Score

方正香港金控

https://www.hkfoundersc.com/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China Hong Kong

China Hong Kong Products

2

Investment Advisory Service、Stocks

Surpassed 4.72% brokers

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01978

Brokerage Information

More

Company Name

方正證券(香港)金融控股有限公司

Abbreviation

方正香港金控

Platform registered country and region

Company address

Company website

https://www.hkfoundersc.com/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

APP Downloads

- Cycle

- Downloads

- 2024-05

- 8567

Rules: The data displayed is the downloads of the APP in one year before current time.

APP Regional Popularity

- Country/RegionDownloadsProportion

Others

336739.29%Oman

143916.80%Norway

127214.85%Finland

124814.57%Ireland

124114.49%

Rules: The data is displayed as the downloads and regional share of the APP in one year before current time.

Features of Brokerages

Commission Rate

0.20%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

| Founder Securities |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | N/A |

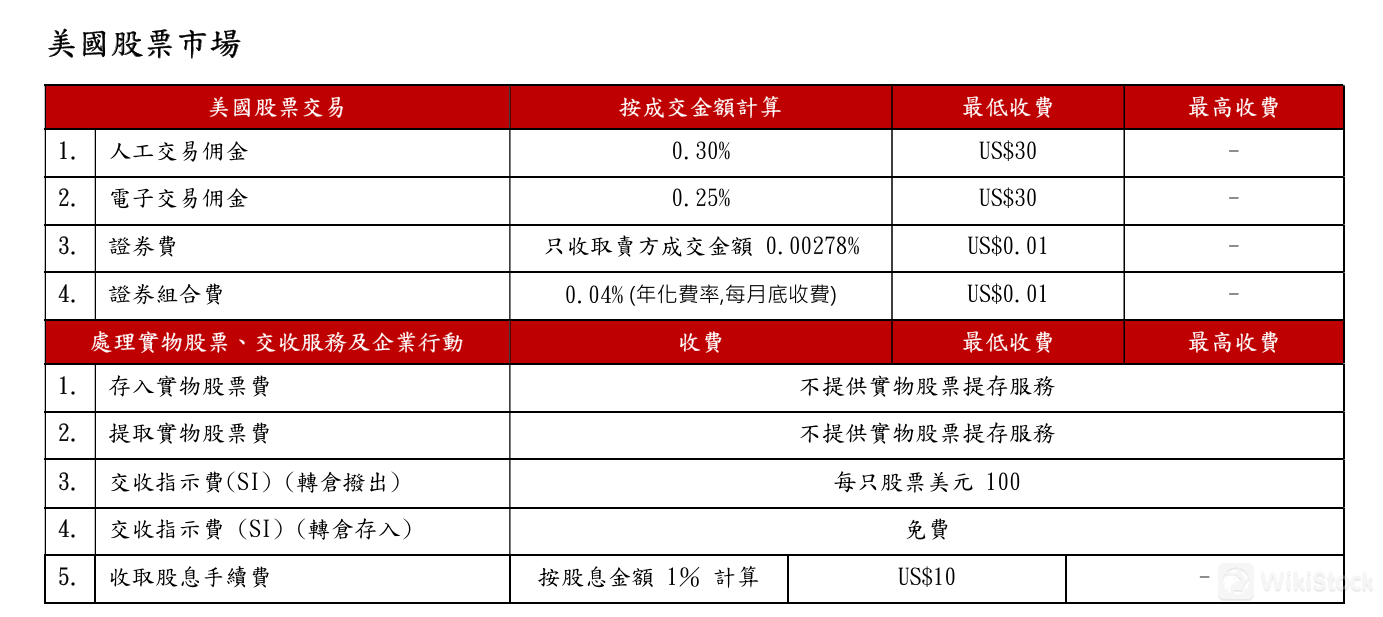

| Fees | Variable, Hong Kong Stock: commission starting at 0.25% for manual trades and 0.20% for electronic trades, with a minimum fee of HKD 75; U.S. market:commission rates at 0.30% for manual transactions and 0.25% for electronic transactions, each with a minimum fee of USD 30; Taiwan: commission for non-online trades is 0.30%, with a minimum fee of TWD 1,500 |

| Mutual Funds Offered | No |

| App/Platform | Web, desktop and mobile app |

| Promotions | Not available yet |

Founder Securities Information

HK Founder Securities, headquartered in Hong Kong, offers a diverse range of financial services and investment opportunities. As a subsidiary of Founder Group, a prominent financial conglomerate in China, the broker provides access to a variety of securities including stocks, bonds, and structured products. HK Founder Securities seeks to cater to both individual and institutional investors.

The broker prides itself on its integrated financial services, which include asset management and securities trading. With a strong focus on customer satisfaction, HK Founder Securities offers personalized investment advisory services and a robust trading platform.

Pros and Cons of Founder Securities

HK Founder Securities offers a broad array of financial services and investment opportunities, making it a versatile option for both individual and institutional investors. The broker is well-regulated, holding a license from The China Hong Kong Securities and Futures Commission (SFC), which ensures compliance with stringent regulatory standards. Additionally, the broker's commitment to security, demonstrated through advanced safety measures like SSL encryption and two-factor authentication (2FA), ensures a secure trading environment.

