China International Securities is a corporation licensed by the Securities and Futures Commission of Hong Kong to provide Type 1 Dealing in Securities regulated activities and the Hong Kong Exchange as an Exchange Participant.

What is CIS?

China International Securities (CIS), operating under the regulatory oversight of the SFC, provides a trading platform for both individual and corporate clients. All financial transactions, including cash withdrawals, strictly adhere to regulatory standards, ensuring funds are deposited exclusively into the account owner's designated bank account. However, there is limited information available regarding fees and charges associated with services.

Pros & Cons of CIS

Pros: Regulated by SFC: Operating under the oversight of the Securities and Futures Commission (SFC) ensures that CIS maintains high regulatory standards, fostering trust and reliability among clients.

Flexibility in Account Options: CIS offers various account options, catering to the diverse needs of both individual and corporate clients, enhancing flexibility and convenience in managing funds.

Convenient Deposit and Withdrawal Mechanisms: CIS provides convenient options for depositing and withdrawing funds, ensuring ease of access and smooth financial transactions for clients.

Cons: Restricted Withdrawal Policy: CIS's policy of restricting cash withdrawals to designated bank accounts limits flexibility for clients, particularly those needing to withdraw funds to third-party accounts.

Limited Transparency on Fees, Products, and Services: While CIS prioritizes operational transparency, there is limited information available regarding fees, products, and services, potentially causing confusion for clients.

Lack of Protective Measures: CIS lacks certain protective measures for clients, potentially exposing them to risks such as insufficient investor protection or inadequate safeguards against fraudulent activities.

Is CIS Safe?

China International Securities (CIS) operates under the oversight of the Securities and Futures Commission (SFC) of Hong Kong, holding License No. BHY490. The SFC, as a pivotal regulatory body in one of the world's leading financial centers, plays a crucial role in enhancing and safeguarding the integrity and stability of Hong Kong's securities and futures markets. Its primary mission is to fortify investor protection and uphold the robustness of the financial industry.

By regulating entities like CIS, the SFC ensures that they adhere to stringent standards of conduct, transparency, and operational efficiency. This oversight is pivotal in fostering trust and confidence among investors, both local and international, who participate in Hong Kong's dynamic financial ecosystem. Through continuous monitoring, regulatory frameworks, and enforcement of laws, the SFC mitigates risks, promotes fair market practices, and fosters sustainable growth within the securities and futures sectors.

CIS Platforms Review

China International Securities (CIS) offers China International Securities trading platform. China International Securities (CIS) prides itself on offering a cutting-edge trading platform tailored to meet the diverse needs of its clientele. At the heart of CIS's service is its sophisticated and user-friendly trading platform, designed to provide clients with seamless access to global financial markets. Whether clients prefer trading on-the-go via mobile applications or through the convenience of online channels, CIS ensures they can execute trades swiftly and efficiently.

The CIS trading platform distinguishes itself through its intuitive interface and robust functionality. It equips clients with essential tools to monitor market trends, analyze real-time data, and execute trades promptly and securely. The platform supports a variety of order types and integrates comprehensive market research capabilities, empowering clients to make informed investment decisions. It can be downloaded via Apple Store, Google Store and APK Android Store.

CIS Accounts Review

China International Securities (CIS) provides both individual and corporate account options.

For individual investors, CIS offers a straightforward account opening process designed to be convenient and quick. Clients have the flexibility to initiate account setups through multiple channels, including online platforms, visits to CIS offices, or by mail. This accessibility ensures that individuals can choose the method that best suits their preferences and schedule.

Once accounts are established, individual clients benefit from access to CIS's comprehensive trading platform. This platform is renowned for its user-friendly interface and robust functionality, empowering users to monitor market trends, conduct real-time analyses, and execute trades seamlessly. Clients can utilize various order types and leverage integrated market research tools to make informed investment decisions confidently.

Corporate clients also enjoy tailored account management solutions from CIS. The firm understands the unique requirements of businesses and offers specialized support to facilitate corporate account openings. This includes personalized consultations to align account features with corporate financial strategies and goals.

CIS Deposit & Withdrawal Review

China International Securities (CIS) offers a variety of convenient options for depositing and withdrawing funds to and from client accounts.

