Score

Great Bay Securities Limited

http://www.greatbaysec.com/default.asp?langcode=en

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

China

ChinaProducts

5

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Surpassed 14.85% brokers

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01471

Brokerage Information

More

Company Name

Great Bay Securities Limited

Abbreviation

Great Bay Securities Limited

Platform registered country and region

Company address

Company website

http://www.greatbaysec.com/default.asp?langcode=enCheck whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.2%

Funding Rate

7%

New Stock Trading

Yes

Margin Trading

YES

| Great Bay Securities Limited |  |

| WikiStock Rating | ⭐⭐⭐ |

| Account Minimum | HKD 1,500 |

| Fees | Fee ranges based on account type |

| Account Fees | HKD 50 (Monthly account maintenance fee) |

| Interests Rates | Monthly interest rate of 0.25% |

| Margin Interest Rates | Overdue unsettled balances are charged 2% per month |

| Mutual Funds Offered | Yes |

| App/Platform | Available on iOS, Android, and Web |

| Promotions | Yes |

What is Great Bay Securities Limited?

Great Bay Securities Limited is an established online brokerage firm allowing individuals to trade securities such as stocks, Exchange-traded funds (ETFs), Mutual funds, Securities Lending Fully Paid, and Investment Advisory Services from global exchanges, a wide range of services across multiple devices including iOS, Android, and Web. As one of the pioneering online brokers, Great Bay Securities Limited features a powerful trading platform and a wide range of trading services to help many traders take advantage of market opportunities. However, its research offerings are somewhat limited and do not fully cater to the needs of all users.

Pros and Cons of Great Bay Securities Limited

Great Bay Securities Limited is an established online brokerage that offers traders a variety of trading markets and account options. The brokerage supports trading in stocks, Exchange-traded funds (ETFs), Mutual funds, Securities Lending Fully Paid, and Investment Advisory Services. The trading platform is accessible via desktop and mobile applications, featuring real-time quotes, charts, and order routing for convenient access on and go. Commission fees are tiered based on 30-day trade volume while funding and withdrawals are available through multiple convenient payment methods. Customer service is provided via phone, email, and live chat to address trader inquiries.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Is Great Bay Securities Limited safe?

Great Bay Securities Limited operates with a strict regulatory framework overseeing its business. As a licensed entity, the company is regulated by the Securities and Futures Commission (SFC) of Hong Kong, the firm operates with license number ABQ520. Additionally, it adheres to standards set by the Financial Conduct Authority in the United Kingdom.

What are securities to trade with Great Bay Securities Limited?

