthorized parties to access sensitive information. The company also employs robust account security measures, such as multi-factor authentication and regular security audits, to prevent unauthorized access and potential data breaches. These measures are crucial in protecting client information and maintaining the overall security of the trading environment. By combining cutting-edge technology with stringent security protocols, China Taiping demonstrates a strong commitment to maintaining the highest standards of safety for its clients.

China Taiping Services

China Taiping Financial Holdings (TPFH) provides a comprehensive range of financial services through its subsidiaries, primarily focusing on:

Corporate Finance: Taiping Capital Limited provides comprehensive advisory services, assisting companies in mergers and acquisitions, corporate restructuring, and financial consulting. They help clients navigate complex transactions, ensuring strategic growth and optimization of financial structures.

Securities Brokerage: Taiping Securities (HK) Co. Ltd. offers a wide range of services, including securities trading, investment services, and market analysis. They cater to both retail and institutional clients, providing real-time trading platforms, research reports, and investment advice to maximize portfolio performance.

Asset Management: Taiping Asset Management (HK) Co. Ltd. delivers investment management and cross-border investment solutions. They design customized investment strategies for corporate and institutional clients, focusing on long-term growth, risk management, and business development.

Trust Services: Taiping Trustees Limited offers specialized trust services, managing equity, debt instruments, and structured finance products. They provide tailored trust solutions to safeguard assets, optimize tax benefits, and facilitate wealth transfer and estate planning for high-net-worth individuals and families.

Loans: China Insurance Group Finance Company Limited (CIG Finance), a wholly-owned subsidiary of Taiping Financial Holdings, holds a money lenders license (License number: 1761/2023) in Hong Kong. CIG Finance offers a range of tailor-made and flexible loan services for larger-scale financing needs. Their application process is straightforward, involving preliminary inquiries, document submission, formalities, contract signing, and withdrawals. Clients need to provide identity documents, proof of residence, property deeds, and income proof. Contracts may need to be signed with a law firm depending on the loan category.

China Taiping is a well-established financial group with a strong presence in the Hong Kong and Mainland China markets, offering diverse financial products and services to meet the needs of their clients.

What are securities to trade with China Taiping?

China Taiping Financial Holdings offers a broad range of trading products through its subsidiary Taiping Securities (HK) Co. Ltd. These products include:

Equities: Shares of companies listed on major stock exchanges, including those in Hong Kong, Mainland China, and international markets.

Bonds: Government and corporate bonds offering fixed-income investment opportunities.

Futures and Options: Derivative instruments for hedging and speculative purposes.

Exchange-Traded Funds (ETFs): Funds that track the performance of specific indices or sectors.

Mutual Funds: Pooled investment vehicles managed by professional asset managers.

Structured Products: Custom financial instruments that are designed to meet specific investment goals.

Securities Trading Account: Allows trading in equities, bonds, ETFs, and other securities. Suitable for both retail and institutional investors.

Margin Account: Provides leverage for trading, enabling clients to borrow funds to increase their market exposure.

Investment Fund Account: Facilitates investments in mutual funds and other pooled investment vehicles.

Corporate Account: Designed for businesses, offering comprehensive financial services including investment management and corporate finance advisory.

Java: Essential for running certain trading applications.

Adobe Reader: For viewing and managing PDF documents.

WinRAR: A utility for file compression and extraction.

China Taiping Accounts

China Taiping Financial Holdings offers various account types to meet the diverse needs of its clients. Here are the main account types available:

These accounts cater to different investment strategies and risk appetites, ensuring clients can effectively manage their portfolios.

