Customer's account balances at Tachibana Securities are insured. The coverage amount varies depending on the regulations and insurance policies applicable in Japan.

Typically, brokerage accounts in Japan are covered by the Japan Investor Protection Fund (JIPF), providing insurance coverage up to a certain limit per account.

Safety Measures:

Tachibana Securities implements several security measures to safeguard client accounts and information.

This includes encryption protocols to protect sensitive data during transmission and storage. Multi-factor authentication adds an extra layer of security during login processes.

Regular security audits and updates ensure the platform remains resilient against emerging threats. Additionally, client funds are held in segregated accounts to mitigate risks in case of insolvency.

What are Securities to Trade with Tachibana Securities Co., Ltd.?

Tachibana Securities Co., Ltd. offers a range of tradable securities.

Japan Stocks: Investing in Japan stocks grants shareholders ownership in the respective companies. These stocks offer liquidity, allowing investors to buy and sell them at their discretion. While they offer the potential for capital gains and dividends, they also entail risks stemming from factors like corporate performance and economic trends.

Bonds: Bonds serve as vital instruments for asset management. Tachibana Securities primarily deals in government bonds for individuals, offering avenues for stable returns. Interested investors can reach out to the sales office for details on subscription periods and maturities.

Investment Trusts: Managed by specialized institutions, investment trusts pool funds from numerous investors to invest in various securities. They provide advantages such as professional management, diversification, and accessibility even with small investments. However, investors should carefully assess risk factors and the characteristics of each investment trust before committing funds.

Foreign stocks: For those seeking exposure beyond Japan markets, Tachibana Securities facilitates trading in foreign stocks such as US and Hong Kong stocks. While offering opportunities for capital gains and dividends, trading foreign stocks involves risks including exchange rate fluctuations and additional fees.

Futures and options provide avenues for leveraging capital, but investors must navigate index fluctuations and potential loss of principal.

