天眼評分

評分指數

券商鑒定

影響力

C

影響力指數 NO.1

愛爾蘭

愛爾蘭交易品種

3

債券/固收、衍生性商品、股票

交易牌照

擁有1個交易牌照

英國FCA證券交易執照

券商信息

更多

公司全稱

Jarvis Investment Management Ltd

公司簡稱

Jarvis Investment Management Ltd

平台註冊國家、地區

公司地址

隨時想查就查

WikiStock APP

互聯網基因

基因指數

APP評分

| Jarvis Investment Management Ltd |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | N/A |

| Fees (Trading Fees) | 網上交易(X-O.co.uk):每筆交易£5.95ShareDeal Active:每筆交易£9.50Dial-n-Deal:每筆交易£27.50SellMyShareCertificates.com:每筆交易£25.00 |

| Account Fees | 股票和股票ISA每年收取£40 + VAT的管理費 |

| Interests on Uninvested Cash | N/A |

| Margin Interest Rates | N/A |

| Mutual Funds Offered | 是 |

| App/Platform | Jarvis Invest app |

| Promotion | 否 |

什麼是Jarvis Investment Management Ltd?

Jarvis Investment Management Ltd是一家位於英國的公司,提供以低固定佣金為特點的交易服務,起價為£5.95,並提供透明的費用結構。

他們的平台提供了一系列可交易的證券,但國際市場覆蓋範圍有限。

Jarvis受到金融行為監管局的監管,為投資者提供安全和信任。然而,他們缺乏廣泛的教育資源。

優點和缺點

Jarvis Investment Management擁有幾個優點,特別是低固定佣金,起價為£5.95,吸引著注重成本的投資者,尋求交易費用的可負擔性和可預測性。此外,提供移動平台增強了可訪問性和便利性,滿足現代投資者喜歡在移動中管理投資組合的需求。

受金融行為監管局的監管增加了安全和信任的層面,向客戶保證遵守嚴格的監管標準,有助於增強對平台合法性和可靠性的信心。

然而,Jarvis Investment Management在可交易證券領域遇到了限制。該平台提供的可交易資產範圍相對狹窄,可能限制了客戶尋求更廣泛市場覆蓋和多元化的投資機會。

此外,它缺乏全面的教育資源,可能阻礙投資者做出明智的決策和最大化投資潛力。

| 優點 | 缺點 |

| 低固定佣金,起價£5.95 | 可交易證券範圍有限 |

| 提供移動平台-Jarvis Invest | 國際市場覆蓋有限 |

| 受金融行為監管局監管 | 某些服務需額外收費 |

| 透明的費用結構 | 缺乏教育資源 |

Jarvis Investment Management Ltd是否安全?

- 監管:

- 資金安全:

- 安全措施:

- 股票:代表對一家公司的所有權。您可以買賣倫敦證券交易所上市的公司股票,包括大型和小型公司。

- 基金:這些是從多個投資者那裡籠集資金並投資於各種資產(如股票、債券和商品)的投資池。Jarvis提供了一個平台,可以交易在各種交易所上市的基金。

- ISA(個人儲蓄帳戶):這些是稅務優惠帳戶,允許您以稅收優惠的方式投資各種資產。Jarvis提供股票和股票ISA,讓您可以投資各種證券。

- SIPP(自助投資個人養老金):這些是允許您投資比傳統養老金計劃更廣泛資產的養老金帳戶。Jarvis提供SIPP,讓您可以投資各種證券。

- 應用程式介面

- Jarvis Investment Management 是否安全可靠?

- 是的,與 Jarvis Investment Management 進行交易是安全的,因為它受到金融行為監管局的監管,確保遵守嚴格的安全標準以保護客戶資產。

- Jarvis Investment Management 是否合法?

- 是的,Jarvis Investment Management 是一家合法的公司,在英國受金融行為監管局的監管。

- Jarvis Investment Management 是否適合投資/退休?

Jarvis Investment Management擁有證券牌照,牌照號碼為116413,經英國金融行為監管局(FCA)授權進行證券交易。他們的監管狀態確保符合FCA標準,為客戶提供遵守行業規定和最佳證券交易實踐的保證。

是的,Jarvis Investment Management的客戶賬戶餘額得到保險。通過金融服務補償計劃(FSCS),每個個人客戶在每家機構的所有存款損失上可獲得高達£85,000(或聯名賬戶為£170,000)的賠償。

Jarvis Investment Management 重視客戶資產的安全和保障,通過全面的措施來實現。

所有客戶資金都存放在分離帳戶中,與公司資金分開,符合FCA規定。嚴格的控制和定期的合規委員會會議確保準確性和遵守法規。

此外,專業賠償保險可防範疏忽或詐騙。在Jarvis停業的情況下,客戶資產與債權人的要求保持分開,提供安心和資產安全。

Jarvis Investment Management Ltd 交易的證券有哪些?