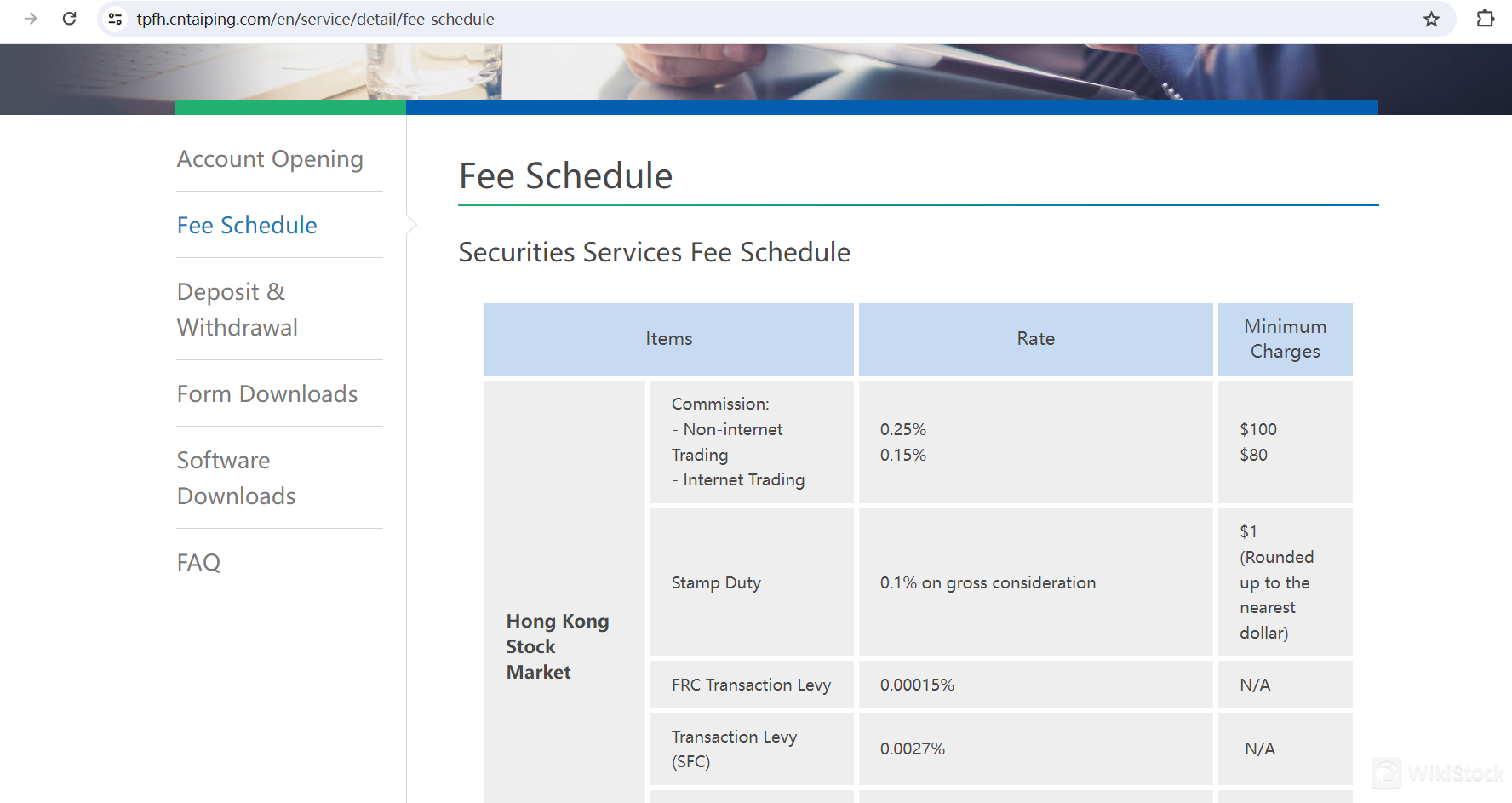

China Taiping Fees Review

China Taiping Financial Holdings provides a variety of securities services with associated fees. For the Hong Kong Stock Market, the commission for non-internet trading is 0.25% of the transaction amount with a minimum charge of HKD 100, whereas internet trading carries a commission of 0.15% with a minimum charge of HKD 80. The stamp duty is 0.1% on the gross consideration, rounded up to the nearest dollar. Additional levies include a FRC transaction levy of 0.00015%, a transaction levy (SFC) of 0.0027%, a trading fee (SEHK) of 0.00565%, and a CCASS stock settlement fee of 0.002% with a minimum charge of HKD 2.

