Prime Securities Limited is a licensed securities dealer, holds the SFC for Type 1 regulated license (CE No. ACX574). We also are the Participant of SEHK (broker no. 3220-3229) and the Direct Clearing Participant of HKSCC (Participant ID: B01567) "Prudence and Honesty" has been our core business values to serve customers for over 23 years.

Prime Securities Information

Prime Securities was established in 1971 as one of the founding members of Kam Ngan Stock Exchange Limited and began to engage in stockbroking business. The company has a good continuous risk management system and a good internal control system to protect customers' assets and effectively controls management and employees in strict accordance with the professional code of conduct. While Prime Securities is well regulated and offers kinds of services including stock trading and securities margin financing, it faces challenges such as limited customer support options and a lack of educational resources for investors.

Pros and Cons of Prime Securities

The Prime Securities have a good reputation and operate under formal regulatory oversight. The company has a sound risk control system to ensure the healthy development of various businesses. The company also offered IPO but did not provide some professional educational resources and convenient customer service channels.

Is Prime Securities safe?

Regulation

Prime Securities is regulated. It operates under stringent regulatory oversight and offers margin trading. However, traders should thoroughly evaluate all aspects before participating in trading activities to ensure a safer and more dependable trading experience.

What are securities to trade with Prime Securities?

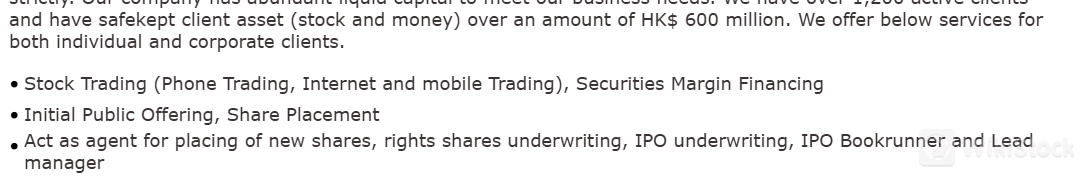

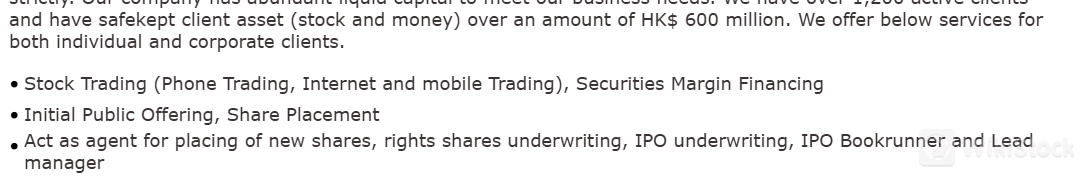

The company's business scope includes Stock Trading (Phone Trading, Internet and mobile Trading), Securities Margin Financing, Initial Public Offering, Share Placement, Act as agent for placing of new shares, rights shares underwriting, IPO underwriting, IPO Bookrunner and Lead manager.