Tachibana Securities Co., Ltd. Fees Review

Japan Listed Stock Fees

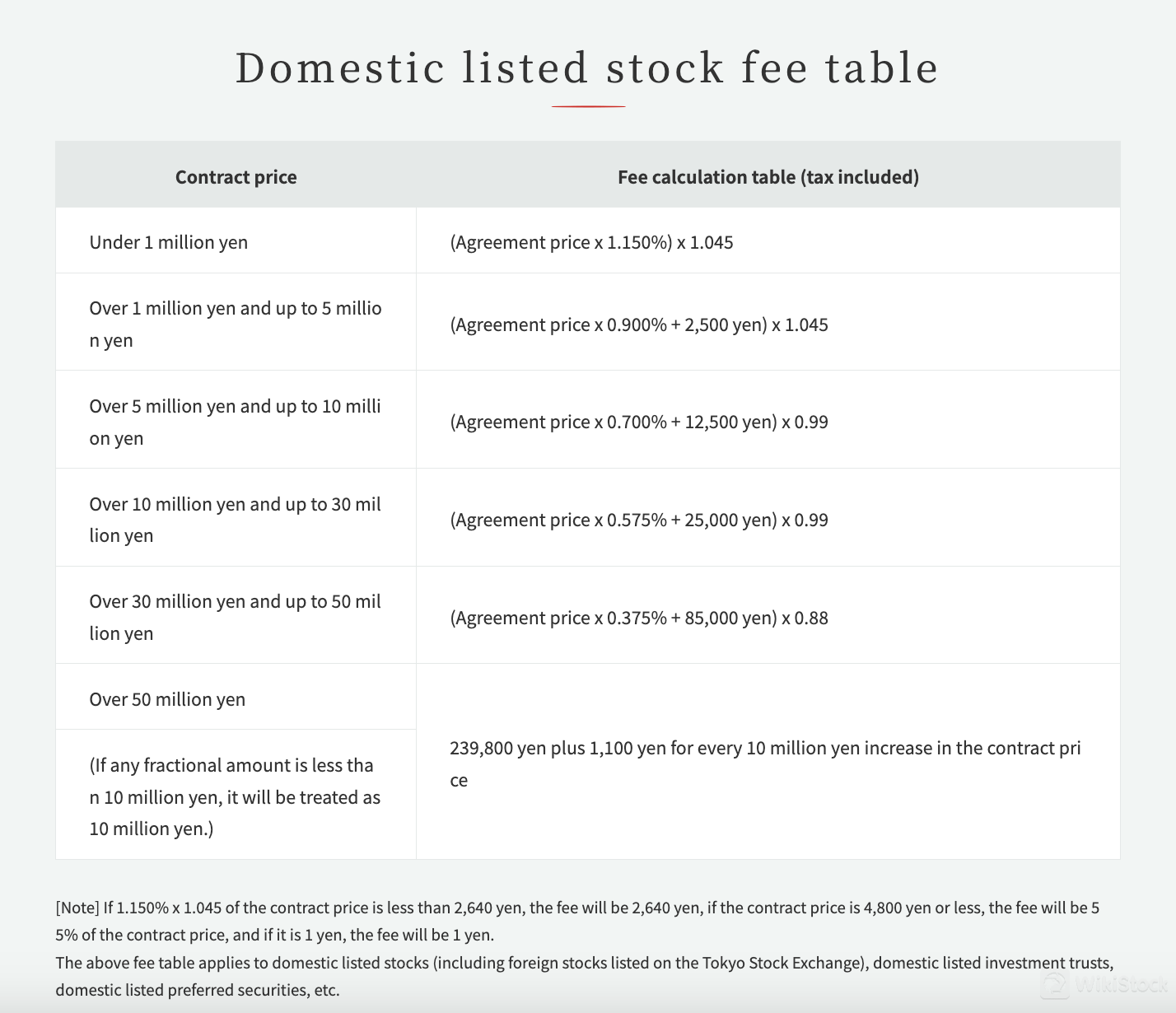

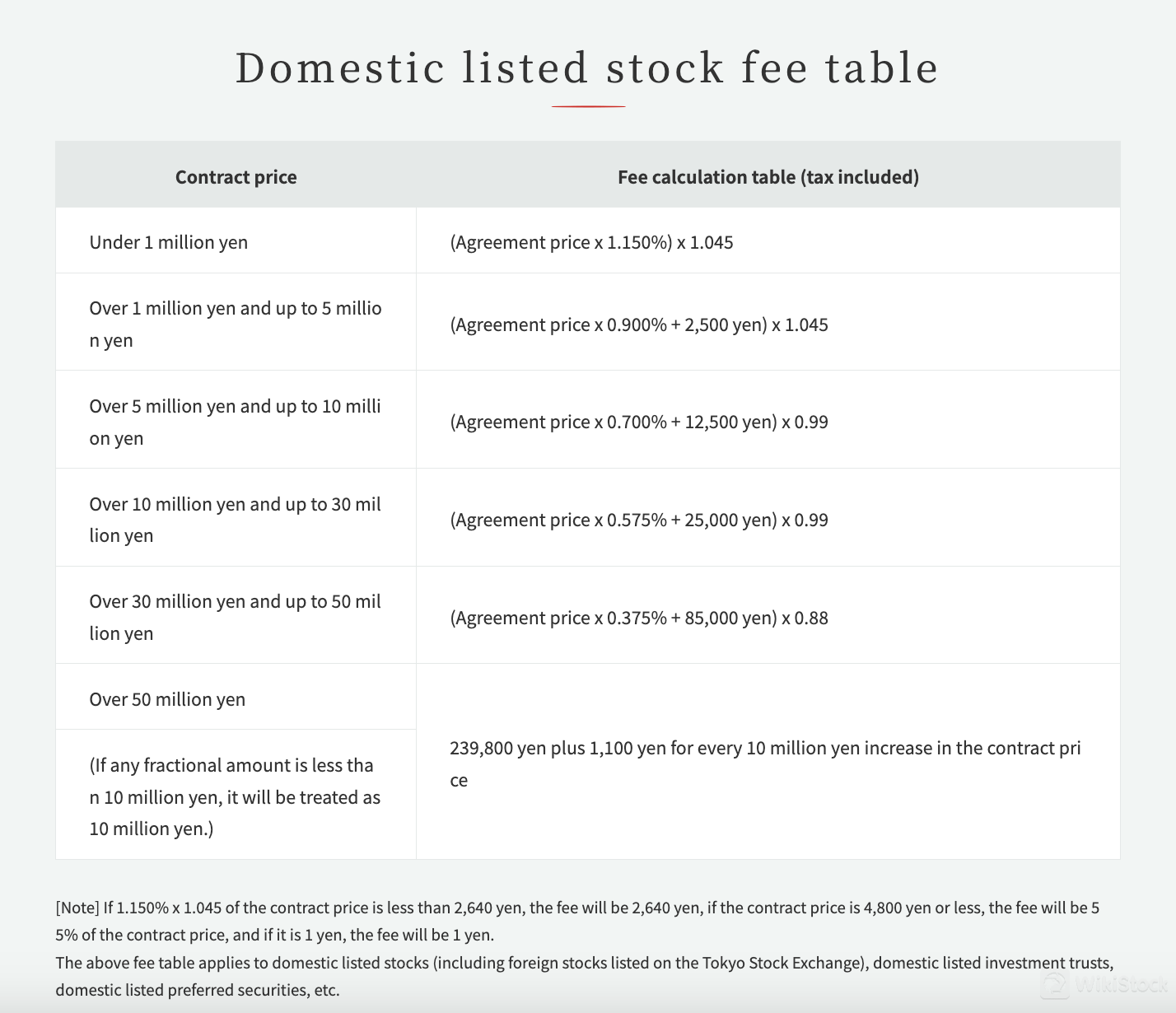

Tachibana Securities Co., Ltd. applies a tiered fee structure for Japan listed stocks, ensuring that fees align with the value of the transaction. For transactions under 1 million yen, the fee is calculated at 1.150% of the agreement price, with additional taxes applied. As the transaction value increases, the percentage fee decreases gradually, accompanied by fixed amounts or minimum fees. For instance, transactions exceeding 50 million yen incur a fee of 239,800 yen, plus an additional 1,100 yen for every 10 million yen increase in the contract price. This structure provides transparency and flexibility for investors, allowing them to optimize costs based on their investment volume.

Protected Account Management Fees

Tachibana Securities also imposes account management fees for both Japan and foreign accounts. For Japan accounts, the annual management fee is set at 1,000 yen, providing investors with affordable account maintenance. Foreign account management fees are slightly higher, with charges of 3,150 yen for one year and 7,560 yen for three years. These fees cover administrative costs associated with account maintenance and ensure the security and integrity of client assets.

Despite these fees, Tachibana Securities remains competitive in the brokerage industry, offering a balance between cost-effectiveness and quality service.