Jarvis Investment Management Ltd 提供了一個平台,可以在各種交易所上交易各種證券。以下是您可以通過Jarvis Investment Management Ltd進行交易的一些證券:

Jarvis Investment Management Ltd 帳戶

Jarvis Investment Management 提供以下4種帳戶類型:

ShareDeal Active

ShareDeal Active 提供直接且具有成本效益的網上交易服務,每筆交易固定佣金為£9.50。此帳戶非常適合經常買賣股票並偏好平價佣金結構簡單的活躍交易者和投資者。無論交易規模如何,它都非常適合那些重視使用便利性和可預測的交易成本的人。

X-O.co.uk

X-O 帳戶提供低成本的執行交易服務,每筆交易固定佣金為£5.95。此帳戶專為注重成本的投資者設計,他們更喜歡通過網上平台獨立處理交易。無年費和簡單的費用結構,適合那些尋找無花俏、預算友好的投資股票方式,而不需要諮詢服務或其他支援。

SellMyShareCertificates.com

SellMyShareCertificates.com 專門從事證券化股票的銷售,每筆交易固定佣金為£25.00。此服務針對持有實體股票證書並希望將其變現的投資者。特別適合那些希望以最少的數碼參與管理其證券化股票並尋找簡單、具有成本效益的銷售方式的個人。

Dial-n-Deal

Dial-n-Deal 提供一種基於電話的股票交易服務,每筆交易固定佣金為£27.50。這個帳戶非常適合偏好透過電話進行交易的投資者,特別是那些經常交易有證書的股票或需要定期協助的投資者。這項服務對於重視個人互動和支援的個人在交易過程中非常有益,對於純網上交易平台不太熟悉的投資者尤其如此。

Jarvis Investment Management Ltd 佣金評論

對於透過 X-O.co.uk 服務進行網上交易,Jarvis Investment Management Ltd 收取固定佣金£5.95 每筆交易。無論交易規模如何,此費用都適用,這對於經常交易並希望成本可預測的投資者來說是一個有吸引力的選擇。相比之下,ShareDeal Active 帳戶收取稍高的固定佣金費用,每筆交易為£9.50。

對於使用 Dial-n-Deal 服務進行電話交易,佣金為£27.50 每筆交易,這反映了個性化服務的額外成本。

SellMyShareCertificates.com 服務收取£25.00 每筆交易的固定佣金,不收設置費或持續費用。

將 Jarvis Investment Management 的佣金與其他經紀商相比較,他們的固定佣金交易費用在英國市場上具有競爭力。X-O.co.uk 的£5.95 網上交易費用明顯低於許多競爭對手,使其處於低費用類別。ShareDeal Active 的£9.50 佣金費用也相對較低,儘管略高於 X-O 帳戶。