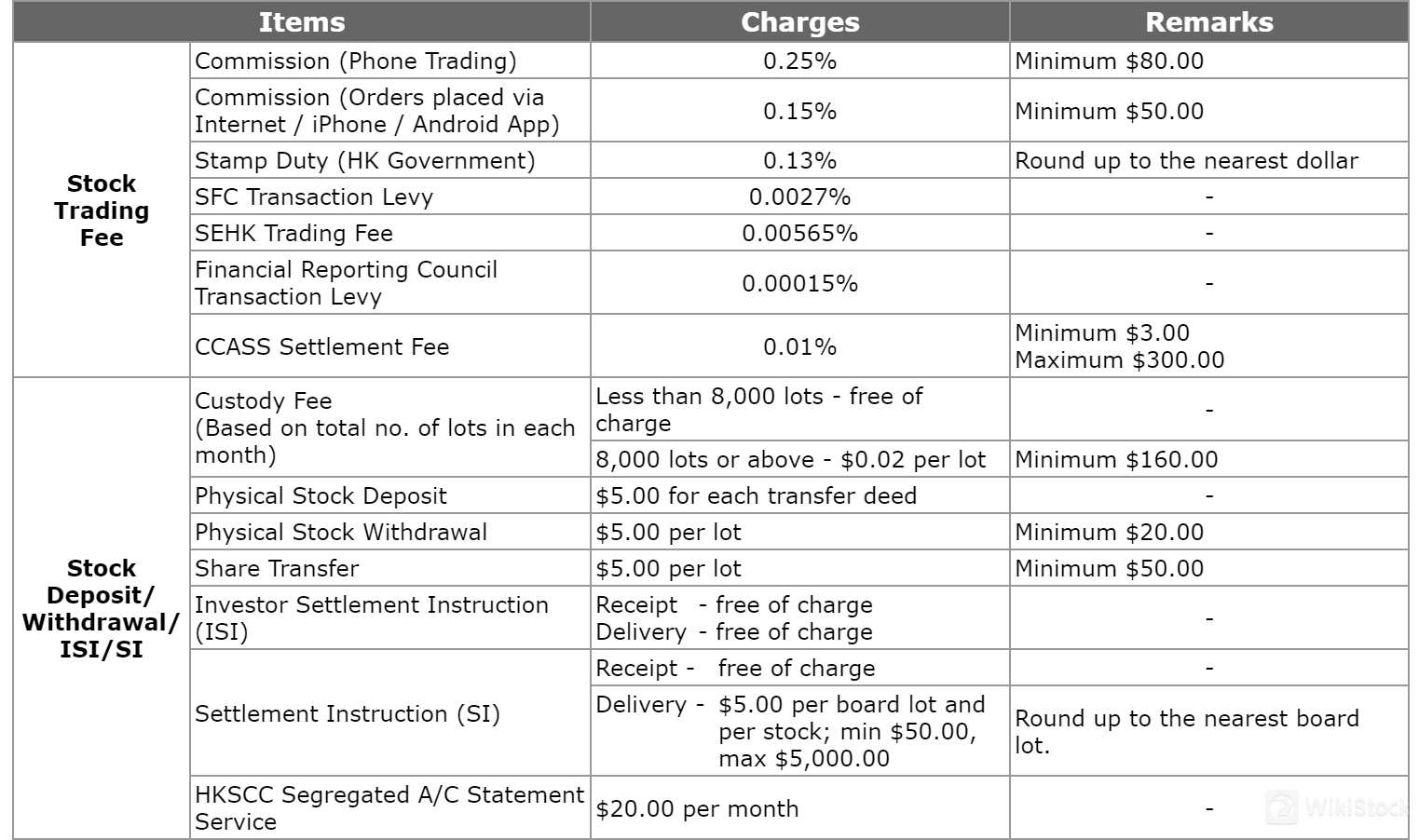

Prime Securities Fees Review

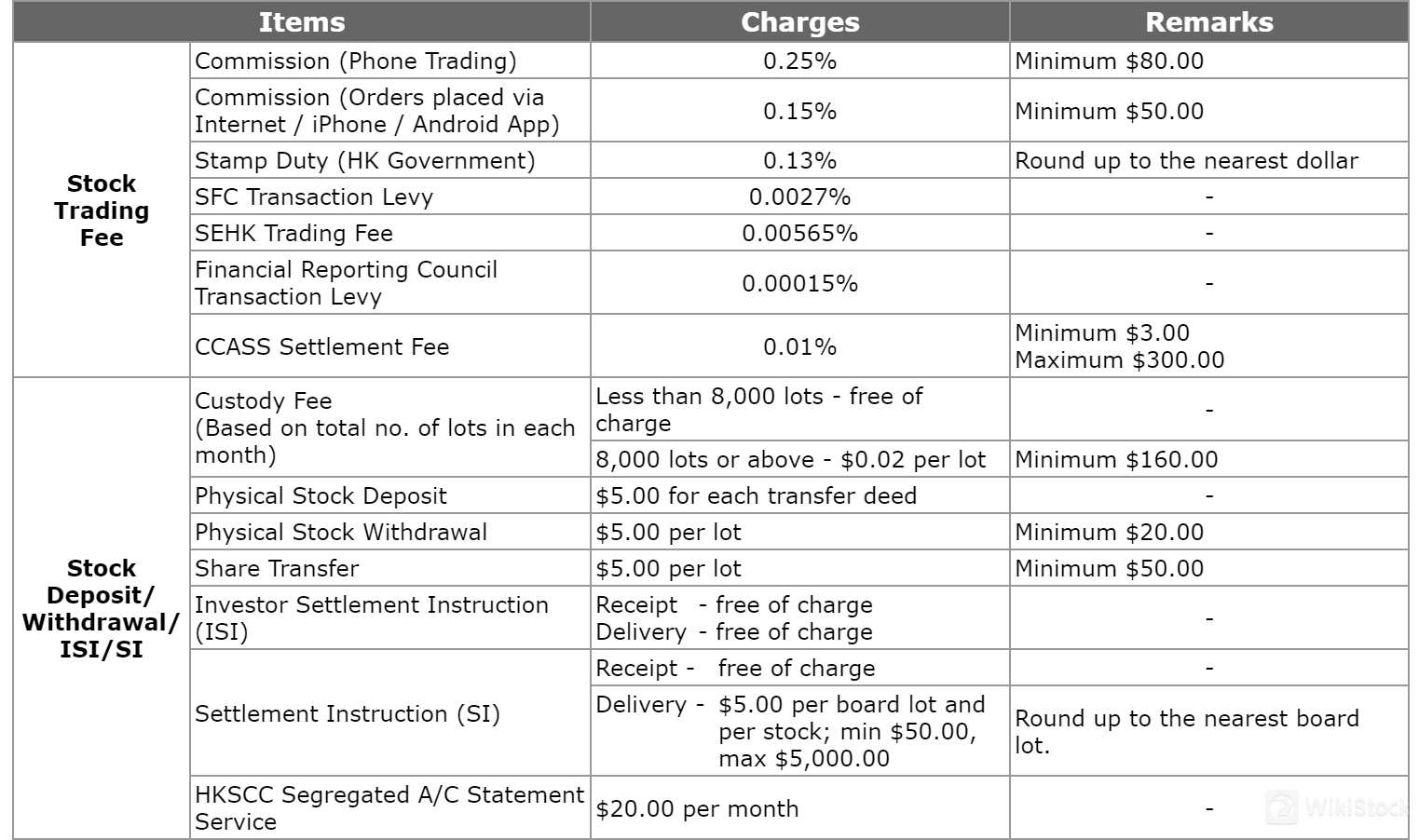

Stock Trading Fees:Prime Securities offers tiered commission rates for stock trading. Phone trades incur a 0.25% commission with a minimum of $80, while orders placed via internet or mobile apps are charged 0.15% with a minimum of $50. Additional fees include a 0.13% stamp duty (rounded up to the nearest dollar), 0.0027% SFC transaction levy, 0.00565% SEHK trading fee, 0.00015% Financial Reporting Council transaction levy, and a 0.01% CCASS settlement fee (minimum $3, maximum $300).Stock Deposit, Withdrawal, and Transfer Fees:Custody fees are based on the total number of lots held each month. Accounts with less than 8,000 lots are free, while those with 8,000 lots or more are charged $0.02 per lot, with a minimum fee of $160. Physical stock deposits cost $5 per transfer deed, and withdrawals are $5 per lot with a minimum of $20. Share transfers are priced at $5 per lot with a $50 minimum.Settlement Instructions:Investor Settlement Instructions (ISI) for both receipt and delivery are free of charge. Settlement Instructions (SI) for receipt are also free, while SI delivery fees are $5 per board lot and per stock, with a minimum of $50 and a maximum of $5,000, rounded up to the nearest board lot.Additional Services:HKSCC Segregated Account Statement Service is available for $20 per month.

