天眼评分

富士商品

https://www.fujihk01.com/

官方网址

评分指数

券商鉴定

影响力

C

影响力指数 NO.1

United States

United States交易品种

3

Futures、Investment Advisory Service、Stocks

交易牌照

拥有1个交易牌照

SFCRegulated

China Hong Kong Securities Trading License

券商信息

更多

公司全称

Fuji Hong Kong Commodities Co., Ltd

公司简称

富士商品

平台注册国家、地区

公司地址

随时想查就查

WikiStock APP

互联网基因

基因指数

APP评分

券商特色

Commission Rate

0.15%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Fuji Hong Kong Commodities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Fees (Hong Kong Stocks) | Electronic Trading Platform: 0.15% (min HK$50) |

| Telephone Order: 0.25% (min HK$100) | |

| Government Stamp Duty: 0.13% | |

| App/Platform | Fuji Securities App, Stock trading Platform |

Fuji Hong Kong Information

Fuji Hong Kong Commodities Limited was established in 1974 and holds a license issued by the Securities and Futures Commission of Hong Kong. Fuji Hong Kong provides global futures contract trading and clearing services in major markets such as Hong Kong, New York, Chicago, London and Tokyo. It also participates in the Investor Compensation Fund (ICF), with compensation of up to HK$500,000 per investor in securities and futures contracts.

Pros & Cons of Fuji Hong Kong

| Pros | Cons |

|

|

| |

| |

|

Regulated by SFC: Holds a license issued by the Securities and Futures Commission (SFC) of Hong Kong.

Global Coverage: Provides futures contract trading and clearing services in major global markets such as Hong Kong, New York, Chicago, London and Tokyo.

Electronic Trading: Provides advanced electronic trading systems and application software.

Investor Protection: Participates in the Investor Compensation Fund (ICF), with compensation up to HKD 500,000 per person.

Cons:Lack of educational resources: Lack of educational resources for beginners on trading markets, trading products, and trading strategies.

Is Fuji Hong Kong Safe?

Fuji Hong Kong can be considered safe. Fuji Hong Kong Commodities Limited is regulated by China Hong Kong Securities and Futures Commission of Hong Kong (SFC) under license number AAG657. Fuji Hong Kong adheres to strict regulatory standards set by the SFC, ensuring the security of client funds through mandated trust accounts and designated locations.

They participate in the Investor Compensation Fund (ICF), offering compensation up to HK$500,000 per person in securities and futures contracts in case of financial loss due to non-compliance.

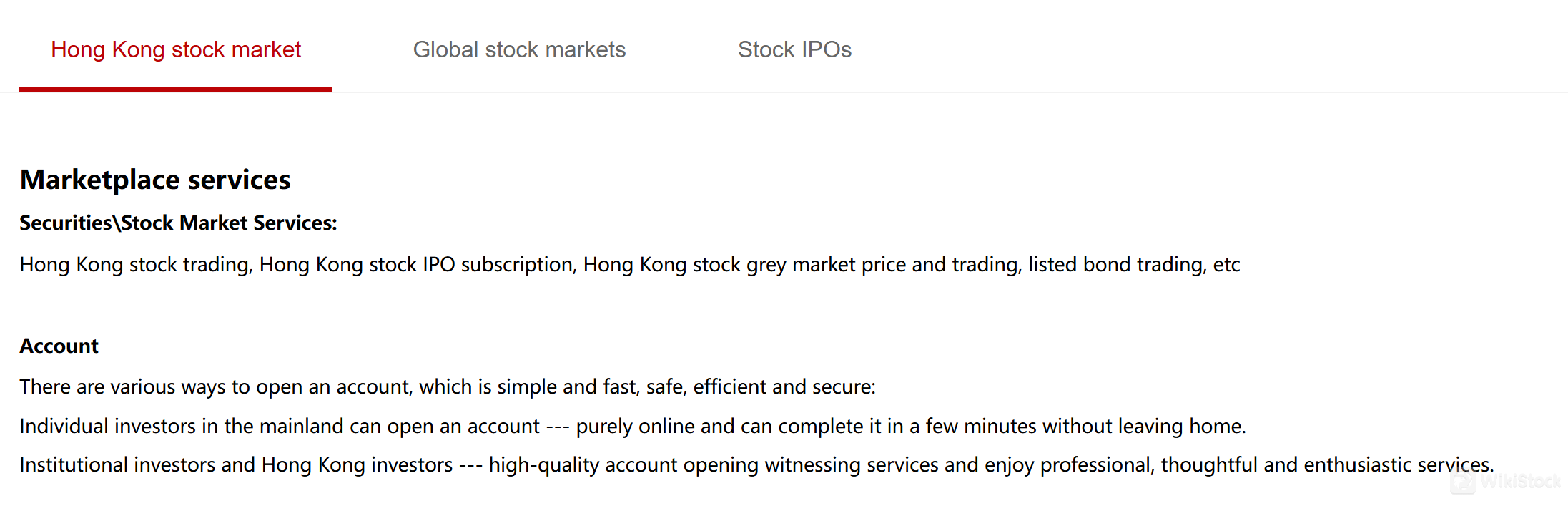

What are Securities to Trade with Fuji Hong Kong?

Fuji Hong Kong offers a variety of securities trading, including Hong Kong stock trading, Hong Kong stock IPO subscription, Hong Kong stock dark market price and trading, listed bond trading, etc. In addition, Fuji Hong Kong also provides overseas listed stock trading. Investors can access overseas markets through exchanges such as NYSE Euronext (Netherlands, Belgium, France, Portugal) and Switzerland (SIX) to trade US, Canadian, British, German (Frankfurt Stock Exchange) and other European stocks. In addition, multi-market services cover stocks in Singapore, Australia, Japan, South Korea, Malaysia, Indonesia, the Philippines and Taiwan.

