Patrons Securities Limited is licensed to carry out regulated activities of Type 1 for Dealing in Securities and Type 4 for Advising on Securities under the Securities and Futures Ordinance (CE Number.: BPQ161). It is committed to providing the most professional, stable and secure financial services to act as a bridge of a close financial relationship between Hong Kong and mainland.

Patrons Securities Information

Patrons Securities offers a flexible investment platform with no specified account minimum, making it accessible to a wide range of investors. Fees vary based on the type of transaction, with some accounts being free, while commissions start at a minimum of USD $3. New accounts enjoy fee-free setup. Interest on uninvested cash and margin interest rates are not specified, and the platform does not offer mutual funds. Patrons Securities provides a robust trading experience through its app, available on iOS, Android, and web platforms, ensuring convenient access for all users.

Pros and Cons of Patrons Securities

Patrons Securities has several advantages, including being regulated by the SFC and complying with financial regulations, which ensures a secure trading environment. The platform offers a variety of asset types and is accessible on multiple devices, including iOS, Android, Mac, Windows, and web, providing flexibility for users. However, the fee structure can be complex, and information regarding interest on uninvested cash and margin interest rates is not specified, which may pose challenges for investors seeking clarity on these aspects.

Is Patrons Securities safe?

Regulation

Patrons Securities Limited is a broker-dealer registered with the Securities and Futures Commission (SFC) of Hong Kong.

Segregated Client Accounts: PSL holds client funds in segregated accounts separate from the company's own assets, safeguarding them in case of PSL's insolvency.

Investor Compensation Scheme (ICS) Participation: PSL participates in the SFC's Investor Compensation Scheme (ICS), providing protection of up to HK$1,000,000 per investor in the event of PSL's insolvency.

Internal Security Measures: PSL implements internal security measures to protect client funds and data, including a secure trading platform, data encryption, and risk management protocols.

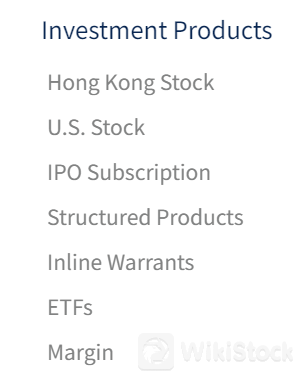

What are securities to trade with Patrons Securities?

Patrons Securities offers a diverse range of investment products to meet the varied needs of investors. Clients can trade Hong Kong and U.S. b, participate in IPO subscriptions, and invest in structured products and inline warrants. Additionally, Patrons Securities provides access to ETFs and margin trading, enabling clients to leverage their positions and maximize potential returns. This comprehensive suite of securities ensures that investors have the tools and options needed to build a well-rounded portfolio.

Stocks: Direct investment in publicly listed companies, suitable for investors seeking capital appreciation and dividends.

ETFs: Funds that invest in a variety of assets, typically tracking a specific index, offering immediate market exposure and liquidity.

Annuities: A long-term retirement investment product that offers periodic income, suitable for risk-averse conservative investors.

Patrons Securities Accounts

Patrons Securities offers two primary types of accounts: Individual and Corporate. The Individual Account is designed for personal investment needs, providing direct access to a wide range of financial instruments and trading options. The Corporate Account caters to businesses, offering comprehensive services to manage corporate investments efficiently. Both account types ensure secure access and robust support, tailored to meet the distinct needs of individual investors and corporate entities.

Patrons Securities Fees Review

Commission: USD 0.015 per share (minimum USD 3)

SEC Fees: 0.0008% of trade value (minimum USD 0.01). Charged by the U.S. Securities and Exchange Commission (SEC) for sell transactions only. Fee rate subject to change based on SEC policy.

Trading Activity Fee (TAF): USD 0.00013 per share (minimum USD 0.01, maximum USD 6.49). Charged by the Financial Industry Regulatory Authority (FINRA) for sell transactions during winter time (Hong Kong Time: 10:30 PM - 5:00 AM).

Clearing Fees: USD 0.003 per share (minimum USD 0.01). Charged by NSCC/DTC.

