The customer's account balance in Tse's Securities Limited is not insured. As a brokerage firm regulated by the Securities and Futures Commission (SFC) in Hong Kong, Tse's Securities Limited does not provide insurance coverage for client account balances.

Safety Measures:

Tse's Securities Limited implements comprehensive security measures to protect client assets and information. These include stringent encryption protocols for data transmission, ensuring sensitive information remains secure during online transactions. The platform utilizes secure authentication processes to prevent unauthorized access to accounts. Client funds are held in segregated accounts, adhering to regulatory standards to safeguard against misuse.

What are Securities to Trade with Tse's Securities Limited?

Tse's Securities Limited provides access to a variety of tradable securities, focusing on Stocks, Exchange-Traded Funds (ETFs), and Mutual Funds.

Stocks: Investors can trade a wide range of individual stocks listed on the Hong Kong Stock Exchange (HKEX). This includes blue-chip companies, growth stocks, and small-cap firms.

ETFs: The platform supports trading in ETFs, which offer diversification by tracking indices, sectors, or asset classes. These are suitable for investors looking for a more cost-effective way to achieve broad market exposure.

Mutual Funds: Clients also have access to mutual funds, allowing them to invest in professionally managed portfolios of stocks, bonds, or other securities. This option is ideal for investors seeking to benefit from professional management and diversified holdings.

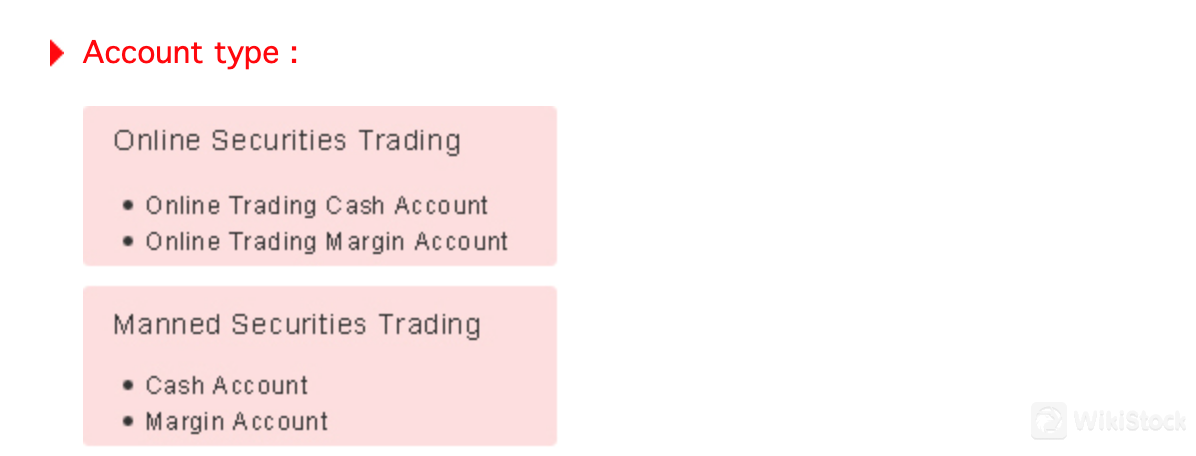

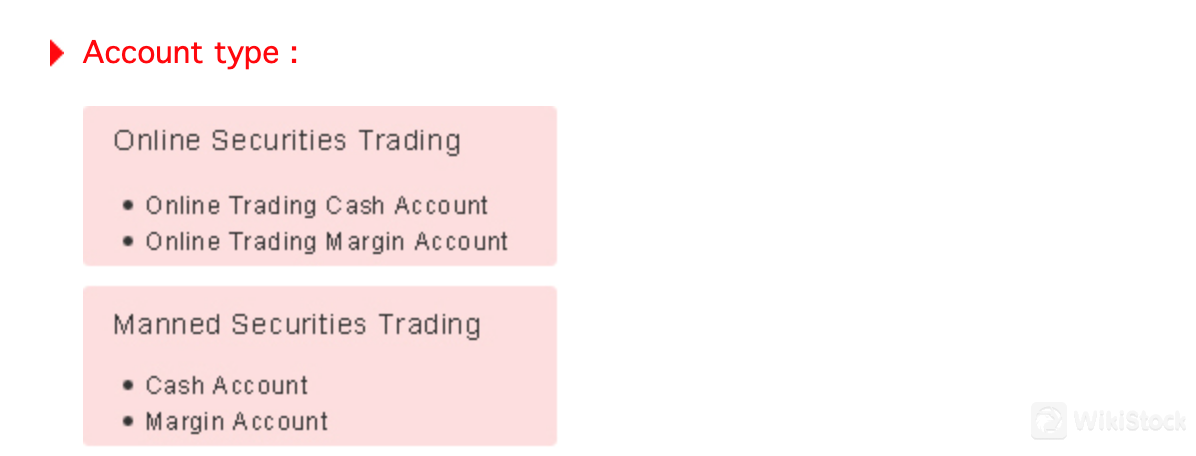

Tse's Securities Limited Accounts

Tse's Securities Limited provides several account types.

Online Trading Accounts:

Tse's Securities Limited provides two main options for online trading: the Online Trading Cash Account and the Online Trading Margin Account.

The Online Trading Cash Account is ideal for conservative investors or beginners who want to trade using only their available funds. This account type ensures that investors can only buy securities equivalent to their cash balance, offering a straightforward and low-risk trading approach.