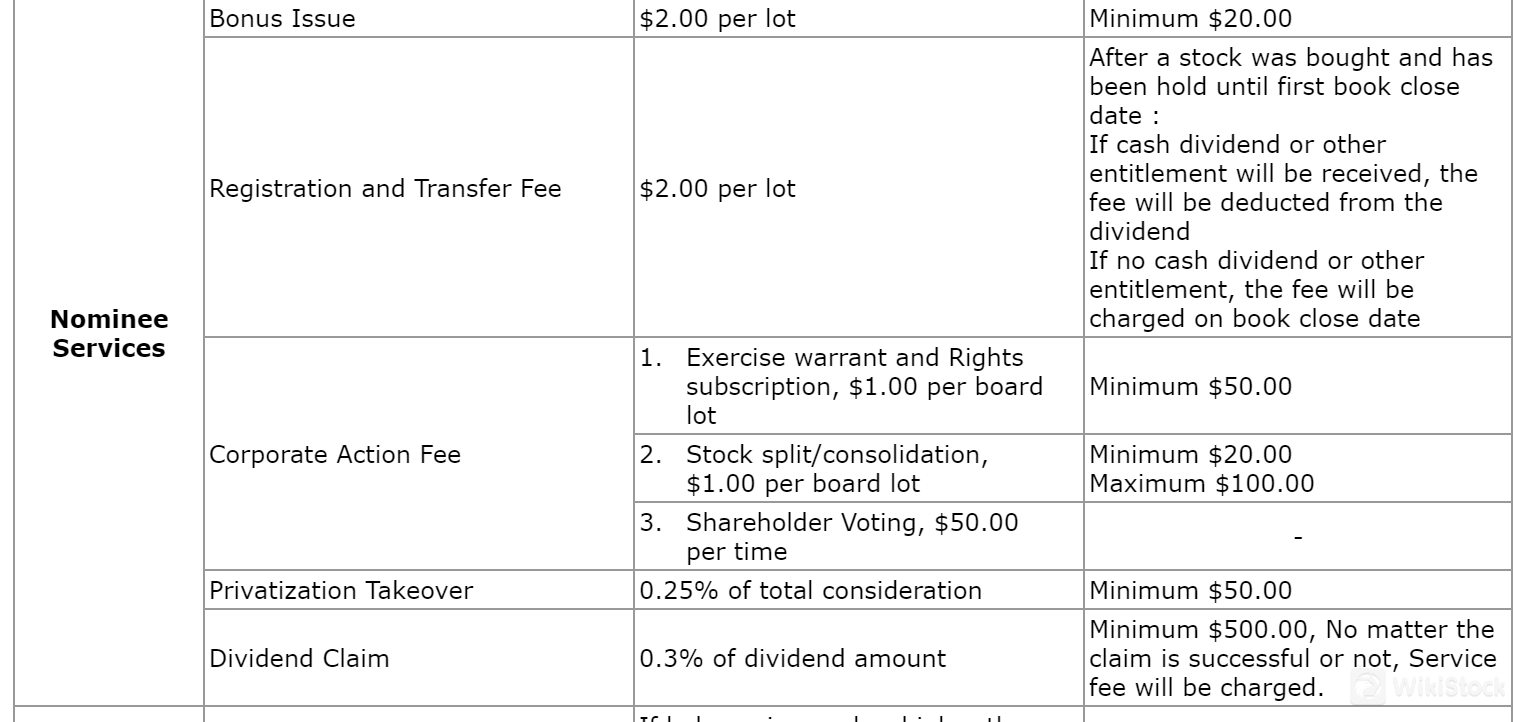

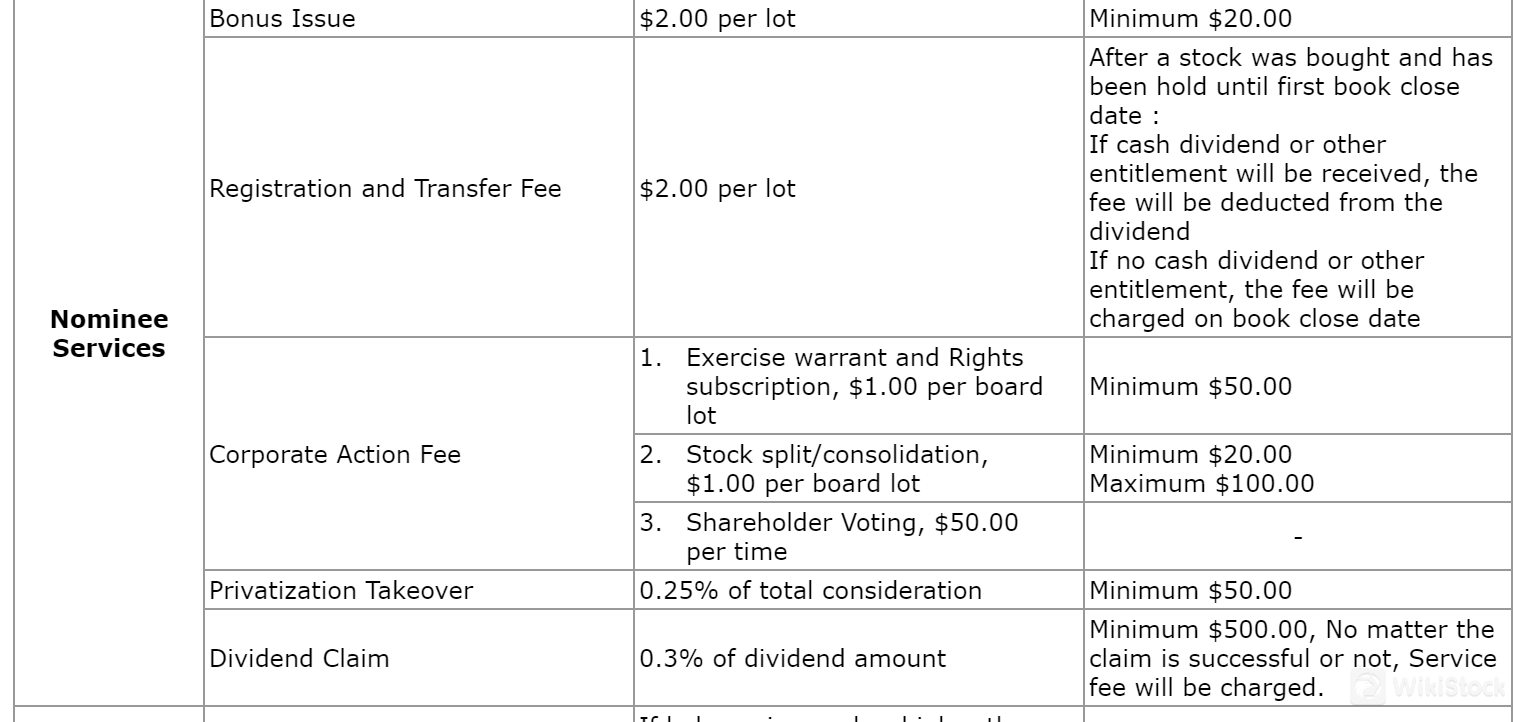

Dividend and Corporate Actions:Prime Securities charges 0.3% of the dividend amount for cash/scrip dividend collection, with a minimum fee of $20. Bonus issues are priced at $2 per lot, also with a $20 minimum. For stocks held until the first book close date, a registration and transfer fee of $2 per lot applies. This fee is deducted from cash dividends or other entitlements, or charged on the book close date if no such payments are received.Corporate action fees vary by type:

- Warrant exercise and rights subscriptions: $1 per board lot, minimum $50

- Stock splits/consolidations: $1 per board lot, minimum $20, maximum $100

- Shareholder voting: $50 per instance

Takeovers and Dividend Claims:Privatization takeovers incur a fee of 0.25% of the total consideration, with a minimum charge of $50. Dividend claims are subject to a 0.3% fee based on the dividend amount, with a minimum of $500. This service fee applies regardless of the claim's success.