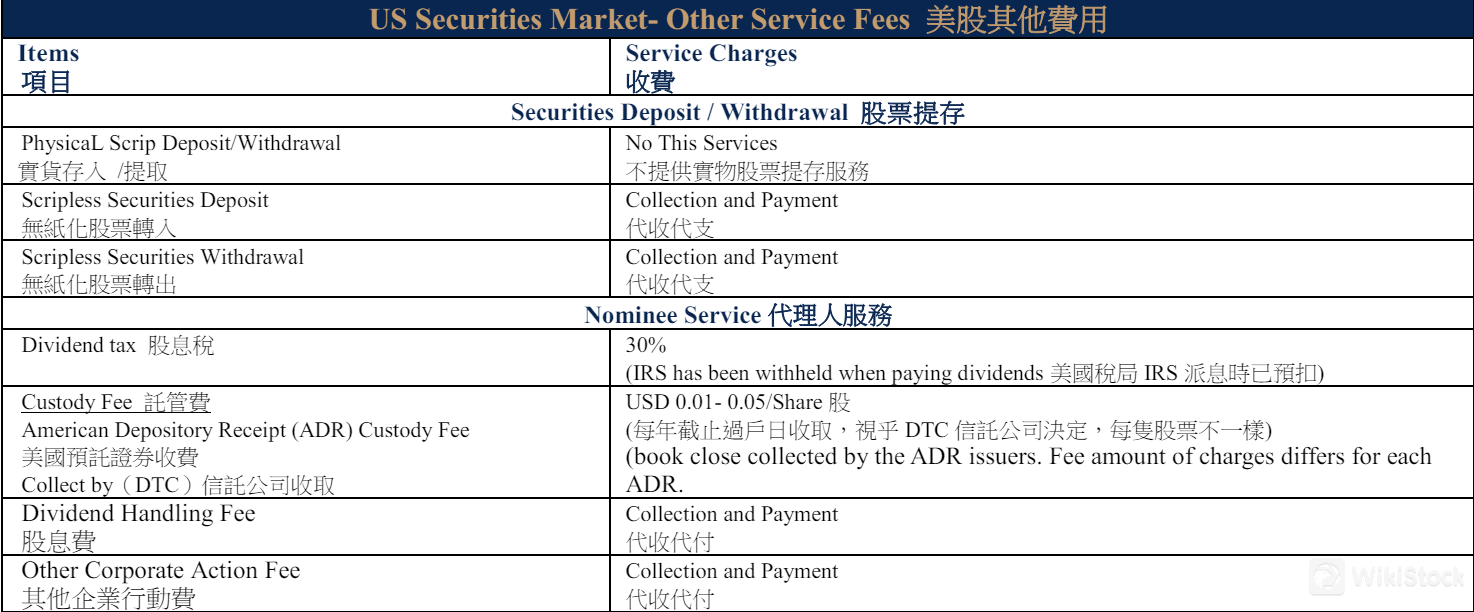

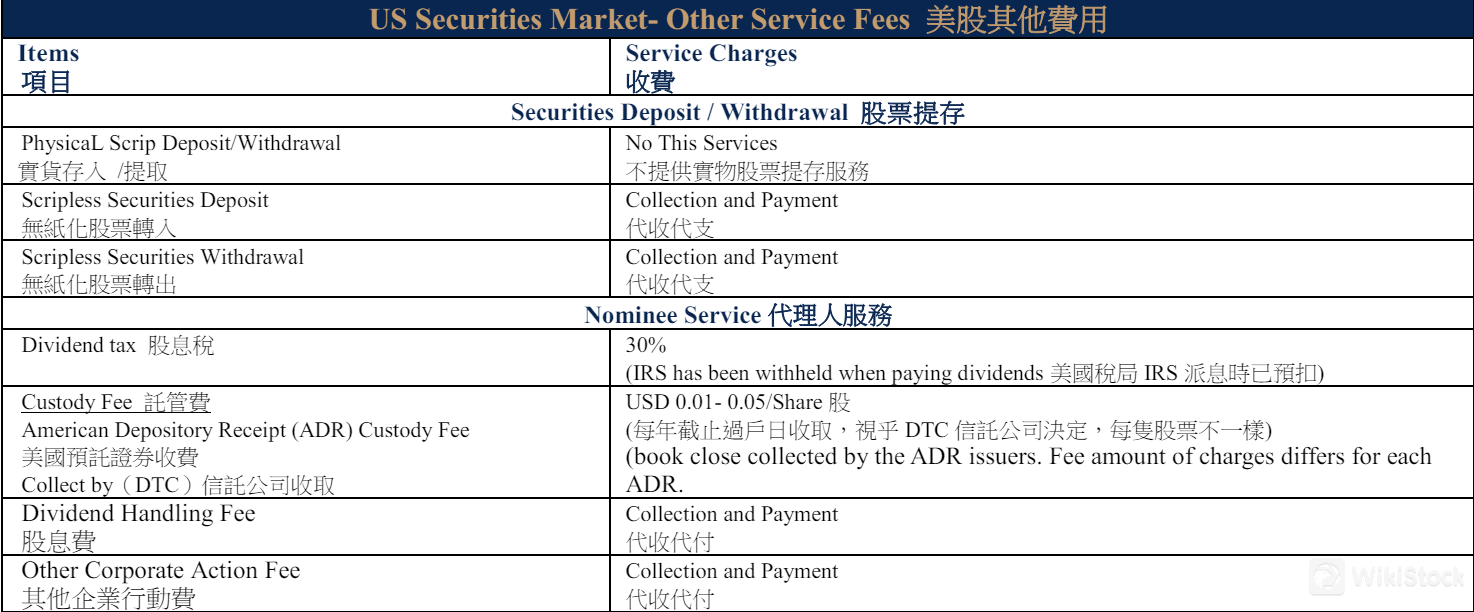

Nominee Service

Dividend tax - 30% (Note: IRS has been withheld when paying dividends

Custody Fee - USD 0.01-0.05/Share

American Depository Receipt (ADR) Custody Fee - (Annually collected by the DTC depository ) (Note: book close collected by the ADR issuers. Fee amount of charges differs for each ADR.

Patrons Securities App Review

Patrons Securities offers a versatile and user-friendly app available on iOS, Android, Mac, Windows, and web platforms. The app provides a seamless trading experience, enabling investors to manage their portfolios and execute trades from any device. With its intuitive design and robust functionality, the Patrons Securities app ensures that users can access market information, track investments, and perform transactions efficiently and conveniently.

Research and Education

Patrons Securities provides extensive research and education services, including timely Company News Notices. These notices deliver critical updates on market trends, financial news, and corporate developments, empowering investors with the information needed to make informed decisions. Through these resources, Patrons Securities ensures that clients stay well-informed about the latest market dynamics and company-specific events.

Customer Service

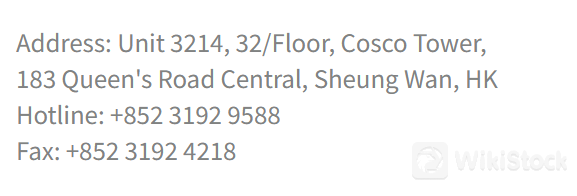

Patrons Securities offers robust customer support through multiple channels to address client inquiries and concerns efficiently. Clients can reach the support team via a dedicated hotline at +852 3192 9588 for immediate assistance or send documents and requests via fax at +852 3192 4218. This multi-channel approach ensures that clients receive prompt and effective support for all their needs.

Conclusion

In conclusion, Patrons Securities stands out for its regulatory compliance with the SFC and its diverse range of asset offerings, making it a secure and versatile choice for investors. The platform's accessibility across various devices, including iOS, Android, Mac, Windows, and web, ensures convenience and flexibility. It is well-suited for investors seeking a regulated and comprehensive trading platform, despite the complexities in its fee structure and unspecified interest rates.

FAQs

Is Patrons Securities safe to trade?

Yes, Patrons Securities is safe to trade as it is regulated by the Securities and Futures Commission (SFC) and complies with financial regulations, ensuring a secure trading environment for investors.

Is Patrons Securities a good platform for beginners?

Patrons Securities can be a good platform for beginners due to its user-friendly app available on multiple devices and the absence of an account minimum. However, beginners should be aware of the complex fee structure and seek clarity on transaction fees.

Is Patrons Securities legit?

Yes, Patrons Securities is a legitimate platform. It is regulated by the SFC, adhering to strict financial regulations and industry standards.

Is Patrons Securities good for investing/retirement?

Patrons Securities offers a diverse range of investment products, making it suitable for various investment strategies, including long-term investing and retirement planning. However, potential investors should consider the unspecified interest rates on uninvested cash and margin trading before making a decision.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)