Tachibana Securities Co., Ltd. App Review

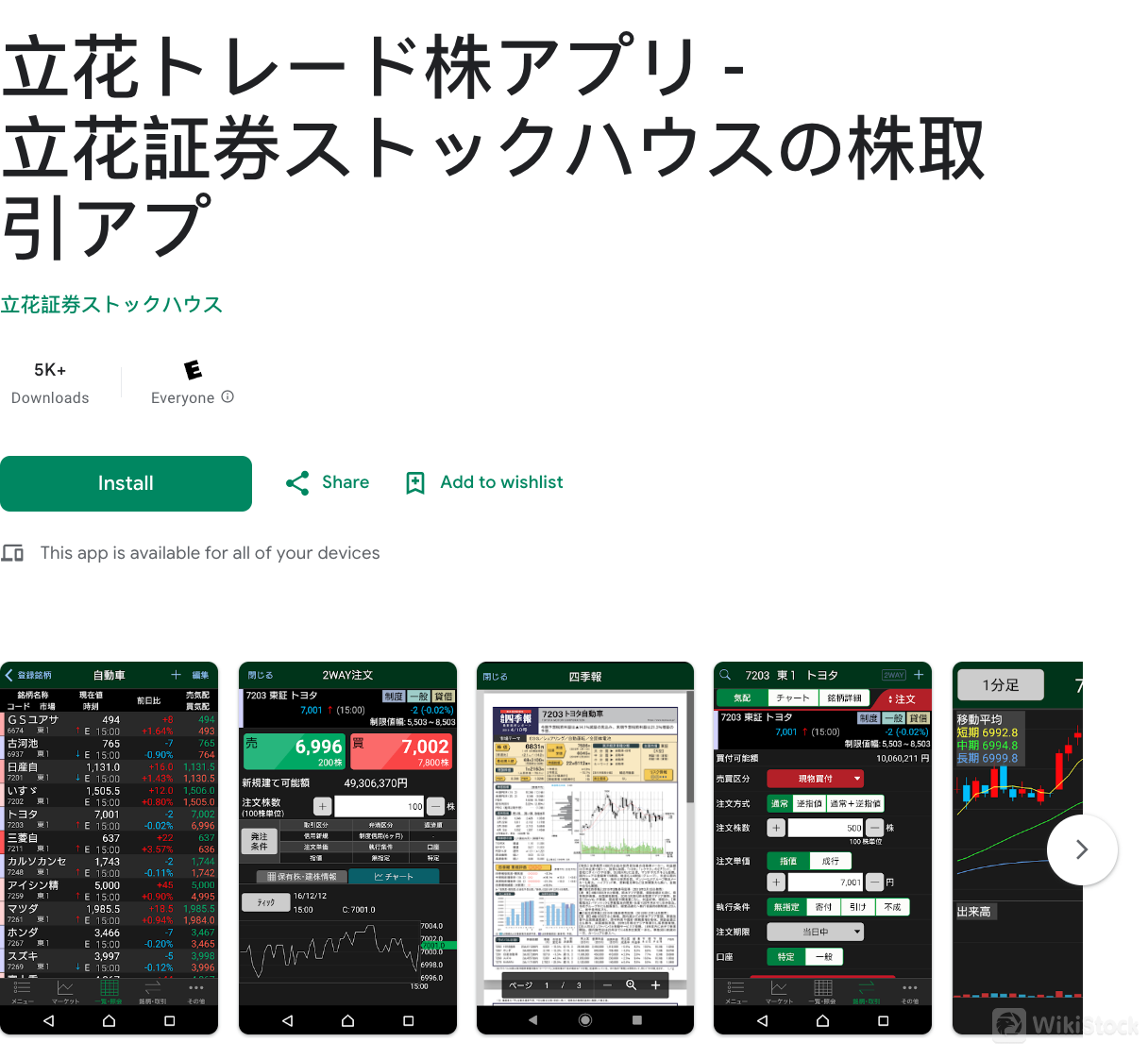

The “Tachibana Trade Stock App” by Tachibana Securities Stockhouse serves as a comprehensive stock trading tool for smartphones.

Alongside real-time stock price updates, it offers a plethora of market information such as stock data, charts, rankings, AI news, and the latest stock reports. Users can enjoy convenient trading functions including 2-way orders, providing an easy trading experience.

Clients with a securities account at Tachibana Securities Stockhouse can access the app at no additional cost. The app facilitates swift transactions through its intuitive smartphone interface, empowering users to trade efficiently and conveniently.

To download the app, users can visit the respective app store on their smartphones.

Services

Tachibana Securities Co., Ltd. provides comprehensive services for customers seeking to transact through a sales representative. One notable offering is the “special account,” designed to simplify tax filing processes.

By opting for this account, clients delegate capital gains and losses calculations to Tachibana Securities. At the start of each year, clients receive an “annual transaction report,” facilitating straightforward tax return filing. Moreover, clients can choose between “tax withheld” or “tax without withholding,” streamlining tax payment procedures.

To apply for a “special account,” customers can consult their sales representative during the account opening process.

