Halcyon offers several advantages and considerations for potential investors. On the positive side, it provides convenient mobile and web access, allowing users to manage investments flexibly across various platforms. The platform features competitive fees for securities trading and offers access to mutual funds, broadening investment options. However, prospective users should note the absence of promotional incentives and limited upfront information on account fees, which may impact overall cost transparency. Additionally, while the 5% margin interest rate is competitive for margin trading, investors should carefully consider the associated risks.

Initial Public Offerings (IPOs):An Initial Public Offering (IPO) is the process through which a private company offers shares to the public for the first time, thereby becoming a publicly traded company.

Mergers and Acquisitions (M&A): Mergers and Acquisitions (M&A) refer to transactions where companies combine assets or are acquired by other entities through various means such as mergers, acquisitions, consolidations, or takeovers.

Placement and Underwriting of Shares and Other Securities:Placement and underwriting involve the sale of securities (such as stocks, bonds, or derivatives) to investors either through private placements or public offerings.

Other Financial Advisory Services: Financial advisory services encompass a wide range of consulting and advisory activities provided by financial professionals to individuals, corporations, and governments.

Halcyon Fees Review

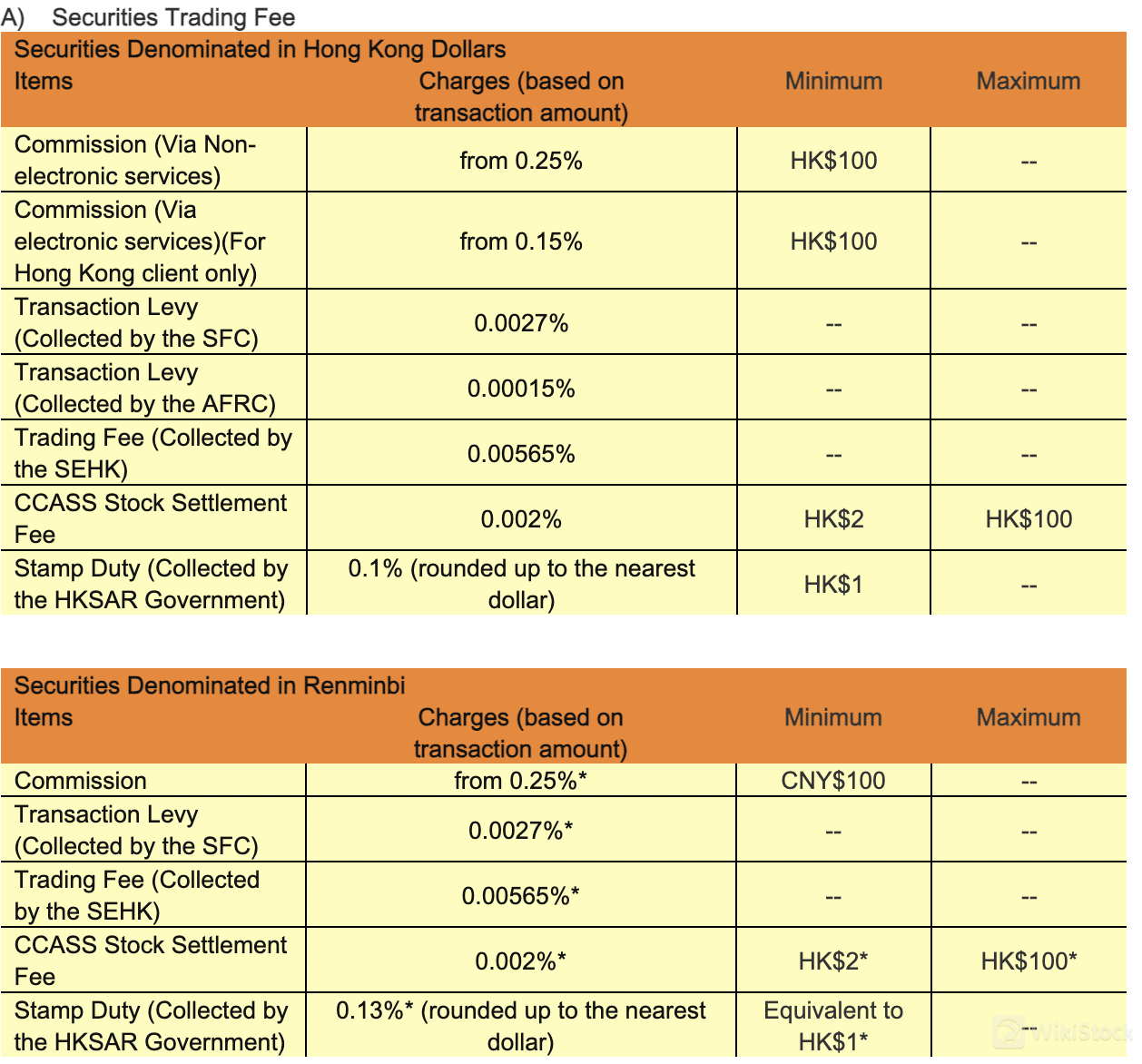

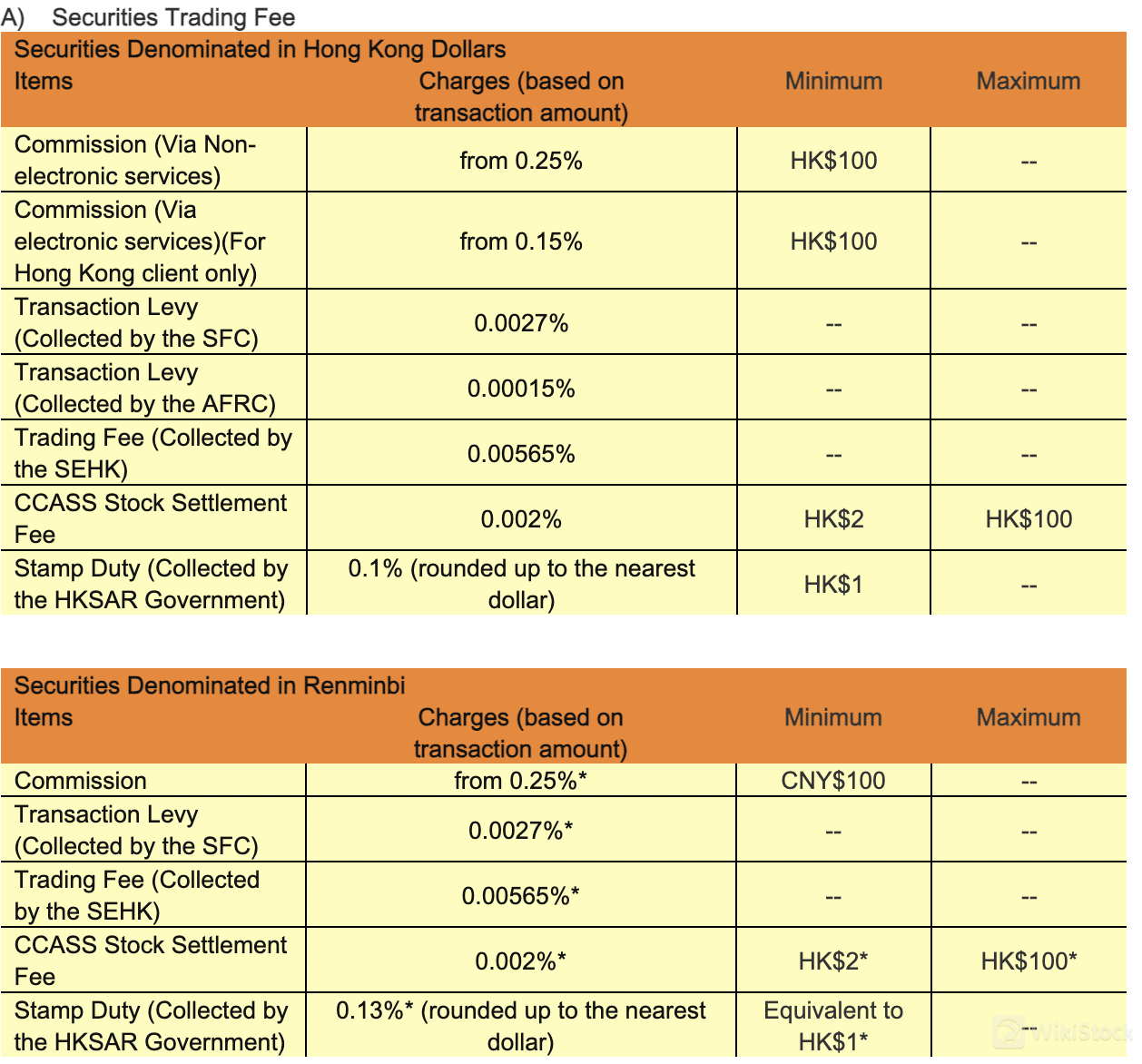

Halcyon provides a structured fee schedule for securities trading across different currencies. For securities denominated in Hong Kong Dollars (HKD), commissions vary from 0.25% for non-electronic services, with a minimum commission of HK$100, to 0.15% for electronic services available to Hong Kong clients. Additional charges include a transaction levy of 0.0027% collected by the Securities and Futures Commission (SFC), a trading fee of 0.00565% collected by the Stock Exchange of Hong Kong (SEHK), and a CCASS stock settlement fee ranging from HK$2 to HK$100. Stamp duty stands at 0.1%, rounded up to the nearest dollar, collected by the Hong Kong SAR Government. For securities denominated in Renminbi (CNY), commissions, transaction levy, trading fee, CCASS stock settlement fee, and stamp duty are similarly structured.