The Online Trading Margin Account, on the other hand, is suited for more experienced traders who seek to leverage their investments. This account allows borrowing funds from the brokerage to increase purchasing power, which can amplify potential gains as well as losses.

Manned Trading Accounts:

For those who prefer broker-assisted trading, Tse's Securities Limited offers the Cash Account and the Margin Account under its manned trading services.

The Cash Account is similar to the online version but involves placing trades through a broker. This is perfect for clients who value personalized service and expert advice, or who prefer not to manage trades online.

The Margin Account in this category allows trading on margin with broker assistance. It is tailored for sophisticated investors who appreciate leveraging opportunities while benefiting from professional advice. This account suits those who engage in larger volume trades and want to maximize their market opportunities without immediate cash constraints.

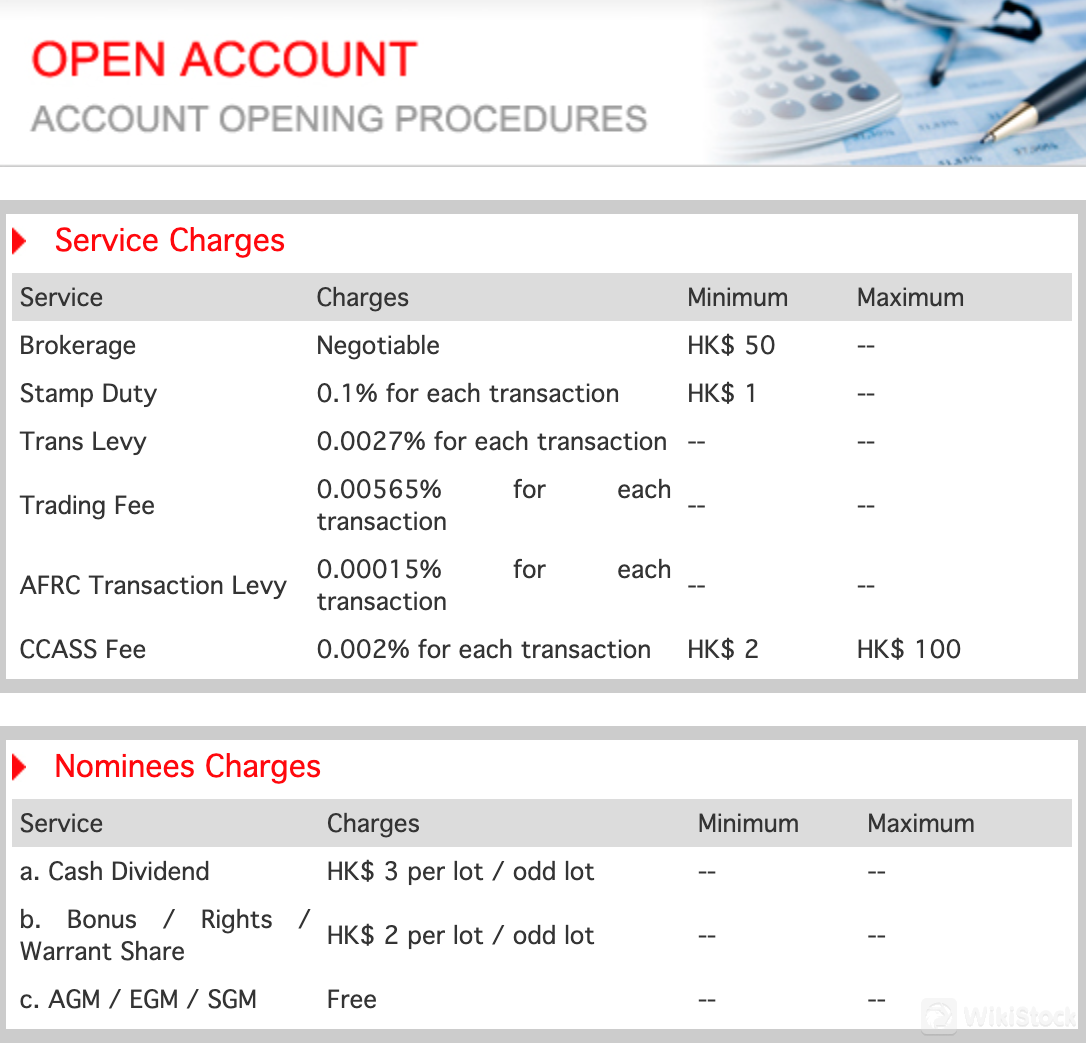

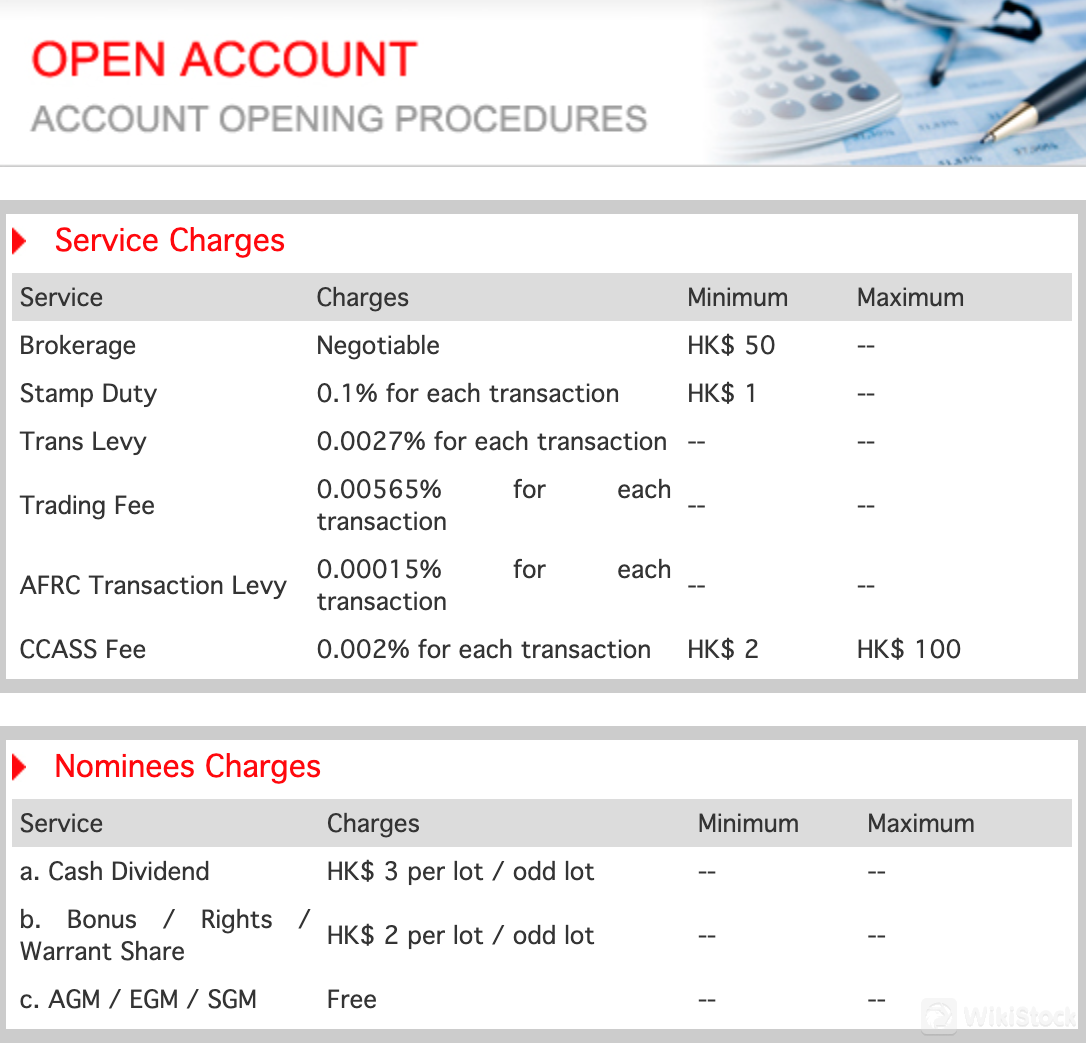

Tse's Securities Limited Fees Review

Brokerage Fees:

Tse's Securities Limited charges a negotiable commission for each securities transaction, with a minimum fee set at HK$50. This negotiable structure offers flexibility, potentially providing lower rates for clients depending on their trading volume and frequency. For high-volume traders, this can be particularly advantageous as it allows for tailored commission rates that could result in cost savings.