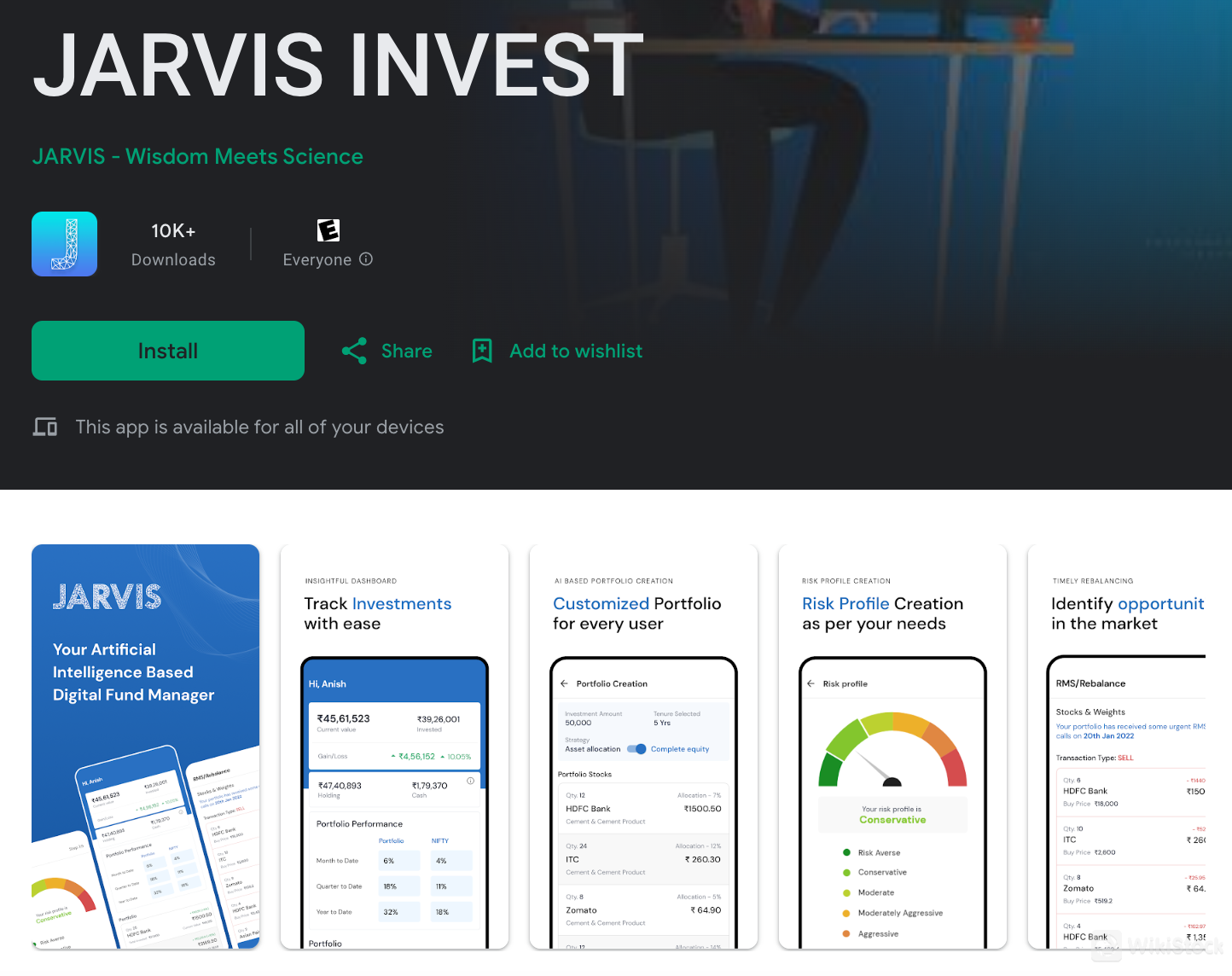

Jarvis Investment Management Ltd 應用程式評論

Jarvis Invest 應用程式採用基於人工智能的研究,為股票市場投資引入了一種新穎的方法。

通過其專有的風險管理系統,該應用程式提供對投資的持續監控,提供各種情景的警報,包括利潤預訂和股票退出。用戶可以自定義投資組合,執行交易並有效地管理風險。

下載應用程式涉及風險概况分析、投資選擇、策略確定、CKYC驗證和經紀人選擇的簡單過程。

這款快速、直觀且無廣告的應用程式可立即下載,提供友好的投資體驗。

服務

Jarvis Investment Management 提供各種適合已建立企業和新進市場的服務。

他們提供可定制的股票交易解決方案,以滿足證券交易所成員和非成員公司的需求,從部分外包到完全白標選項。

在保管和結算方面,Jarvis為希望更換供應商或進入市場的企業提供靈活的解決方案。

客戶服務

Jarvis Investment Management Ltd 通過電話、傳真和電子郵件等多種渠道提供客戶支援。他們的團隊週一至週五從08:00至17:00提供服務。

要聯繫他們,您可以致電01892 700800或傳真至01892 518977。或者,您可以發送電子郵件至invest@jarvisim.co.uk。

結論

Jarvis Investment Management 提供一個易於使用的平台,低固定佣金吸引著注重成本的投資者。

然而,它的限制包括可交易證券的範圍狹窄和有限的國際市場覆蓋範圍。儘管如此,該平台提供了透明的費用結構和金融行為監管局的監管,從而增強了用戶的信任。

憑藉方便訪問的移動平台,它適合追求價格實惠和易於使用的投資者。然而,對於那些希望擁有廣泛投資選擇或教育資源的人來說,它可能不完全適合。

常見問題

是的,Jarvis Investment Management 提供適合長期投資和退休計劃的投資服務,提供各種投資選擇和退休賬戶。

風險警告

所提供的信息基於 WikiStock 對該券商網站數據的專家評估,並可能會有所變動。此外,網上交易涉及重大風險,可能導致投資資金的全部損失,因此在參與之前了解相關風險至關重要。

其他信息

註冊地

英國

經營時間

10-15年

受監管國數量

1

可交易品類

債券/固收、衍生性商品、股票

下載應用

評價

暫無評價

推薦券商更多

IBKR 盈透證券

天眼評分

HSBC 滙豐

天眼評分

Mizuho Securities

天眼評分

Webull 微牛證券

天眼評分

NOMURA

天眼評分

Barclays

天眼評分

Korea Investment & Securities

天眼評分

OANDA

天眼評分

Daiwa 大和證券(中國)

天眼評分

IG

天眼評分