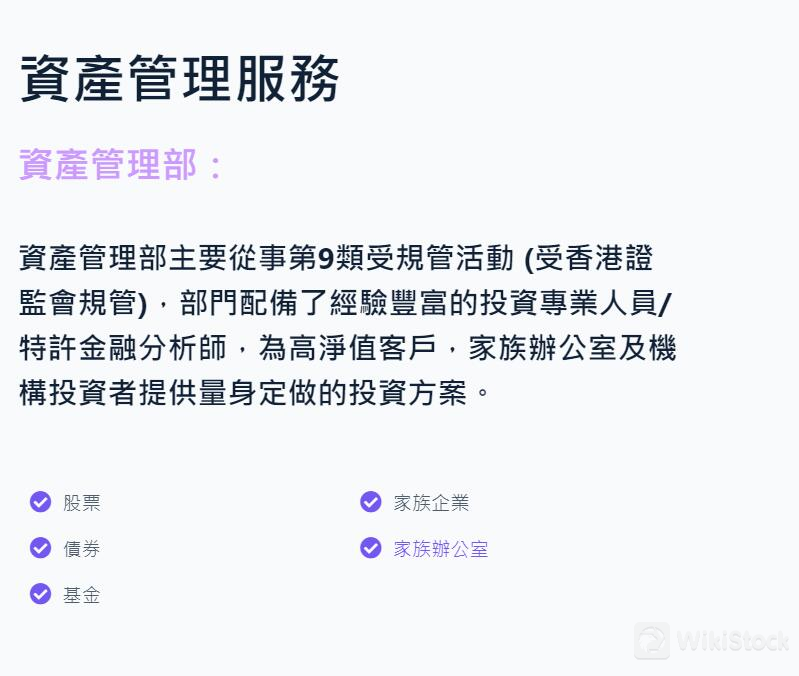

Great Bay Securities Limited offers a wide variety of tradable financial instruments, including stocks, Exchange-traded funds (ETFs), Mutual funds, Securities Lending Fully Paid, and Investment Advisory Services. Great Bay Securities Limited provides tailor-made investment solutions for high-net-worth clients, and family businesses. However, it does not offer commodities futures contracts or direct trading of cryptocurrencies.

Specifically, the broker provides access to:

ETFs: Traders can access a wide range of indexed exchange-traded funds that track major indices like S&P 500, NYSE, and sector-specific funds. ETFs provide cost-effective diversification and intraday liquidity.

Stocks: Traders can seek alpha through direct ownership of equities listed on over 25 exchanges worldwide including the US, Canada, Europe, Asia, and Australia.

Mutual Funds: Actively managed and indexed mutual funds from top fund families are available for risk management and income strategies. No transaction fees apply.

Securities Lending Fully Paid: Qualified traders can lend fully paid securities for additional returns while holding on to ownership.

Investment Advisory Service: Professional portfolio management services delegate day-to-day decisions to experienced advisors for a fee based on assets under management.

Securities Brokerage Business: Great Bay Securities Limited's securities brokerage business is committed to providing clients with professional investment advice, transaction execution, and asset management services to help clients achieve their financial goals.

Investment Advisory Business: Great Bay Securities Limited's investment advisory business is committed to providing clients with personalized portfolio advice and financial planning to help clients achieve their long-term financial goals, and provides regular market analysis and investment strategy updates.

With these varied offerings, traders can develop low-cost, tax-efficient portfolios addressing different goals through a single integrated platform. Great Bay Securities Limited's breadth and depth of tradeable products cater to varied risk appetites and strategies.