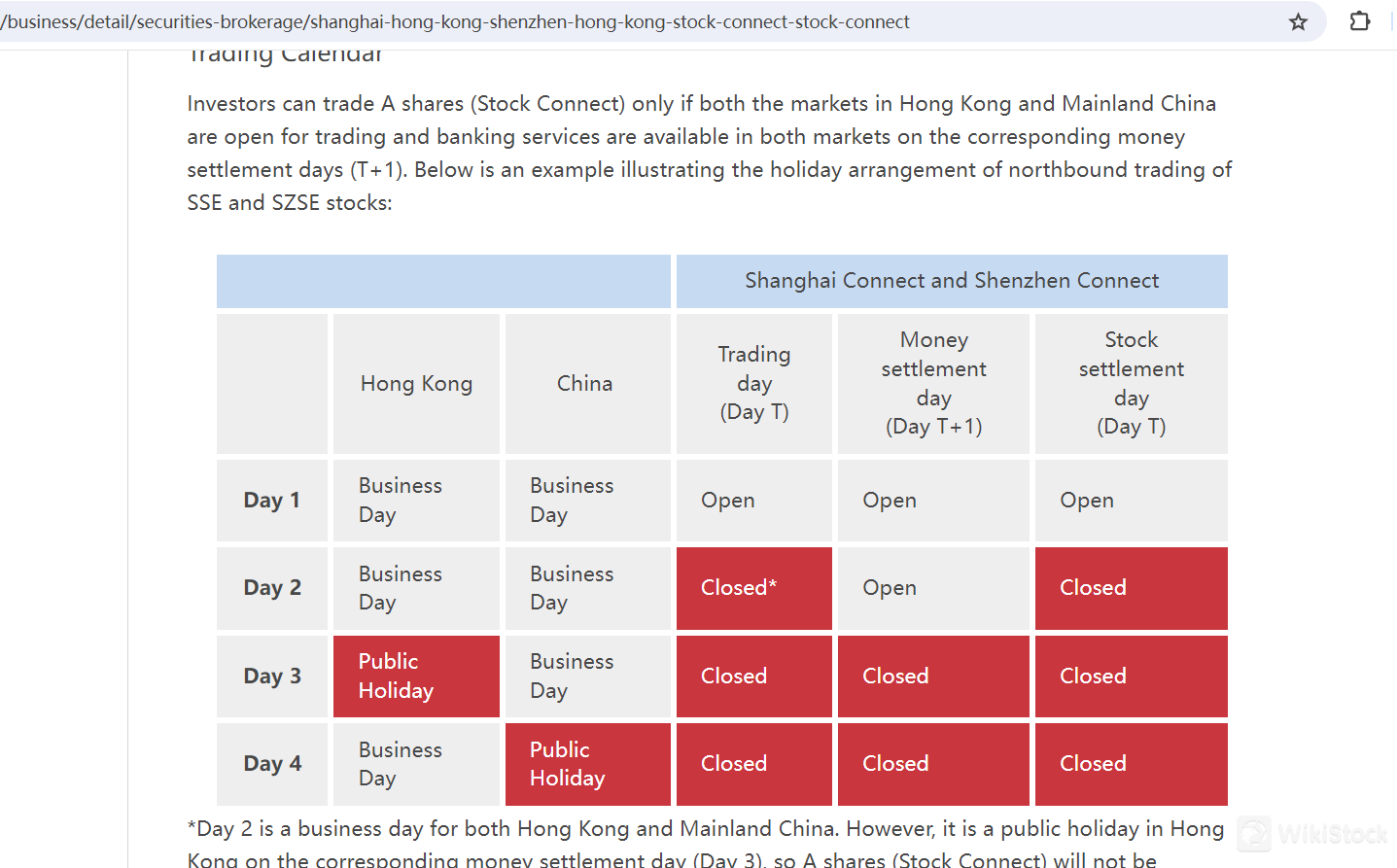

For China A-shares traded through the Shanghai and Shenzhen Connect, the commission rates are similar, with non-internet trading at 0.25% and internet trading at 0.15%, both having minimum charges of RMB 100 and RMB 80 respectively. The handling fee is 0.00341% with a minimum charge of RMB 0.01, the securities management fee is 0.002% with a minimum charge of RMB 0.01, and the transfer fee is 0.003% with a minimum charge of RMB 0.01. The stamp duty for sellers is 0.05%. There is also a portfolio fee of 0.008% of the value of shares held, calculated daily and charged monthly.

For ETFs traded via the Shanghai and Shenzhen Connect, the commission rates remain the same, with a handling fee of 0.004% and a transfer fee of 0.002%, both having minimum charges of RMB 0.01. The securities management fee and stamp duty are waived. Additionally, a portfolio fee of 0.008% applies, calculated daily and charged monthly.

