Po Kay Securities & Shares Company Limited, having been established since early stage of 70’, is a stockbroking firm dedicated to providing quality financial services to clients varying from individuals to corporations to achieve desirable returns. Through excellent client service and efficient settlement, the company has become an indispensable partner of our clients. We are a registered Securities Dealer with the Hong Kong Securities & Futures Commission (Central Entity No. AAD452) and Participant of the Hong Kong Exchanges and Clearing Limited (Broker No. 0460/1) as well as Options Broker Exchange Participant. Currently we hold two trading rights of the Hong Kong Stock Exchanges and Clearing Limited.

Po Kay Securities & Shares Information

Po Kay Securities & Shares, based in Hong Kong, offers a range of tradable securities including Hong Kong stocks, Singapore, Australia, and US shares, alongside stock options.

They provide commission rates for Hong Kong stocks (0.18% to 0.25%) and a transparent fee structure covering stamp duty, trading fees, and custody fees. Regulated by the Securities and Futures Commission (SFC), Po Kay Securities & Shares ensures compliance with regulatory standards.

Pros and Cons

Po Kay Securities & Shares offers standard commission rates for Hong Kong stocks, ranging from 0.18% to 0.25% based on transaction amounts. This fee structure is favorable compared to industry standards, making it cost-effective for investors to trade in the Hong Kong market. The brokerage provides a wide selection of tradable securities, including Hong Kong stocks, Singapore, Australia, and US shares, as well as options trading. Being regulated by the Securities and Futures Commission (SFC) ensures that Po Kay Securities & Shares adheres to regulatory standards, providing a level of security and trust for investors.

However, a notable drawback is the absence of a mobile trading app, limiting the flexibility and convenience for traders who prefer to manage their investments on the go. Additionally, while the brokerage offers access to real-time market data and basic trading tools, it relies on external educational resources, such as the SFC and Investor Education Centre, for investor education.

Is Po Kay Securities & Shares Safe?

Regulations

Po Kay Securities & Shares is regulated by the Securities and Futures Commission (SFC) and holds a Securities Trading License with License No. AAD452. This license authorizes Po Kay Securities & Shares to engage in securities trading activities under the oversight and regulations set forth by the SFC.

Funds Safety

The customer's account balance at Po Kay Securities & Shares is not insured. As a brokerage regulated by the Securities and Futures Commission (SFC) in Hong Kong, they adhere to regulatory standards but do not offer account insurance coverage.

Safety Measures

Po Kay Securities & Shares implements robust security measures to safeguard investor interests. These include encryption protocols to protect sensitive data transmitted through their web-based platform. Additionally, Po Kay Securities & Shares may employ multi-factor authentication and regular security audits to mitigate risks associated with unauthorized access or data breaches.

What are Securities to Trade with Po Kay Securities & Shares?

Po Kay Securities & Shares offers a wide range of tradable securities to investors.

Investors can trade Hong Kong stocks with competitive commission rates based on transaction amounts, ensuring flexibility for both small and large-scale investments.

The brokerage facilitates trading in foreign stocks, including Singapore, Australia, and U.S. shares, providing access to international markets.

Additionally, Po Kay Securities & Shares supports stock options, allowing investors to engage in derivatives trading with defined commission rates and exercise fees.