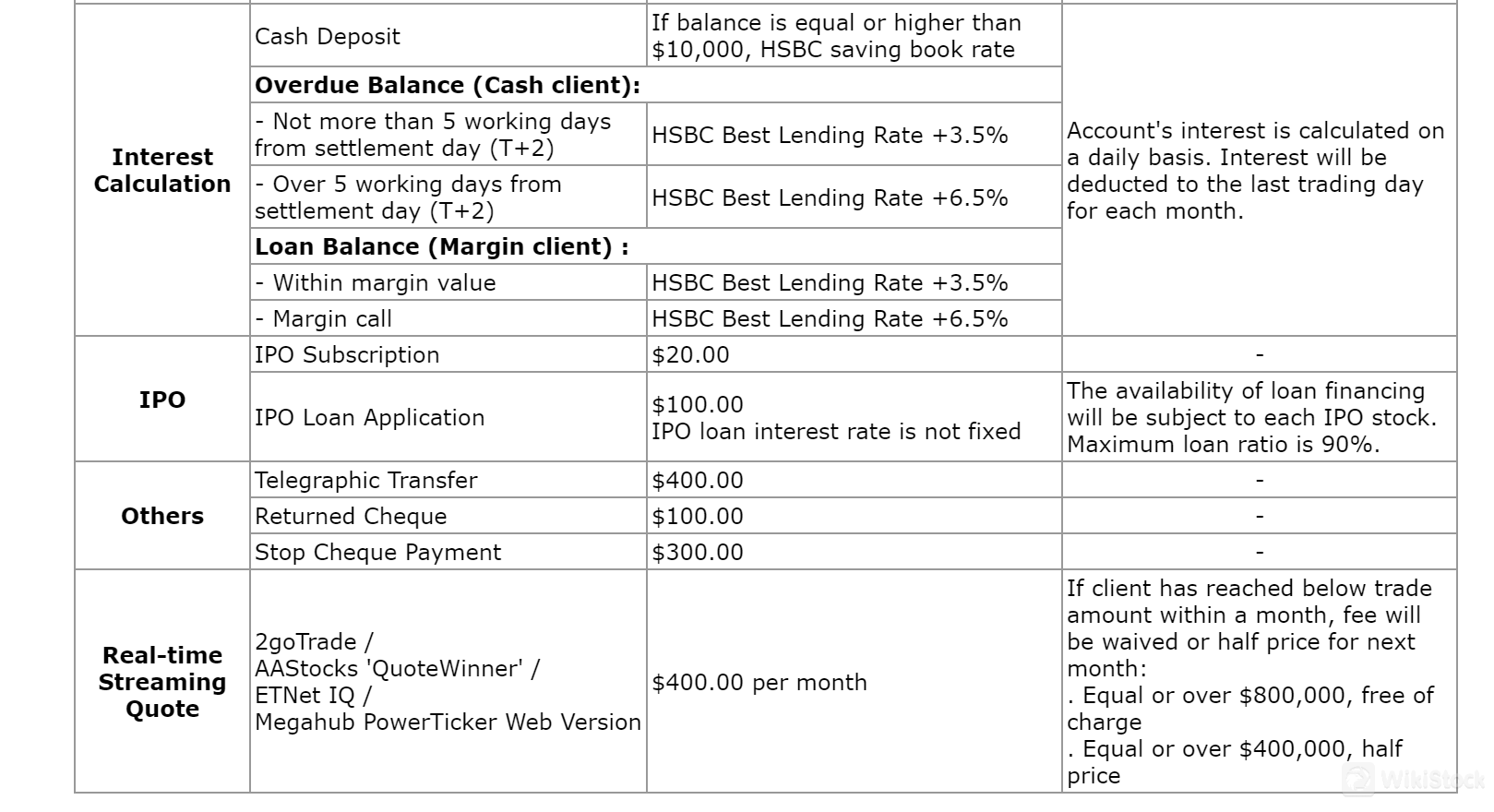

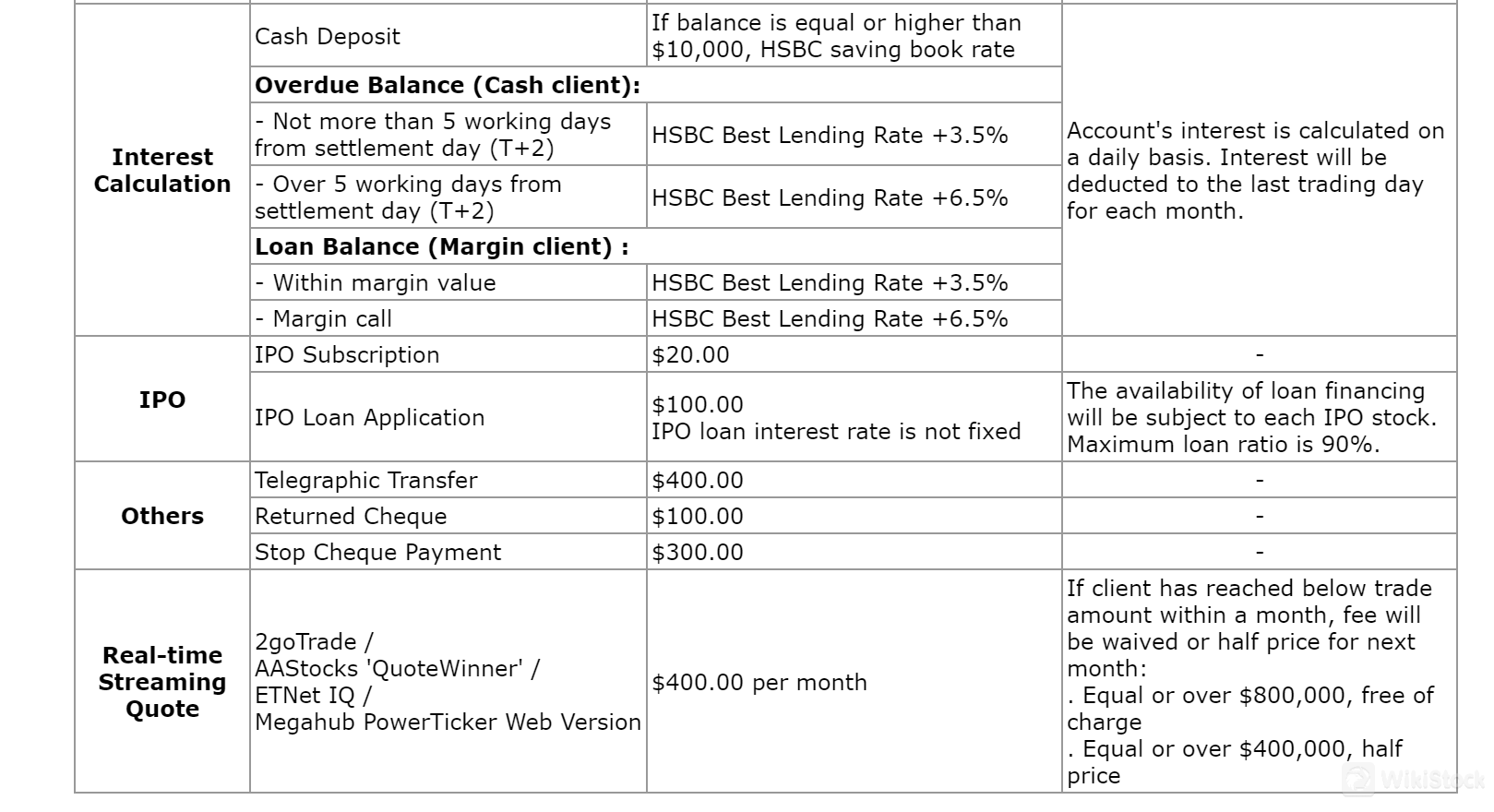

Interest Calculation: Prime Securities offers competitive interest rates for cash deposits, with higher rates for balances of $10,000 or more. Interest is calculated daily and credited monthly. For overdue balances, rates range from HSBC Best Lending Rate +3.5% to +6.5%, depending on the duration. Margin clients are subject to similar rates, with higher rates applied during margin calls.IPO Services: The firm charges $20 for IPO subscriptions and $100 for loan applications. IPO loan interest rates vary, with financing subject to individual stock offerings. A maximum loan ratio of 90% is available.Miscellaneous Fees: Prime Securities imposes fees for various services, including $400 for telegraphic transfers, $100 for returned cheques, and $300 for stop cheque payments.Real-time Streaming Quotes: Several platforms are available at $400 per month. However, this fee can be waived or reduced based on monthly trading volume. Clients trading $800,000 or more receive the service free of charge, while those trading $400,000 or more qualify for a 50% discount.

Prime Securities App Review

The app, known as “GoTrade2”, is available on both iOS and Android devices. Users can easily access it through the Apple App Store or Google Play Store. For convenience, a QR code is provided for quick access to the app's installation page.The application is developed by 2GoTrade, ensuring reliable and professional