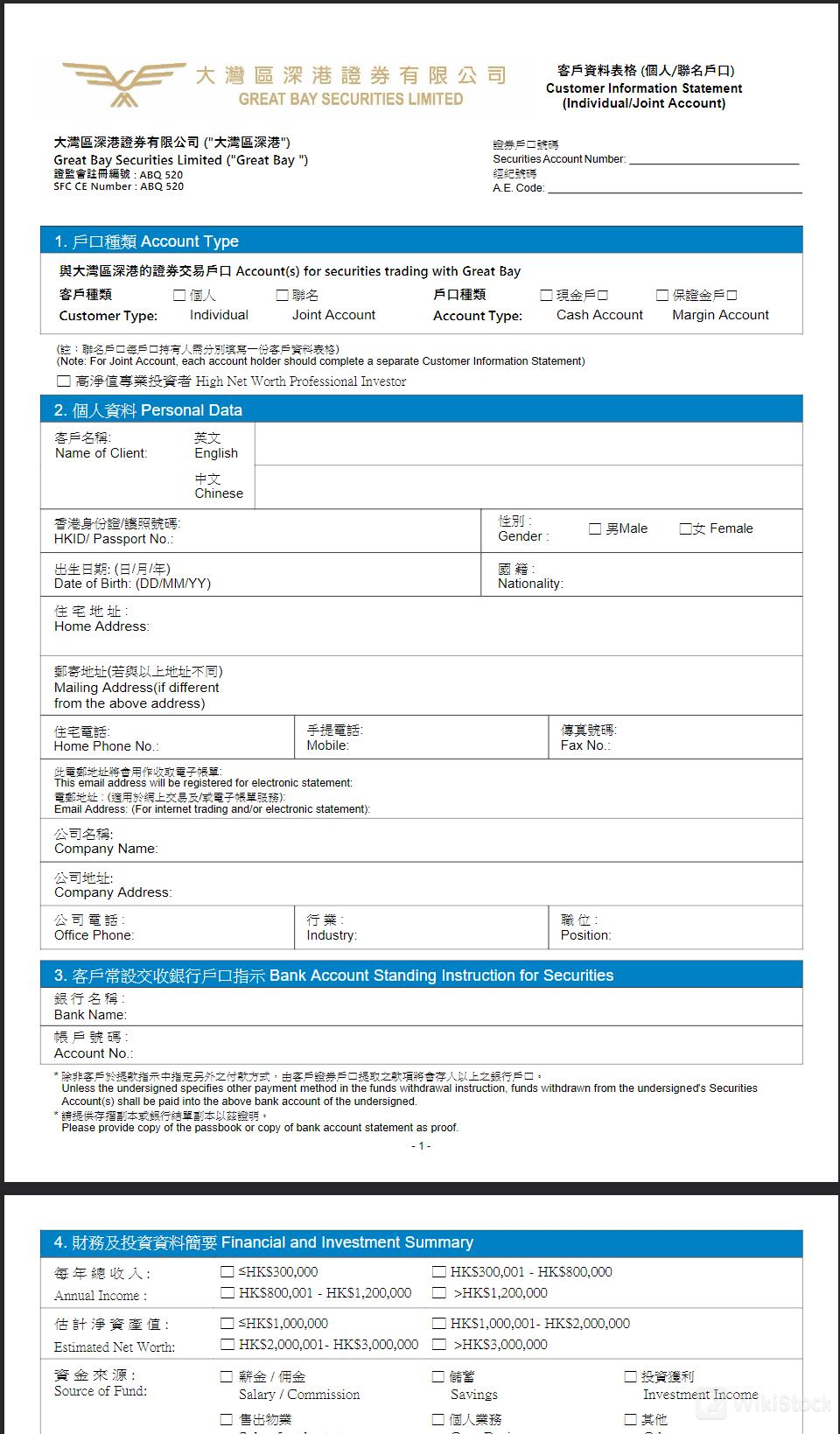

Great Bay Securities Limited Accounts

Great Bay Securities Limited offers four primary account types:

Individual Accounts: Designed for individual investors trading with their funds. These accounts provide access to a range of investment products and services.

Joint Accounts: Allow two or more individuals to hold an account together, with joint ownership and trading permissions, and facilitate multiple parties jointly managing an account.

Cash Accounts: Offer tax-advantaged investment options for retirement planning, such as IRAs and 401(k)s.

Margin Accounts: Allow trading on leverage by borrowing against deposited securities.