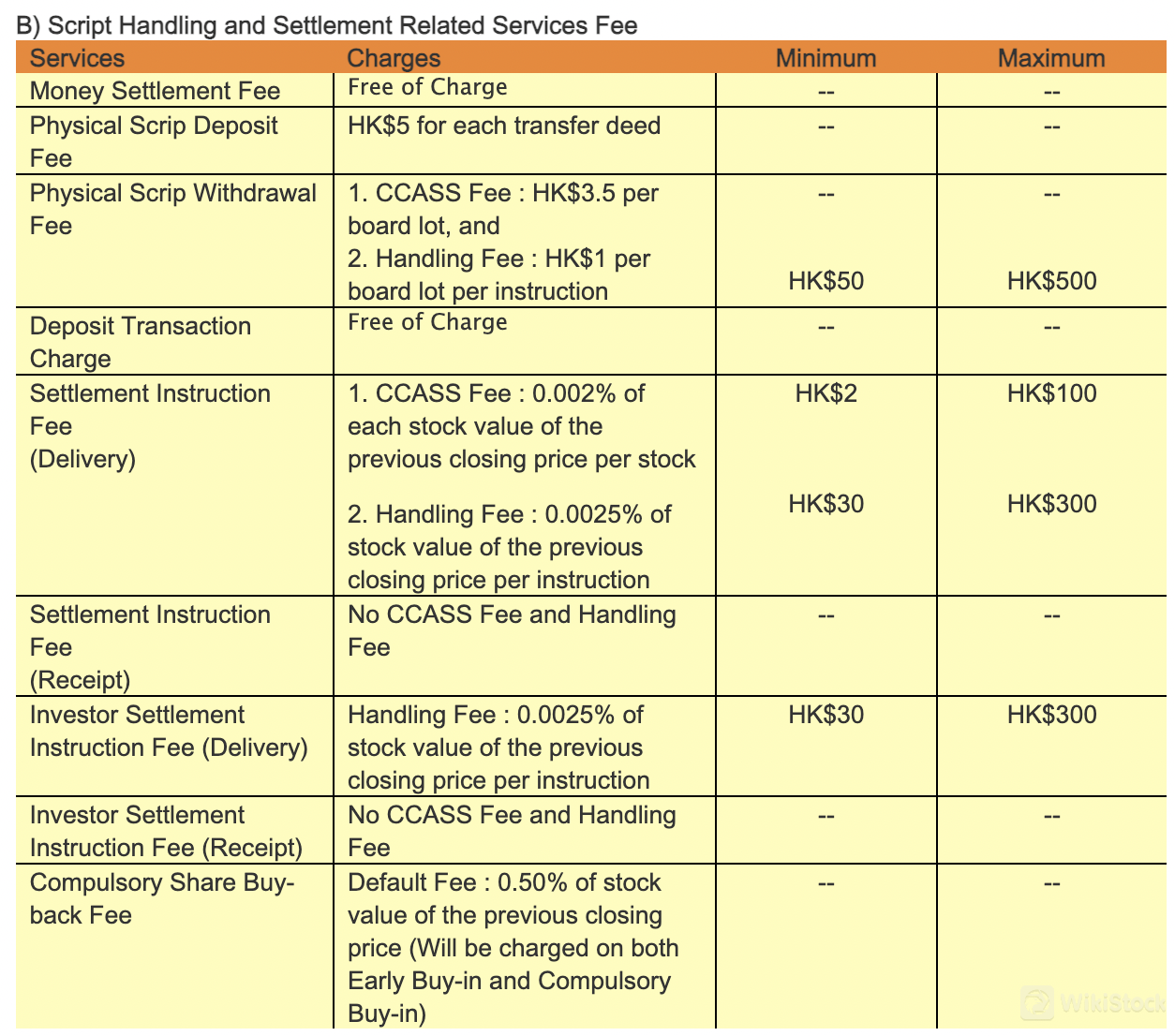

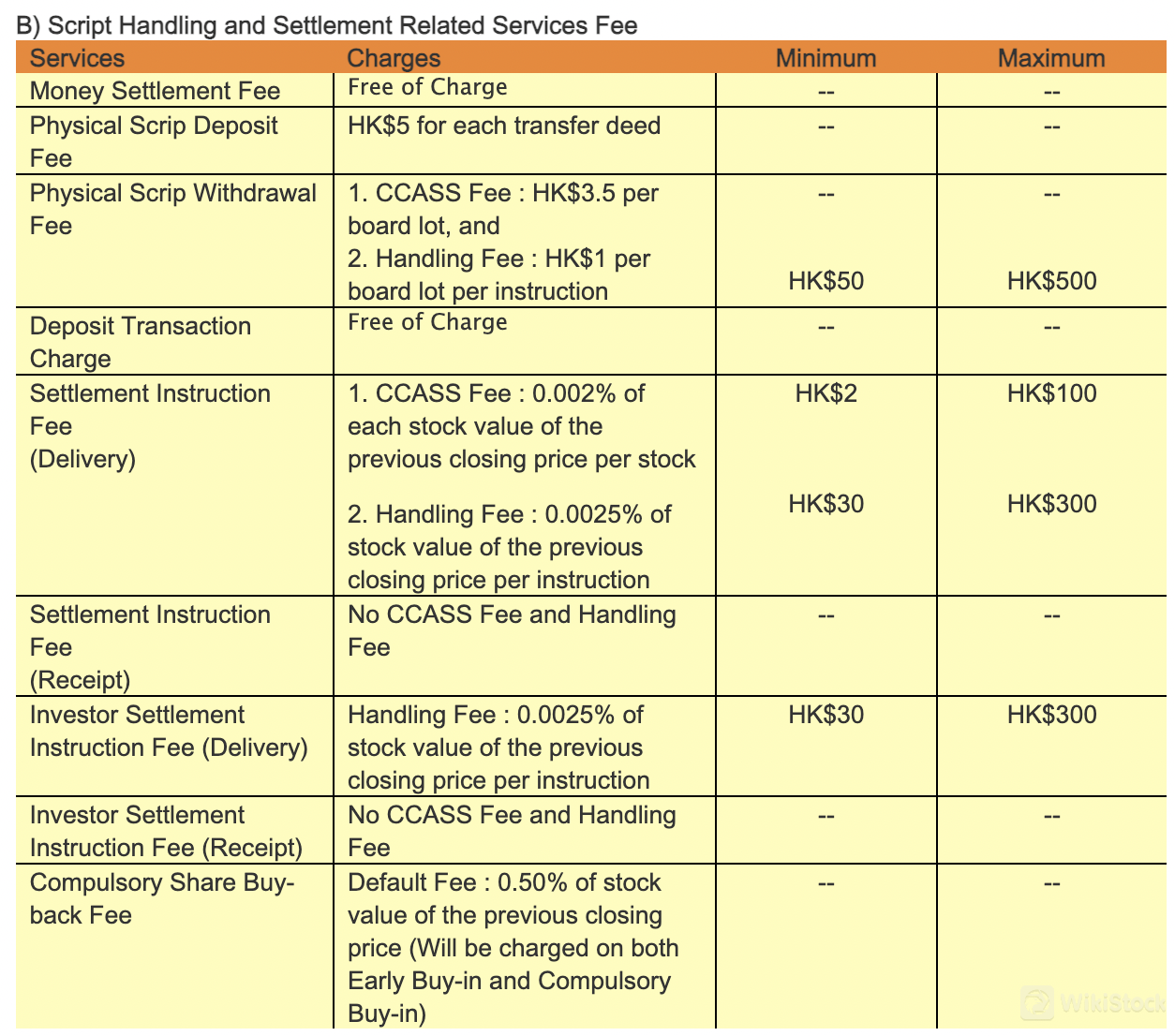

For script handling and settlement-related services, money settlement fees are free of charge, while physical scrip deposits incur a fee of HK$5 per transfer deed. Withdrawals involve a CCASS fee of HK$3.5 per board lot and a handling fee of HK$1 per board lot per instruction, with maximum charges capped at HK$500. Deposit transactions are free, and settlement instructions for delivery incur a fee of HK$2, with additional charges including a CCASS fee of 0.002% and a handling fee of 0.0025% based on the stock's previous closing price, with minimums and maximums set at HK$30 and HK$300. Receipt settlement instructions are exempt from CCASS and handling fees, but an investor settlement instruction fee of HK$30 to HK$300 applies. Compulsory share buy-backs attract a default fee of 0.50% of the stock's previous closing price, applicable to both early and compulsory buy-ins.