Information services for internet trading accounts with real-time quotes are optional and vary depending on the provider and client location. For Hong Kong clients, the monthly charges for providers like Megahub, Etnet, AA Stock, and Tele-Trend Konson range from HKD 300 to HKD 360. For PRC clients, the charges range from HKD 170 to HKD 215.

Scrip handling and settlement-related charges include a physical withdrawal charge of HKD 6 with a minimum of HKD 30 and a transfer deed fee of HKD 5 per deed. Stock transfer instructions are free for receiving but incur a charge of 0.002% of the gross trade value for delivering, with minimum charges of HKD 200 for HK stocks and RMB 200 for A-shares. Dividend or bond interest collection charges are 0.5% of the amount with minimum charges of HKD 10, RMB 10, or USD 1.29. Dividend tax is net at 10% and deducted by the State Administration of Taxation, while dividend claims cost HKD 500, with HKD 200 collected by CCASS. IPO applications are charged at HKD 100 per form for financing and HKD 50 per form for eIPO.

Other fees include account confirmation at HKD 100 per set, duplicate copy of statements over 3 months at HKD 100 per set, and a general meeting attendance fee of HKD 50 per transaction. Interest for late payment on cash accounts is the prime rate plus 5%, and for margin accounts, it is the prime rate plus 2.5%. Nominee services and corporate actions include scrip fees of HKD 2, RMB 2, or USD 0.26 per board lot, with additional handling charges for corporate actions.

Additional miscellaneous fees include fund transfer by CHATS at HKD 100 plus bank handling fees, express bank transfers at HKD 80 for individuals and HKD 200 for corporates, dishonored cheque charges of HKD 200, deposit verification at HKD 200 per transaction, cheque image at HKD 200 per copy, and a letter for CIES at HKD 500 per letter.

Fee Schedule Table

| Items | Rate | Minimum Charges |

| Hong Kong Stock Market | ||

| Commission (Non-internet Trading) | 0.25% | HKD 100 |

| Commission (Internet Trading) | 0.15% | HKD 80 |

| Stamp Duty | 0.1% on gross consideration | HKD 1 (rounded up to the nearest dollar) |

| FRC Transaction Levy | 0.00% | N/A |

| Transaction Levy (SFC) | 0.00% | N/A |

| Trading Fee (SEHK) | 0.01% | N/A |

| CCASS Stock Settlement Fee | 0.00% | HKD 2 |

| China A-share (Shanghai and Shenzhen Connect) | ||

| Commission (Non-internet Trading) | 0.25% | RMB 100 |

| Commission (Internet Trading) | 0.15% | RMB 80 |

| Handling Fee | 0.00% | RMB 0.01 |

| Securities Management Fee | 0.00% | RMB 0.01 |

| Transfer Fee | 0.00% | RMB 0.01 |

| Stamp Duty | 0.05% (seller only) | N/A |

| Portfolio Fee | 0.008% (daily calculation, monthly charge) | RMB 0.01 |

| ETF (Shanghai and Shenzhen Connect) | ||

| Commission (Non-internet Trading) | 0.25% | RMB 100 |

| Commission (Internet Trading) | 0.15% | RMB 80 |

| Handling Fee | 0.00% | RMB 0.01 |

| Securities Management Fee | Waived | N/A |

| Transfer Fee | 0.00% | RMB 0.01 |

| Stamp Duty | Waived | N/A |

| Portfolio Fee | 0.008% (daily calculation, monthly charge) | RMB 0.01 |

| Information Services | ||

| Internet Trading Account Real-time Quotes (HK Client) | ||

| Megahub | Full: HKD 360 / Junior: HKD 300 per month | N/A |

| Etnet | HKD 360 per month | N/A |

| AA Stock | HKD 360 per month | N/A |

| Tele-Trend Konson | HKD 360 per month | N/A |

| Internet Trading Account Real-time Quotes (PRC Client) | ||

| Megahub | Full: HKD 215 / Junior: HKD 170 per month | N/A |

| Etnet | HKD 215 per month | N/A |

| AA Stock | HKD 215 per month | N/A |

| Tele-Trend Konson | HKD 190 per month | N/A |

| Scrip Handling & Settlement-related | ||

| Physical Withdrawal Charge | HKD 6 | HKD 30 |

| Transfer Deed | HKD 5 per deed | HKD 5 |

| Account Maintenance | ||

| Stock Transfer Instruction | Receive: FREE / Deliver (HK Stock): 0.002% | HKD 200 (HK Stock) / RMB 200 (A-Share) |