Stamp Duty:

Each transaction at Tse's Securities Limited incurs a stamp duty of 0.1%. This is a standard statutory fee required by the Hong Kong government for securities trading and is consistently imposed across all brokers in the region. The stamp duty ensures that all transactions contribute to public revenue, reflecting the financial market's role in the broader economy.

Transaction Levies:

In addition to the stamp duty, several regulatory levies are applied to each transaction. These include a Trans Levy at 0.0027%, a Trading Fee at 0.00565%, an AFRC Transaction Levy at 0.00015%, and a CCASS Fee at 0.002% of the transaction value, with a minimum charge of HK$2 and a maximum of HK$100. These fees are typical across Hong Kongs financial industry, designed to cover the costs of regulatory oversight and market infrastructure maintenance. They ensure that all market participants contribute to the integrity and efficiency of the financial system.

Nominees Charges:

For services related to securities held under nominee arrangements, Tse's Securities Limited applies specific charges. Cash dividends are handled with a fee of HK$3 per lot or odd lot, while processing bonus, rights, or warrant shares incurs a fee of HK$2 per lot or odd lot. Attending Annual General Meetings (AGM), Extraordinary General Meetings (EGM), or Special General Meetings (SGM) is free of charge. These fees cover the administrative costs associated with managing and distributing entitlements from securities held in nominee accounts.