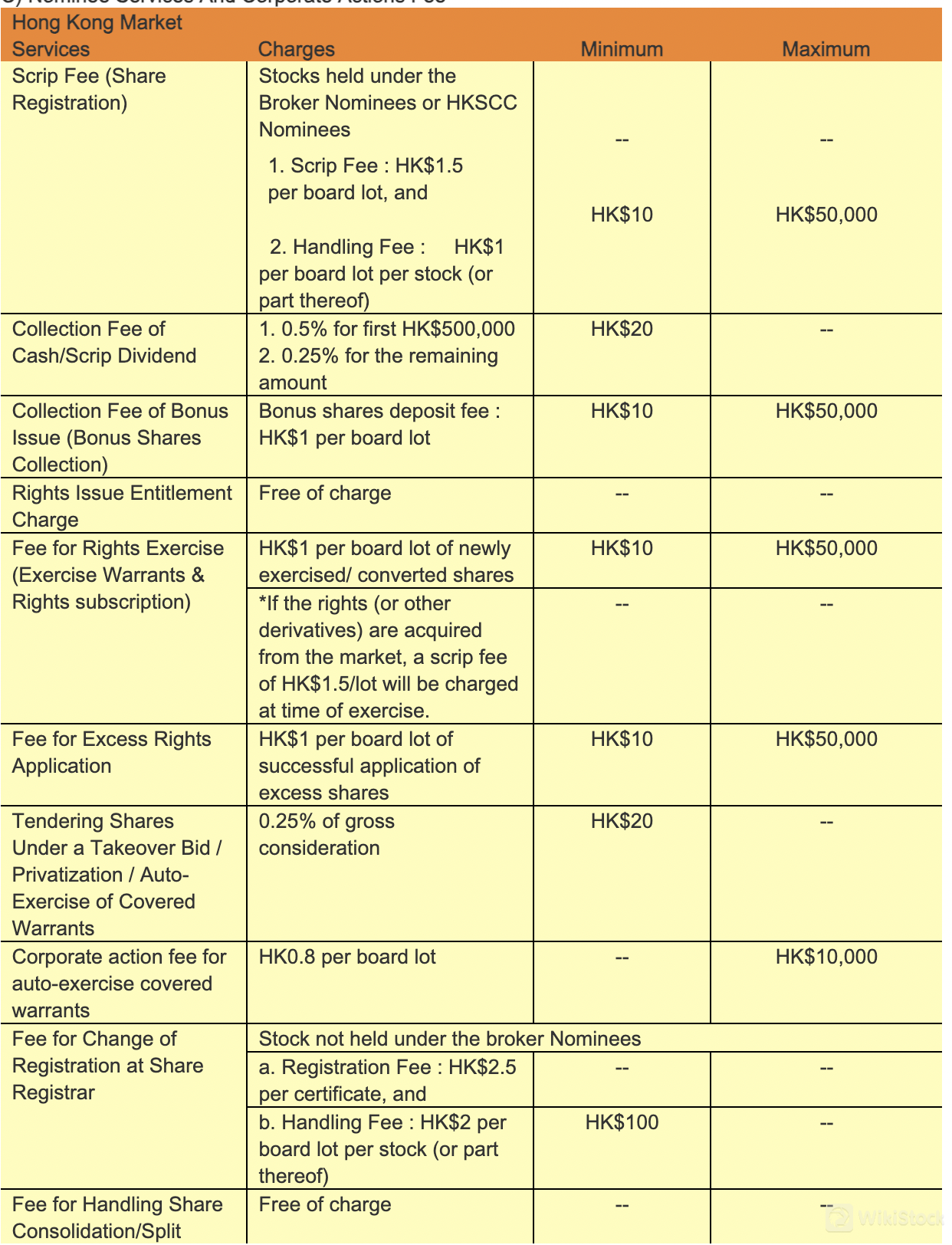

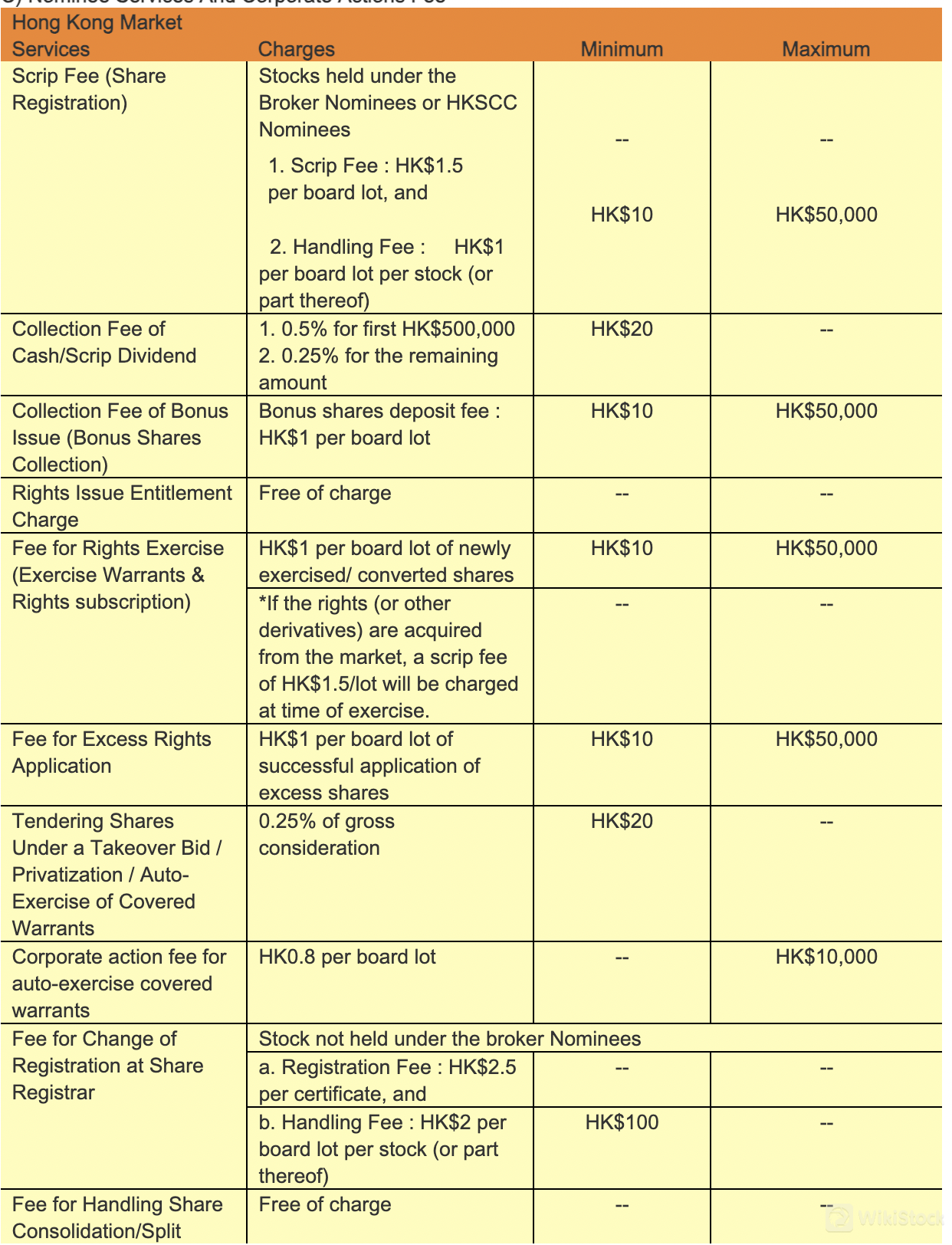

For scrip fees related to share registration held under broker nominees or HKSCC nominees, charges include HK$1.5 per board lot and a handling fee of HK$1 per board lot per stock or part thereof, with minimums ranging from HK$10 to HK$20 and maximums up to HK$50,000. Dividend collection fees are structured as 0.5% for the first HK$500,000 and 0.25% for amounts exceeding this threshold. Bonus shares incur a deposit fee of HK$10 per collection. Rights issue entitlements are free of charge, while fees for exercising warrants or rights range from HK$1 per board lot to HK$50,000 per transaction. Tendering shares under takeover bids or privatizations involves a fee of 0.25% of gross consideration, with additional charges applicable for corporate actions such as auto-exercising covered warrants. For stocks not held under broker nominees, registration fees include HK$2.5 per certificate and a handling fee of HK$2 per board lot per stock. Handling fees for share consolidations or splits are provided free of charge.

Halcyon applies a structured fee approach to account maintenance and custody services within the Hong Kong market. Custody fees are calculated at HK$0.15 per board lot, with semi-annual charges ranging from HK$50 to a maximum of HK$5,000 per portfolio at the end of June and December or part thereof. Stock balance or account certification fees incur a flat rate of $100 per account per certification request. Dormant account fees are not applicable, ensuring no charges for inactive accounts. Clients opting for a Stock Segregated Account with CCASS statement service or maintaining securities or futures accounts are subject to an account maintenance fee of HK$10 per client per month.