| Deliver (A-Share): 0.002% | ||

| Dividend / Bond Interest Collection Charge | 0.50% | HKD 10 / RMB 10 / USD 1.29 |

| Dividend Tax | 10% net dividend (deducted by SAT) | N/A |

| Dividend Claim | HKD 500 (HKD 200 collected by CCASS) | N/A |

| IPO Application (Financing) | HKD 100 per application form | N/A |

| IPO Application (eIPO) | HKD 50 per application form | N/A |

| Account Confirmation | HKD 100 per set | N/A |

| Duplicate Copy of Statement | Within 3 months: FREE / Over 3 months: HKD 100 per set | N/A |

| Attend General Meeting Fee | HKD 50 per transaction | N/A |

| Interest for Late Payment (Cash Account) | Prime rate + 5% | N/A |

| Interest for Late Payment (Margin Account) | Prime rate + 2.5% | N/A |

| Nominee Services & Corporate Actions | ||

| Scrip Fee | HKD 2 / RMB 2 / USD 0.26 per board lot | HKD 10 / RMB 10 / USD 1.29 |

| Corporate Action Service Fee (Privatization/General Offer) | ||

| HK Stock Action Fee: | HKD 0.8 per board lot (collected by CCASS) | N/A |

| Handling Charges: | HKD 50 per transaction | |

| A-Share Action Fee: | RMB 0.8 per board lot | |

| Handling Charges: | RMB 100 per transaction | |

| Other Fees | ||

| Fund Transfer by CHATS | HKD 100 plus bank handling fee | N/A |

| Express Bank Transfer | Individual: HKD 80 per transaction / Corporate: HKD 200 per transaction | N/A |

| Dishonored Cheque | HKD 200 per dishonored cheque | N/A |

| Deposit Verification | HKD 200 per transaction | N/A |

| Cheque Image | HKD 200 per copy | N/A |

| Deposit Securities Charge | FREE | FREE |

| Letter for CIES | HKD 500 per letter | HKD 500 |

China Taiping App Review

China Taiping Financial Holdings provides several trading platforms to cater to the diverse needs and preferences of their clients. These platforms are designed to facilitate smooth and efficient trading experiences.