Despite its many strengths, HK Founder Securities has some notable drawbacks. One significant issue is the lack of transparency regarding account types. While the broker provides a robust trading platform, the absence of detailed information on its functionalities and capabilities might leave prospective users uncertain about its suitability for their trading needs. Moreover, the broker's educational resources, although helpful, could benefit from more diverse and advanced materials to better support traders at different levels of expertise.

| Pros | Cons |

| Regulated by SFC | Lack of clear information on account types |

| Wide range of investment opportunities | Limited information on the functionalities and capabilities of the trading platform |

| Segregated client funds for added safety | Educational resources could be more extensive |

| User-friendly trading platform |

Is Founder Securities safe?

Regulations

Founder Securities is officially licensed and regulated by The China Hong Kong Securities and Future Commission (SFC) under license number BEC725.

Funds Safety

HK Founder Securities places a high priority on the safety of client funds. The broker adheres to stringent regulatory requirements set by the Securities and Futures Commission (SFC) of Hong Kong, ensuring that all client funds are kept in segregated accounts. This segregation prevents the company from using client funds for its operational activities, providing an additional layer of protection. Furthermore, HK Founder Securities is a member of the Investor Compensation Fund, which offers an extra level of security for investors.

Safety Measures

To safeguard clients' personal and financial information, HK Founder Securities employs a range of advanced security protocols. The broker uses SSL encryption to secure data transmissions between clients and its servers, ensuring that sensitive information remains confidential. Additionally, robust authentication procedures, including two-factor authentication (2FA), are implemented to prevent unauthorized access to client accounts. Regular security audits and vulnerability assessments are conducted to identify and mitigate potential threats, maintaining a secure trading environment.

What are securities to trade with Founder Securities?

HK Founder Securities provides access to a wide array of securities, catering to various investment needs. Heres a detailed overview:

- Stocks: Clients can trade a broad range of stocks listed on major global exchanges, including those in Hong Kong, the United States, and Mainland China. The broker supports trading through the Stock Connect programs (Shanghai-Hong Kong and Shenzhen-Hong Kong), which allow direct market access between Hong Kong and Mainland China. This wide selection enables investors to diversify their portfolios across different markets and sectors.

- Bonds: For fixed-income investors, HK Founder Securities offers a variety of bonds, including government and corporate bonds. These securities provide opportunities for stable returns and are suitable for risk-averse investors looking for steady income streams. The broker also offers access to high-yield bonds, which, while riskier, can offer higher returns.

- Structured Products: HK Founder Securities provides a range of structured products designed to meet specific investment objectives and risk profiles. These products often combine different financial instruments, such as stocks, bonds, and derivatives, to create customized investment solutions. They can offer enhanced returns or capital protection, depending on the structure.