Deposit Options:

Local Bank Transfer & Telegraphic Transfer:

Clients can deposit funds into CIS accounts through local bank transfers or international telegraphic transfers. They can use designated banks such as Bank of China (Hong Kong) Limited, DBS Bank (Hong Kong) Limited, and ICBC(Asia) Limited. Its essential to include the client account number or full name in the remarks column of the deposit slip and submit a copy to CIS for timely processing.

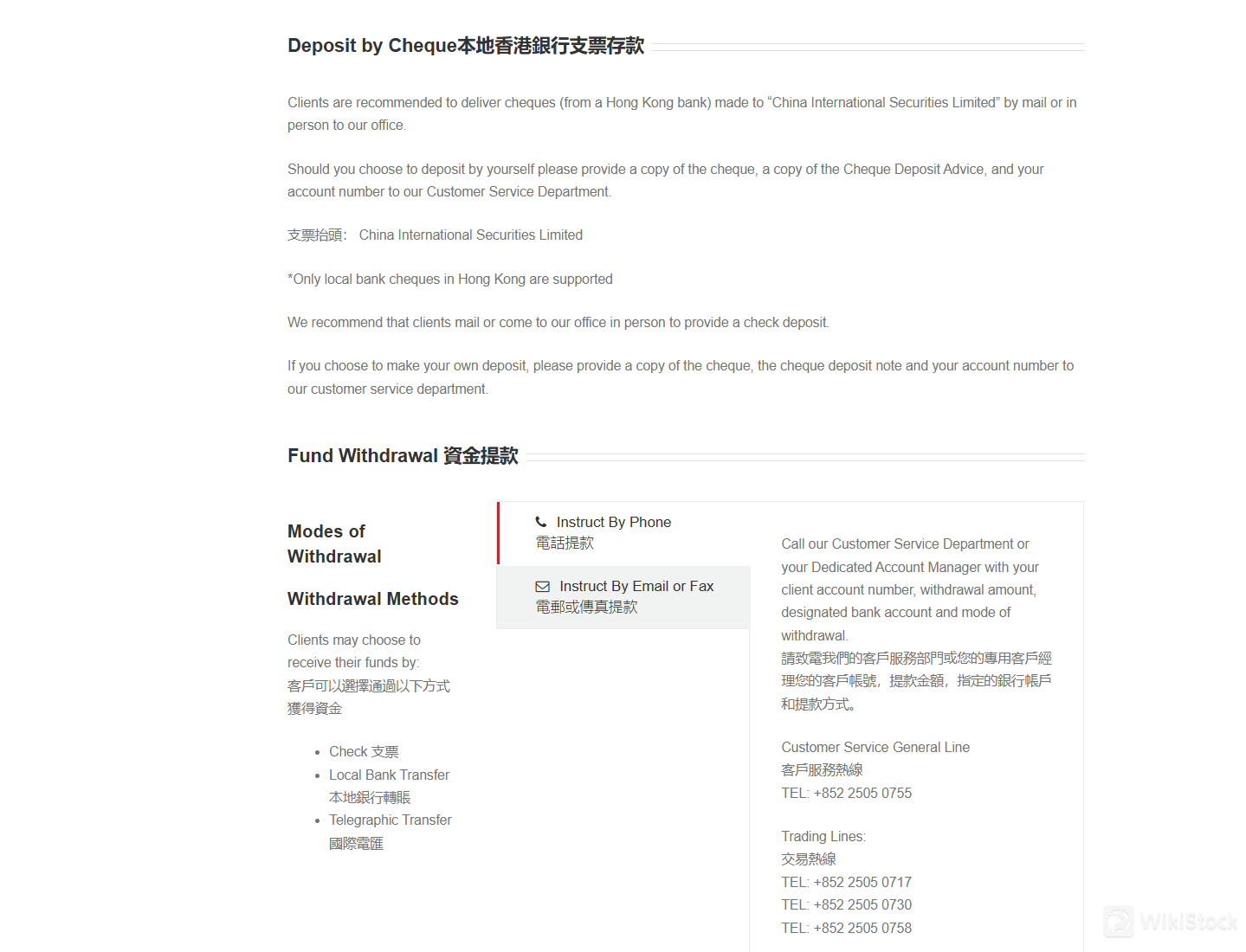

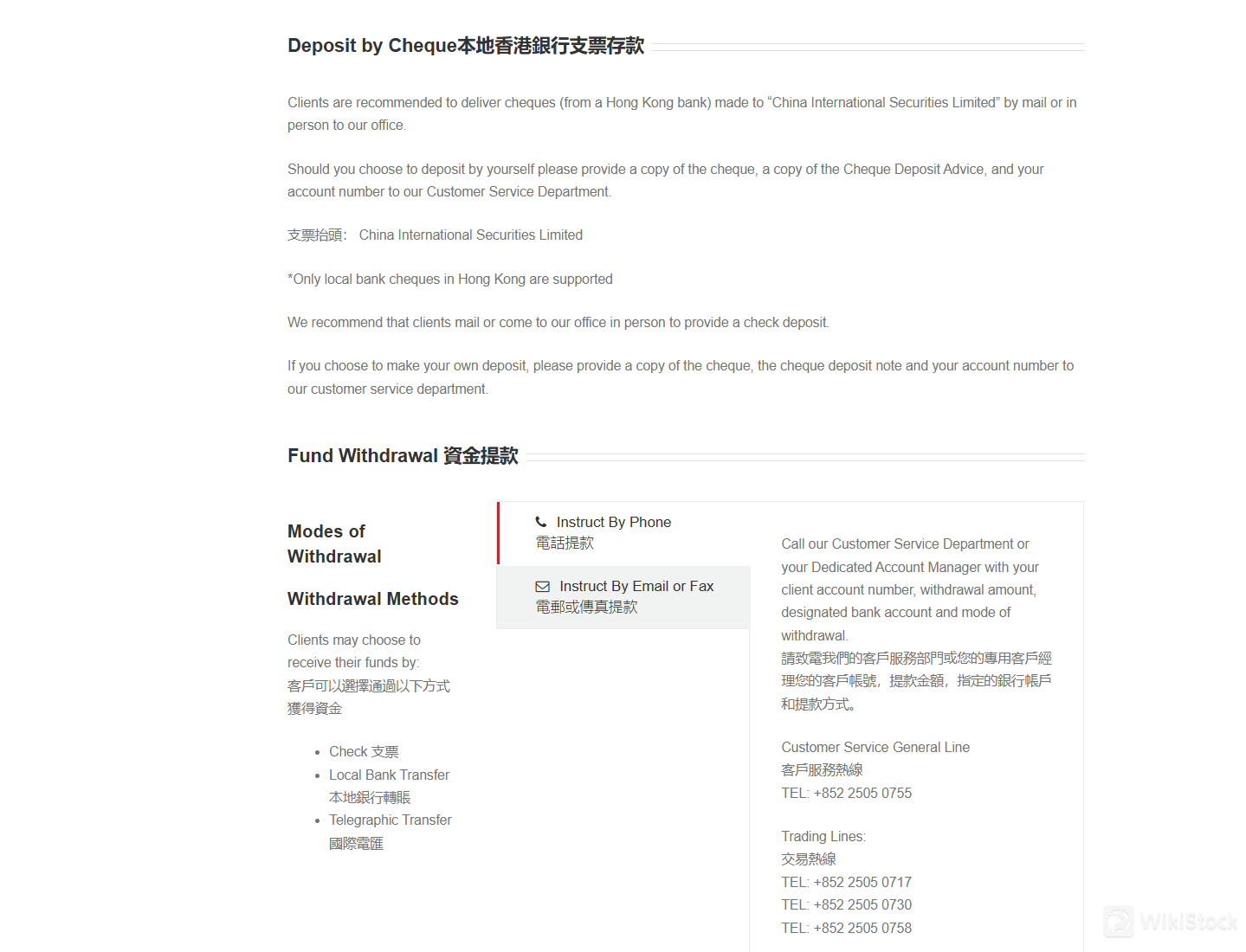

Deposit by Cheque:

Clients can deposit Hong Kong bank cheques made out to “China International Securities Limited” either by mail or in person at CIS offices. They need to provide a copy of the cheque, Cheque Deposit Advice, and their account number for processing.

Withdrawal Options:

Cheque: Clients can request withdrawals by cheque.

Local Bank Transfer:

Funds can be transferred directly to a local bank account in Hong Kong.

Telegraphic Transfer:

International withdrawals can be processed via telegraphic transfer.

Instructions by Phone, Email, or Fax:

Clients can instruct withdrawals by contacting CISs Customer Service Department or their Dedicated Account Manager. They need to provide their client account number, withdrawal amount, designated bank account details, and preferred withdrawal method.