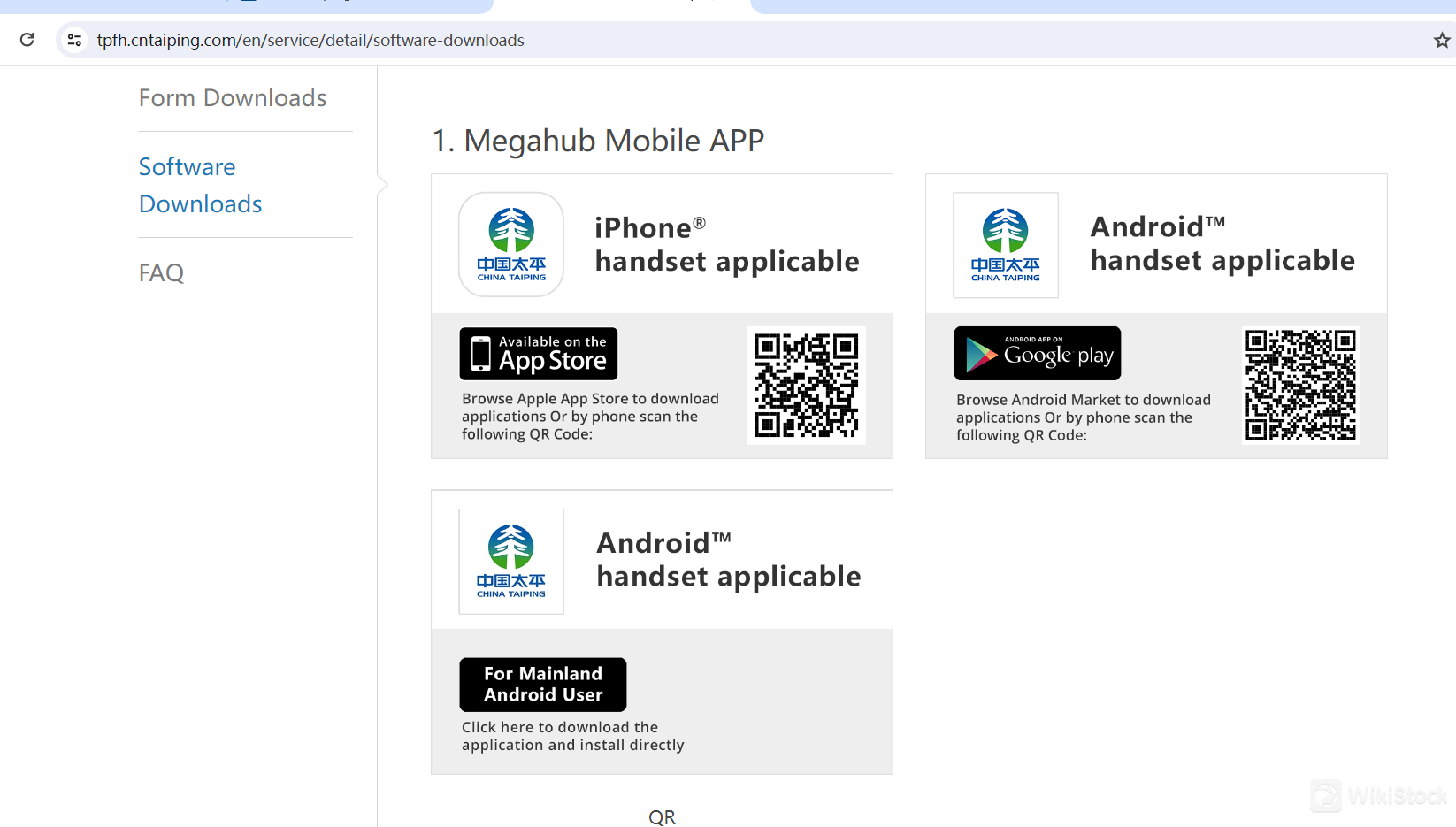

1. Megahub Mobile APP

The Megahub Mobile APP is available for both iOS and Android devices. It allows clients to trade on the go with a user-friendly interface and real-time market data.

Clients can also download the app directly using the provided download link and QR code.

2. Trading Program for Mobile (Chinese Only)

This mobile trading program, available exclusively in Chinese, provides a comprehensive trading experience with advanced features tailored to the Chinese-speaking client base.

3. Desktop Trading Program (Chinese Only)

The desktop version of the trading program offers a robust platform for clients who prefer to trade from their computers. This program is also available exclusively in Chinese.

Additional Software Downloads

To ensure seamless operation and enhanced functionality, China Taiping Financial Holdings also provides links to download essential software such as Java, Adobe Reader, and WinRAR. These tools support various aspects of the trading process and improve overall user experience.

These trading platforms and software downloads ensure that clients have the necessary tools to execute trades effectively, whether they prefer trading on mobile devices or desktop computers.

Research and Eduation

China Taiping Financial Holdings provides a comprehensive range of research and education services to help clients make informed investment decisions and enhance their trading skills. These services are designed to cater to both novice and experienced investors.

Research Services

Market Analysis Reports:

China Taiping provides in-depth market analysis reports covering a wide range of financial instruments, including equities, bonds, ETFs, and derivatives. These reports offer insights into market trends, economic indicators, and sector performance, helping investors stay informed about the latest market developments.

Company Research:

Detailed research reports on individual companies are available, offering analysis of financial statements, business models, competitive positioning, and growth prospects. This helps investors assess the potential risks and rewards of investing in specific companies.

Macroeconomic Research:

China Taiping's macroeconomic research covers global and regional economic trends, policy developments, and key economic indicators. This research helps investors understand the broader economic environment and its potential impact on their investments.

Technical Analysis:

Technical analysis reports provide insights into price trends, chart patterns, and technical indicators. These reports help investors identify potential entry and exit points for their trades based on historical price movements and technical signals.

Industry Research:

Industry-specific research reports focus on trends, challenges, and opportunities within particular sectors. These reports help investors identify promising sectors and companies that may offer attractive investment opportunities.

Education Services

Seminars and Webinars:

China Taiping organizes regular seminars and webinars on various investment topics. These sessions are led by industry experts and cover a wide range of subjects, from basic investment principles to advanced trading strategies. They provide a platform for clients to interact with experts and enhance their knowledge.