trading experience. Once located in the respective app store, users can simply tap the “Install” button to download and set up the app on their mobile devices.After successful installation, users can immediately launch the app by tapping “Open,” granting them instant access to Prime Securities' mobile trading platform. This streamlined process allows clients to quickly engage with the markets and manage their investments on the go.This mobile solution demonstrates Prime Securities' commitment to providing accessible and user-friendly trading tools for their clients, aligning with modern expectations for financial service providers.

Customer Service

The company can be contacted at (852) 2545 0038 or (852) 2545 2185 by call or cs@primesec.com.hk by email for any inquiries or assistance. Operating hour: Mon-Fri 9am-6pm

Conclusion

Overall, Prime Securities has developed into a well-known member of the Stock Exchange of Hong Kong Limited since 1986.the company is known for its robust risk management and internal control systems to protect client assets and ensure compliance with professional conduct standards. While Prime Securities is well-regulated and offers a range of services including stock trading, securities margin financing, and IPOs, it faces challenges such as limited customer support options and a lack of educational resources for investors.

FAQs

Is Prime Securities safe to trade with?

Yes, Prime Securities is safe to trade with as it operates under strict regulatory oversight from The Stock Exchange of Hong Kong Limited. The firm adheres to rigorous standards for risk management and internal controls to protect client assets and ensure a secure trading environment.

Is Prime Securities a good platform for beginners?

Prime Securities may present some challenges for beginners due to its limited educational resources. While the firm offers robust trading options and security measures, new traders might need to seek additional educational support externally or inquire directly about any beginner-friendly resources the firm might offer.Is Prime Securities legitimate?Yes, Prime Securities is a legitimate brokerage firm. It was established in 1971 and is a founding member of Kam Ngan Stock Exchange Limited, later becoming an individual member of The Stock Exchange of Hong Kong Limited after the unification of four individual stock exchanges.

Is Prime Securities good for investing/retirement?

Prime Securities offers various services such as securities margin financing, initial public offerings, and share placements that can be suitable for long-term investment strategies and retirement planning. However, potential investors should carefully consider their personal financial goals and consult with financial advisors at Prime Securities to tailor an investment strategy that aligns with their retirement needs.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Indonesia

IndonesiaObtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)