VMI Securities Limited (hereinafter referred to as "VMI Securities") is a licensed corporation (CE number: BIG265) approved to engage in Category 1 (Securities Trading) regulated activities under the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). VMI Securities adheres to the concept of "VMI Securities, Creating Value" and provides customers with diversified local and global securities trading channels based on the Hong Kong International Financial Center.

VMI Securities Review

What is VMI Securities?

VMI Securities, established in May 2016, is a licensed corporation under SFC. The company caters to diverse investment objectives with a range of financial products, including Hong Kong stocks via the Shanghai-Hong Kong Stock Connect, bonds for stable returns and risk management, structured products, unicorn block trading, and derivatives services.

Pros & Cons of VMI Securities

Pros: Regulated by SFC: Being regulated by the SFC ensures that VMI Securities operates under strict guidelines, providing a level of security and reliability for investors.

Wide Range of Financial Products: VMI Securities offers offers a comprehensive range of financial products including Hong Kong stocks via Shanghai-Hong Kong Stock Connect, bond products, structured products, unicorn block trading, and derivatives services. This variety allows clients to diversify their investments according to their financial goals.

Clear Fee Structure: Transparency in fee structures helps investors understand the costs associated with trading or investing through VMI Securities.

Cons: Limited Deposit Options: Only two banks (Bank of China and DBS Bank) are mentioned for depositing funds into accounts.

Is VMI Securities Safe?

VMI Securities operates under the regulatory oversight of the Securities and Futures Commission (SFC), holding License No. BIG265. The SFC, a pivotal financial regulator within a global financial hub, plays a crucial role in upholding the integrity and stability of Hong Kong's securities and futures markets. Its mandate extends to safeguarding investor interests and fostering a fair and transparent marketplace conducive to sustainable industry growth.

As part of its regulatory framework, the SFC imposes stringent standards aimed at maintaining market integrity and investor protection. These standards encompass comprehensive monitoring and enforcement activities across various financial entities, including securities firms like VMI Securities .

What are Securities to Trade with VMI Securities?

VMI Securities offers a variety of financial products tailored to diverse investment objectives. In addition to Hong Kong stocks available via the Shanghai-Hong Kong Stock Connect, the firm provides a range of bond products designed to stabilize returns and manage investment risks effectively. These bonds offer trading flexibility and include comprehensive nominee services for activities such as interest collection, rights exercises, maturity redemption, and secondary market trading.

Furthermore, VMI Securities provides structured products, unicorn block trading capabilities, and derivatives services. The firm's commitment to asset management services underscores its approach to meeting clients' financial needs through customized solutions and expert guidance.

