Founded in 1991, Sunrise Brokers is a global leader in listed and OTC derivative products and has been ranked as the number one equity derivatives broker globally by Risk Magazine for the last twelve years consecutively. With offices in Europe, US and Asia, Sunrise offers broking services across equity, credit, FX, hybrid and commodity derivative asset classes, convergence analytics and execution in cash equities.

What is Sunrise?

Sunrise offers a flexible approach to account management with no specified account minimum and varying fees based on transaction types, ranging from free for certain accounts to variable fees. New accounts enjoy fee-free benefits, although specific details about interests on uninvested cash and margin interest rates are not provided. The platform does offer mutual funds, and its flagship app, MatchBox, is accessible on iOS, Android, and Web platforms. Additionally, Sunrise runs promotional offers, enhancing its appeal to potential investors seeking a diverse and accessible trading experience.

Pros and Cons of Sunrise

Sunrise offers several advantages, including no account minimum requirement and full compliance with financial regulations, ensuring a secure trading environment. The platform is accessible across various devices such as iOS, Android, Mac, Windows, and Web, enhancing convenience for users. However, some areas for improvement include the need for greater transparency regarding account fees, clarification on specific account types offered, and an expansion of the range of securities available for trading, addressing potential limitations in the platform's offerings.

Is Sunrise safe?

Sunrise is a broker-dealer registered with the China Hong Kong Securities and Futures Commission (SFC) of Hongkong.

What are securities to trade with Sunrise?

Sunrise offers diverse securities and financial services, including cash equities, commodities, credit, equity derivatives, high yield and distressed securities, hybrid instruments, and interest rates products. Their research integrates quantitative, technical, and fundamental analysis to provide cutting-edge, independent insights. Additionally, they comply with MiFID II regulations and provide services related to MSCI indexes, ensuring a comprehensive and sophisticated approach to market analysis and trading. However, Sunrise does not provide products like commodity bonds, forex, and cryptocurrencies.

- Cash Equities: Direct investment in publicly listed stocks, providing liquidity and potential for capital appreciation and dividends.

- Commodities: Investment in physical goods such as metals, energy, and agricultural products, offering diversification and a hedge against inflation.

- Credit: Investment in corporate bonds and other debt instruments, suitable for investors seeking fixed income and lower risk compared to equities.

- Equity Derivatives: Financial instruments like options and futures based on stocks, used for hedging or speculative purposes to enhance returns or manage risk.

Sunrise Service Offerings

Interest Rate:

Sunrise's Interest Rates service is a cornerstone of their comprehensive offerings, leveraging a diverse team with deep market knowledge across Europe, particularly in France, Switzerland, Italy, and Iberia. Their expertise spans various products including government bonds, covered bonds, supra-sovereign bonds, and corporate bonds, with a focus on liquidity provision, advisory services, research, and trade ideas. Additionally, Sunrise is expanding its capabilities to include Interest Rates swaps, Futures, and Options, catering to global clients while maintaining a strong presence in European and Asian markets.

High Yield and Distressed

Sunrise's High Yield and Distressed service showcases their extensive credit expertise across various jurisdictions, sectors, and companies. Their research focuses on identifying unique and undervalued opportunities, capitalizing on asset price anomalies from a relative value perspective. Particularly notable is their coverage of distressed credits, including in-depth research on entities like Lehman, Icelandic Banks, distressed shipping companies, and Del Monte Finance. They also handle larger restructuring situations in the European LBO sector and cater to bespoke client requests. Additionally, Sunrise trades a diverse range of public and private securities globally, emphasizing their comprehensive approach to high yield and distressed asset trading, primarily based in their European office.