Great Bay Securities Limited Fees Review

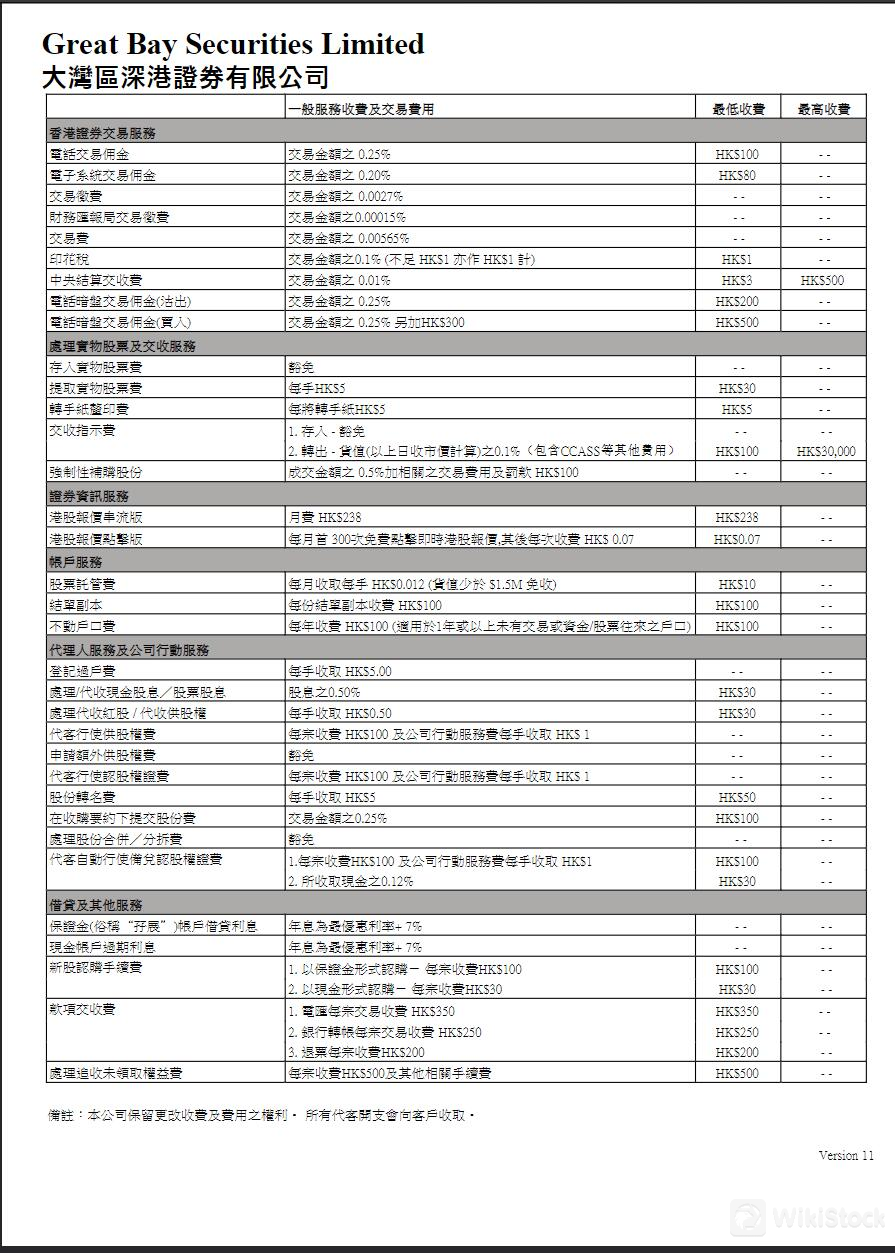

Trading Commission and Related Fees

Clients will be charged a commission and related fees by regulatory bodies when trading Hong Kong stocks. The commission for phone trading is 0.25% of the transaction amount, with a minimum of HK$100. For electronic trading systems, the commission is 0.20% of the transaction amount, with a minimum of HK$80. Additionally, clients need to pay a transaction levy of 0.0027%, an SFC transaction levy of 0.00015%, a trading fee of 0.00565%, and a stamp duty of 0.1% (minimum HK$1).

Dark Pool Trading and Physical Scrip Services

For dark pool selling, the commission is 0.25% of the transaction amount, with a minimum of HK$200. For dark pool buying, it's 0.25% of the transaction amount plus HK$300, with a minimum of HK$500. Withdrawal of physical scrips is charged at HK$5 per lot, with a minimum of HK$30. The transfer deed stamp duty is HK$5 per transfer deed. There is no fee for depositing physical scrips.

Securities Information and Account Services

Clients can subscribe to the Hong Kong stock streaming quote service at HK$238 per month, or the quote-on-demand service at HK$0.07 per quote after the first 300 free quotes. For account services, duplicate statements are charged at HK$100 per copy, and inactive accounts are subject to an annual HK$100 fee if there's no trading activity for over a year.