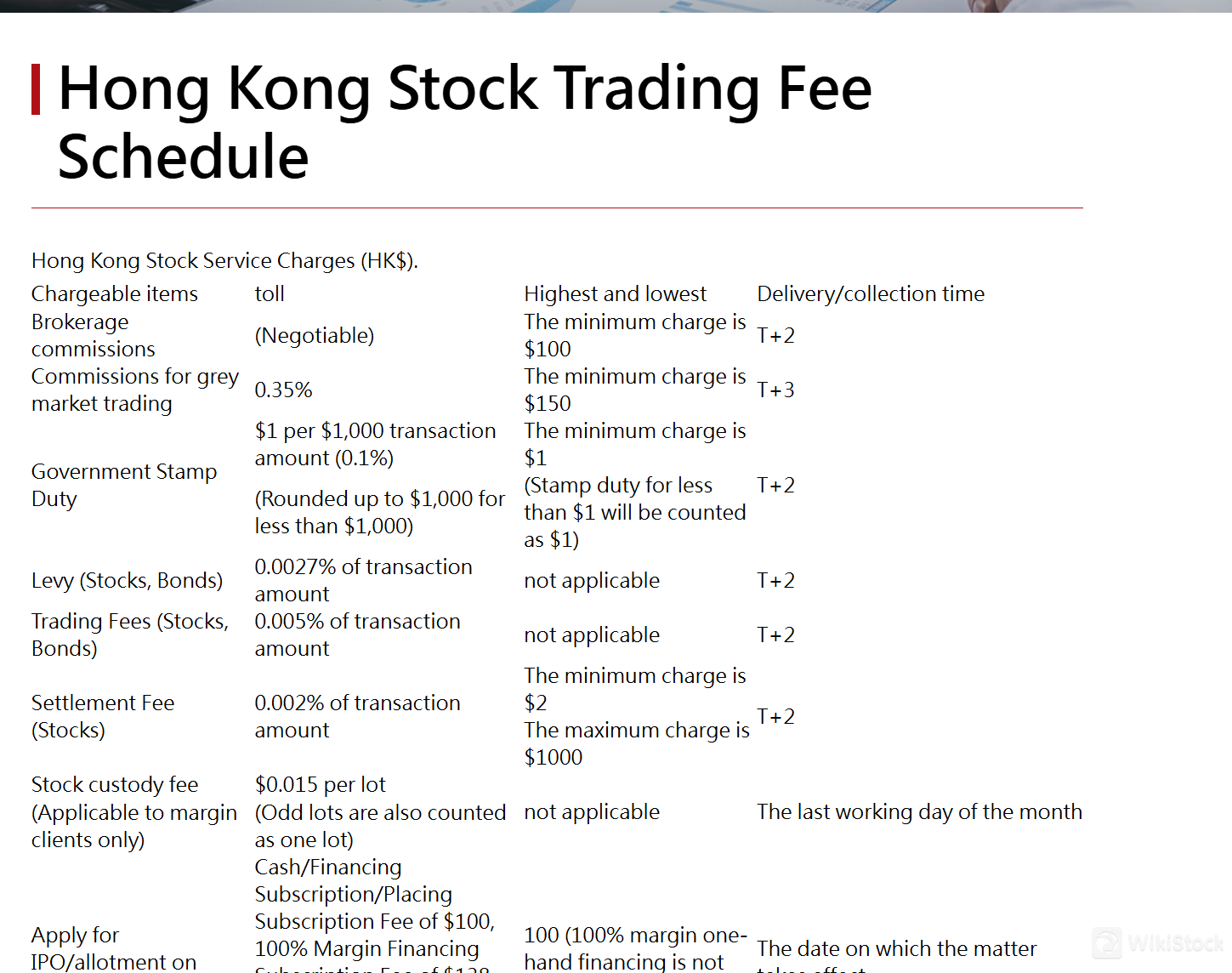

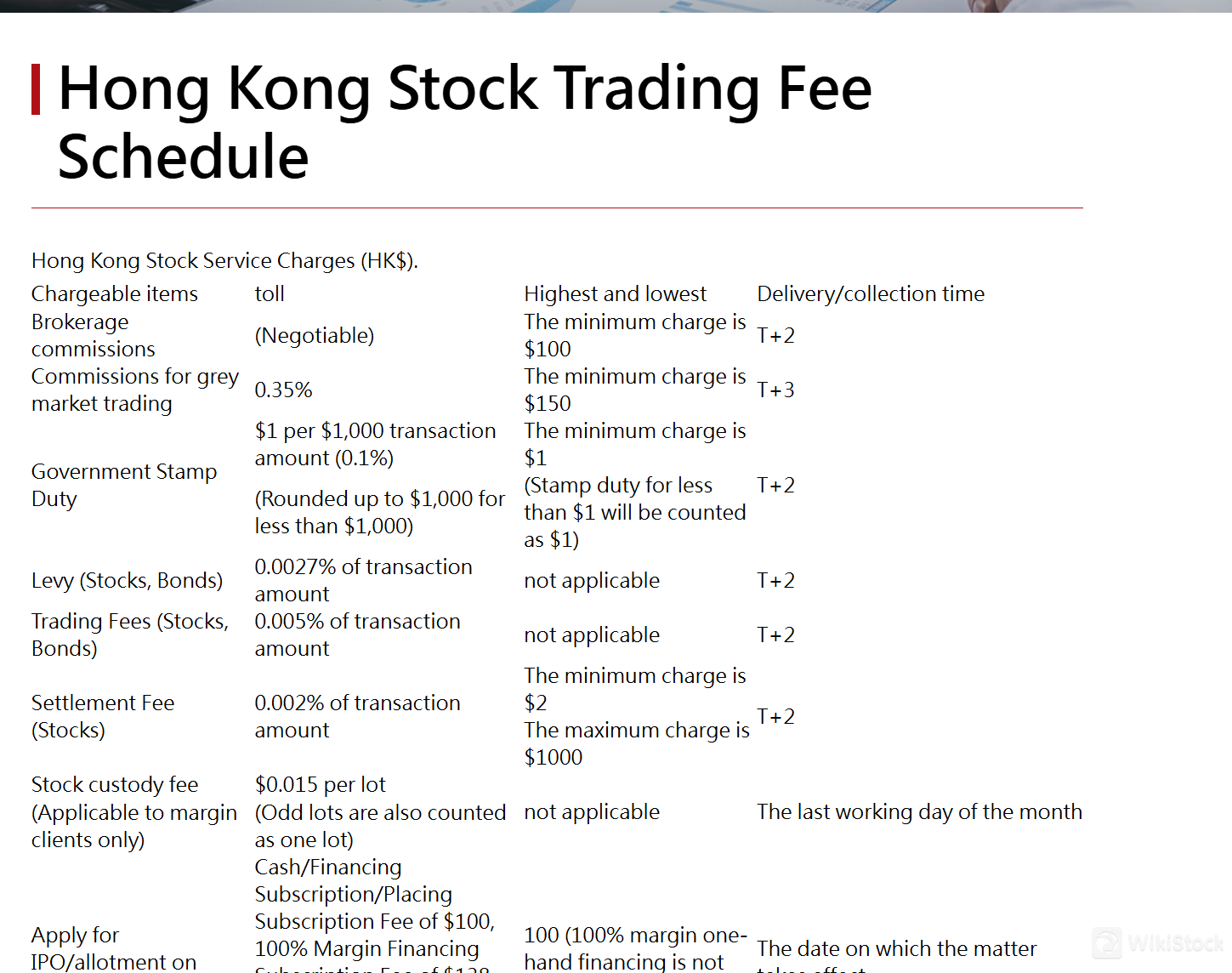

VMI Securities Fees Review

VMI Securities charges fees such as General Trading Fees, Custody and Handling Fees, Withdrawal and Deposit Fees, Stock Transfer Fees, Dividend Service Fees, Equity Matters, and Miscellaneous Fees.

VMI Securities Deposit and Withdrawal Review

Clients can deposit funds into their accounts via two designated banks: Bank of China (Hong Kong) and DBS Bank (Hong Kong) Limited.

To initiate a deposit, the depositor must provide specific details including the bank name, account number, account name, Swift code, and bank address. After making the deposit, they are required to send an email to fund@venturemarkit.com, attaching their account number and a copy of the deposit slip for verification.

For withdrawals, clients can initiate the process by sending an email to fund@venturemarkit.com, specifying their account number and detailing the withdrawal request.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Phone: 852-3902-3930

Email: cs@vmimarkit.com

Address: Room 1105, 11/F Tai Yau Building, 181 Johnson Street, Wanchai, Hong Kong

Conclusion

In conclusion, VMI Securities presents a regulated and transparent option for investors, offering a diverse range of financial products. However, limitations in deposit options should be carefully weighed against its benefits when considering its suitability for individual investment strategies and preferences. Overall, VMI Securities is a popular choice for traders looking for a reliable and trustworthy broker in the securities market.

Frequently Asked Questions (FAQs)

Is VMI Securities regulated?

Yes. It is regulated by SFC.

How can I contact VMI Securities?

You can contact via phone: 852-3902-3930 and email: cs@vmimarkit.com.

What are the fees charged by VMI Securities?

VMI Securities charges various fees such as General Trading Fees, Custody and Handling Fees, Withdrawal and Deposit Fees, Stock Transfer Fees, Dividend Service Fees, Equity Matters, and Miscellaneous Fees.

What are the options for depositing funds into accounts with VMI Securities?

Clients can deposit funds into their accounts through designated banks: Bank of China (Hong Kong) and DBS Bank (Hong Kong) Limited.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Obtain 1 securities license(s)