Sunrise Platform Review

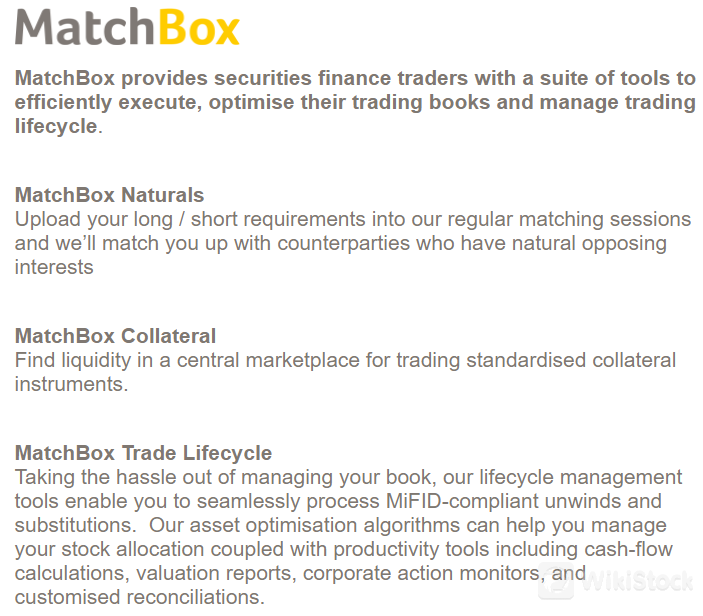

MatchBox by Sunrise offers a comprehensive suite of tools designed for securities finance traders to optimize their trading activities and manage the trading lifecycle efficiently. With MatchBox Naturals, traders can upload their long and short requirements for matching sessions with counterparties, facilitating natural opposing interests. MatchBox Collateral provides access to a central marketplace for trading standardized collateral instruments, enhancing liquidity. Additionally, MatchBox Trade Lifecycle simplifies book management with MiFID-compliant unwinds and substitutions, asset optimization algorithms, cash-flow calculations, valuation reports, corporate action monitoring, and customized reconciliations. This award-winning platform, designed by traders for traders, streamlines price negotiation, offers full trade lifecycle management, and ensures compliance with risk and regulatory requirements, enabling traders to focus on securing the best deals.

Research and Eduation

Sunrise's Research and Education platform provides up-to-date news and insights to clients, ensuring they stay informed and make well-informed decisions. The platform includes a date filter feature for easy access to historical data and trends. This dedication to excellence extends to providing valuable educational resources and market analysis, empowering clients with the knowledge needed for successful trading strategies.

Customer Service

Sunrise's Customer Support is dedicated to providing exceptional service to clients, offering direct contact through phone at +1 212 403 6900 or via email atinfoNY@sunrisebrokers.com. The support team is responsive and knowledgeable, ready to assist with inquiries, account management, technical support, and any other client needs promptly and professionally. Whether clients require assistance with trading activities, platform navigation, or regulatory compliance, Sunrise's Customer Support is committed to ensuring a smooth and efficient experience for every client.

Conclusion

Sunrise emerges as a versatile brokerage firm with notable strengths in flexibility and accessibility. Their no-account-minimum policy and variable fee structure cater to a wide range of investors, complemented by fee-free benefits for new accounts. The availability of mutual funds and the user-friendly MatchBox app across multiple platforms further enhance their appeal. However, areas for improvement include the need for greater transparency on account fees and additional details on interest rates and margin policies. Overall, Sunrise presents a promising option for investors seeking a diverse and adaptable trading experience.

FAQs

Is Sunrise safe to trade?

Yes, Sunrise is safe for trading. The platform is registered with relevant financial authorities, ensuring compliance with security standards.

Is Sunrise a good platform for beginners?

Sunrise is an excellent platform for beginners. With no minimum account balance required, a user-friendly interface, and educational resources, it provides new traders with a supportive environment to start their investment journey.

Is Sunrise legit?

Yes, Sunrise is a legitimate trading platform. It is fully regulated, complying with the rules and regulations of major financial oversight bodies. This assures users of the platform's integrity and reliability.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

France

FranceObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong

--

--

Positive

Positive