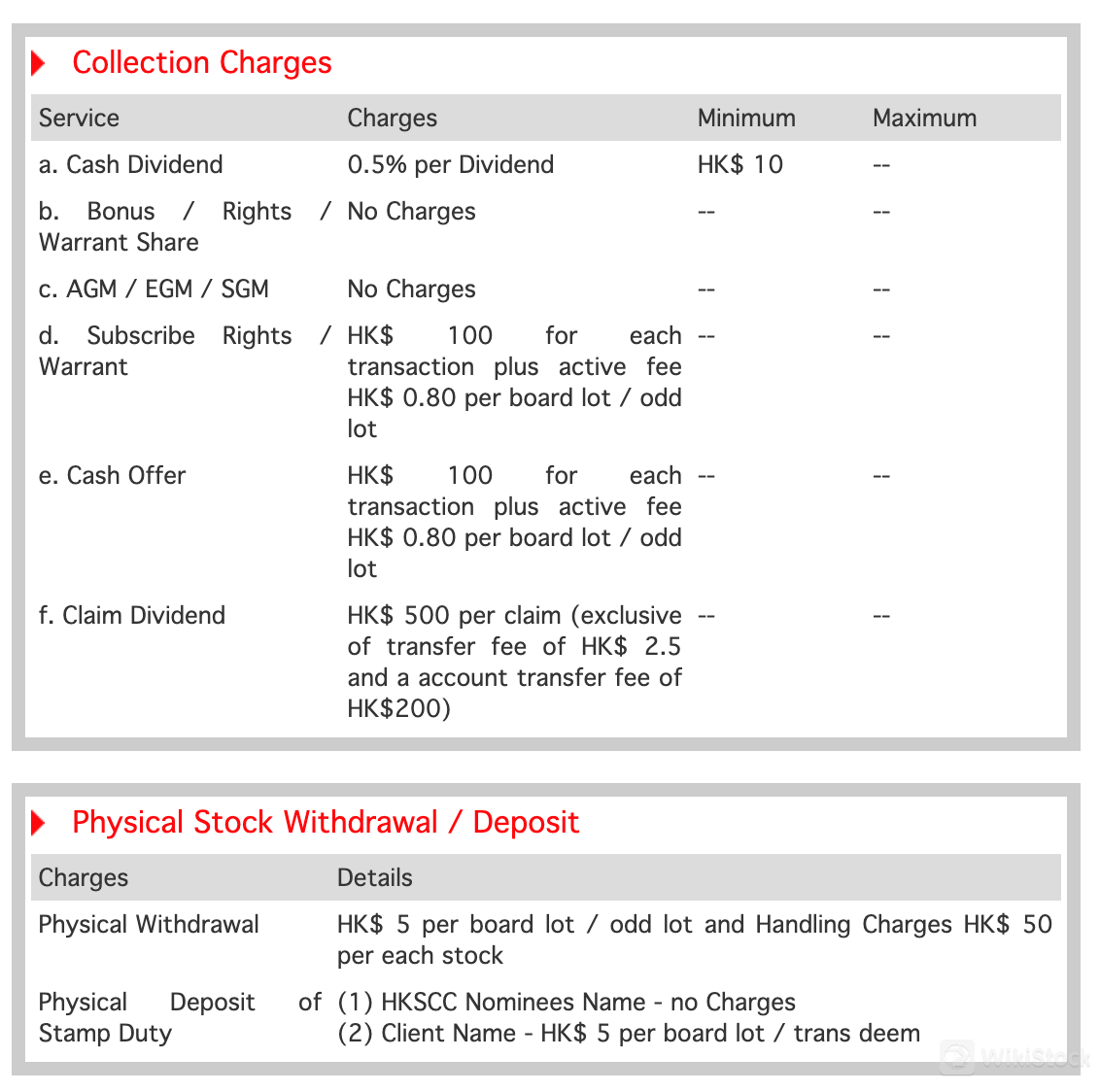

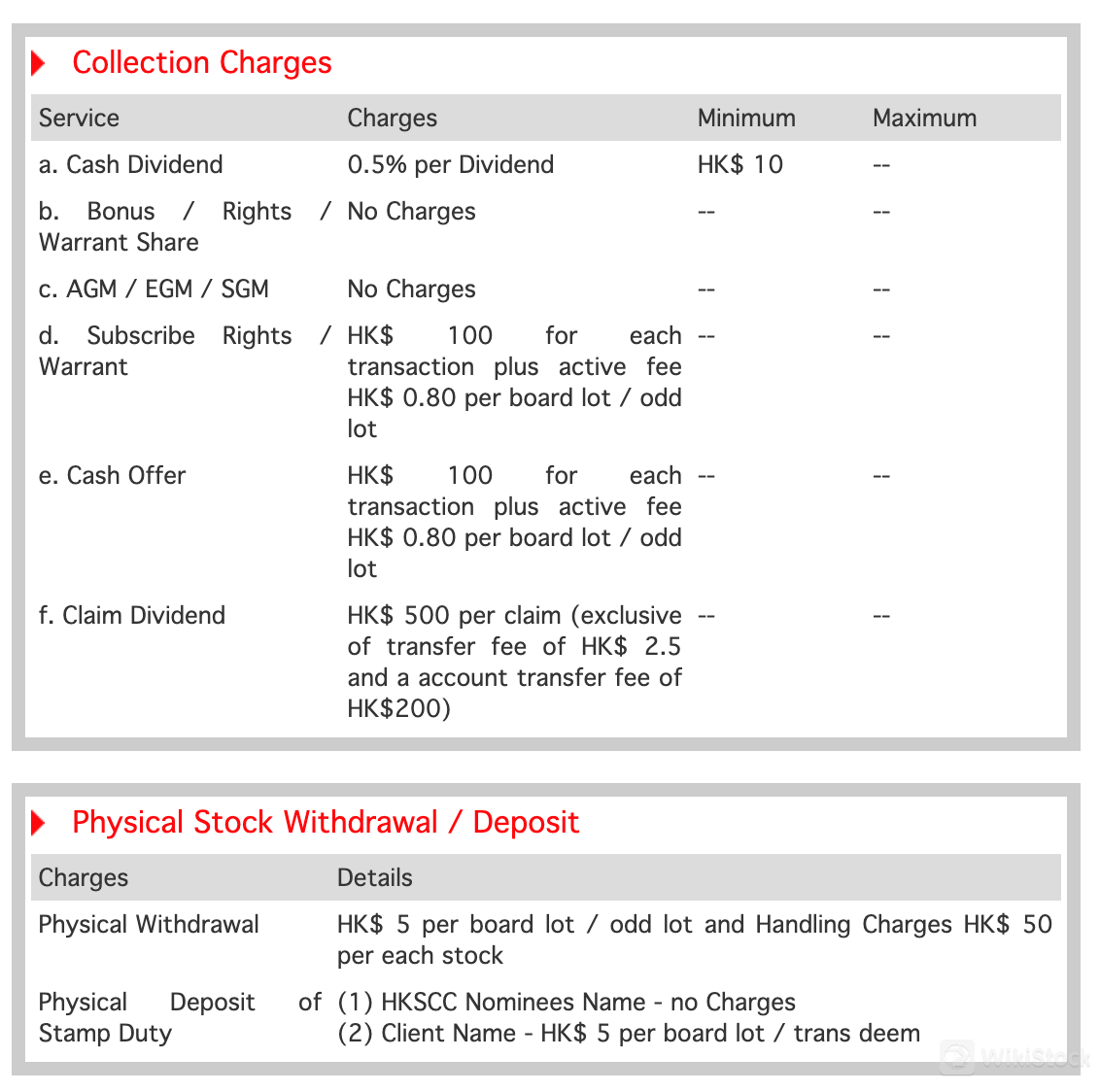

Collection Charges:

When it comes to the collection of dividends and the management of other corporate actions, Tse's Securities Limited charges 0.5% per cash dividend with a minimum fee of HK$10. There are no charges for handling bonus shares, rights, or warrant shares. For subscribing to rights or warrants, the fee is HK$100 per transaction plus an active fee of HK$0.80 per board lot or odd lot. Similarly, the same fee structure applies to cash offers. Claiming dividends involves a fee of HK$500 per claim, along with a transfer fee of HK$2.5 and an account transfer fee of HK$200. The fee for collecting cash dividends at 0.5% is relatively high compared to some brokers that might offer this service for free or at a lower percentage, particularly for substantial dividend amounts.

Physical Stock Withdrawal/Deposit:

For handling physical stock certificates, the withdrawal fee is HK$5 per board lot or odd lot, with an additional handling charge of HK$50 per stock. Depositing physical stock into a nominee account under HKSCC incurs no charge, while depositing in a clients name costs HK$5 per board lot or transaction deemed. These fees are associated with the administrative effort required to process physical stock movements, reflecting the less common but still necessary handling of physical certificates in today's digital trading environment.

S.I / I.S.I Instruction Charges:

Charges for Settlement Instruction (S.I) or Investor Settlement Instruction (I.S.I) delivery include 0.005% of the share value (calculated as the number of shares multiplied by the closing price) plus HK$1 per transaction, with a minimum fee of HK$10. Receiving instructions incurs no charge. Any amendments or cancellations of instructions cost HK$10 per transaction. These charges cover the processing of transferring securities in or out of the client's account, ensuring accurate and timely settlement of trades.