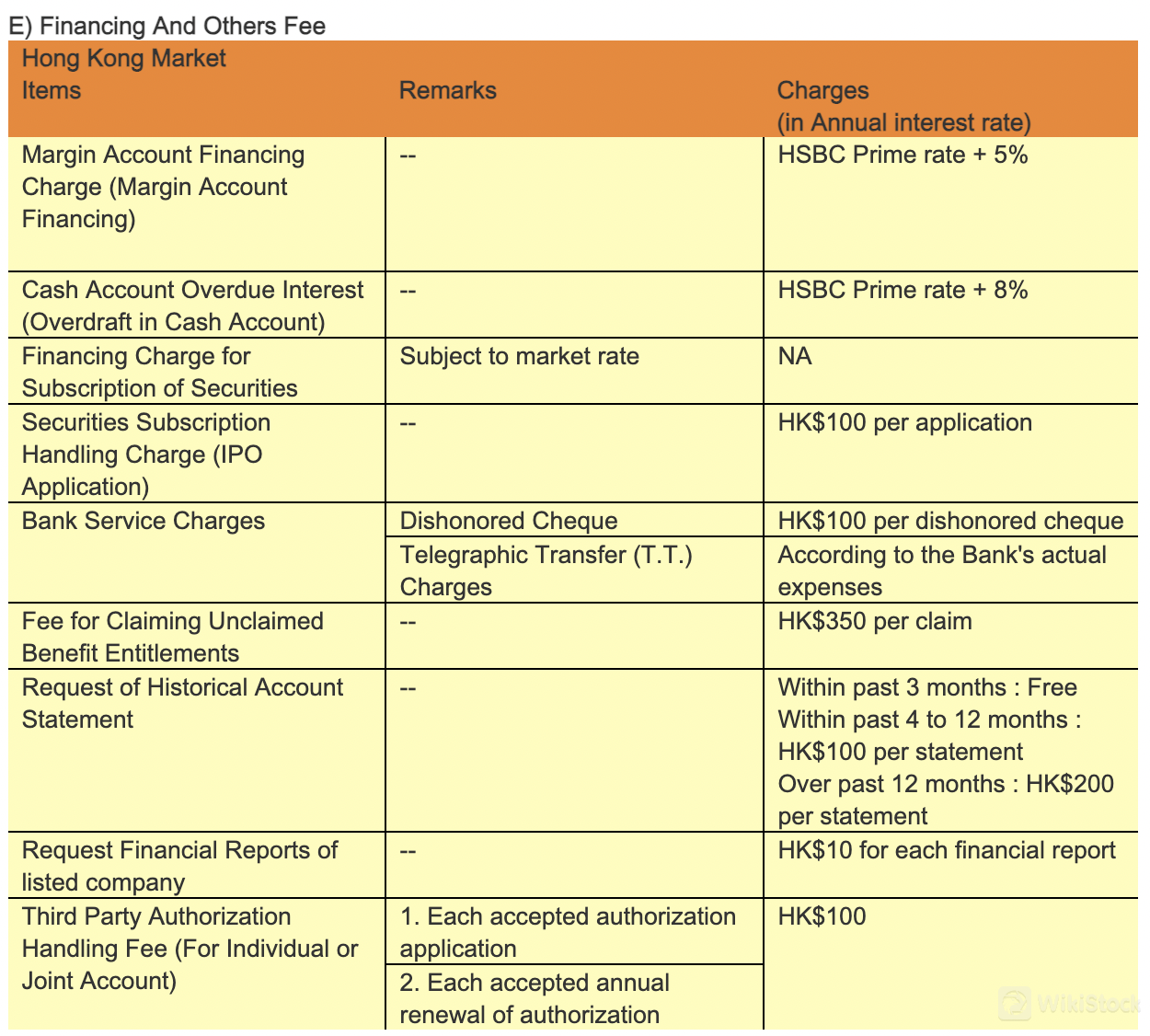

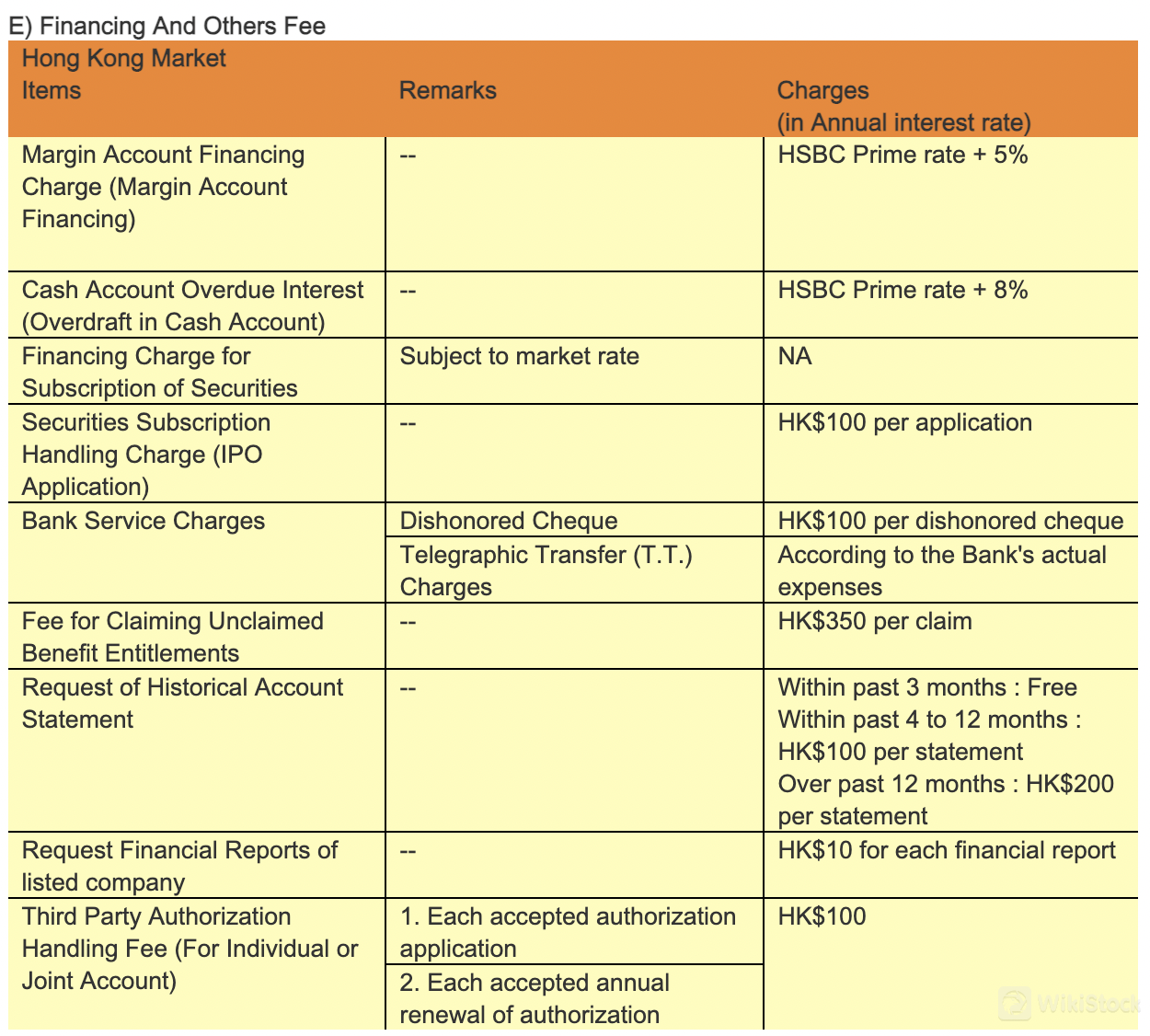

Halcyon outlines a comprehensive fee structure encompassing various financial services and administrative charges tailored for clients in the Hong Kong market. Margin account financing charges are set at HSBC Prime rate plus 5%, facilitating borrowing against securities held in margin accounts. Cash account overdue interest, applicable to overdrafts, follows HSBC Prime rate plus 8%. Financing charges for subscription of securities are subject to prevailing market rates, with a fee of HK$100 per application for IPO subscriptions. Dishonored cheques incur a fee of HK$100 per instance, while telegraphic transfers are billed according to the bank's actual expenses. Claiming unclaimed benefit entitlements involves a fee of HK$350 per claim, ensuring efficient retrieval of owed benefits. Historical account statements requested