Founder Securities Fees Review

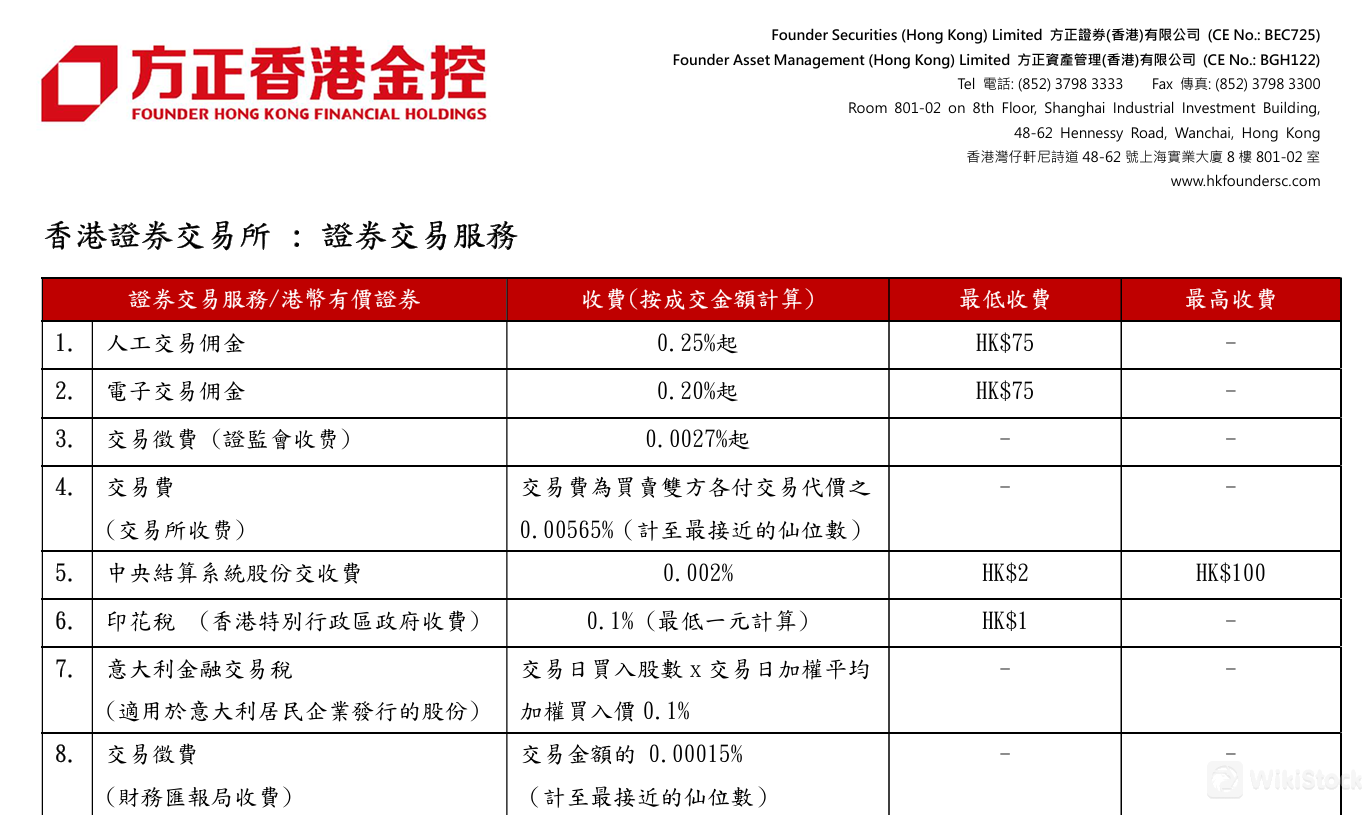

HK Founder Securities offers a extensive fee structure for trading across various markets, including Hong Kong, the United States, and Taiwan. For securities trading on the Hong Kong Stock Exchange, the broker charges a commission starting at 0.25% for manual trades and 0.20% for electronic trades, with a minimum fee of HKD 75. Additional costs include a trading fee of 0.00565%, a transaction levy of 0.0027%, and a stamp duty of 0.1%, with a minimum of HKD 1.

For trading in the U.S. market, HK Founder Securities sets its commission rates at 0.30% for manual transactions and 0.25% for electronic transactions, each with a minimum fee of USD 30. Additionally, a securities fee of 0.00278% is applied to the sales side, with a minimum of USD 0.01. The securities portfolio fee is 0.04% annually, calculated and charged monthly.

In Taiwan, the commission for non-online trades is 0.30%, with a minimum fee of TWD 1,500. Sales transactions are subject to a sales tax of 0.3%. Additionally, each trade incurs a transaction fee of TWD 1,500. A handling fee for trade instructions is applicable, set at TWD 30 for transactions up to TWD 2 million, with an additional TWD 10 for every TWD 1 million above that threshold.

Founder Securities App Review

HK Founder Securities offers a robust trading platform designed to meet the needs of both novice and experienced traders. The platform provides a user-friendly interface with advanced features such as real-time market data, charting tools, and customizable dashboards. It supports trading across multiple asset classes, including stocks, bonds, futures, and ETFs. The platform is accessible via desktop and mobile devices, ensuring clients can trade on the go. Additionally, the broker offers a range of order types and execution options, enabling traders to implement their strategies effectively.

Research and Education

Founder Securities offers a variety of research and educational resources to support its clients.

- Investment Academy: This brokager provides basic knowledge about stock, bond, and investment school.

- FAQs: Founder Securities also offers a FAQ section to answer questions about account management and trading notice.

Customer Service

Founder Securities prides itself on providing excellent customer service. Clients can reach the support team through various channels, including email(cs@hkfoundersc.com), phone(+852-3798-1599), and a message box on their website. The customer service team is responsive and knowledgeable, assisting clients with any issues they may encounter. This high level of support ensures that clients can resolve their problems efficiently and continue trading with minimal disruptions.

Conclusion

HK Founder Securities, a subsidiary of the renowned Founder Group, offers a diverse range of financial services and investment opportunities, including stocks, bonds, and structured products. The broker's strong regulatory compliance with the SFC and advanced security measures ensure a high level of safety for client funds and personal information. However, the lack of transparency regarding account types and detailed information on trading platform functionalities may be a drawback for potential clients.

FAQs

Is Founder Securities a regulated broker?

Yes, Founder Securities is regulated by the China Hong Kong Securities and Future Commission (SFC), ensuring compliance with strict financial standards and oversight.

What securities can I trade with Founder Securities?

Clients can trade a variety of securities, including stocks, bonds, structured products.

How can I contact HK Founder Securities customer service?Clients can reach the customer service team via email at cs@hkfoundersc.com or by phone at +852-3798-3333.

Risk Warning

WikiStock's expert assessment of the brokerage's website data is subject to change and should not be taken as financial advice. Online trading carries substantial risks, including the potential loss of all invested capital, and it's crucial to fully understand these risks before investing.

Others

Registered region

China Hong Kong

Years in Business

5-10 years

Products

Investment Advisory Service、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

Matrix Securities

Score

NG

Score

興旺證券

Score

ZSL

Score

Cornerstone Securities

Score

UCI

Score

GSL

Score

Huayu Securities

Score

Chelsea Securities

Score

West Bull

Score