General Service Fees:

Several other general service fees apply at Tse's Securities Limited. Transferring securities to a client's name involves a fee of HK$100 per transfer plus HK$2.5 per scrip page. Electronic Initial Public Offerings (E.I.P.O) attract a fee of HK$20, while bouncing cheques cost HK$100 per instance. An administration fee of HK$100 is charged if there are no transactions in the account for six months. Copies of account statements are provided at a fee of HK$50 each, although there is no charge for custody. These fees reflect the additional administrative services provided by the brokerage, covering the costs associated with maintaining and managing client accounts.

Internet Charges:

Tse's Securities Limited offers free access to real-time teletext if the client's monthly trading turnover reaches HK$500,000 or more. If the turnover is below this threshold, a monthly fee of HK$404 is applied. Snapshot clicks with a 15-minute delayed quote are provided free of charge. This pricing structure supports active traders by waiving fees for high turnover, while still offering essential market data services to all clients.

Comparing these fees to those of popular brokers, Tse's Securities Limited's commission structure appear competitive for smaller trades due to the minimum HK$50 charge. For larger or more frequent trades, the negotiable rates can be more competitive. The various fees for physical stock handling, dividend collection, and administrative tasks are aligned with industry norms but can be on the higher side compared to brokers who provide more bundled services or fewer individual charges.