Po Kay Securities & Shares Accounts

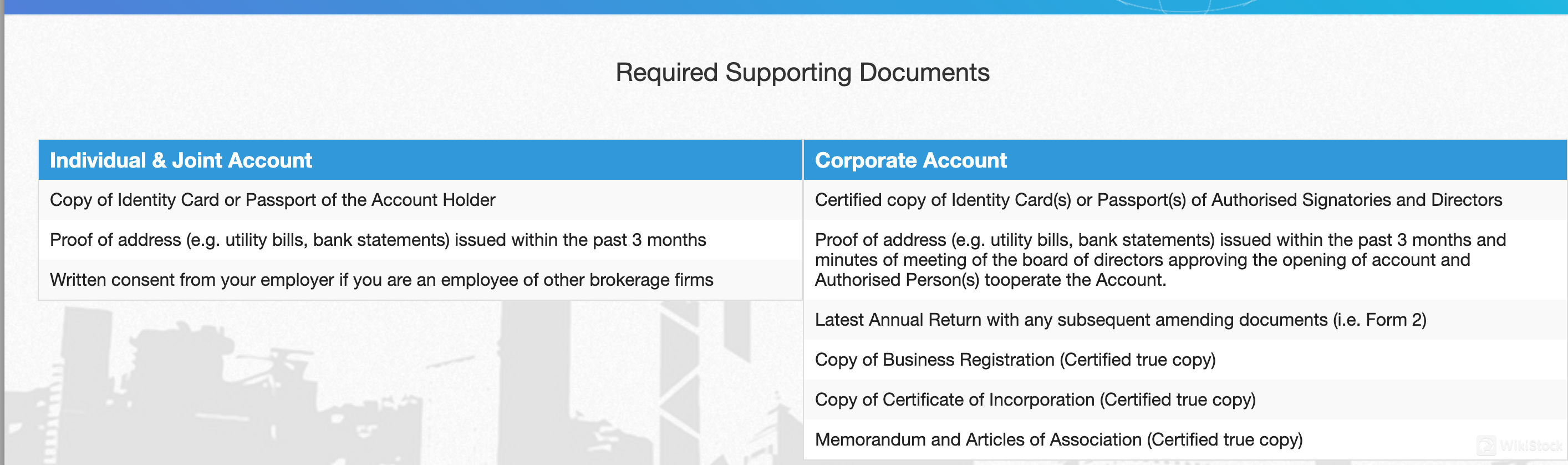

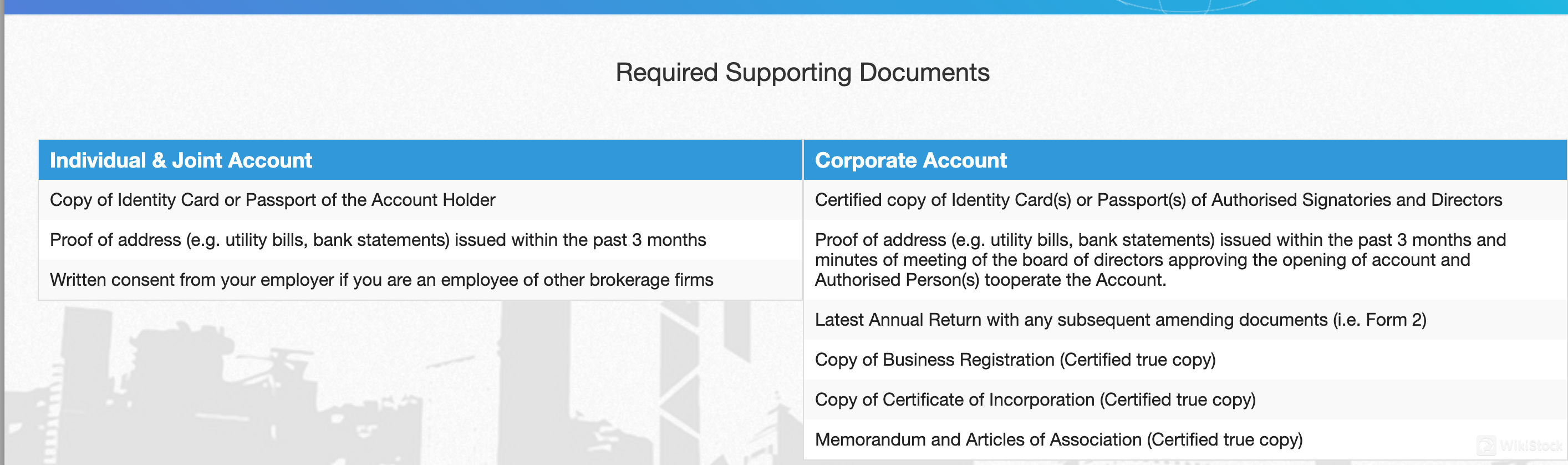

Po Kay Securities & Shares offers individual & joint accounts and corporate account.