Customer Service

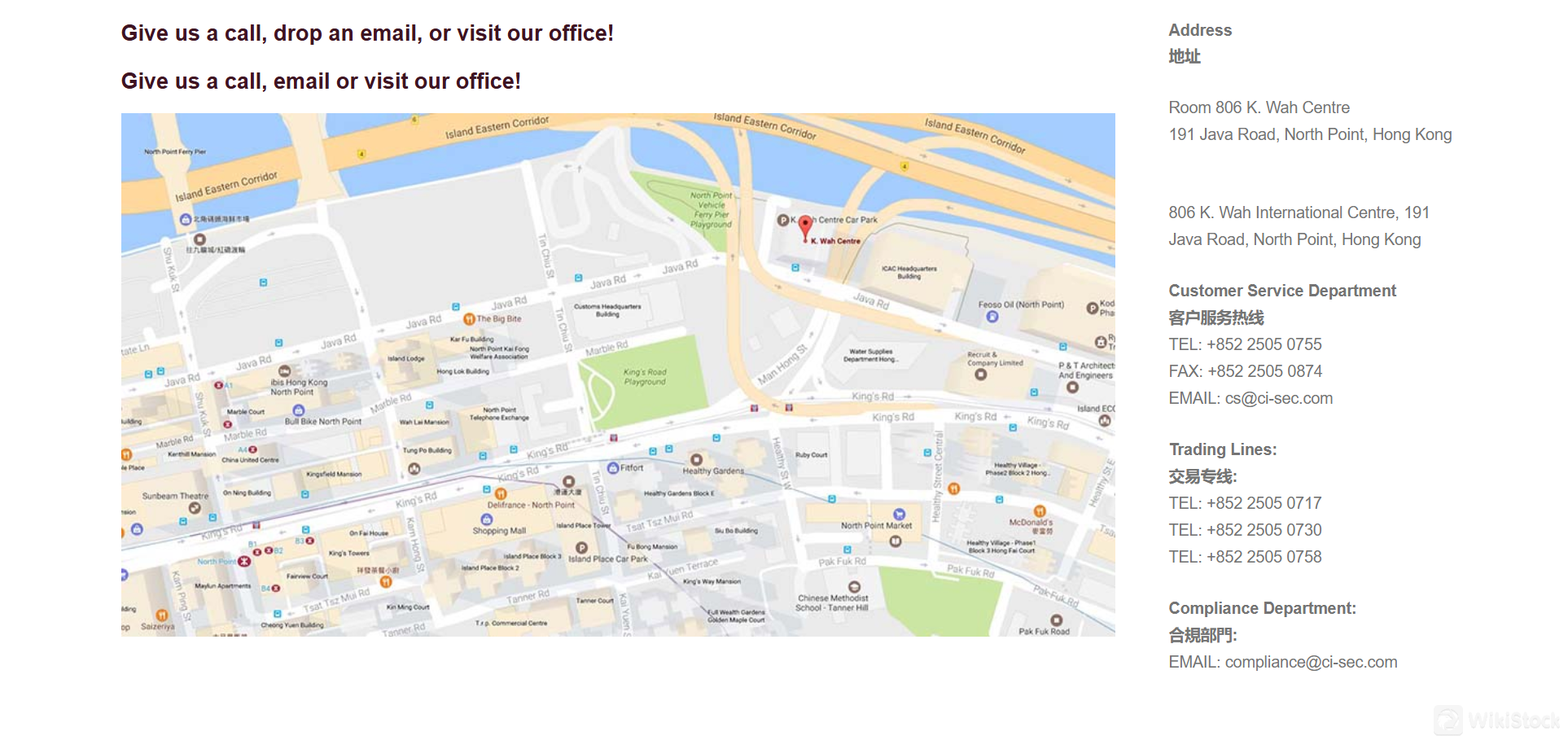

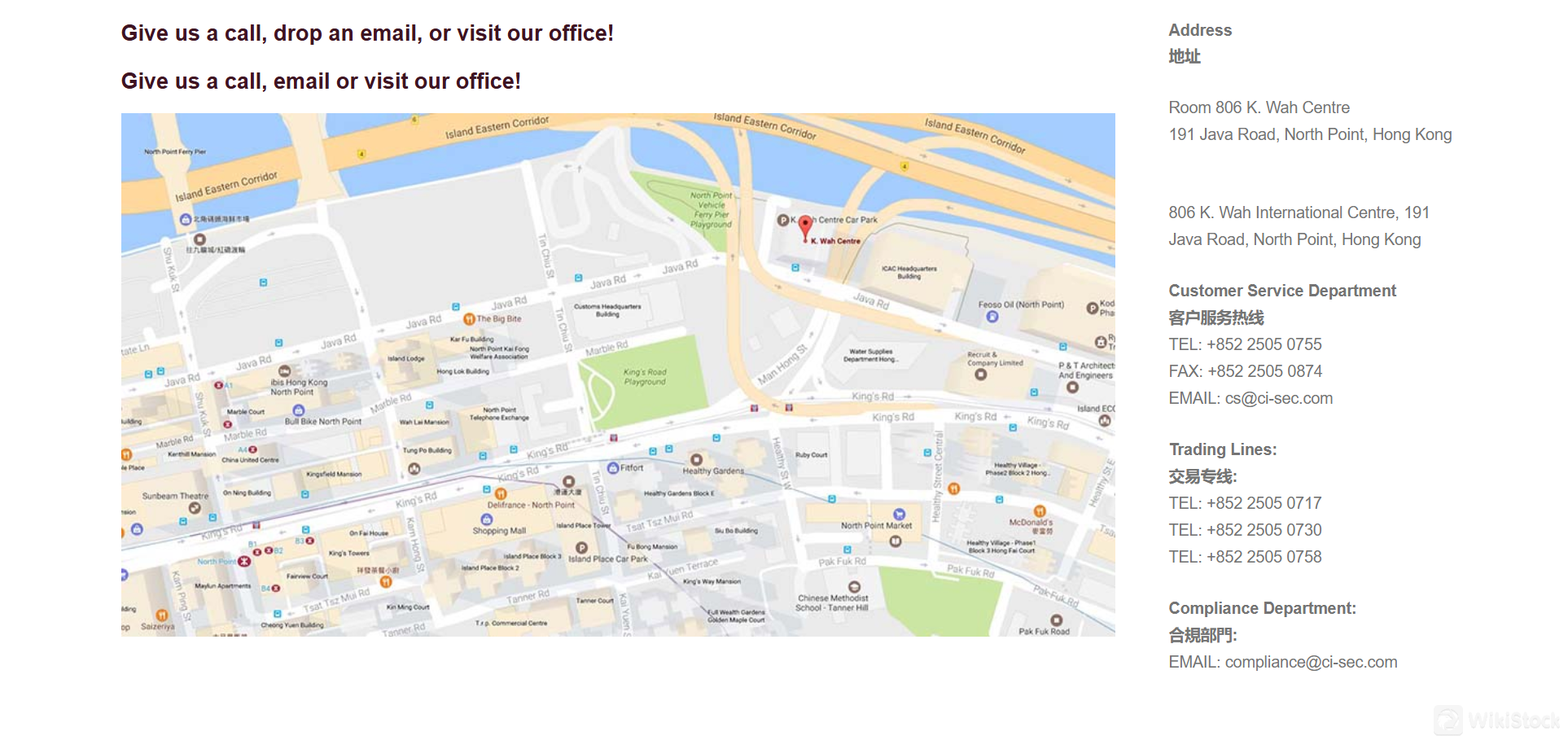

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +852 2505 0755

FAX: +852 2505 0874

Email: cs@ci-sec.com

Address: Room 806 K. Wah Centre, 191 Java Road, North Point, Hong Kong

Conclusion

In conclusion, CIS operates within Hong Kong's (SFC, ensuring adherence to high regulatory standards. CIS stands out for its trading platform, offering diverse account options that cater to both individual and corporate clients' needs. With convenient deposit and withdrawal mechanisms and responsive customer support channels, CIS prioritizes client convenience and satisfaction.

However, challenges include a restricted withdrawal policy that limits flexibility, potential gaps in transparency regarding fees and services, and concerns about the adequacy of protective measures for clients.

Frequently Asked Questions (FAQs)

Is CIS regulated?

Yes. It is regulated by SFC.

What are platforms offered by CIS?

It provides the China International Securities trading platform.

How can I contact CIS?

You can contact via telephone: +852 2505 0755, fax: +852 2505 0874 and email: cs@ci-sec.com.

Can the cash withdrawn be deposited to any third partys bank account?

No. Cash withdrawals must be deposited to the accounts beneficial owners only.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)