within specific timeframes incur varying charges, ranging from free for statements within the past 3 months to HK$200 per statement for records over 12 months old. Additionally, requesting financial reports of listed companies costs HK$10 per report, and third-party authorizations attract a handling fee of HK$100 per application, with annual renewals subject to the same charge.

Halcyon App Review

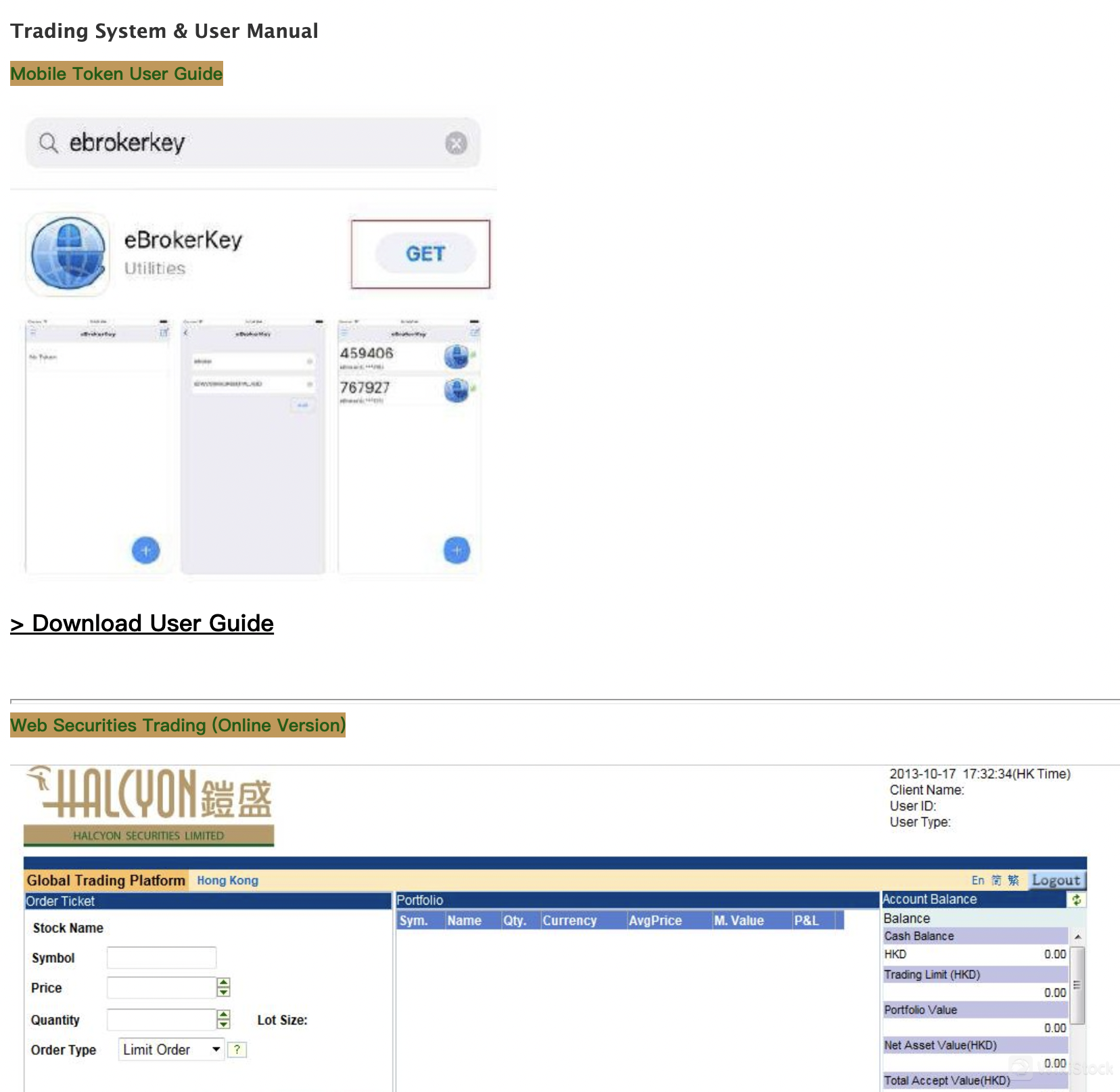

Halcyon Securities offers a versatile trading experience with its accessible platforms available on iOS and Android mobile apps, as well as web and Windows interfaces. This broad availability ensures that users can conveniently manage their investments across various devices, whether on-the-go with mobile devices or at home using desktops or laptops. The app and web platforms are designed to provide intuitive navigation and essential trading functionalities.