Individual & Joint Account

Po Kay Securities & Shares offers individual and joint accounts, suitable for retail investors and small groups of individuals looking to invest in various financial instruments. These account types are suitable for individuals who prefer to manage their investments independently or jointly with family members or business partners. Individual accounts provide a personalized approach, allowing investors to make decisions based on their own financial goals and risk tolerance. Joint accounts, on the other hand, accommodate multiple account holders who wish to pool their resources for investment purposes, facilitating collaborative investment strategies while maintaining separate ownership and accountability.

Corporate Account

The corporate account option at Po Kay Securities & Shares is designed for businesses and corporate entities seeking to invest in financial markets. This account type is suitable for corporations, partnerships, and other legal entities looking to manage corporate funds, conduct business-related investments, or engage in strategic financial planning. Corporate accounts typically offer tailored services including access to corporate advisory services, institutional trading platforms, and specialized reporting capabilities.

Po Kay Securities & Shares Fees Review

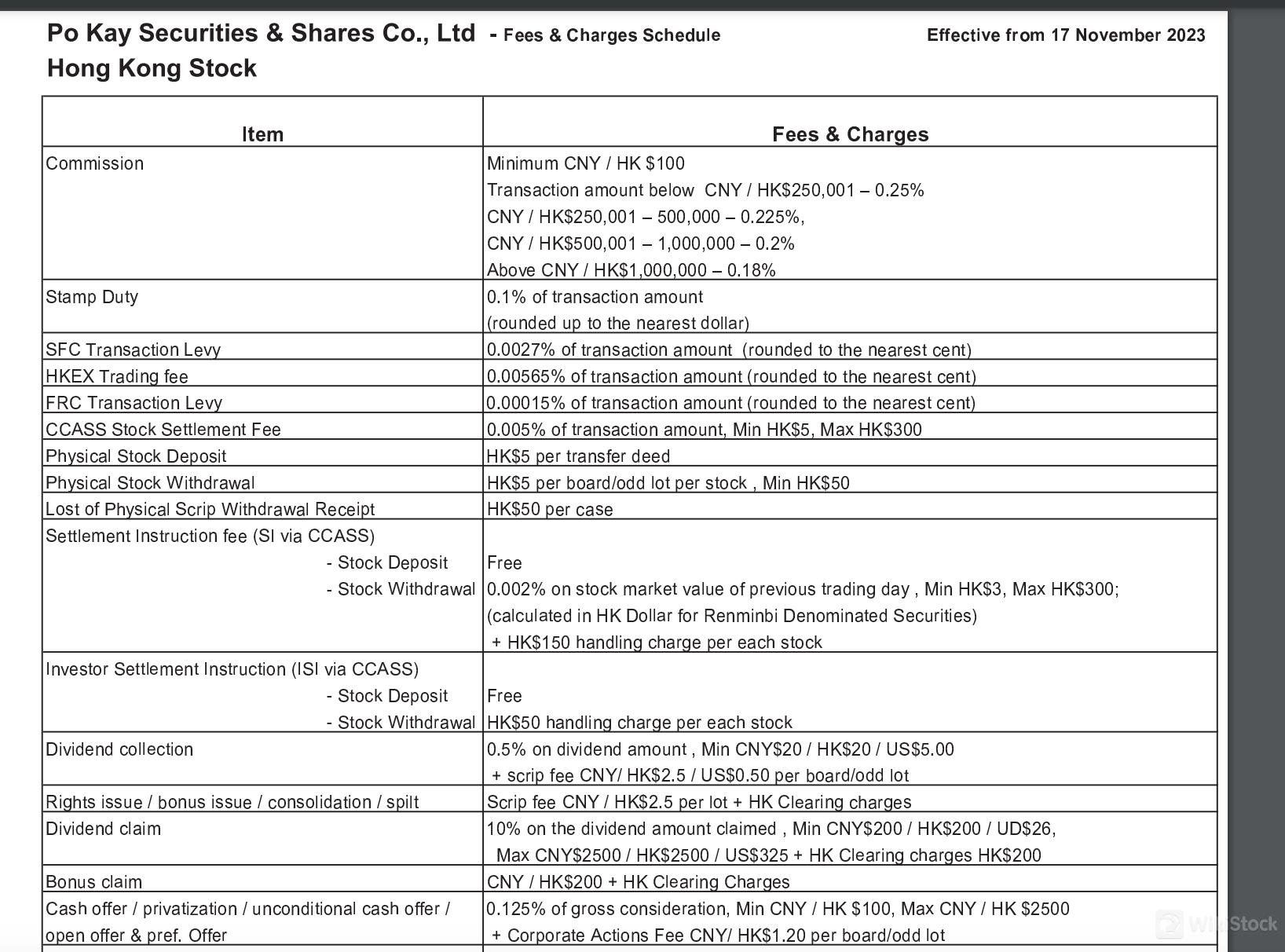

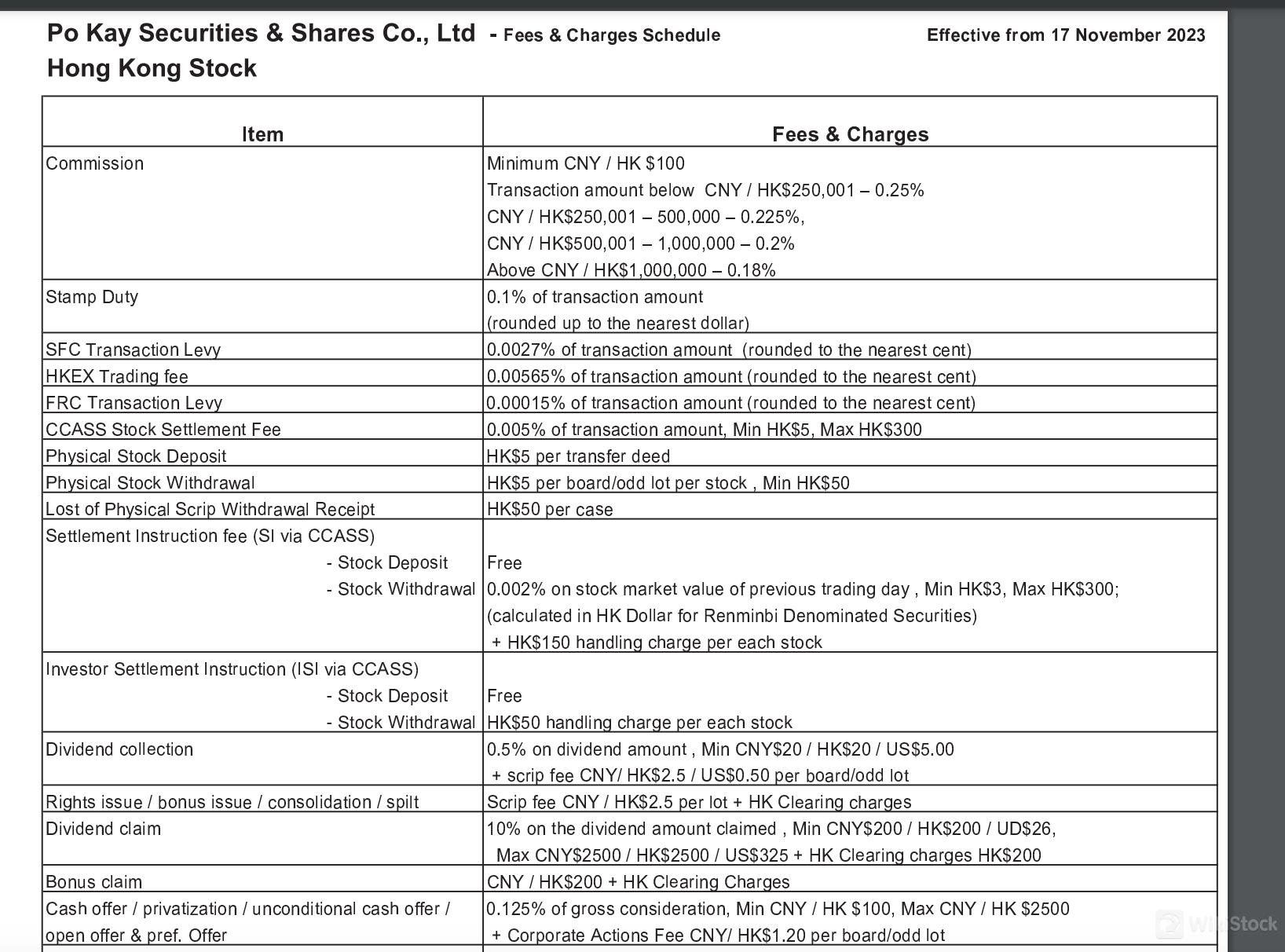

Hong Kong Stock

Commission:

Po Kay Securities & Shares charges commission based on transaction amount tiers:

Below CNY/HK$250,001: 0.25%

CNY/HK$250,001 - 500,000: 0.225%

CNY/HK$500,001 - 1,000,000: 0.2%

Above CNY/HK$1,000,000: 0.18%

Minimum commission per transaction is CNY/HK$100.

Stamp Duty:

0.1% of transaction amount, rounded up to the nearest dollar.

SFC Transaction Levy:

0.0027% of transaction amount, rounded to the nearest cent.

HKEX Trading Fee:

0.00565% of transaction amount, rounded to the nearest cent.

Foreign Stock

Singapore Shares:

Commission: 0.5% of transaction amount, with a minimum of USD 20.

Clearing Fee: 0.0325% of transaction amount, with a minimum of USD 10.

SGX SI Fee: USD 0.26 per transaction.

Dividend Collection Fee: 1% on net dividend amount (Min HKD 50, Max HKD 300) plus handling fee.

Australia Shares:

Commission: 0.4% of transaction amount, minimum AUD 45.

Dividend Collection Fee: AUD 7.

Custody Fee: 0.05% p.a. of Australia stock portfolio value, minimum AUD 1 per month.

US Shares:

Commission: 0.25% of transaction amount (below USD 15,000), 0.20% (USD 15,000 or above), minimum USD 20 per order.

Dividend Collection Fee: 3% on dividend amount (Min USD 8, Max USD 80).

Stock Option Fees

Commission:

Exercise Fees:

Brokerage for Exercise/Assign: Exercise price x No. of contract x lot size x 0.25%, minimum HKD 100.

Government Stamp Duty: HKD 1 per HKD 1,000 transaction amount.

Transaction Levy: 0.003% of transaction amount.

Transaction Fee: 0.005% of transaction amount.

Po Kay Securities & Shares' fees for Hong Kong, foreign stocks, and stock options are aligned with industry standards. For Hong Kong stocks, the commission rates are aligned with industry standards, providing a balance between cost and service. Foreign stock commissions vary but generally reflect market norms. Stock option fees are structured with transparent pricing.

Po Kay Securities & Shares Trading Platform Review

Po Kay Securities & Shares offers an online trading platform accessible via web browsers. This platform enables investors to trade Hong Kong stocks and other securities, providing essential features such as order management, real-time market data, and portfolio tracking. The platform is user-friendly, designed to accommodate both novice and experienced traders with intuitive navigation and essential trading functionalities.

Research & Education

Po Kay Securities & Shares doesn't provide educational resources itself. Investors are encouraged to visit the Securities and Futures Commission (SFC) and Investor Education Centre (IEC) websites for comprehensive investment education and regulatory information.

Customer Service

For customer support, Po Kay Securities & Shares offers several contact options.

You can reach them via postal mail at 14/F, Grand Building, 15-18 Connaught Road, Central, Hong Kong. Alternatively, you can send a facsimile to (852) 2845 2240 or speak directly to a customer service officer by calling (852) 2868 3811.

For inquiries via email, you can contact their Customer Service Department atdealer@pokayonline.com.hk.

Conclusion

In conclusion, Po Kay Securities & Shares offers a competitive fee structure and a wide range of tradable securities, including Hong Kong stocks and international shares. The platform is suitable for investors seeking cost-effective trading opportunities in the Hong Kong market and beyond. However, potential users should consider the absence of a mobile trading app and the reliance on external educational resources. The brokerage's regulatory oversight by the Securities and Futures Commission provides a level of trust and security.

FAQs

Obtain 1 securities license(s)

![]() Owns 1 seat(s)

Owns 1 seat(s)