Customer Service

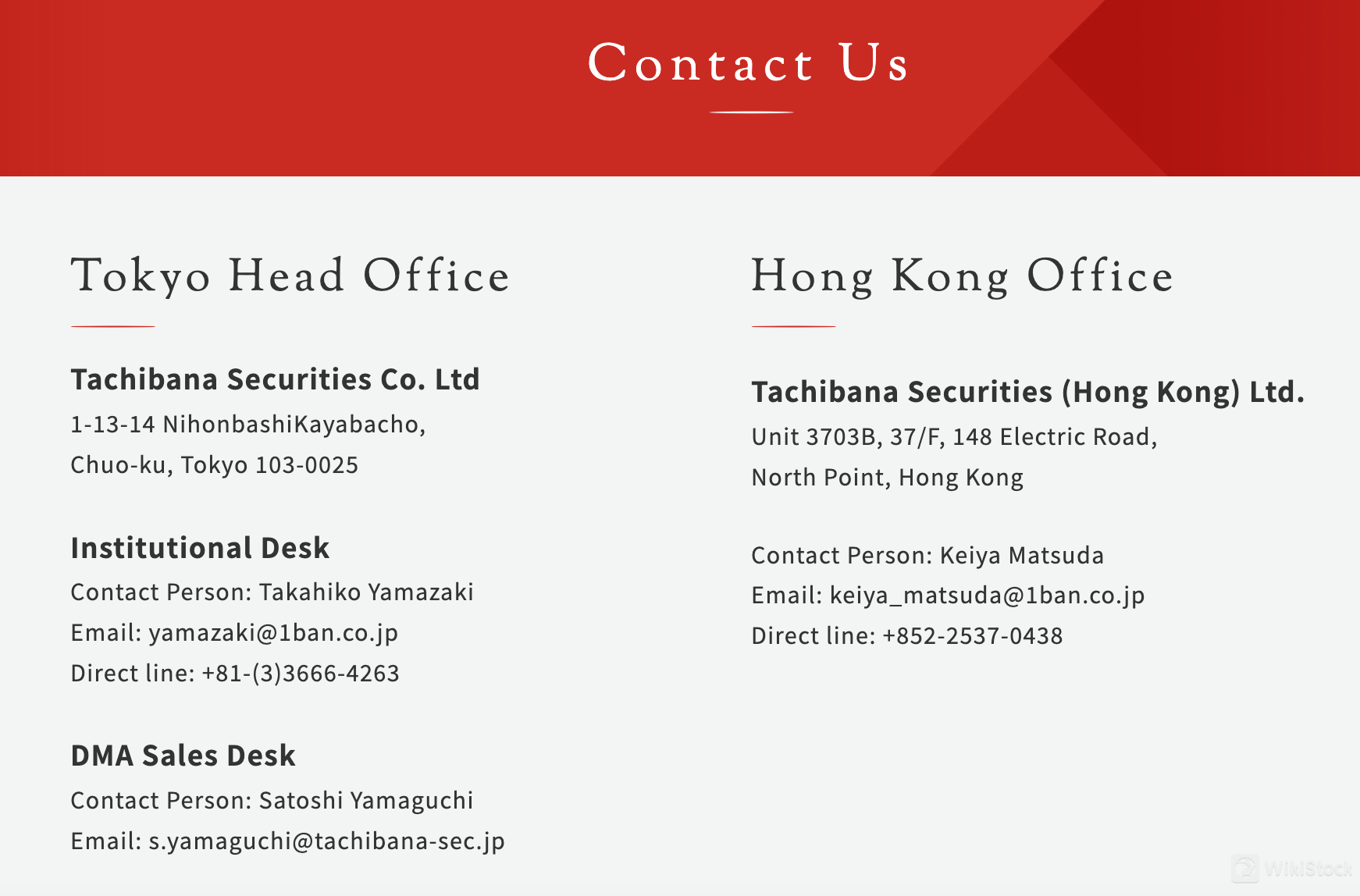

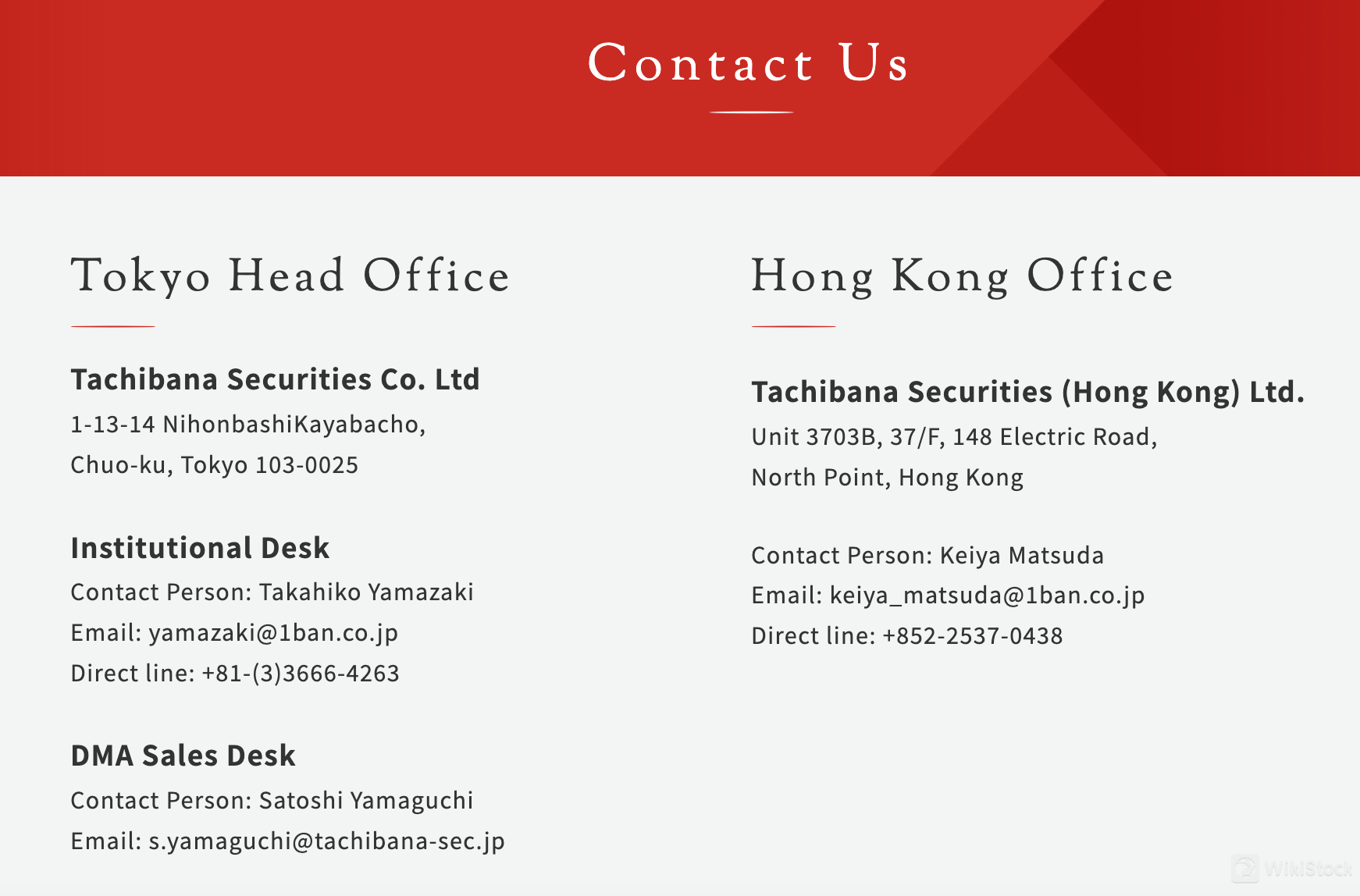

Tachibana Securities Co., Ltd. offers comprehensive customer support services from its Tokyo Head Office and Hong Kong Office.

For inquiries related to institutional services, customers can contact Takahiko Yamazaki via email at yamazaki@1ban.co.jp or reach out directly at +81-(3)3666-4263. For Direct Market Access (DMA) sales inquiries, Satoshi Yamaguchi can be contacted at s.yamaguchi@tachibana-sec.jp.

In Hong Kong, customers can connect with Keiya Matsuda via email at keiya_matsuda@1ban.co.jp or call directly at +852-2537-0438.

These services are available during standard business hours, ensuring prompt assistance and support to meet customer needs.

Conclusion

Tachibana Securities offers competitive fees and a user-friendly mobile platform, making it appealing for Japan-focused investors seeking cost-effective trading.

However, limitations include a narrow range of international securities and higher fees for foreign account management.

Despite drawbacks, its regulated status and comprehensive market information enhance trust and accessibility.

The platform suits individuals interested in Japan stock trading, particularly those seeking transparent fee structures and simplified tax filing through special accounts.

FAQs

Japan

Japanขอรับใบอนุญาตหลักทรัพย์ 1

![]() เป็นเจ้าของ 3 ที่นั่ง

เป็นเจ้าของ 3 ที่นั่ง

--