Online Courses:

A variety of online courses are available, catering to different skill levels. These courses cover topics such as stock market fundamentals, technical analysis, portfolio management, and risk management. They are designed to help clients build a solid foundation and develop advanced trading skills.

Educational Articles and Guides:

China Taiping offers a wealth of educational articles and guides on their website. These resources cover a broad range of topics, including investment strategies, market analysis techniques, and financial planning. They are easily accessible and provide valuable information to help clients improve their investment knowledge.

Newsletters:

Regular newsletters are sent to clients, providing updates on market developments, investment opportunities, and educational content. These newsletters keep clients informed and engaged, offering timely insights and tips for successful investing.

Interactive Tools and Resources:

China Taiping provides various interactive tools and resources, such as financial calculators, investment simulators, and risk assessment tools. These tools help clients practice their trading strategies, assess their risk tolerance, and make more informed investment decisions.

By offering a robust combination of research and education services, China Taiping Financial Holdings ensures that their clients are well-equipped to navigate the financial markets and achieve their investment goals.

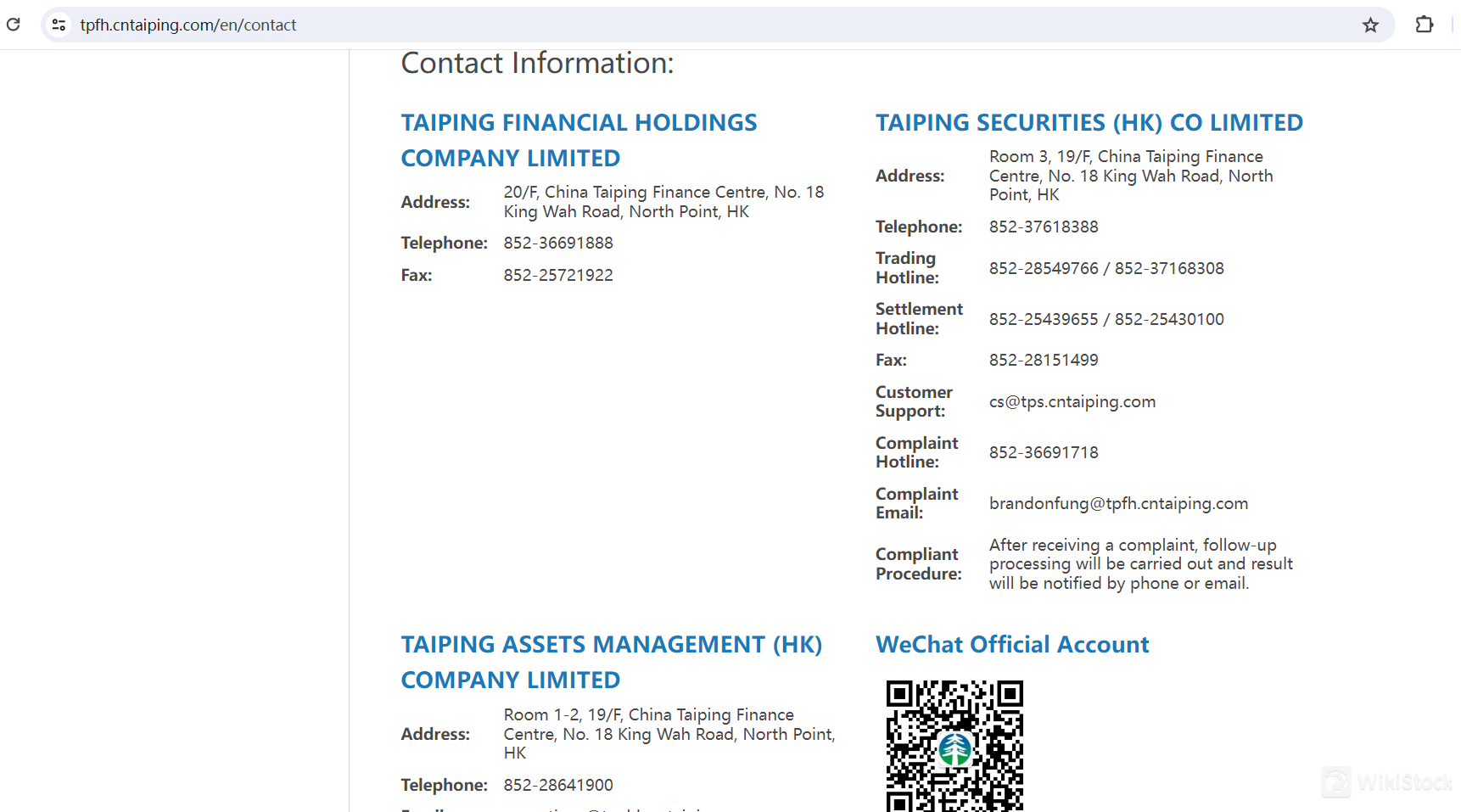

Customer Service

China Taiping Financial Holdings is committed to providing exceptional customer support to ensure clients have a seamless and efficient experience. The company offers multiple contact options for clients to reach out for assistance. Clients can contact the customer support team via telephone at 852-36691888 or fax at 852-25721922. Additionally, specific departments such as Taiping Securities (HK) Co Limited and Taiping Assets Management (HK) Company Limited have dedicated contact numbers and emails for more targeted support. For trading-related inquiries, clients can call the trading hotline at 852-28549766 or 852-37168308, while settlement-related questions can be directed to the settlement hotline at 852-25439655 or 852-25430100. Email support is available at cs@tps.cntaiping.comfor general customer service inquiries, and operations@tpahk.cntaiping.com for asset management queries.

China Taiping also places a strong emphasis on handling complaints efficiently. They have a complaint hotline at 852-36691718 and a complaint email at brandonfung@tpfh.cntaiping.com. Upon receiving a complaint, the company ensures that follow-up processing is carried out promptly, and clients are notified of the results via phone or email. This structured approach to customer support underscores China Taiping's commitment to addressing client issues thoroughly and maintaining high service standards. Additionally, the company engages with clients through its WeChat Official Account, providing an accessible platform for updates and support. This multi-faceted support system reflects China Taipings dedication to customer satisfaction and continuous improvement in service delivery.