Corporate Actions Services Registration for transfer is charged at HK$5 per lot. The commission for collecting cash/scrip dividends is 0.5% of the dividend amount (minimum HK$30). Exercising rights issues/warrants incurs a HK$100 handling fee plus HK$1 per lot corporate action fee. Share re-registration costs HK$5 per lot, with a minimum of HK$50.

Financing and Other Services

The interest rate for margin accounts is the prime rate plus 7% per annum. The same interest rate applies to overdue cash account balances. The handling fee for IPO financing is HK$100 per transaction, or HK$30 for cash subscriptions. For fund settlement, telegraphic transfers cost HK$350 per transaction, bank transfers HK$250, and returned cheques HK$200 each.

Great Bay Securities Limited App Review

Great Bay Securities Limited mobile app is well-designed for convenient trading on the go. It comes with all the core features of the web platform including real-time market data, advanced charts, order entry, and management. The intuitive interface is optimized for seamless usability across iOS and Android devices. Traders can closely monitor their portfolios and markets using the app. In addition to the mobile app, Great Bay Securities Limited delivers versatile platforms optimized for different usage scenarios. Cross-platform Web Trading portals further expand accessibility across any internet-enabled device.

Research and Education

Great Bay Securities Limited offers extensive educational resources from two dimensions:

In-house Research and Tools:

Advanced stock screening and data analysis tools

Comprehensive charts with technical indicators

Sector-specific watchlists and reports

Virtual paper trading to refine strategies

Detailed tutorials and trading guides

Third-party Market Insights:

Research from top institutional providers

-macroeconomic analysis and commentary

-Thematic reports on assets and industry trends

Model portfolios from strategist groups

Great Bay Securities Limited offers fundamental and technical analysis reports through its research section. Traders can access daily market briefings, educational videos, and articles on various topics from professional analysts and instructors. The learning center equips traders with the necessary skills to fine-tune their strategies. Traders also get access to webinars and seminars hosted by the broker. Continuous self-learning remains an integral focus at Great Bay Securities Limited for empowering traders at every stage.

Customer Service

Great Bay Securities Limited offers the following comprehensive customer service support:

Support Methods:

24/7 Live Chat and telephone support

Email support responded within 24 hours

Dedicated account manager for high-balance clients

Service Time Periods:

Live Chat and Phone Support: Monday to Friday, 9:00 to 18:00 UTC

Email Support: responded within 24 hours, except on weekends.

The Customer Service Email Address: cs@greatbaysec.com

Account Manager Service: during weekdays, 9:00 to 18:00 UTC

With round-the-clock availability through multiple channels, Great Bay Securities Limited ensures traders receive timely assistance regarding accounts, trading platforms, market inquiries or technical issues. Reliable customer service remains a top priority.

Conclusion

In conclusion, Great Bay Securities Limited is a reliable choice for global traders looking to capitalize on financial market opportunities. With its low-cost trading, broad product selection, tight security, and versatile support, Great Bay Securities Limited equips traders with the necessary tools to take their skills to the next level.

FAQs

Is Great Bay Securities Limited a good platform for beginners?

Great Bay provides in-depth educational resources, allowing beginners to learn effectively with easy-to-use tools before trading.

Is Great Bay Securities Limited legit?

Yes, it is a properly regulated brokerage with legal operations globally. Multiple licensing certifies its legitimacy and protects traders.

Is Great Bay Securities Limited good for investing/retirement?

While suitable for long-term holdings, retirement investors may prefer advisory accounts for guidance. Great Bay offers diversified investment options to accumulate wealth but requires monitoring performance over time.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to a total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Review

No ratings

Recommended Brokerage FirmsMore

Victory Securities

Score

Quam Securities

Score

Tianda Financial

Score

Gaoyu Securities

Score

Success

Score

COL Global Access

Score

Westock

Score

競富

Score

CJS INTERNATIONAL

Score

JVSakk

Score