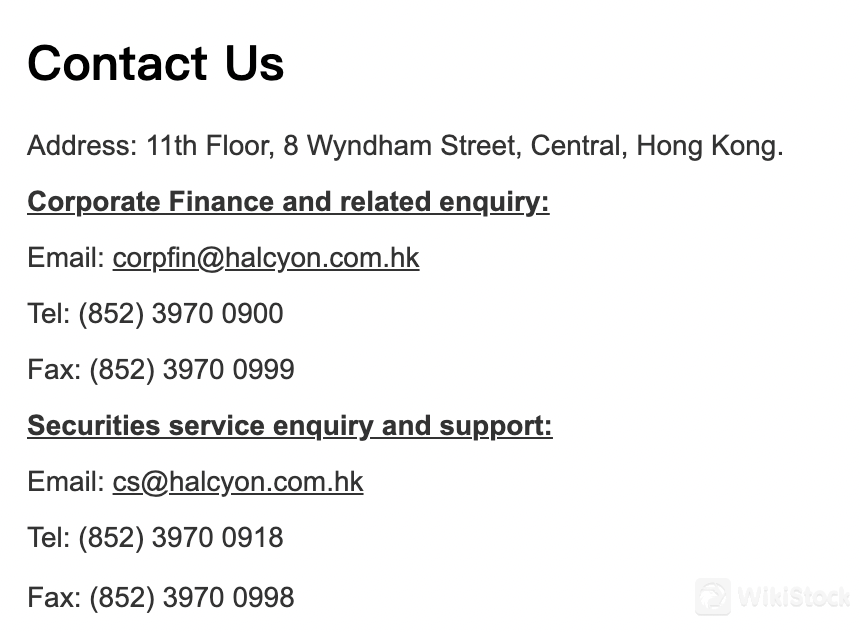

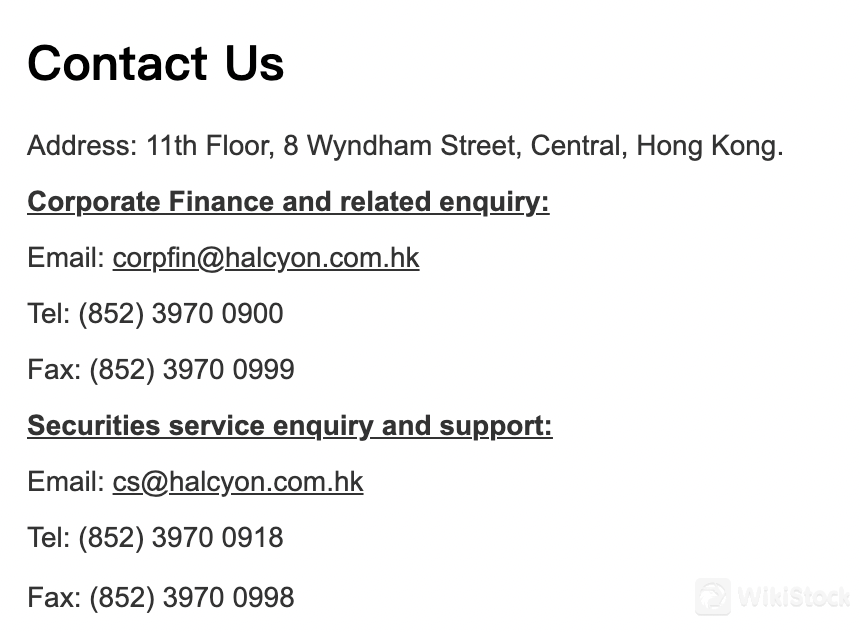

Customer Service

Halcyonprides itself on providing comprehensive customer service support to its clients.

Address: 11th Floor, 8 Wyndham Street, Central, Hong Kong.

Corporate Finance and related enquiry:

Email: corpfin@halcyon.com.hk

Tel: (852) 3970 0900

Fax: (852) 3970 0999

Securities service enquiry and support:

Email: cs@halcyon.com.hk

Tel: (852) 3970 0918

Fax: (852) 3970 0998

Conclusion

In conclusion, Halcyon Securities presents itself as a competitive option in the brokerage landscape, offering a user-friendly platform with no minimum account requirement and competitive fees for securities trading. With access available on iOS and Android mobile apps, as well as web and Windows platforms, it provides flexibility and convenience for investors. The inclusion of mutual funds and an attractive 8% interest rate on uninvested cash further enhances its appeal. While specific details on account fees are not disclosed, Halcyon Securities positions itself as a accessible choice for investors seeking a straightforward yet comprehensive trading experience across multiple devices.

FAQs

Is Halcyon safe to trade?

Halcyon Securities' safety for trading depends on several factors, including its regulatory compliance, security measures, and customer reviews. To ensure safety, potential users should verify if Halcyon is registered with relevant financial authorities, understand its security protocols for data protection, and review feedback from existing customers regarding their trading experiences and security measures.

Is Halcyon a good platform for beginners?

Halcyon Securities offers a user-friendly platform with no minimum account requirement, making it accessible for beginners. Its availability on iOS and Android mobile apps, as well as web and Windows platforms, provides convenience and flexibility. However, beginners should consider educating themselves on the platform's fee structure, trading tools, and customer support quality to determine if it meets their learning and investment needs.

Is Halcyon legit?

The legitimacy of Halcyon Securities can be verified by checking its registration with relevant financial regulatory authorities and reviewing its compliance with industry standards. Additionally, researching customer reviews and testimonials can provide insights into its reputation and reliability as a brokerage platform. Conducting thorough due diligence is essential to ensure Halcyon Securities is a legitimate and trustworthy option for investment and trading activities.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Taiwan

China TaiwanObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

--