Conclusion

China Taiping Financial Holdings is a reputable and secure financial institution, offering a comprehensive range of services including corporate finance, securities brokerage, and asset management. Regulated by HKEX, the company ensures high standards of transparency and investor protection. With robust safety measures, diverse investment products, and extensive research and educational resources, China Taiping is well-equipped to meet the needs of both retail and institutional investors, making it a reliable choice in the financial market.

FAQs

Is China Taiping Financial Holdings safe to trade?

Yes, China Taiping Financial Holdings is safe to trade. The company is regulated by the Hong Kong Stock Exchange (HKEX), which ensures it adheres to strict financial and operational standards. Additionally, China Taiping employs advanced security measures and offers insurance coverage for client accounts, providing a secure trading environment.

Is China Taiping Financial Holdings a good platform for beginners?

Yes, China Taiping Financial Holdings is suitable for beginners. The company offers a wide range of educational resources, including seminars, webinars, online courses, and detailed market analysis reports. These resources help beginners understand market fundamentals and develop effective trading strategies.

Is China Taiping Financial Holdings legit?

Yes, China Taiping Financial Holdings is a legitimate financial institution. It is regulated by the Hong Kong Stock Exchange (HKEX), ensuring compliance with high standards of transparency and investor protection. The company's long-standing presence in the market and comprehensive range of services further attest to its legitimacy.

Is China Taiping Financial Holdings good for investing/retirement?

Yes, China Taiping Financial Holdings is a good choice for investing and retirement planning. The company offers diverse investment products, including equities, bonds, ETFs, mutual funds, and structured products, catering to various investment goals and risk appetites. Their asset management services provide tailored investment strategies focusing on long-term growth and risk management, making it suitable for retirement planning.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

その他情報

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

関連企業

国

会社名

関連企業

--

Taiping Assets Management (Hong Kong) Company Limited

Group Company

--

Taiping Financial Futures (HK) Company Limited

Group Company

--

Taiping Financial Investment Company Limited

Group Company

--

Taiping Trustees Limited

Group Company

--

China Insurance Group Finance Company Limited

Group Company

--

Taiping Capital Limited

Group Company

--

Taiping Securities (HK) Company Limited

Group Company

評判

コメントなし

推奨する証券会社More

Canfield Securities

スコア

Sino Wealth Securities

スコア

China Enterprise

スコア

YMETA

スコア

Ruibang Securities

スコア

Safari Asia

スコア

華信證券

スコア

Lego Securities

スコア

大田證券

スコア

JQ Securities

スコア