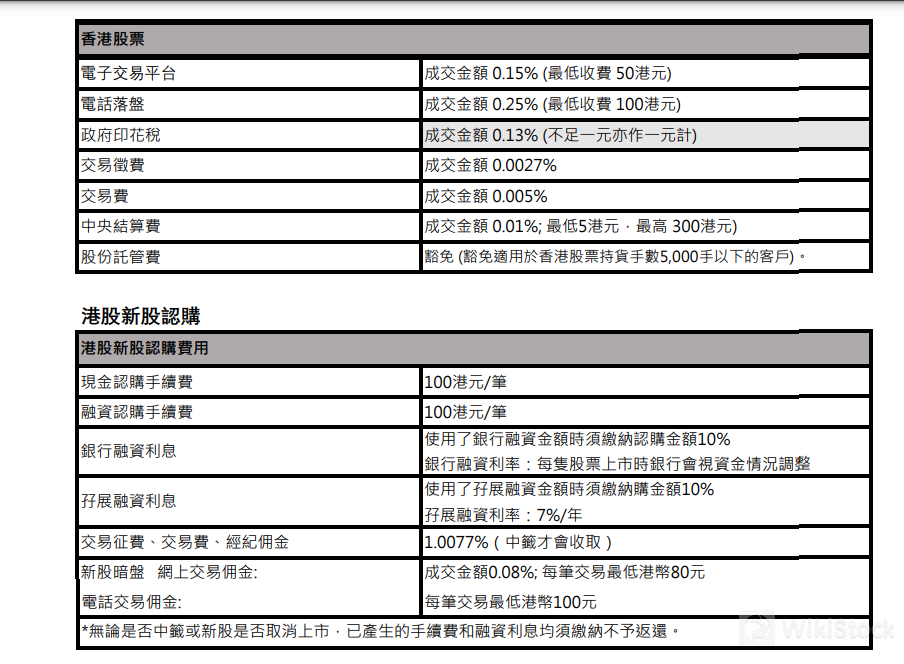

Fuji Hong Kong Fees Review

Fuji Hong Kong charges competitive fees for basic Hong Kong stock trading. On its electronic trading platform, the transaction fee is 0.15% of the transaction amount, with a minimum charge of HK$50. For telephone orders, the fee is slightly higher, at 0.25%, with a minimum charge of HK$100. In addition, transactions are subject to a government stamp duty of 0.13% of the transaction amount, rounded up to the nearest whole HK$ if it is less than HK$1.

There is also a transaction levy of 0.0027% and a transaction fee of 0.005%. The central clearing fee is 0.01% of the transaction amount, with a minimum of HK$5 and a maximum of HK$300. Clients holding fewer than 5,000 Hong Kong shares are exempt from the custody fee.

For subscriptions to Hong Kong IPOs, the company charges a uniform subscription fee of HK$100 per stock, whether it is cash subscription or bank loan subscription. If bank financing is adopted, an additional subscription fee of 10% of the subscription amount will be charged.

Note: Please refer to this link for fee details: https://www.fujihk01.com/index/shares/sf.html

Fuji Hong Kong App Review

Fuji Securities App is available on iOS and Android devices, providing users with easy access to market data, real-time quotes and trading capabilities. Users can execute trades, monitor portfolios and access research materials directly from their mobile devices. The app supports secure login with two-factor authentication for enhanced security. It also includes features such as customizable watchlists and alerts to keep users informed of market movements. In addition, Fuji Hong Kong also offers an online trading platform for stock trading.

Customer Service

Fuji Hong Kong Merchandise Company Limited offers customer service from 9:00 to 18:00, Monday to Friday, except Hong Kong public holidays. They can be reached via their central number at +852 2559 1041 or through email at sales@fujihk.com. The company fax is +852 2559 4526.

Conclusion

Fuji Hong Kong is a regulated brokerage firm that offers comprehensive trading services for global futures contracts and Hong Kong stocks. The company offers application software and online trading platforms. The company is protected by the Investor Compensation Fund, but the company lacks educational resources for beginners. Overall, Fuji Hong Kong is more suitable for experienced traders who are looking for reliable regulatory oversight and electronic trading capabilities.

Q&A

Is Fuji Hong Kong regulated?

Yes, it is regulated by the Securities and Futures Commission (SFC) of Hong Kong under license number AAG657.

What services does Fuji Hong Kong offer?

It provides global futures contract trading and clearing services in major markets such as Hong Kong, New York, Chicago, London, and Tokyo. They also facilitate Hong Kong stock trading, IPO subscriptions, and trading of listed bonds and overseas listed stocks.

Does Fuji Hong Kong provide a mobile trading app?

Yes, it offers Fuji Securities App, available for both iOS and Android devices.

Is there investor protection with Fuji Hong Kong?

Yes, it participates in the Investor Compensation Fund (ICF), which provides compensation of up to HK$500,000 per person in case of financial loss due to non-compliance.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

其他信息

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Futures、Investment Advisory Service、Stocks

评价

暂无评价

推荐券商更多

CIS Group

天眼评分

電訊證券

天眼评分

Prudential Brokerage

天眼评分

天风国际

天眼评分

國農證券

天眼评分

Synerwealth

天眼评分

雅景證券

天眼评分

CS Wealth

天眼评分

Plutus

天眼评分

Tiger Faith Holdings

天眼评分