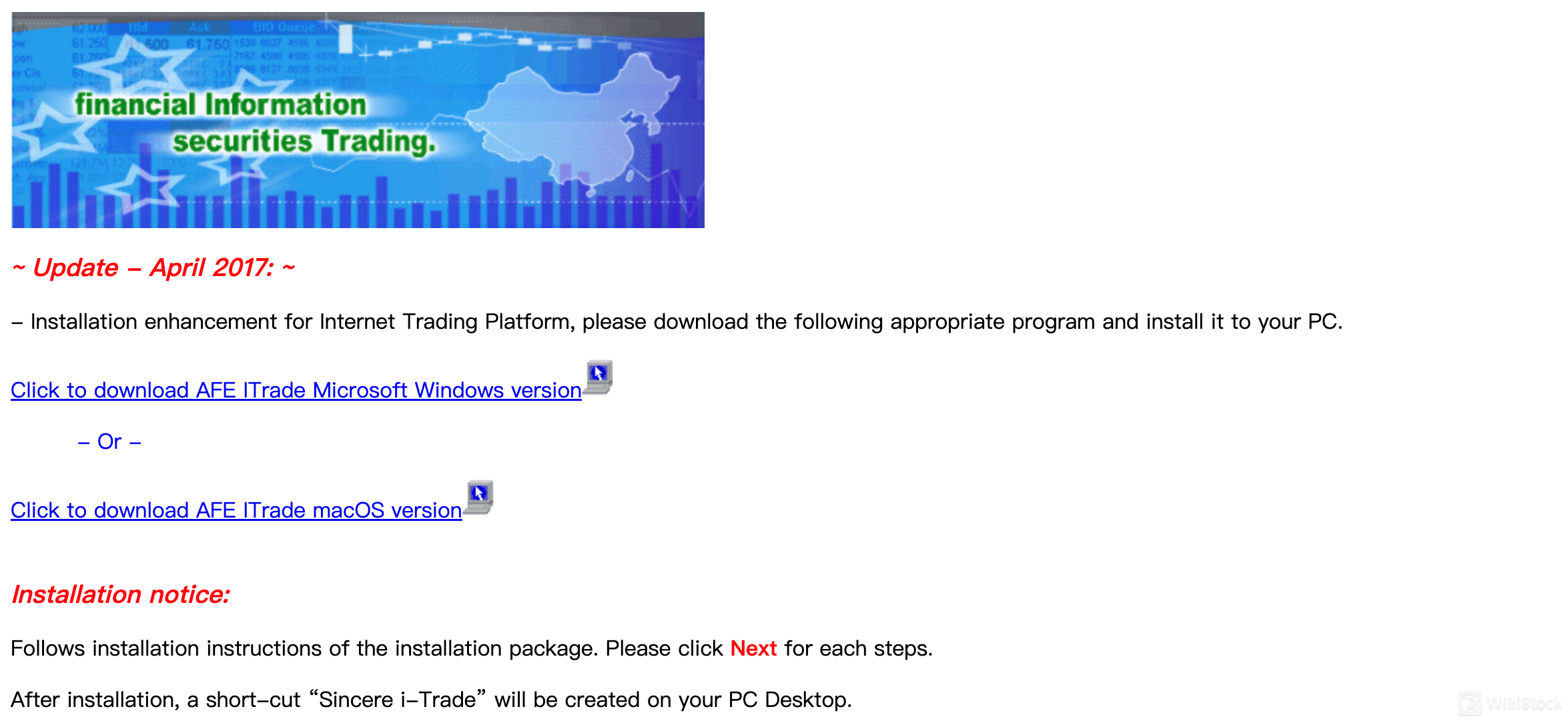

Tse's Securities Limited Trading platform Review

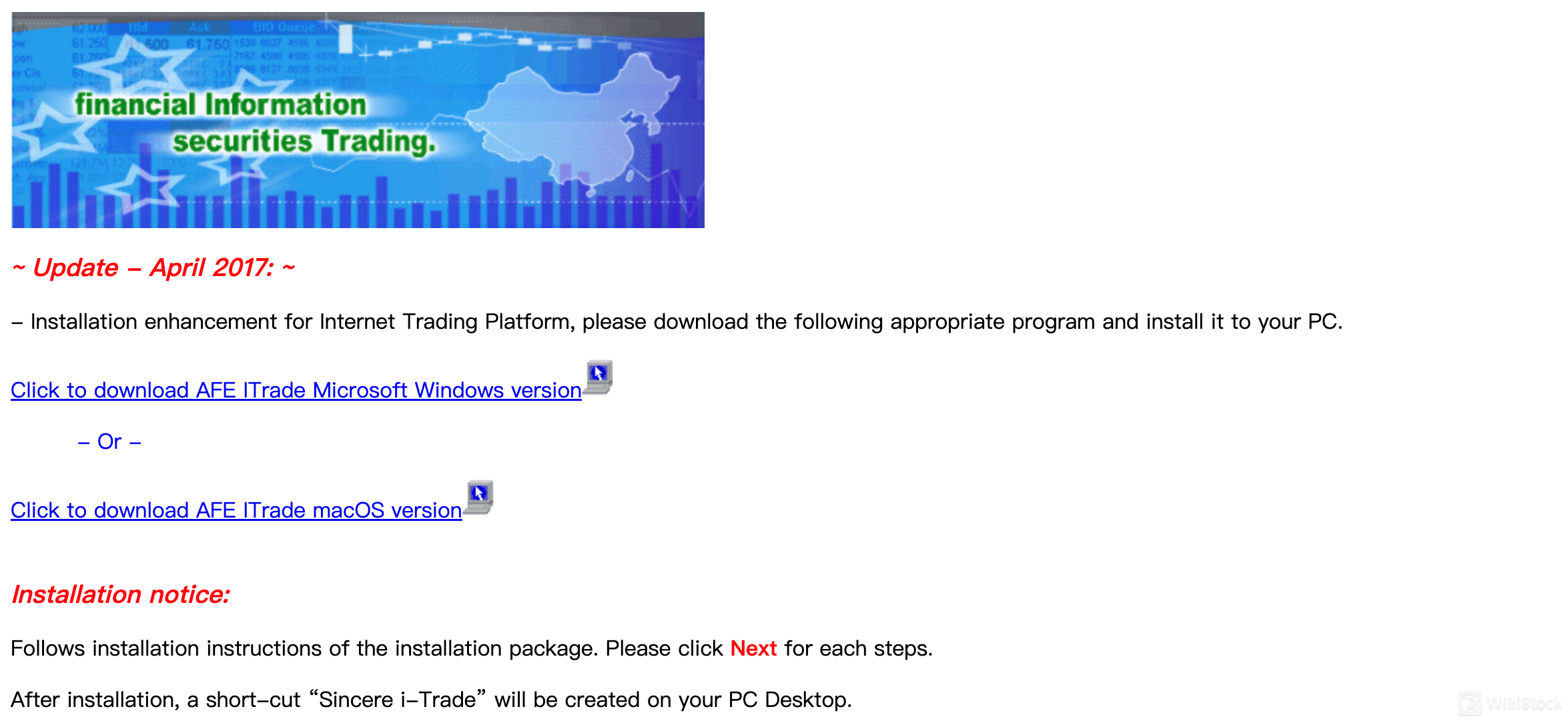

AFE iTrade (Windows and macOS Version):

The AFE iTrade platform, available for Windows and macOS users, is the primary trading tool provided by Tse's Securities Limited for their clients.

This platform supports a range of trading activities, offering real-time market data and analytical tools designed to assist investors in making informed decisions. Key features include a customizable interface, advanced charting tools, and the ability to execute trades directly from the platform. The software also supports multiple account types, providing flexibility for different trading needs.

However, compared to some leading global trading platforms, AFE iTrade lacks certain advanced functionalities such as integrated AI-driven analytics or a broader range of asset classes. It's a solid choice for those focused on Hong Kong securities but might not meet the needs of investors looking for more extensive international trading options or more sophisticated trading tools.

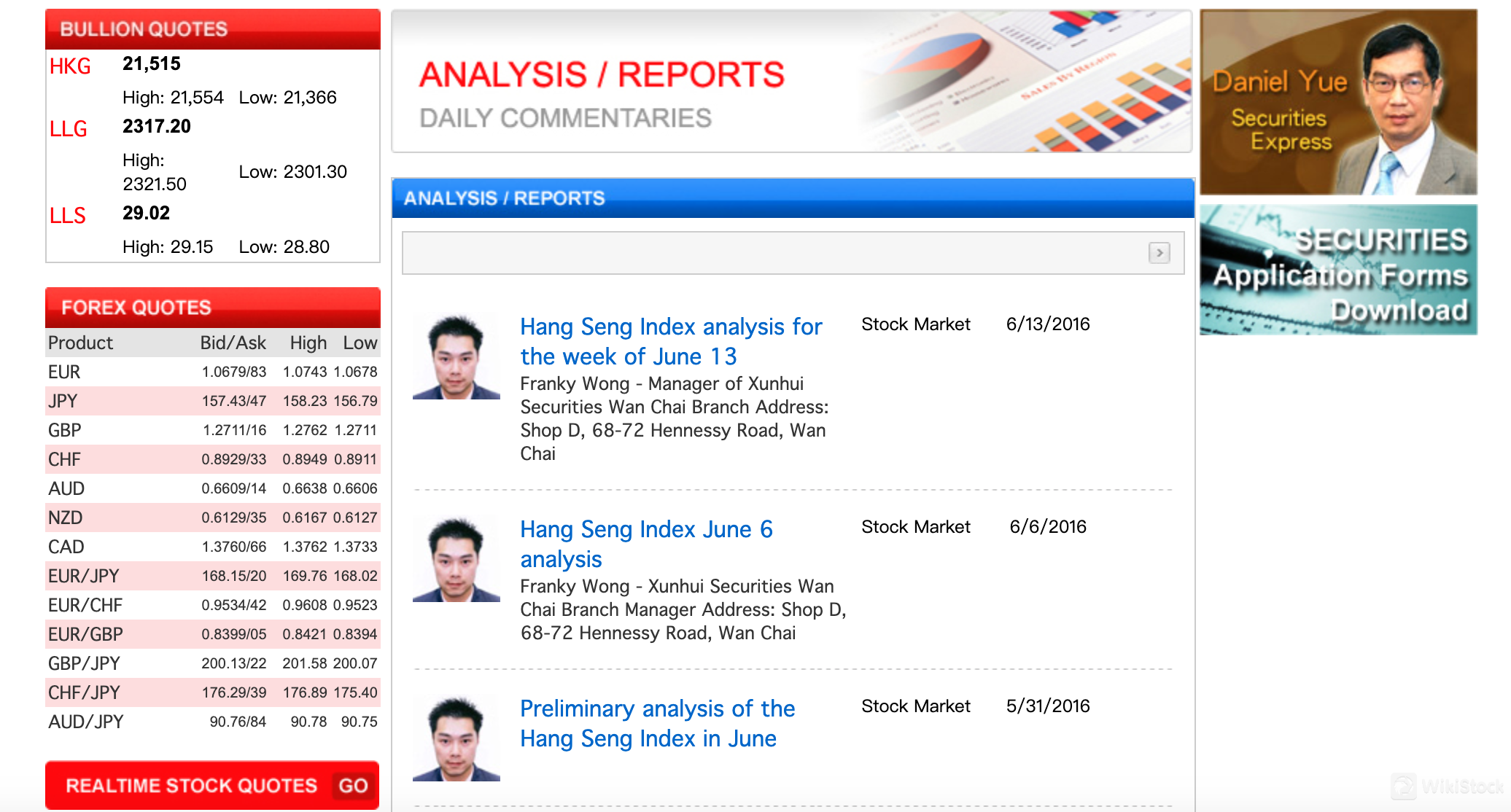

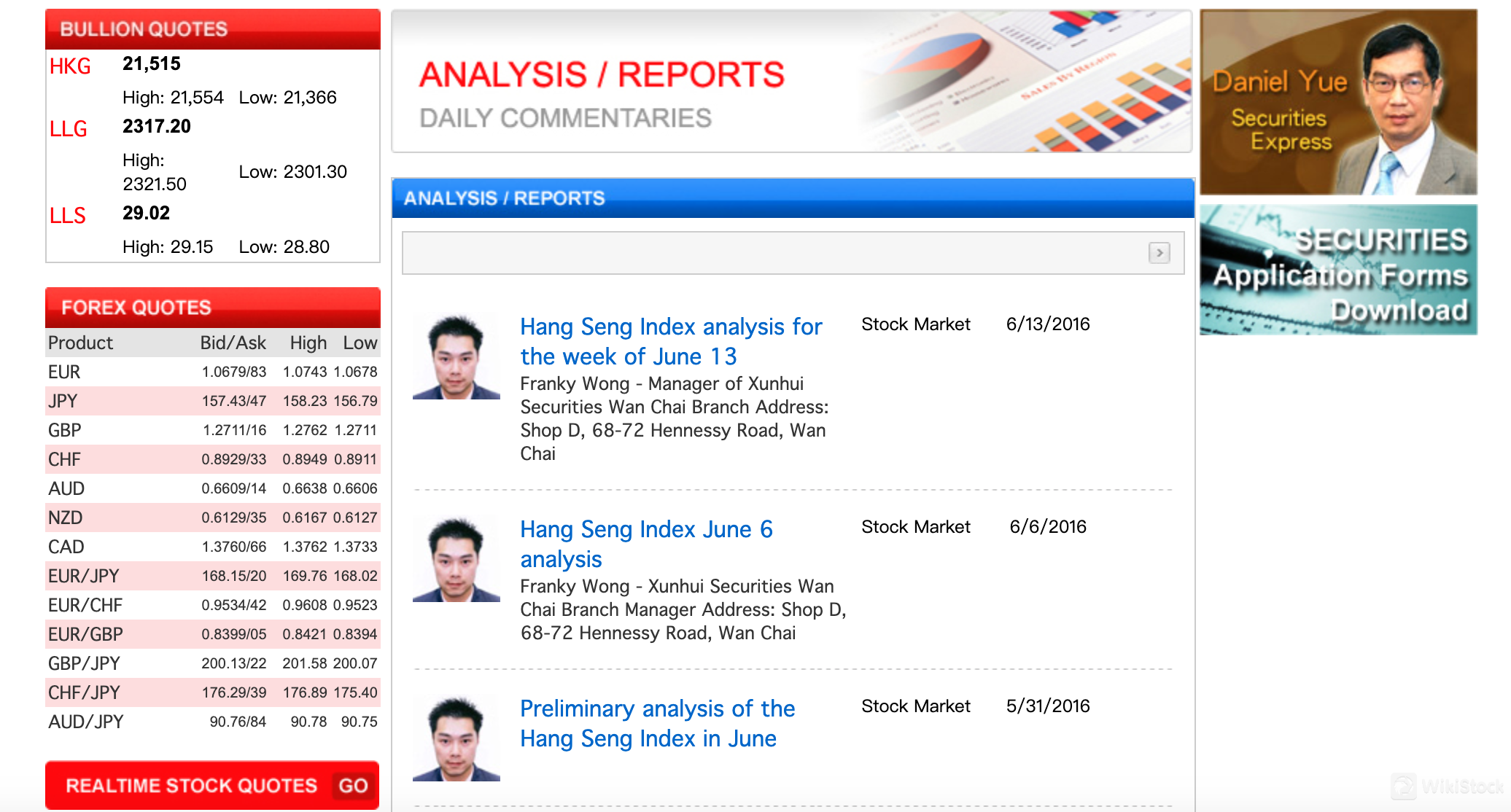

Research & Education

Tse's Securities Limited provides a range of educational resources and research reports to assist investors with their trading decisions. Their offerings include detailed market analyses and reports on various financial indices and economic trends, primarily focused on the Hang Seng Index (HSI). Regular reports, often authored by experienced professionals, cover current market conditions and provide forecasts and insights into market movements.

Customer Service

Tse's Securities Limited provides customer support primarily through an online form available on their website. Clients can submit their inquiries, complaints, or any operational matters by filling out the form, which requires details like name, account number, email, and a message.

Conclusion

In conclusion, Tse's Securities Limited offers a straightforward and regulated platform primarily suited for investors focusing on the Hong Kong market. With a minimum brokerage fee of HK$50 per transaction and no custody fees, it serves well for cost-conscious traders and long-term investors holding securities without additional charges.

However, the platform is not ideal for those seeking extensive global market access or advanced trading tools, as it lacks a dedicated mobile app and comprehensive educational resources.

FAQs

China Hong Kong

China Hong Kong Obtain 1 securities license(s)

--

--

--

--